In a world in which screens are the norm The appeal of tangible printed products hasn't decreased. Be it for educational use and creative work, or simply to add an individual touch to the space, Where To Claim Student Loan Interest On 1040 have become a valuable resource. Through this post, we'll take a dive into the world of "Where To Claim Student Loan Interest On 1040," exploring the different types of printables, where they can be found, and how they can be used to enhance different aspects of your life.

Get Latest Where To Claim Student Loan Interest On 1040 Below

Where To Claim Student Loan Interest On 1040

Where To Claim Student Loan Interest On 1040 -

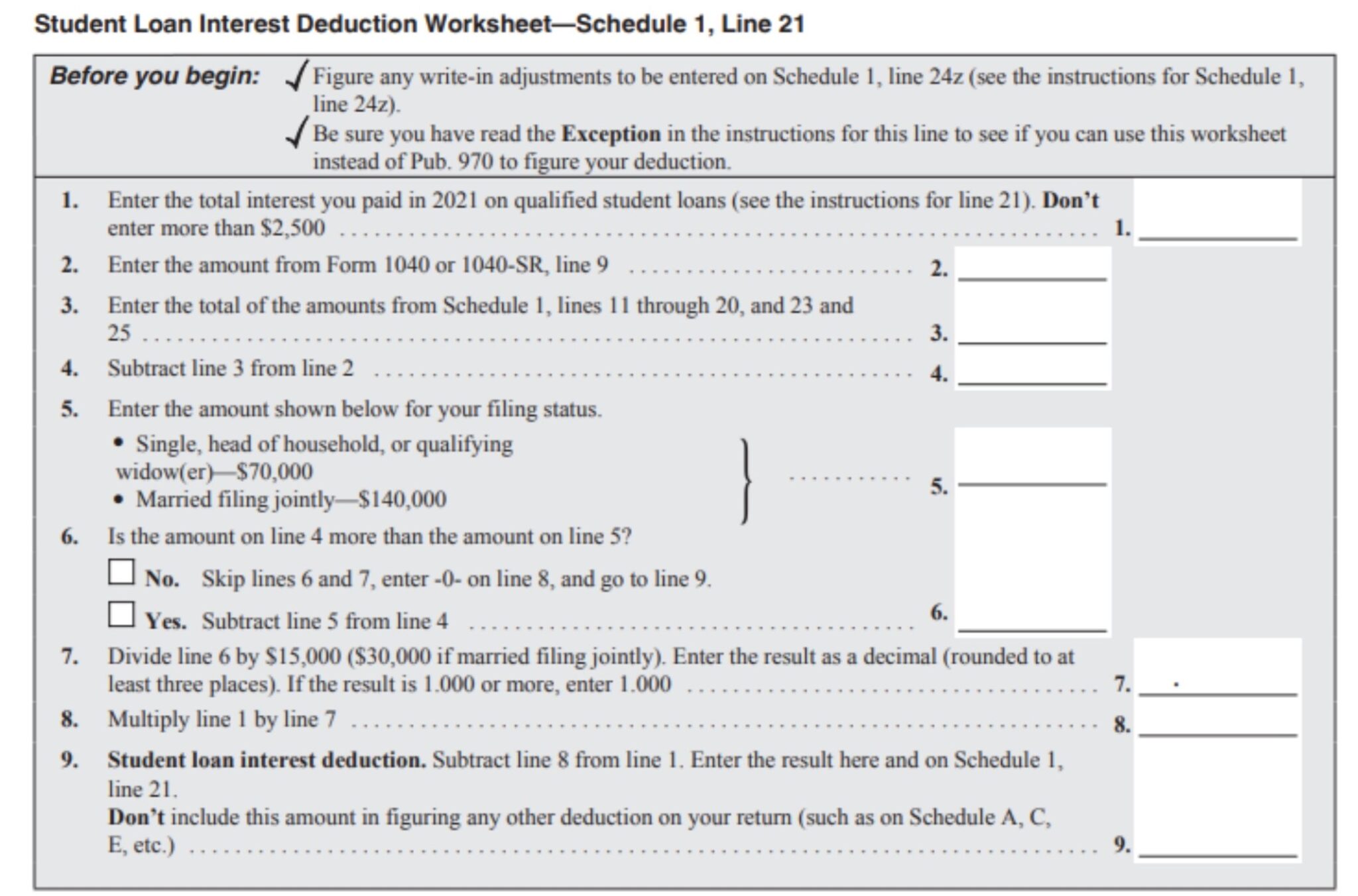

