In a world where screens rule our lives and the appeal of physical printed products hasn't decreased. Whether it's for educational purposes, creative projects, or just adding a personal touch to your area, Where Do You Claim Union Fees On Tax Return have become an invaluable source. We'll take a dive into the sphere of "Where Do You Claim Union Fees On Tax Return," exploring what they are, how they can be found, and how they can add value to various aspects of your lives.

Get Latest Where Do You Claim Union Fees On Tax Return Below

Where Do You Claim Union Fees On Tax Return

Where Do You Claim Union Fees On Tax Return -

You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies

If you re a member of a union you may be eligible for a tax break on your union dues By deducting your dues on Schedule C you can maximize your tax refunds To claim this deduction you must be an eligible individual

Where Do You Claim Union Fees On Tax Return include a broad collection of printable material that is available online at no cost. These resources come in various types, such as worksheets templates, coloring pages and many more. The great thing about Where Do You Claim Union Fees On Tax Return is their flexibility and accessibility.

More of Where Do You Claim Union Fees On Tax Return

Claim Union Fees YouTube

Claim Union Fees YouTube

If you itemize deductions you may deduct union dues as a job related expense Job related expenses are not fully deductible as they are subject to the 2 rule Please see the FAQ

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions However if the taxpayer is self

Where Do You Claim Union Fees On Tax Return have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization They can make printing templates to your own specific requirements whether it's making invitations or arranging your schedule or even decorating your house.

-

Education Value Downloads of educational content for free cater to learners of all ages. This makes them an essential device for teachers and parents.

-

The convenience of Access to a plethora of designs and templates is time-saving and saves effort.

Where to Find more Where Do You Claim Union Fees On Tax Return

US Supreme Court Case Could Weaken Government Workers Unions

US Supreme Court Case Could Weaken Government Workers Unions

The current budget will be balanced within three years of forecasts The government will run a deficit of 26 2bn in 2026 but will achieve a surplus of 10 9bn in 2027

You can deduct dues and initiation fees you pay for union membership These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized

Now that we've ignited your curiosity about Where Do You Claim Union Fees On Tax Return Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Where Do You Claim Union Fees On Tax Return suitable for many reasons.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning tools.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs covered cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing Where Do You Claim Union Fees On Tax Return

Here are some ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Where Do You Claim Union Fees On Tax Return are an abundance with useful and creative ideas for a variety of needs and desires. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the wide world of Where Do You Claim Union Fees On Tax Return today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these resources at no cost.

-

Can I download free printables for commercial purposes?

- It's determined by the specific conditions of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions on use. Always read the terms of service and conditions provided by the designer.

-

How can I print Where Do You Claim Union Fees On Tax Return?

- Print them at home with a printer or visit any local print store for more high-quality prints.

-

What software do I need in order to open printables at no cost?

- The majority of PDF documents are provided in PDF format. These can be opened using free software such as Adobe Reader.

