In this day and age with screens dominating our lives it's no wonder that the appeal of tangible printed items hasn't gone away. In the case of educational materials in creative or artistic projects, or just adding a personal touch to your home, printables for free are now an essential resource. With this guide, you'll dive into the sphere of "What Qualifies For Historic Tax Credits," exploring the benefits of them, where you can find them, and how they can improve various aspects of your lives.

Get Latest What Qualifies For Historic Tax Credits Below

What Qualifies For Historic Tax Credits

What Qualifies For Historic Tax Credits -

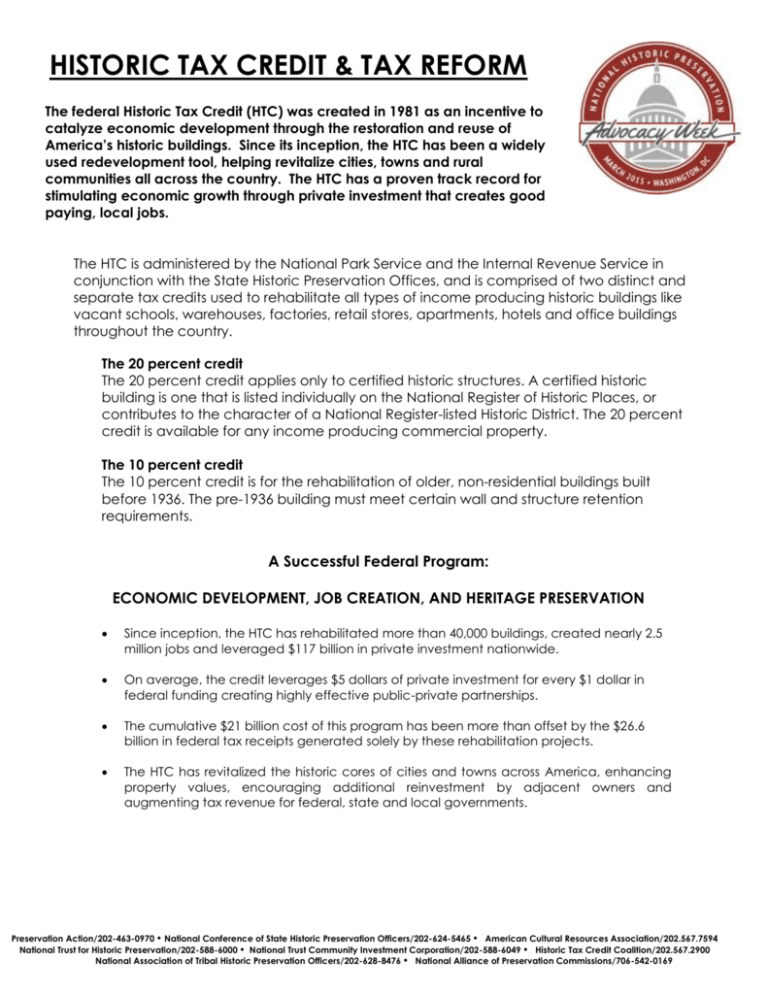

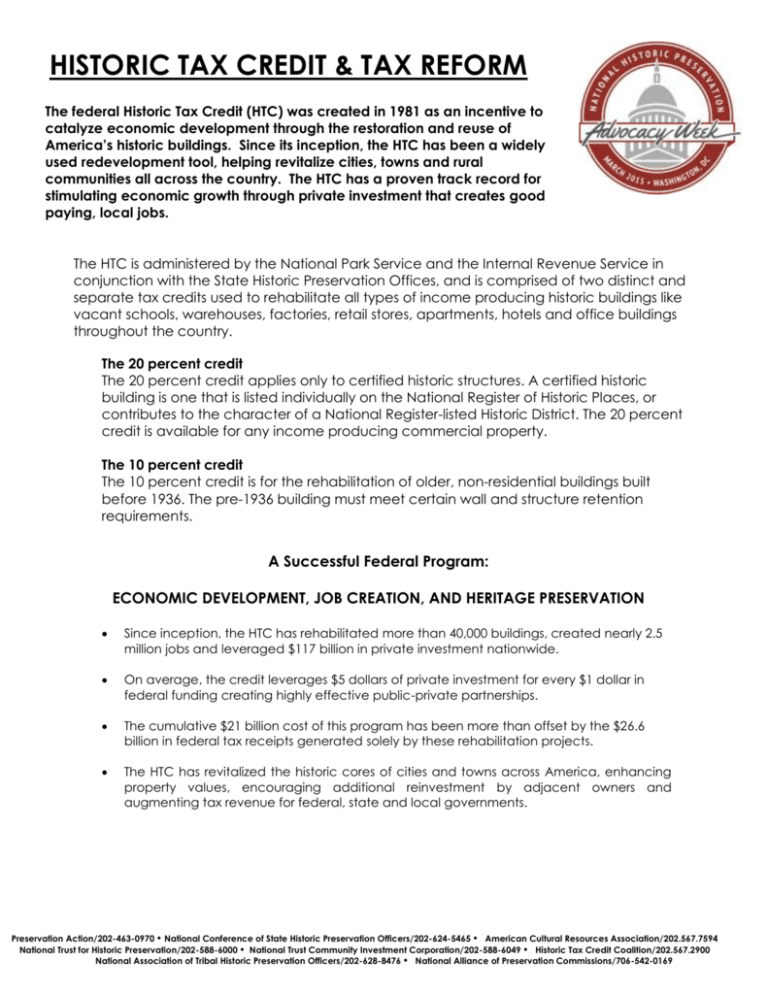

The federal historic rehabilitation tax credit HTC program is an indirect federal subsidy to finance the rehabilitation of historic buildings with a 20 percent tax credit for qualified expenditures

There are four factors that can help you decide whether your rehabilitation project would meet the basic requirements for the 20 tax credit 1 The historic building must be listed in the National Register of Historic Places or be certified as contributing to the significance of a registered historic district

What Qualifies For Historic Tax Credits provide a diverse array of printable material that is available online at no cost. These resources come in many types, like worksheets, coloring pages, templates and more. The appealingness of What Qualifies For Historic Tax Credits lies in their versatility as well as accessibility.

More of What Qualifies For Historic Tax Credits

The Benefits Of Historic Tax Credits

The Benefits Of Historic Tax Credits

Learn how to claim a 20 tax credit for rehabilitating historic buildings that meet certain requirements Find out the eligibility application and filing procedures for the rehabilitation credit

What is the federal historic tax credit The federal government offers a 20 percent investment tax credit for certified rehabilitation of certified historic buildings As the name implies it is not a tax deduction but a dollar for dollar credit applied to federal taxes Only certain expenditures count toward the tax credit Acquisition costs

What Qualifies For Historic Tax Credits have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Customization: There is the possibility of tailoring print-ready templates to your specific requirements whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational Value: Education-related printables at no charge are designed to appeal to students of all ages, which makes these printables a powerful source for educators and parents.

