In this age of technology, where screens dominate our lives yet the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses, creative projects, or simply to add a personal touch to your space, What Is The Maximum Limit In 80c are now a vital source. We'll take a dive through the vast world of "What Is The Maximum Limit In 80c," exploring what they are, where to find them, and ways they can help you improve many aspects of your life.

Get Latest What Is The Maximum Limit In 80c Below

What Is The Maximum Limit In 80c

What Is The Maximum Limit In 80c -

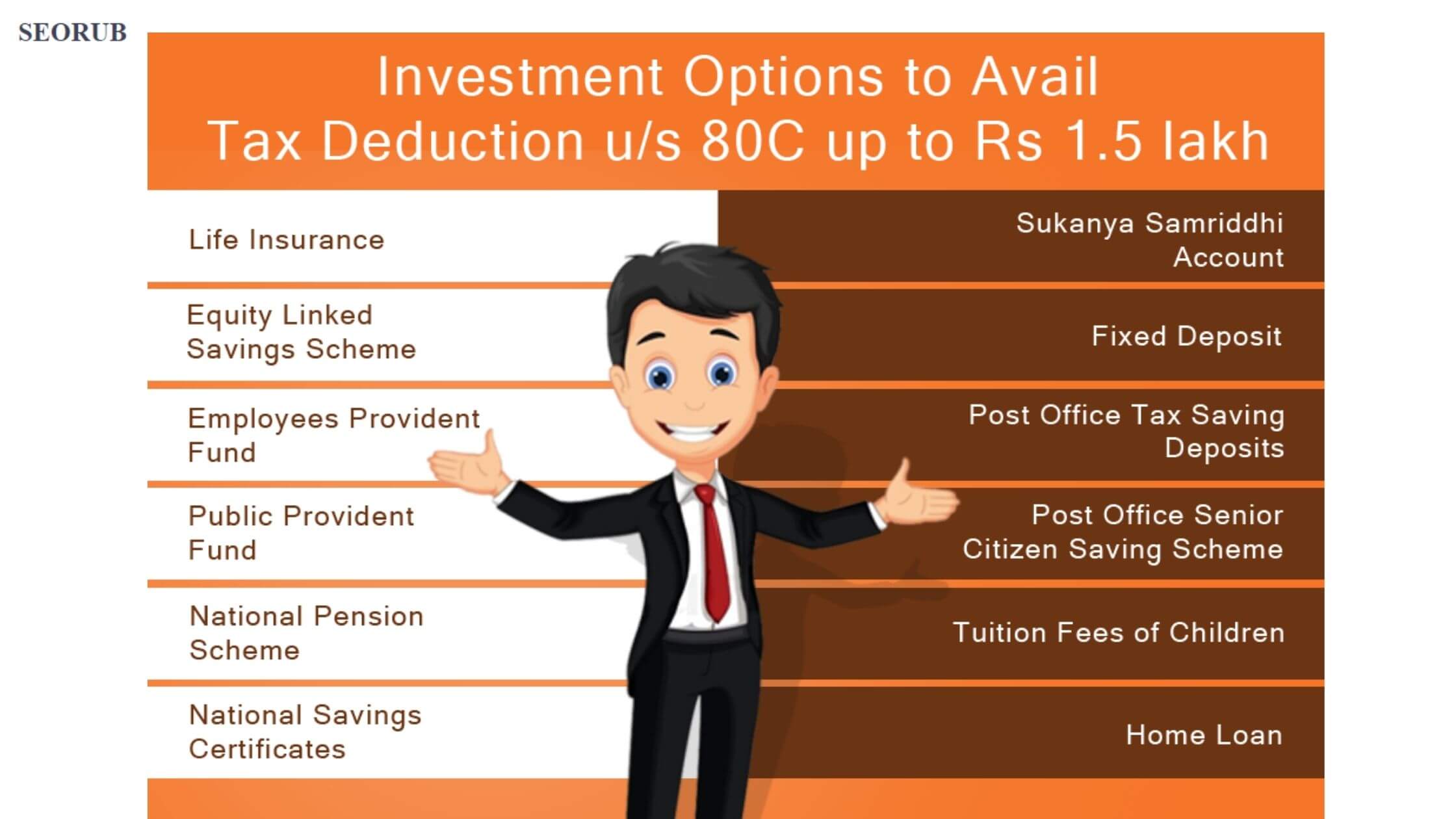

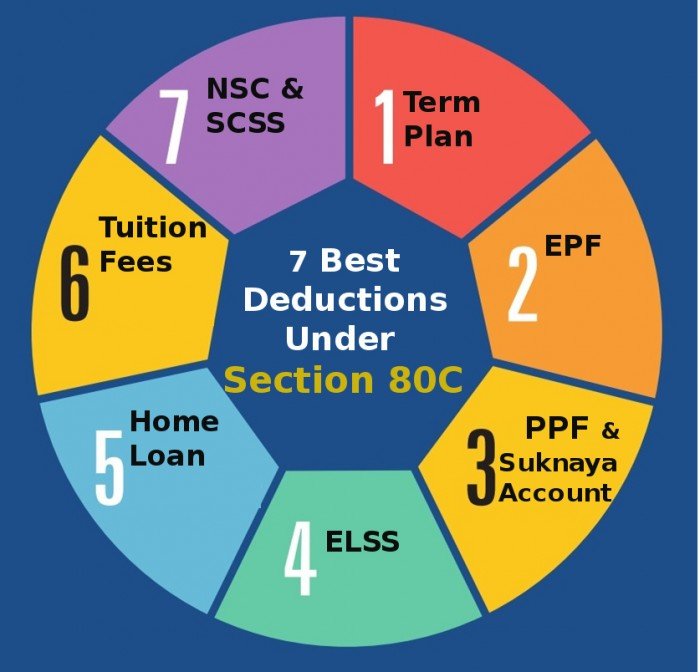

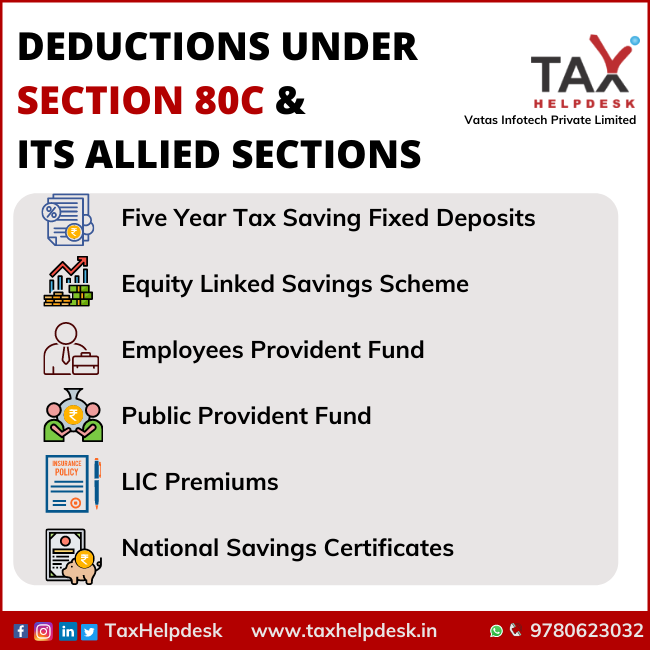

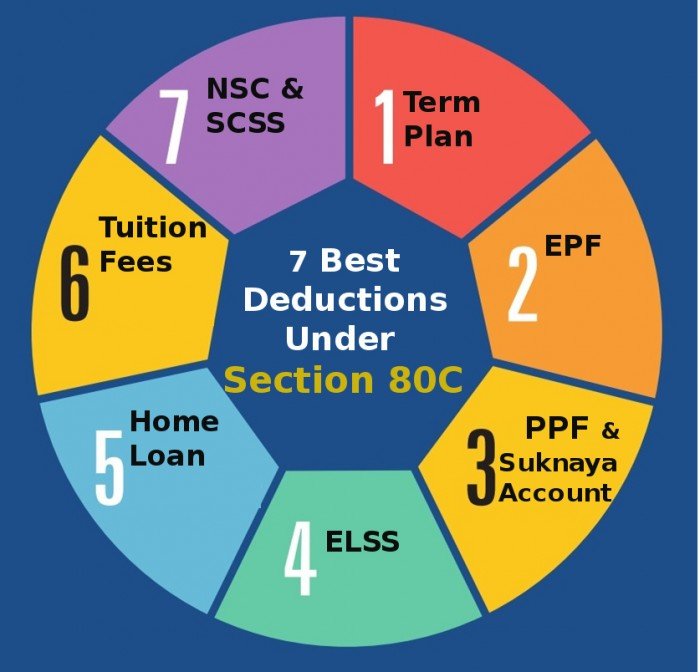

Verkko 13 kes 228 k 2023 nbsp 0183 32 The maximum amount of deduction you can claim under this section per financial year is Rs 1 50 000 a combined limit that includes sections 80CCC and 80CCD 1 The eligible amounts under this section can be deducted from your taxable income reducing your tax liability

Verkko Section 80C of the Income Tax Act allows tax exemptions on infrastructure bonds provided the investment is equal to or higher than Rs 20 000 The 80c deduction limit of Rs 1 5 lakh stays applicable for these long term secured bonds as well Equity Linked Saving Scheme

What Is The Maximum Limit In 80c offer a wide assortment of printable materials online, at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and more. The great thing about What Is The Maximum Limit In 80c is in their versatility and accessibility.

