In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons, creative projects, or simply to add an element of personalization to your space, Where Do You Deduct Student Loan Interest On 1040 have become an invaluable resource. For this piece, we'll dive deeper into "Where Do You Deduct Student Loan Interest On 1040," exploring what they are, how you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Where Do You Deduct Student Loan Interest On 1040 Below

Where Do You Deduct Student Loan Interest On 1040

Where Do You Deduct Student Loan Interest On 1040 -

If you ve paid interest on your student loans you may be able to reduce your federal taxable income by up to 2 500 thanks to the student loan interest deduction or SLID

Student loan interest is an adjustment to income commonly known as an above the line deduction So you claim it on Schedule 1 of your Form 1040 rather than as an itemized deduction on Schedule

The Where Do You Deduct Student Loan Interest On 1040 are a huge array of printable materials that are accessible online for free cost. These printables come in different designs, including worksheets templates, coloring pages and more. One of the advantages of Where Do You Deduct Student Loan Interest On 1040 is their versatility and accessibility.

More of Where Do You Deduct Student Loan Interest On 1040

How To Deduct Student Loan Interest This Could Save You A Ton YouTube

How To Deduct Student Loan Interest This Could Save You A Ton YouTube

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

Student loan interest deduction You can t deduct as interest on a student loan any interest paid by your employer after March 27 2000 and before January 1 2026 under an educational assistance program See chapter 4

Where Do You Deduct Student Loan Interest On 1040 have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring the design to meet your needs, whether it's designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Printing educational materials for no cost provide for students of all ages, which makes them a vital tool for teachers and parents.

-

Easy to use: immediate access many designs and templates helps save time and effort.

Where to Find more Where Do You Deduct Student Loan Interest On 1040

Can I Deduct Health Insurance Premiums If I m Self Employed

Can I Deduct Health Insurance Premiums If I m Self Employed

To claim education credits taxpayers must file IRS Form 8863 with their tax return Taxpayers typically can deduct interest paid on student loans with eligibility and deduction amounts varying by income

This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information you ll need Filing status Basic income information Your adjusted gross income Educational

We've now piqued your interest in Where Do You Deduct Student Loan Interest On 1040 Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Where Do You Deduct Student Loan Interest On 1040 designed for a variety purposes.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Where Do You Deduct Student Loan Interest On 1040

Here are some unique ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Where Do You Deduct Student Loan Interest On 1040 are an abundance with useful and creative ideas catering to different needs and preferences. Their accessibility and flexibility make them a fantastic addition to both professional and personal life. Explore the world of Where Do You Deduct Student Loan Interest On 1040 today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes they are! You can download and print the resources for free.

-

Does it allow me to use free printables to make commercial products?

- It's based on the usage guidelines. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions regarding usage. Make sure to read the terms and condition of use as provided by the author.

-

How do I print Where Do You Deduct Student Loan Interest On 1040?

- You can print them at home with any printer or head to any local print store for top quality prints.

-

What software is required to open printables for free?

- The majority of PDF documents are provided with PDF formats, which is open with no cost programs like Adobe Reader.