-

Accessibility: The instant accessibility to a myriad of designs as well as templates can save you time and energy.

Where to Find more What Qualifies For Historic Tax Credits

Federal Historic Tax Credits Exploring Their Impact PolicyMap

Federal Historic Tax Credits Exploring Their Impact PolicyMap

Learn how to apply for the 20 federal tax credit for rehabilitating historic properties certified by the National Park Service Find out the eligibility criteria standards regulations and resources for this program

Learn how to qualify for and apply for the 20 percent tax credit on eligible improvement expenses for historic buildings Find out the benefits requirements changes and application process of the historic tax credit program

We hope we've stimulated your interest in What Qualifies For Historic Tax Credits Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with What Qualifies For Historic Tax Credits for all reasons.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- The blogs are a vast range of topics, starting from DIY projects to planning a party.

Maximizing What Qualifies For Historic Tax Credits

Here are some unique ways for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

What Qualifies For Historic Tax Credits are an abundance of innovative and useful resources which cater to a wide range of needs and pursuits. Their accessibility and versatility make they a beneficial addition to the professional and personal lives of both. Explore the many options of What Qualifies For Historic Tax Credits now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Qualifies For Historic Tax Credits really free?

- Yes they are! You can download and print these resources at no cost.

-

Are there any free printing templates for commercial purposes?

- It depends on the specific conditions of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with What Qualifies For Historic Tax Credits?

- Certain printables might have limitations regarding usage. Make sure to read the terms and conditions offered by the creator.

-

How do I print What Qualifies For Historic Tax Credits?

- You can print them at home with printing equipment or visit an area print shop for more high-quality prints.

-

What software do I need to open printables for free?

- Most printables come with PDF formats, which can be opened with free software such as Adobe Reader.

