In the age of digital, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. For educational purposes, creative projects, or simply to add an individual touch to your space, What Qualifies For Federal Energy Tax Credit are now a useful source. For this piece, we'll dive into the world of "What Qualifies For Federal Energy Tax Credit," exploring the different types of printables, where to find them, and how they can improve various aspects of your life.

Get Latest What Qualifies For Federal Energy Tax Credit Below

What Qualifies For Federal Energy Tax Credit

What Qualifies For Federal Energy Tax Credit -

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed property from 2022 through 2032

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

What Qualifies For Federal Energy Tax Credit encompass a wide range of downloadable, printable materials available online at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and many more. One of the advantages of What Qualifies For Federal Energy Tax Credit lies in their versatility as well as accessibility.

More of What Qualifies For Federal Energy Tax Credit

Aft home Advanced Fiber Technology

Aft home Advanced Fiber Technology

In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000 applies to electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers This means you can claim a maximum total yearly energy efficient home improvement credit amount up to

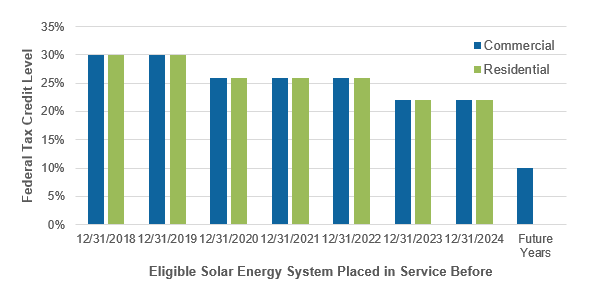

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization It is possible to tailor printables to fit your particular needs when it comes to designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: These What Qualifies For Federal Energy Tax Credit can be used by students from all ages, making them a vital resource for educators and parents.

-

It's easy: Instant access to many designs and templates helps save time and effort.

Where to Find more What Qualifies For Federal Energy Tax Credit

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

Claiming energy tax credits for 2022 and 2023 4 min read Share Making energy efficient updates to your home is a great move for our environment But you might feel the pinch in your household budget The good news is that there are a couple of tax credits that can help out your pocketbook

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product

Since we've got your interest in What Qualifies For Federal Energy Tax Credit Let's find out where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of What Qualifies For Federal Energy Tax Credit for various purposes.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad array of topics, ranging that range from DIY projects to party planning.

Maximizing What Qualifies For Federal Energy Tax Credit

Here are some fresh ways of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

What Qualifies For Federal Energy Tax Credit are a treasure trove filled with creative and practical information for a variety of needs and preferences. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the vast collection that is What Qualifies For Federal Energy Tax Credit today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes they are! You can download and print these files for free.

-

Can I download free printables for commercial use?

- It is contingent on the specific rules of usage. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may come with restrictions on use. Always read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- Print them at home with the printer, or go to an in-store print shop to get the highest quality prints.

-

What program do I need to run printables free of charge?

- The majority are printed in PDF format. They is open with no cost software such as Adobe Reader.

What Qualifies For The Residential Energy Tax Credit Boston Standard

Stimulus Bill Extends Federal Energy Tax Credits DSIRE Insight

Check more sample of What Qualifies For Federal Energy Tax Credit below

What Roofing Qualifies For Tax Credit

Slurry Storage Costs What Qualifies For Capital Allowances

Federal Energy Property Tax Credits Reinstated HB McClure

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Tourshabana Green Energy Tax Credits For Home Improvement

MRCOOL GeoCool 36K BTU 3 Ton Downflow Two Stage CuNi Coil Left Return

https://www. irs.gov /credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www. investopedia.com /terms/e/energy-tax-credit.asp

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum owed to the

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum owed to the

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Slurry Storage Costs What Qualifies For Capital Allowances

Tourshabana Green Energy Tax Credits For Home Improvement

MRCOOL GeoCool 36K BTU 3 Ton Downflow Two Stage CuNi Coil Left Return

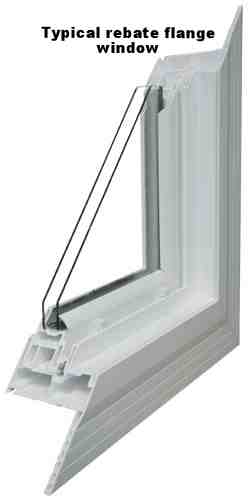

Replacement Windows Rebates Window Replacement

OWB86 Oil Fired Water Boiler Lennox Residential

OWB86 Oil Fired Water Boiler Lennox Residential

MRCOOL GeoCool 24K BTU 2 Ton Horizontal Two Stage CuNi Coil Left