Today, when screens dominate our lives and the appeal of physical, printed materials hasn't diminished. For educational purposes such as creative projects or just adding a personal touch to your area, What Medical Expenses Are Deductible In 2022 are now a useful resource. Here, we'll take a dive deeper into "What Medical Expenses Are Deductible In 2022," exploring what they are, how to find them and ways they can help you improve many aspects of your lives.

Get Latest What Medical Expenses Are Deductible In 2022 Below

What Medical Expenses Are Deductible In 2022

What Medical Expenses Are Deductible In 2022 -

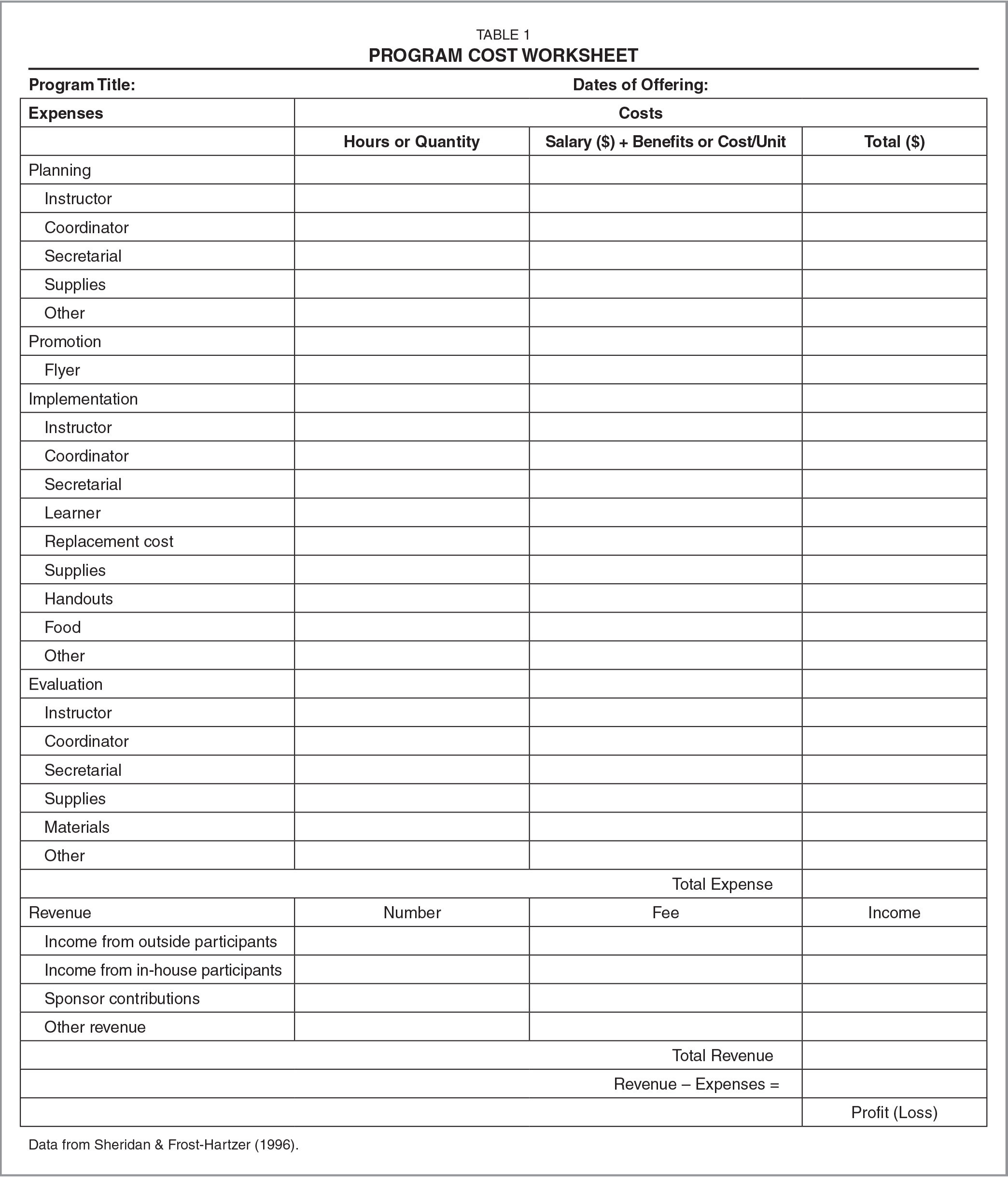

Publication 502 describes the medical expenses that are deductible by taxpayers on their 2022 federal income tax returns Publication 503 explains the requirements that taxpayers must meet to claim the dependent

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses

What Medical Expenses Are Deductible In 2022 include a broad range of printable, free materials that are accessible online for free cost. These materials come in a variety of types, like worksheets, templates, coloring pages, and more. The beauty of What Medical Expenses Are Deductible In 2022 lies in their versatility and accessibility.

More of What Medical Expenses Are Deductible In 2022

Deductible Business Expenses For Independent Contractors Financial

Deductible Business Expenses For Independent Contractors Financial

Medical expenses include dental expenses and in this publication the term medical expenses is often used to refer to medical and dental expenses You can deduct on Schedule A Form

Which Medical Expenses Are Tax Deductible You can deduct unreimbursed medical care expenses paid for yourself your spouse and your dependents

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: It is possible to tailor designs to suit your personal needs whether you're designing invitations, organizing your schedule, or even decorating your home.

-

Educational Use: Printables for education that are free are designed to appeal to students of all ages. This makes the perfect resource for educators and parents.

-

An easy way to access HTML0: Fast access the vast array of design and templates can save you time and energy.

Where to Find more What Medical Expenses Are Deductible In 2022

Claim Medical Expenses On Your Taxes Health For CA

Claim Medical Expenses On Your Taxes Health For CA

You can deduct medical expenses that exceed 7 5 of your income Learn more about the medical expense deduction and how to save money at tax time

You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