Learn About Historic Tax Credits And Restoration Tax Abatement Program

Historic Tax Credits Tax Credits Historic Homes Historical

Check more sample of What Qualifies For Historic Tax Credits below

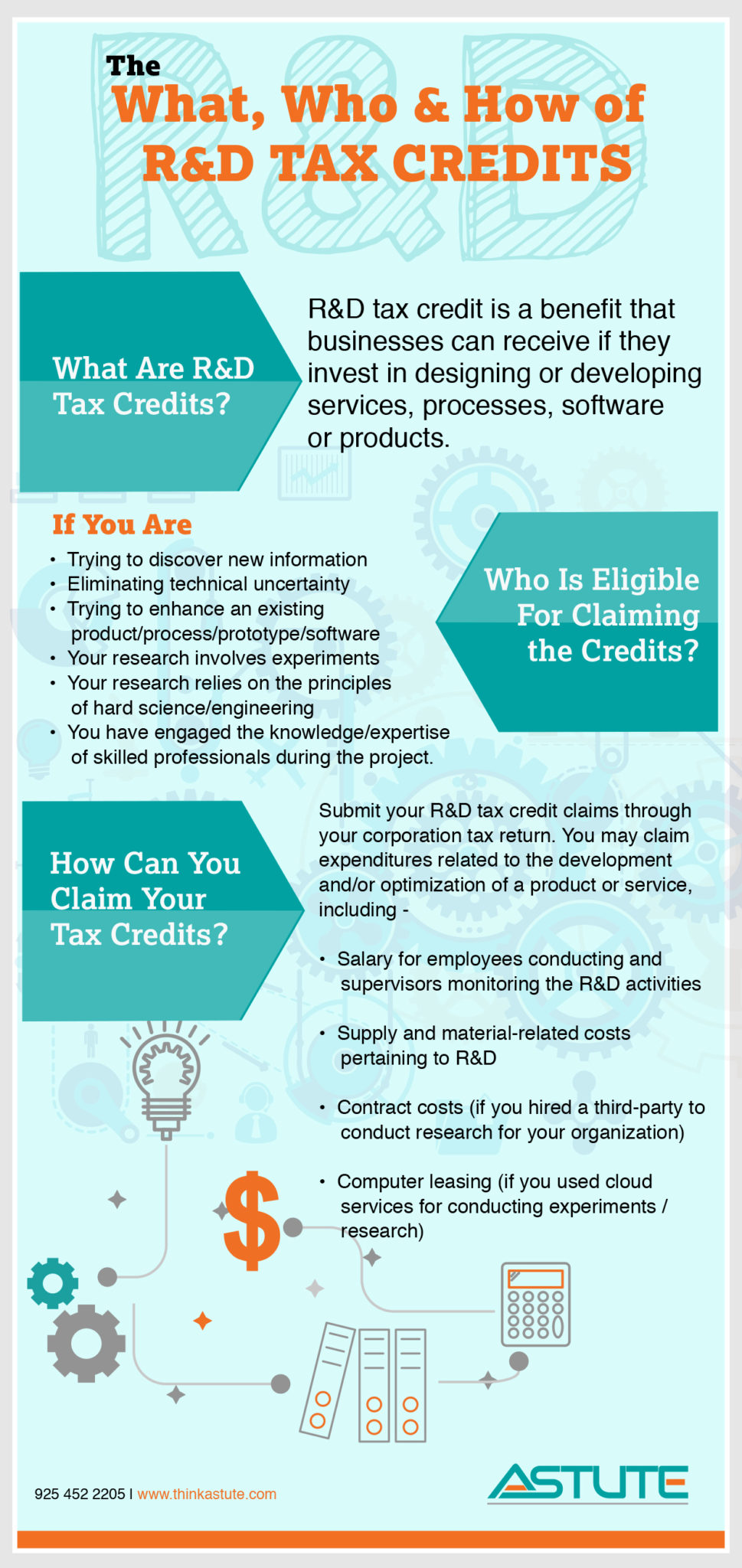

Are You Eligible For R D Tax Credit Find Out Using This Infographic

Layman s Guide To Federal Historic Tax Credits Insights

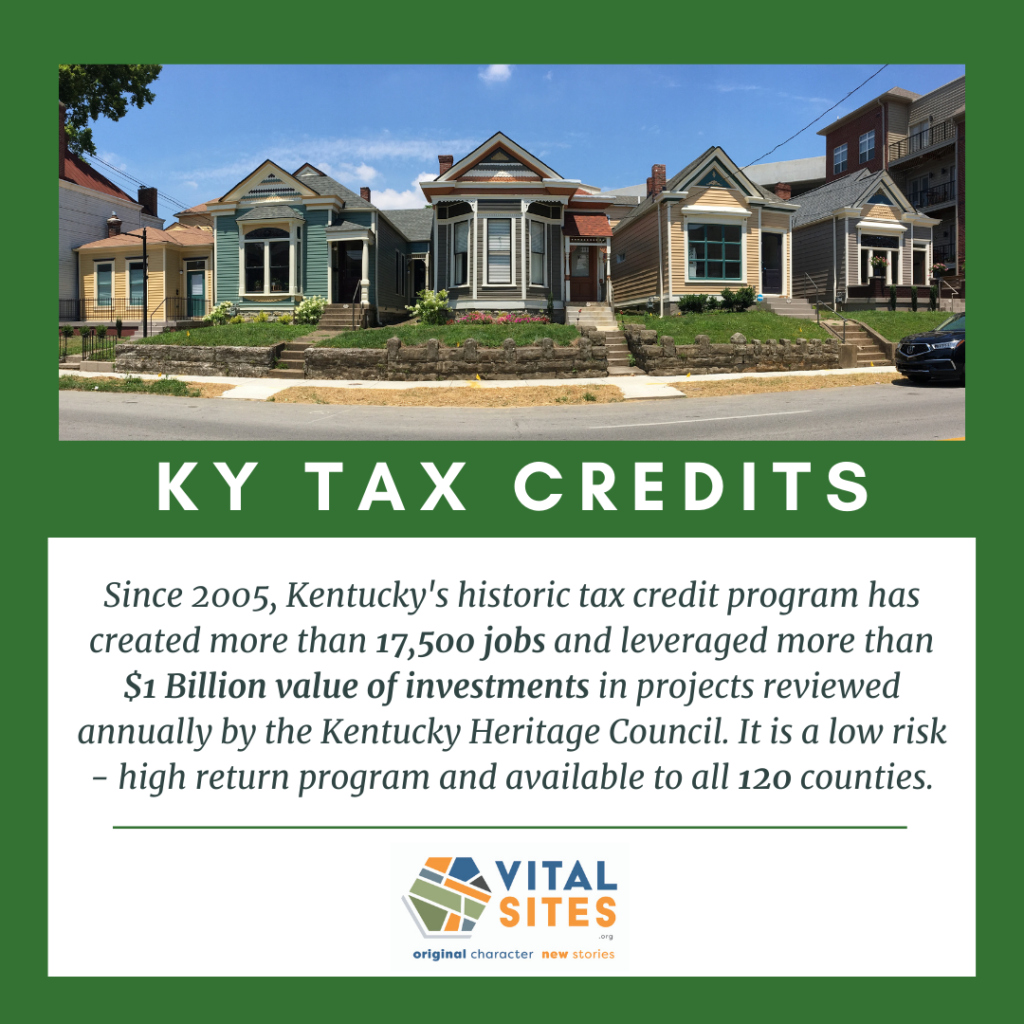

Historic Rehabilitation Tax Credits VITAL SITES

Tax Credits An Overview Boston Preservation Alliance

Tax Credits Save You More Than Deductions Here Are The Best Ones

Historic Tax Credit

https://www.nps.gov/subjects/taxincentives/...

There are four factors that can help you decide whether your rehabilitation project would meet the basic requirements for the 20 tax credit 1 The historic building must be listed in the National Register of Historic Places or be certified as contributing to the significance of a registered historic district

https://www.jpmorgan.com/.../the-historic-tax-credit-program-101

Learn how to claim low cost capital through the federal Historic Preservation Tax Incentives program for historic building rehabilitation Find out how JPMorgan Chase can help you navigate the process and access the tax credits at the state and federal levels

