Today, where screens have become the dominant feature of our lives but the value of tangible printed objects isn't diminished. For educational purposes, creative projects, or simply adding some personal flair to your area, What Is The Meaning Of Input Tax Credit With Example are now a useful source. For this piece, we'll take a dive through the vast world of "What Is The Meaning Of Input Tax Credit With Example," exploring what they are, how they are available, and what they can do to improve different aspects of your lives.

Get Latest What Is The Meaning Of Input Tax Credit With Example Below

What Is The Meaning Of Input Tax Credit With Example

What Is The Meaning Of Input Tax Credit With Example -

What is input tax credit The GST regime allows businesses throughout India to claim input credit for the tax they pay while buying capital goods Therefore input tax credit means that you can lessen the tax you

What is input tax credit with example Input Tax Credit ITC refers to the tax paid on purchases for the business which can be claimed as deduction at the time of paying tax on output tax Here s how When you buy a

What Is The Meaning Of Input Tax Credit With Example provide a diverse assortment of printable, downloadable material that is available online at no cost. They are available in numerous kinds, including worksheets templates, coloring pages and more. The great thing about What Is The Meaning Of Input Tax Credit With Example lies in their versatility as well as accessibility.

More of What Is The Meaning Of Input Tax Credit With Example

Input Tax Credit Meaning Of Input Tax Meaning Of Input Tax Credit

Input Tax Credit Meaning Of Input Tax Meaning Of Input Tax Credit

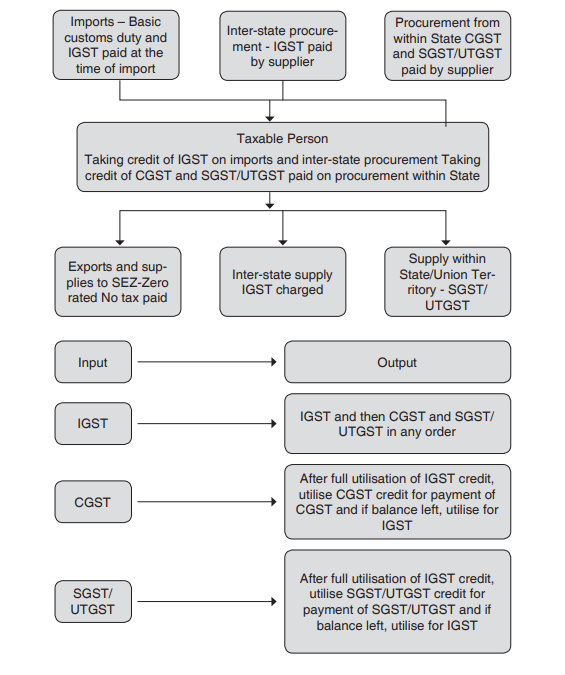

Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax GST law a business

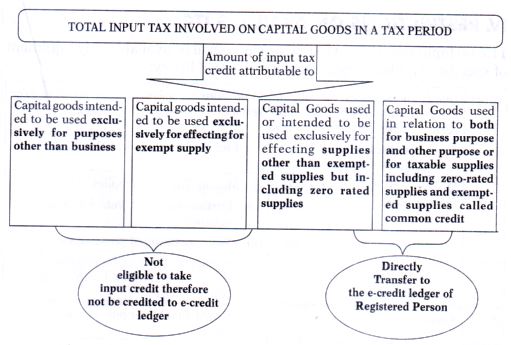

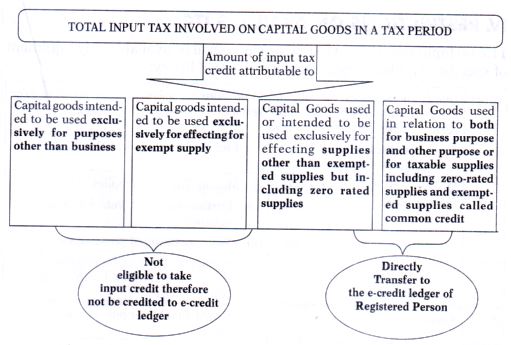

The input tax credit of goods and or service attributable to only taxable supplies can be taken by registered taxable person The amount of eligible credit would be calculated in a manner to be prescribed in terms of

What Is The Meaning Of Input Tax Credit With Example have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Individualization You can tailor the templates to meet your individual needs such as designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Value: The free educational worksheets provide for students from all ages, making the perfect tool for parents and educators.

-

The convenience of instant access the vast array of design and templates will save you time and effort.

Where to Find more What Is The Meaning Of Input Tax Credit With Example

Input Tax Credit A New Era A Nightmare

Input Tax Credit A New Era A Nightmare

A complete guide for understanding the basics of input tax credit and it calculation with detailed examples under GST Goods and Services Tax India

Sec 2 63 of the CGST Act 2017 explains that Input Tax Credit means the credit of input tax wherein input tax in relation to a registered person means the central tax State tax integrated tax or Union territory tax charged

Now that we've ignited your interest in What Is The Meaning Of Input Tax Credit With Example we'll explore the places you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of What Is The Meaning Of Input Tax Credit With Example designed for a variety reasons.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs are a vast selection of subjects, from DIY projects to party planning.

Maximizing What Is The Meaning Of Input Tax Credit With Example

Here are some ways of making the most of What Is The Meaning Of Input Tax Credit With Example:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to reinforce learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

What Is The Meaning Of Input Tax Credit With Example are a treasure trove of practical and innovative resources designed to meet a range of needs and passions. Their accessibility and flexibility make them an invaluable addition to your professional and personal life. Explore the many options of What Is The Meaning Of Input Tax Credit With Example and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can print and download these documents for free.

-

Can I use free printables for commercial purposes?

- It's dependent on the particular terms of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with What Is The Meaning Of Input Tax Credit With Example?

- Some printables may have restrictions on usage. Check these terms and conditions as set out by the designer.

-

How do I print What Is The Meaning Of Input Tax Credit With Example?

- You can print them at home with either a printer at home or in an in-store print shop to get top quality prints.

-

What software is required to open printables that are free?

- Most PDF-based printables are available with PDF formats, which is open with no cost software such as Adobe Reader.

New Provision Relating To Restricted Input Tax Credit

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

Check more sample of What Is The Meaning Of Input Tax Credit With Example below

Ready Reckoner On Input Tax Credit Under GST Taxmann

ITC Under GST On Employee Expenses MN Associates

Input Tax Credit ITC In GST Meaning How To Claim It And Examples

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

Section 53 Of GST Transfer Of Input Tax Credit GST Knowledge Section

Determination Of Input Tax Credit ITC In Respect Of Capital Goods

https://cleartax.in › gst-input-tax-credit

What is input tax credit with example Input Tax Credit ITC refers to the tax paid on purchases for the business which can be claimed as deduction at the time of paying tax on output tax Here s how When you buy a

https://www.charteredclub.com › gst-input-tax-credit

Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit is

What is input tax credit with example Input Tax Credit ITC refers to the tax paid on purchases for the business which can be claimed as deduction at the time of paying tax on output tax Here s how When you buy a

Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit is

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

ITC Under GST On Employee Expenses MN Associates

Section 53 Of GST Transfer Of Input Tax Credit GST Knowledge Section

Determination Of Input Tax Credit ITC In Respect Of Capital Goods

Practical FAQs On Input Tax Credit Under GST Taxmann

Point wise Guide For GST Input Tax Credit With FAQs

Point wise Guide For GST Input Tax Credit With FAQs

Understanding GST Input Tax Credit When Exempted Taxable Supplies Are Made