How Do I Deduct Student Loan Interest

Student Loan Interest Can You Deduct It On Your Tax Return BMG CPAs

Check more sample of Where Do You Deduct Student Loan Interest On 1040 below

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

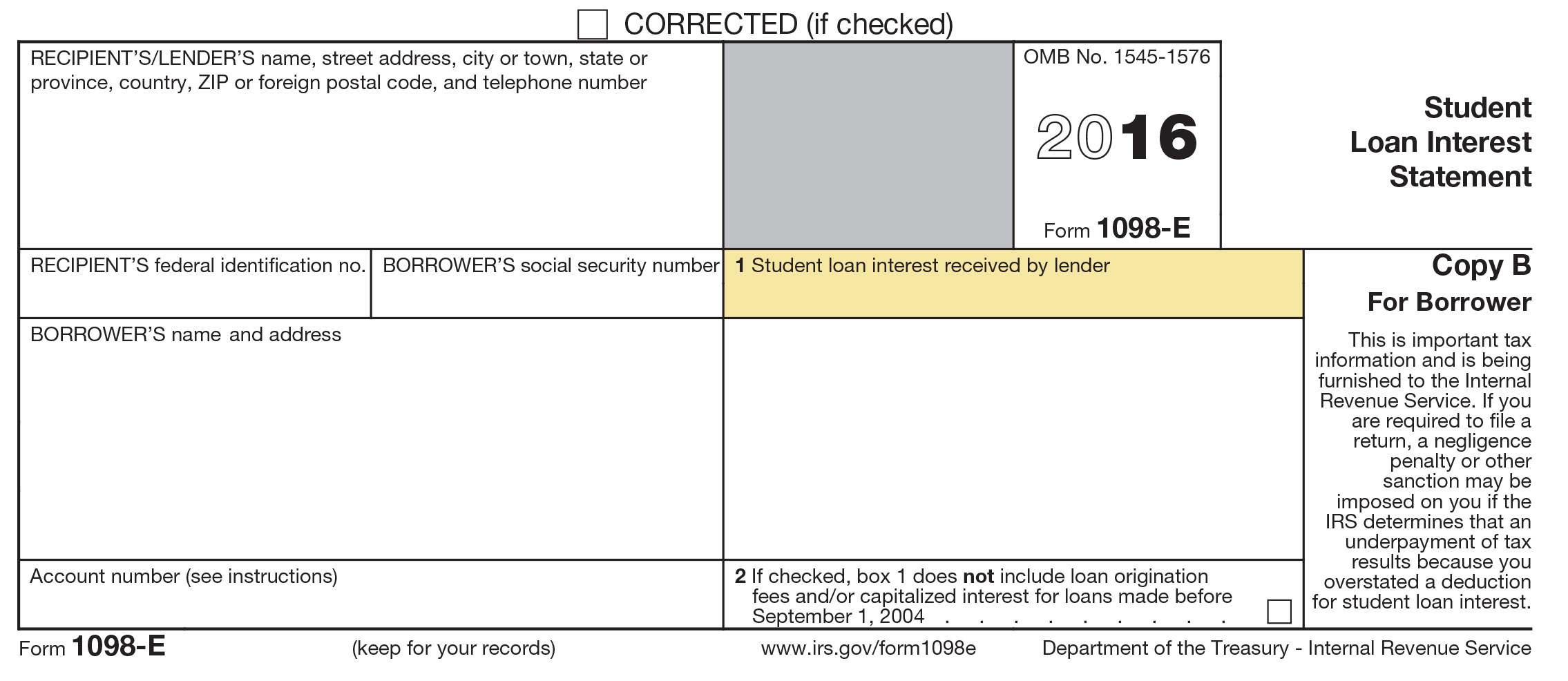

HOW TO DEDUCT STUDENT LOAN INTEREST ON YOUR TAXES 1098 E Blog

39 Mortgage Insurance Premiums Deduction Worksheet Worksheet Master

Tax Tip 2016 Deduct Student Loan Interest Paid By Your Parents YouTube

The Federal Student Loan Interest Deduction

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

Who Can Deduct Student Loan Interest Heintzelman Accounting Services

https://www.forbes.com › advisor › taxe…

Student loan interest is an adjustment to income commonly known as an above the line deduction So you claim it on Schedule 1 of your Form 1040 rather than as an itemized deduction on Schedule

https://www.investopedia.com › terms …

The student loan interest deduction allows borrowers to deduct up to 2 500 of the interest paid on a loan for higher education directly on Form 1040

Student loan interest is an adjustment to income commonly known as an above the line deduction So you claim it on Schedule 1 of your Form 1040 rather than as an itemized deduction on Schedule

The student loan interest deduction allows borrowers to deduct up to 2 500 of the interest paid on a loan for higher education directly on Form 1040

Tax Tip 2016 Deduct Student Loan Interest Paid By Your Parents YouTube

HOW TO DEDUCT STUDENT LOAN INTEREST ON YOUR TAXES 1098 E Blog

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

Who Can Deduct Student Loan Interest Heintzelman Accounting Services

Can I Deduct My Child s Student Loan Interest

Can You Deduct Student Loan Interest On Your Tax Return William H

Can You Deduct Student Loan Interest On Your Tax Return William H

How Do I Deduct Student Loan Interest