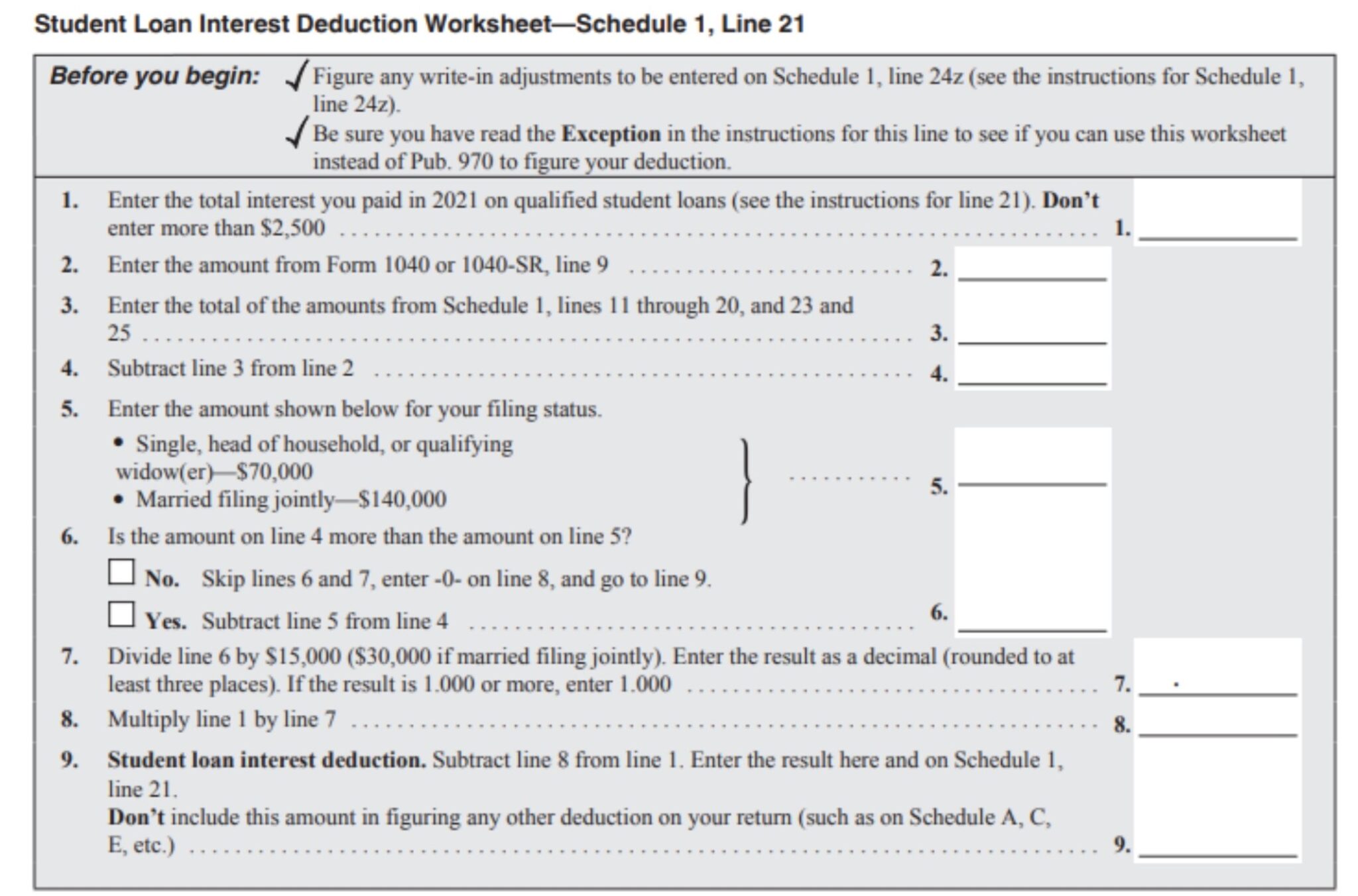

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

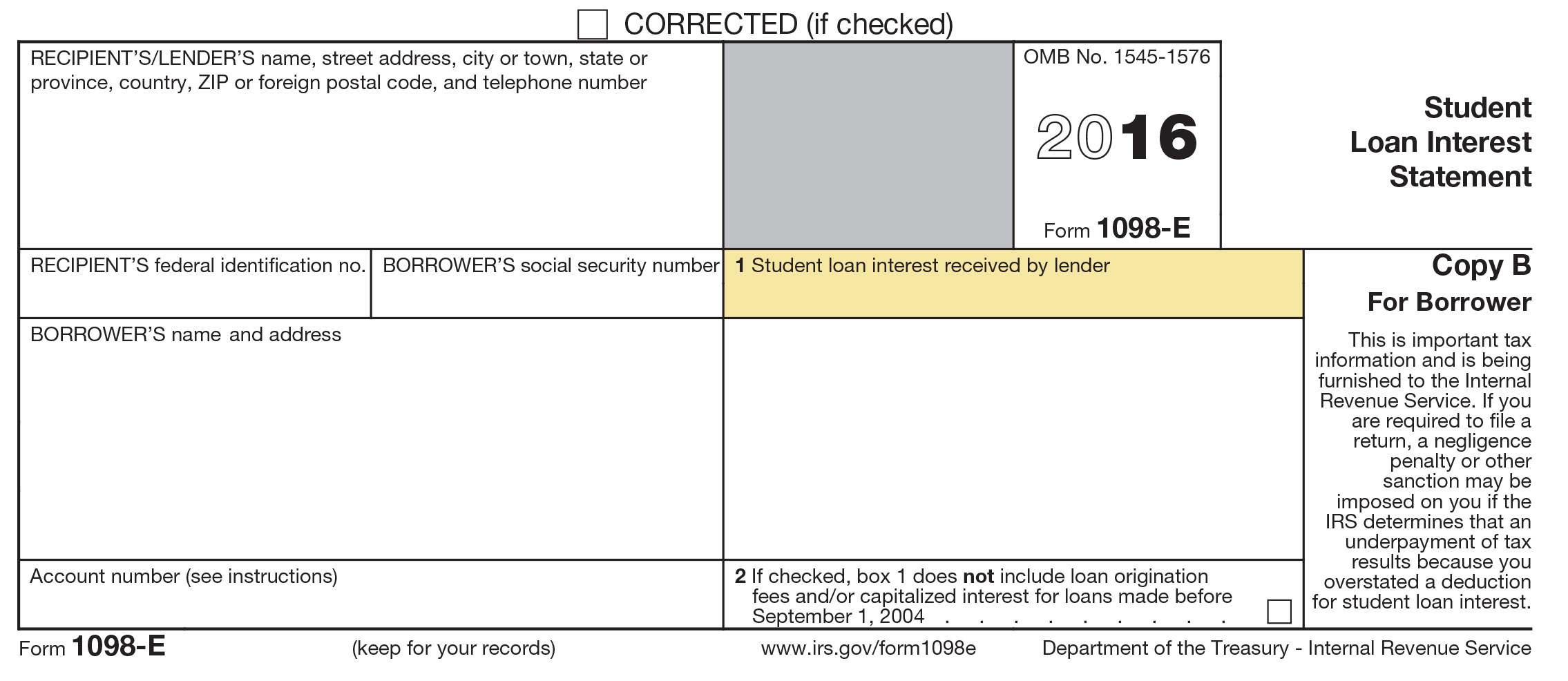

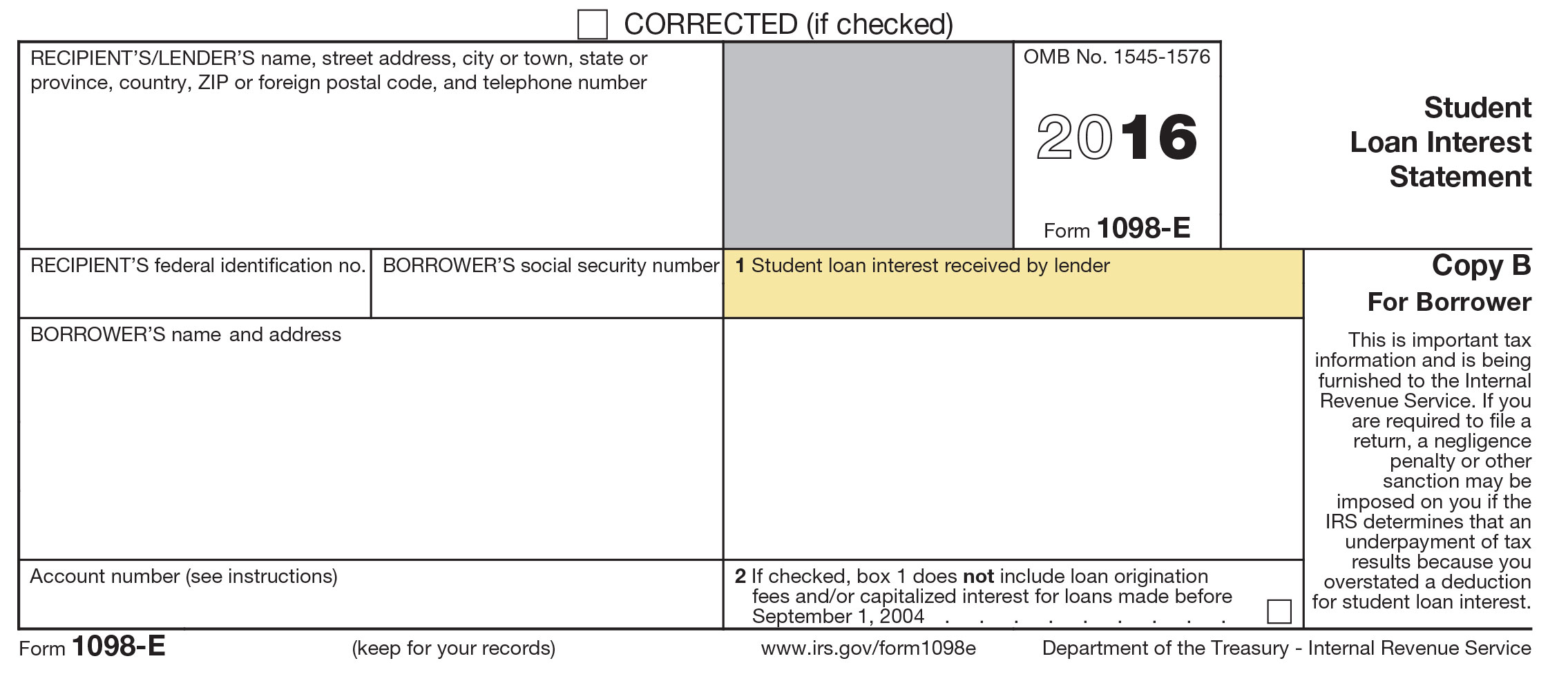

There are a few documents you ll need before you can claim the student loan interest deduction on your federal taxes Form 1040 or 1040 SR This is your federal tax

Where To Claim Student Loan Interest On 1040 provide a diverse assortment of printable, downloadable materials available online at no cost. These printables come in different formats, such as worksheets, templates, coloring pages and much more. The benefit of Where To Claim Student Loan Interest On 1040 lies in their versatility as well as accessibility.