There are four factors that can help you decide whether your rehabilitation project would meet the basic requirements for the 20 tax credit 1 The historic building must be listed in the National Register of Historic Places or be certified as contributing to the significance of a registered historic district

Learn how to claim low cost capital through the federal Historic Preservation Tax Incentives program for historic building rehabilitation Find out how JPMorgan Chase can help you navigate the process and access the tax credits at the state and federal levels

Tax Credits An Overview Boston Preservation Alliance

Layman s Guide To Federal Historic Tax Credits Insights

Tax Credits Save You More Than Deductions Here Are The Best Ones

Historic Tax Credit

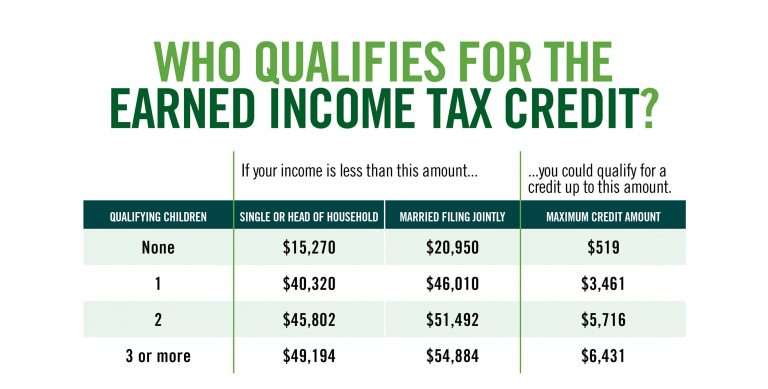

Earning Income Tax Credit Table

Fayette County Historic Courthouse Board Gets An Overhaul Lexington

Fayette County Historic Courthouse Board Gets An Overhaul Lexington

Software Development What Qualifies For R D Tax Credits Ian Farley