More of What Is The Maximum Limit In 80c

Budget 2022 Updates Industry Seeks Clarity On Crypto Taxation Hike In

Budget 2022 Updates Industry Seeks Clarity On Crypto Taxation Hike In

Verkko 9 jouluk 2021 nbsp 0183 32 Under Section 80C Health insurance premium Avail tax benefit under Section 80 D Having health insurance coverage through an individual plan or Family Floater is a must for all members of the

Verkko 21 marrask 2023 nbsp 0183 32 Section 80C of the Income Tax Act allows for deductions up to Rs 1 5 lakh p a Under the section individuals can invest in several savings schemes to claim deductions on their taxable income What is Section 80C Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor printables to fit your particular needs whether you're designing invitations to organize your schedule or decorating your home.

-

Educational Worth: Free educational printables can be used by students from all ages, making them a useful instrument for parents and teachers.

-

Simple: instant access the vast array of design and templates helps save time and effort.

Where to Find more What Is The Maximum Limit In 80c

Section 80C Limit Go Up In The Budget In Feb 2023 SEORUB

Section 80C Limit Go Up In The Budget In Feb 2023 SEORUB

Verkko And one of the major demands as seen on social media is over Section 80C of the Income Tax Act with netizens calling for an increase in exemption limit under Section 80C Here s all you need

Verkko Published 23 11 2023 In 2022 and 2023 the annual maximum limit on out of pocket medicine costs has been EUR 592 16 In 2024 the limit will be increased to EUR 626 94 Parliament has approved a legislative proposal whereby index adjustments for the previous two years to the annual maximum limit on out of pocket medicine costs can

Now that we've piqued your interest in What Is The Maximum Limit In 80c Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of What Is The Maximum Limit In 80c designed for a variety needs.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing What Is The Maximum Limit In 80c

Here are some unique ways of making the most of What Is The Maximum Limit In 80c:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

What Is The Maximum Limit In 80c are an abundance of innovative and useful resources that cater to various needs and interest. Their accessibility and flexibility make them a great addition to each day life. Explore the wide world of What Is The Maximum Limit In 80c now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes, they are! You can print and download these documents for free.

-

Can I utilize free printables for commercial use?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with What Is The Maximum Limit In 80c?

- Some printables may have restrictions regarding their use. Check these terms and conditions as set out by the author.

-

How do I print What Is The Maximum Limit In 80c?

- Print them at home using a printer or visit any local print store for better quality prints.

-

What program do I need in order to open printables free of charge?

- Many printables are offered with PDF formats, which can be opened using free software such as Adobe Reader.

Deductions Under Chapter VIA

Section 80C Deductions List To Save Income Tax FinCalC Blog

Check more sample of What Is The Maximum Limit In 80c below

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Speed Limit Sign What Does It Mean

Deduction Under Section 80C Its Allied Sections

Why Is 80C The Best Tax Saving Instrument

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Tax Savings Deductions Under Chapter VI A Learn By Quicko

https://groww.in/p/tax/section-80c

Verkko Section 80C of the Income Tax Act allows tax exemptions on infrastructure bonds provided the investment is equal to or higher than Rs 20 000 The 80c deduction limit of Rs 1 5 lakh stays applicable for these long term secured bonds as well Equity Linked Saving Scheme

https://www.maxlifeinsurance.com/blog/tax-savings/section-80c

Verkko Section 80C of the Income Tax Act prescribes several instruments that not only offer income tax saving benefits but also provide financial returns throughout the policy period Total 80C limit as per the Income Tax Act 1961 is Rs 1 5 lakh per financial year Following are some of the 80C deduction options available as per the Income Tax Act

Verkko Section 80C of the Income Tax Act allows tax exemptions on infrastructure bonds provided the investment is equal to or higher than Rs 20 000 The 80c deduction limit of Rs 1 5 lakh stays applicable for these long term secured bonds as well Equity Linked Saving Scheme

Verkko Section 80C of the Income Tax Act prescribes several instruments that not only offer income tax saving benefits but also provide financial returns throughout the policy period Total 80C limit as per the Income Tax Act 1961 is Rs 1 5 lakh per financial year Following are some of the 80C deduction options available as per the Income Tax Act

Why Is 80C The Best Tax Saving Instrument

Speed Limit Sign What Does It Mean

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Tax Savings Deductions Under Chapter VI A Learn By Quicko

PDF FortiGate Maximum Values Matrix Technical Note For Example The

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Nylon Plastic Solenoid Valve Operating Temperature Range Upto 80c