More of Where To Claim Student Loan Interest On 1040

39 Mortgage Insurance Premiums Deduction Worksheet Worksheet Master

39 Mortgage Insurance Premiums Deduction Worksheet Worksheet Master

This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information you ll need Filing status Basic income information Your adjusted gross income Educational expenses paid with

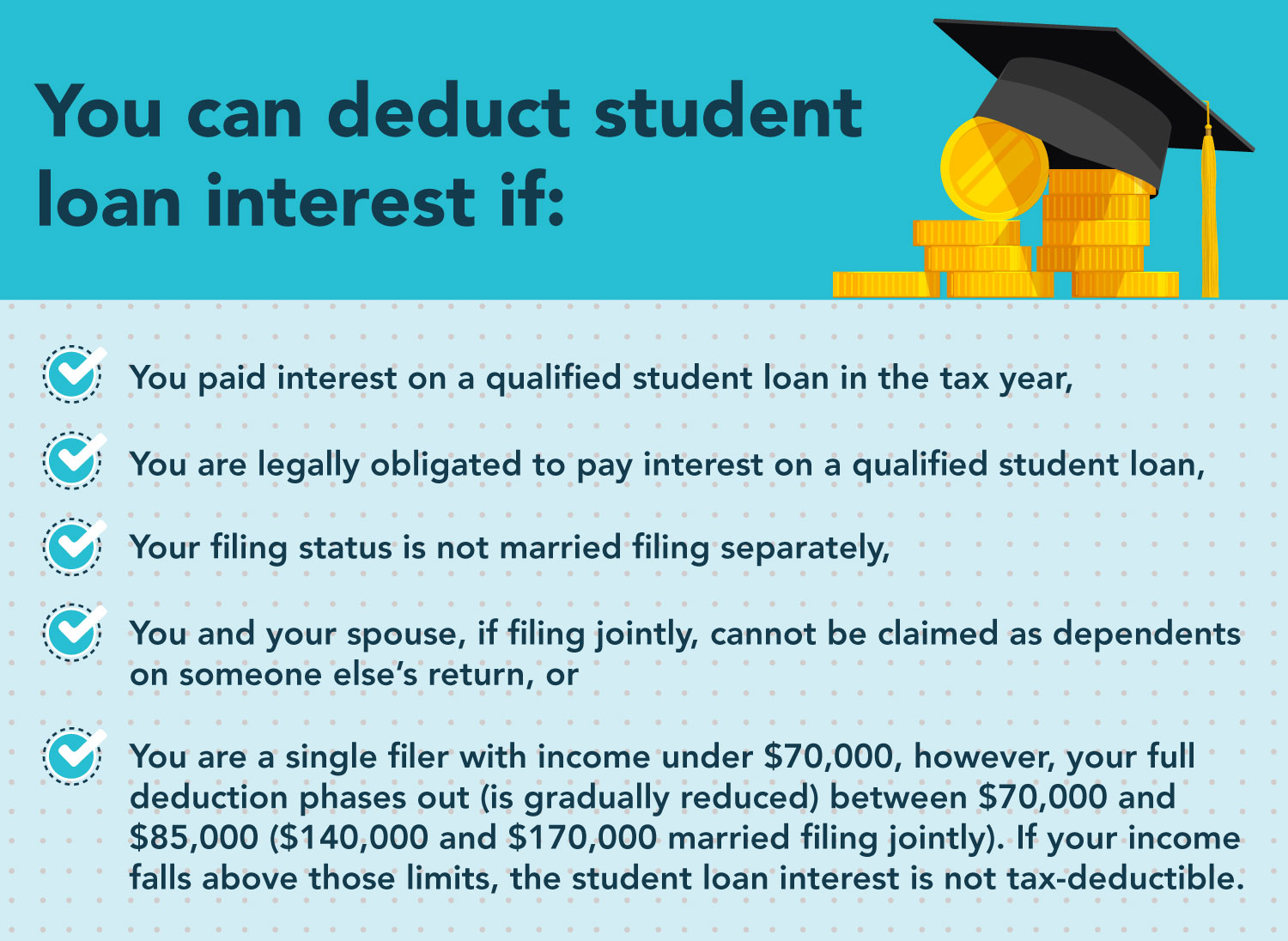

You paid interest during the tax year on a qualified student loan Your filing status is not married filing separately Your modified adjusted gross income MAGI must be less than 70 000 if

Where To Claim Student Loan Interest On 1040 have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Personalization We can customize the templates to meet your individual needs in designing invitations making your schedule, or decorating your home.

-

Educational value: Education-related printables at no charge cater to learners of all ages, which makes these printables a powerful aid for parents as well as educators.

-

Accessibility: Fast access a variety of designs and templates can save you time and energy.

Where to Find more Where To Claim Student Loan Interest On 1040

What Credit Score Is Needed For A Student Loan Student Loan Planner

What Credit Score Is Needed For A Student Loan Student Loan Planner

If you re paying off your student loans you may qualify for a student loan interest deduction which can reduce your taxable income and make up for some of the

It s sometimes called the Student Loan Interest Statement You ll need to file Form 1098 E to deduct student loan interest payments from your taxes You can typically claim

Now that we've ignited your curiosity about Where To Claim Student Loan Interest On 1040 Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Where To Claim Student Loan Interest On 1040 for different needs.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free as well as flashcards and other learning materials.

- It is ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a wide variety of topics, that range from DIY projects to party planning.

Maximizing Where To Claim Student Loan Interest On 1040