We hope we've stimulated your interest in printables for free and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of needs.

- Explore categories such as furniture, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free including flashcards, learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs are a vast selection of subjects, all the way from DIY projects to planning a party.

Maximizing What Medical Expenses Are Deductible In 2022

Here are some unique ways of making the most use of What Medical Expenses Are Deductible In 2022:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

What Medical Expenses Are Deductible In 2022 are a treasure trove of fun and practical tools that cater to various needs and interest. Their accessibility and flexibility make these printables a useful addition to each day life. Explore the vast collection of What Medical Expenses Are Deductible In 2022 right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I utilize free templates for commercial use?

- It is contingent on the specific terms of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using What Medical Expenses Are Deductible In 2022?

- Certain printables might have limitations on their use. Check the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a local print shop for superior prints.

-

What software must I use to open printables free of charge?

- The majority of printables are in the format PDF. This can be opened using free software like Adobe Reader.

Common Health Medical Tax Deductions For Seniors In 2023

What Medical Expenses Are Tax Deductible 10 Items To Deduct

Check more sample of What Medical Expenses Are Deductible In 2022 below

Medical Expenses Islamicmyte

What Business Expenses Are Deductible Buckingham Advisors Ohio

Are Dental Implants Taxable Dental News Network

What Is A Deductible Insurance Shark

IRS Issues Long Term Care Premium Deductibility Limits For 2022 And

What s An FSA Definition Eligible Bills Extra Doddjob

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses

https://www.investopedia.com/.../medi…

For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted gross income AGI for the specific tax

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses

For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted gross income AGI for the specific tax

What Is A Deductible Insurance Shark

What Business Expenses Are Deductible Buckingham Advisors Ohio

IRS Issues Long Term Care Premium Deductibility Limits For 2022 And

What s An FSA Definition Eligible Bills Extra Doddjob

IRS Increases Standard Mileage Rates Starting July 1 2022 Stinson LLP

What Medical Expenses Are Tax Deductible

What Medical Expenses Are Tax Deductible

Are Health Care Costs Tax Deductible AZexplained