Can You Claim Franchise Fees On Tax How To Read Stock Charts For

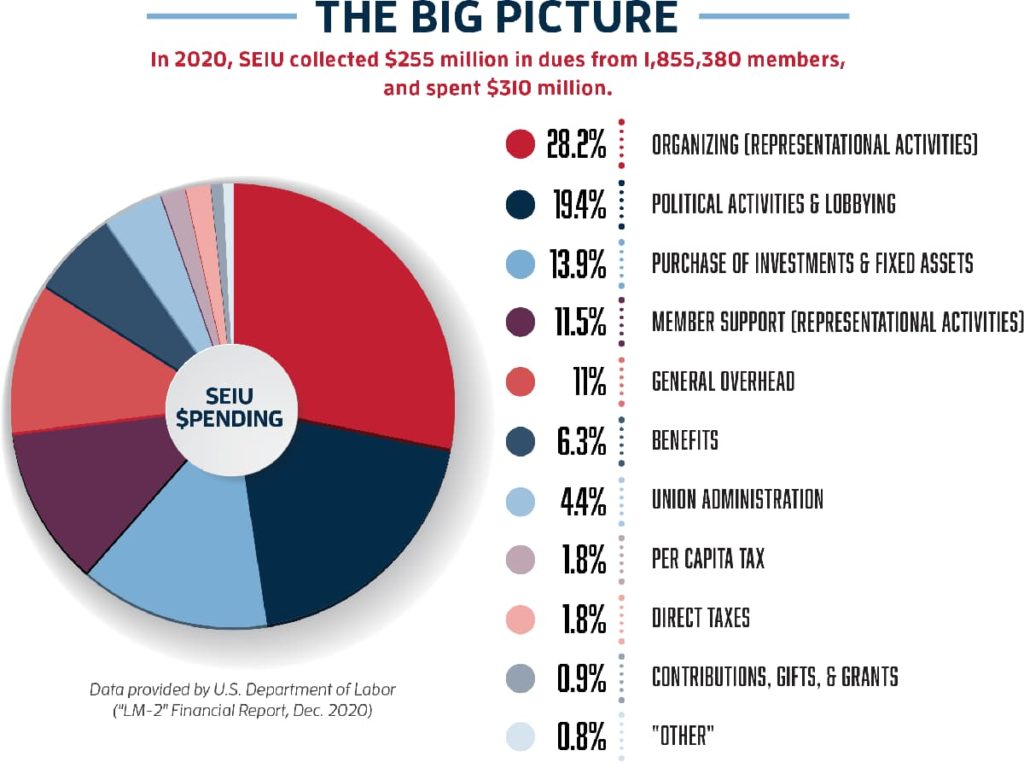

SEIU Where Do Your Dues Go Americans For Fair Treatment

Check more sample of Where Do You Claim Union Fees On Tax Return below

Union Fees Tax Deduction One Click Life

Job Portal Savage Search Associates

Claiming Self Education Expenses On Your 2021 Tax Return Auditax

School Fees 45 000 TAX YouTube

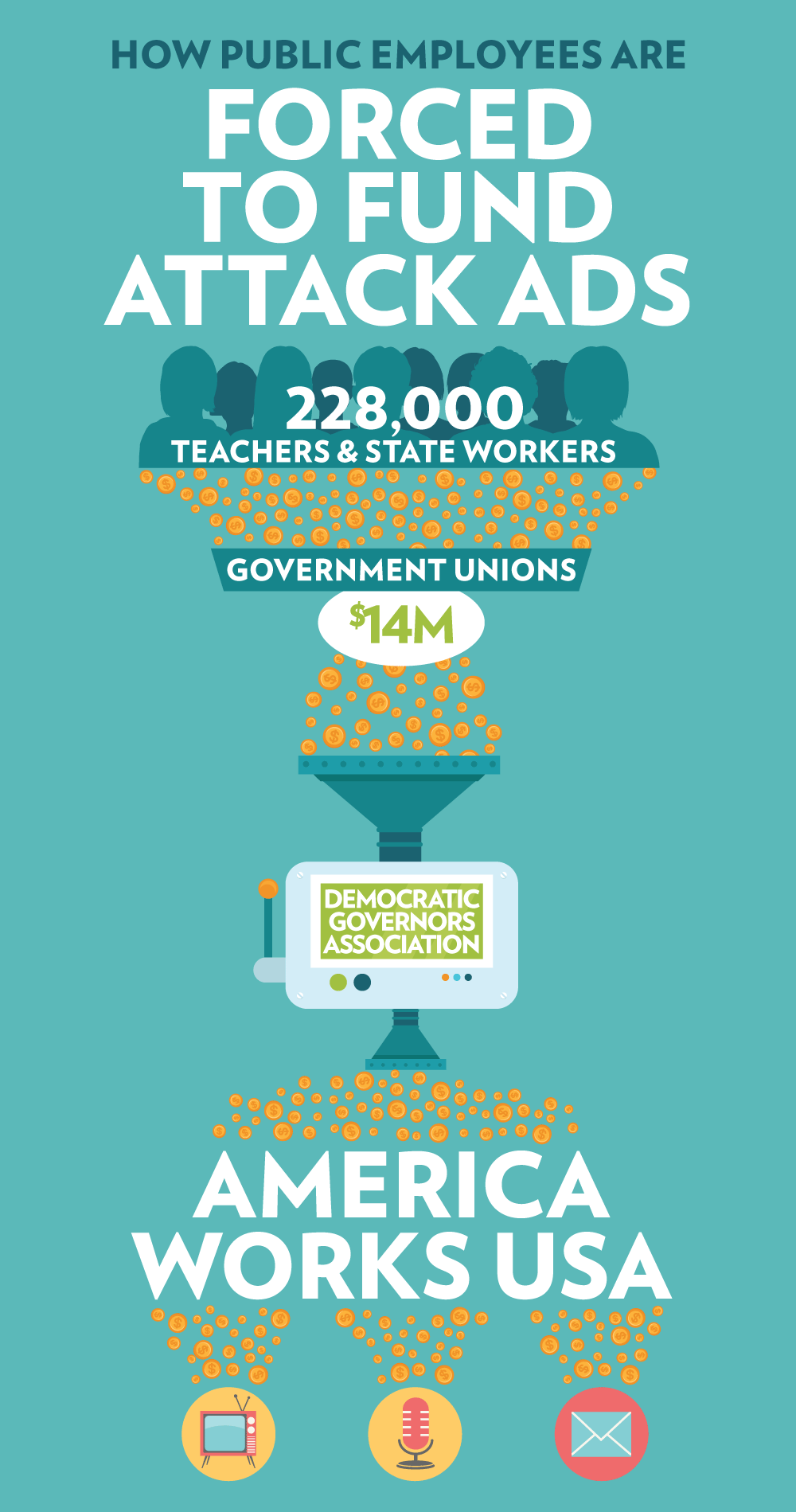

Union Dues Are Used For Politics and Members Don t Know It

About Music Charts On Twitter What Song Do You Claim On Taylor Swift

https://www.irs.com › en › are-union-du…

If you re a member of a union you may be eligible for a tax break on your union dues By deducting your dues on Schedule C you can maximize your tax refunds To claim this deduction you must be an eligible individual

https://ttlc.intuit.com › ... › tax-credits-deductions › deduct-union-dues

If you re self employed you can deduct union dues as a business expense However most employees can no longer deduct union dues on their federal tax return in tax years 2018

If you re a member of a union you may be eligible for a tax break on your union dues By deducting your dues on Schedule C you can maximize your tax refunds To claim this deduction you must be an eligible individual

If you re self employed you can deduct union dues as a business expense However most employees can no longer deduct union dues on their federal tax return in tax years 2018

School Fees 45 000 TAX YouTube

Job Portal Savage Search Associates

Union Dues Are Used For Politics and Members Don t Know It

About Music Charts On Twitter What Song Do You Claim On Taylor Swift

Will Augusta Property Tax Rates Rise Or Stay The Same City Deadlocked

Where Do My Union Dues Go Labor Spending Revealed

Where Do My Union Dues Go Labor Spending Revealed

List Of Tax Benefit On Health Insurance 2023 INFORMATION