Here are some innovative ways that you can make use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Where To Claim Student Loan Interest On 1040 are an abundance of useful and creative resources catering to different needs and desires. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast world of Where To Claim Student Loan Interest On 1040 today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Where To Claim Student Loan Interest On 1040 truly gratis?

- Yes they are! You can download and print these resources at no cost.

-

Can I download free templates for commercial use?

- It's contingent upon the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables could be restricted concerning their use. Make sure you read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- Print them at home with either a printer or go to an area print shop for higher quality prints.

-

What software is required to open printables for free?

- Many printables are offered in the format of PDF, which can be opened with free programs like Adobe Reader.

Student Loan Interest Waiver Here s How It Works Money

The Federal Student Loan Interest Deduction

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

Check more sample of Where To Claim Student Loan Interest On 1040 below

Certificate Courses Student Loans Higher Education Expand Goo

Claiming The Student Loan Interest Deduction

Federal Student Loan Interest Rate For 2019 20 PayForED

16 Best Private Student Loans Of March 2021 NerdWallet Student

Lower Your Student Loan Interest Rate NOW

How To Avoid Student Debt Student Debt Relief

https://money.usnews.com/loans/student-loans/...

There are a few documents you ll need before you can claim the student loan interest deduction on your federal taxes Form 1040 or 1040 SR This is your federal tax

https://www.forbes.com/advisor/taxes/s…

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

There are a few documents you ll need before you can claim the student loan interest deduction on your federal taxes Form 1040 or 1040 SR This is your federal tax

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

16 Best Private Student Loans Of March 2021 NerdWallet Student

Claiming The Student Loan Interest Deduction

Lower Your Student Loan Interest Rate NOW

How To Avoid Student Debt Student Debt Relief

Why You Should Prepare For Student Loan Payments To Resume even If

Hire Student Loan Planner For Your Custom Student Loan Plan Student

Hire Student Loan Planner For Your Custom Student Loan Plan Student

How Can You Find Out If You Paid Taxes On Student Loans