Today, when screens dominate our lives however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education for creative projects, simply adding an individual touch to the space, Where To Put Student Loan Interest On 1040 have become an invaluable resource. In this article, we'll dive through the vast world of "Where To Put Student Loan Interest On 1040," exploring what they are, how you can find them, and what they can do to improve different aspects of your life.

Get Latest Where To Put Student Loan Interest On 1040 Below

Where To Put Student Loan Interest On 1040

Where To Put Student Loan Interest On 1040 -

Learn how to deduct up to 2 500 in student loan interest from your taxes if you meet the income and eligibility requirements Find out who can claim the deduction how to

You paid interest during the tax year on a qualified student loan Your filing status is not married filing separately Your modified adjusted gross income MAGI must be less than 70 000 if

Where To Put Student Loan Interest On 1040 provide a diverse selection of printable and downloadable content that can be downloaded from the internet at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and many more. The appealingness of Where To Put Student Loan Interest On 1040 is their flexibility and accessibility.

More of Where To Put Student Loan Interest On 1040

Student Loans Are Paused But Here s 6 Things To Do Now

Student Loans Are Paused But Here s 6 Things To Do Now

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

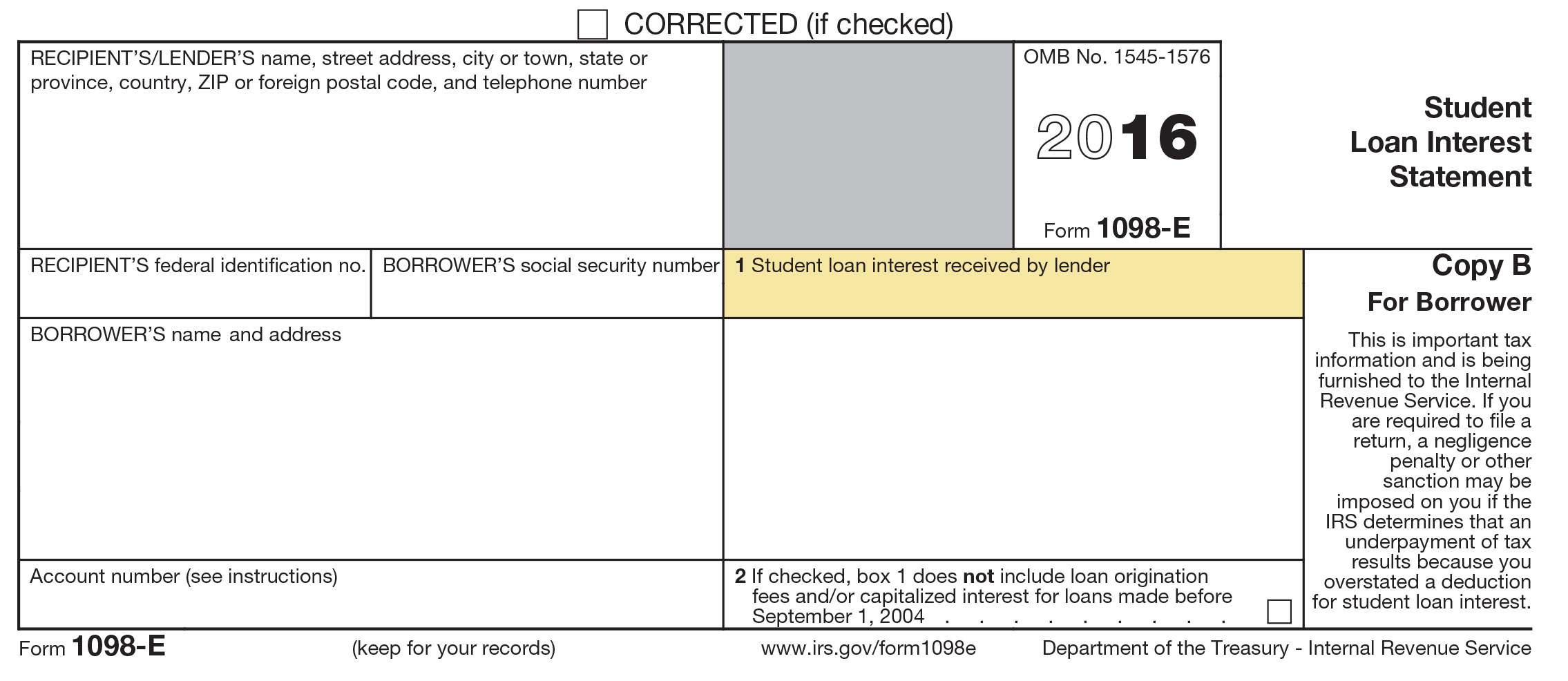

If you receive 600 or more in student loan interest from an individual you need to file Form 1098 E and provide a statement to the borrower Learn about the form s current revision

Where To Put Student Loan Interest On 1040 have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Customization: We can customize printables to fit your particular needs in designing invitations planning your schedule or decorating your home.

-

Educational value: Education-related printables at no charge cater to learners of all ages, which makes them a great source for educators and parents.

-

An easy way to access HTML0: immediate access many designs and templates cuts down on time and efforts.

Where to Find more Where To Put Student Loan Interest On 1040

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

Learn how to deduct up to 2 500 of your student loan interest payments from your taxable income if you meet the eligibility criteria Find out what qualifies as a student loan how to

Here s how to enter your student loan interest Follow these instructions whether or not you received a 1098 E from your lender

In the event that we've stirred your interest in Where To Put Student Loan Interest On 1040 and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and Where To Put Student Loan Interest On 1040 for a variety reasons.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs covered cover a wide range of interests, that range from DIY projects to party planning.

Maximizing Where To Put Student Loan Interest On 1040

Here are some inventive ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Where To Put Student Loan Interest On 1040 are an abundance filled with creative and practical information that satisfy a wide range of requirements and passions. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the vast array of Where To Put Student Loan Interest On 1040 now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes they are! You can print and download these items for free.

-

Are there any free printing templates for commercial purposes?

- It depends on the specific conditions of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright problems with Where To Put Student Loan Interest On 1040?

- Some printables could have limitations on use. Be sure to review the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home using your printer or visit the local print shops for higher quality prints.

-

What software do I require to open printables free of charge?

- A majority of printed materials are in the PDF format, and can be opened with free software such as Adobe Reader.

39 Mortgage Insurance Premiums Deduction Worksheet Worksheet Master

What Credit Score Is Needed For A Student Loan Student Loan Planner

Check more sample of Where To Put Student Loan Interest On 1040 below

Student Loan Interest Waiver Here s How It Works Money

The Federal Student Loan Interest Deduction

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

Certificate Courses Student Loans Higher Education Expand Goo

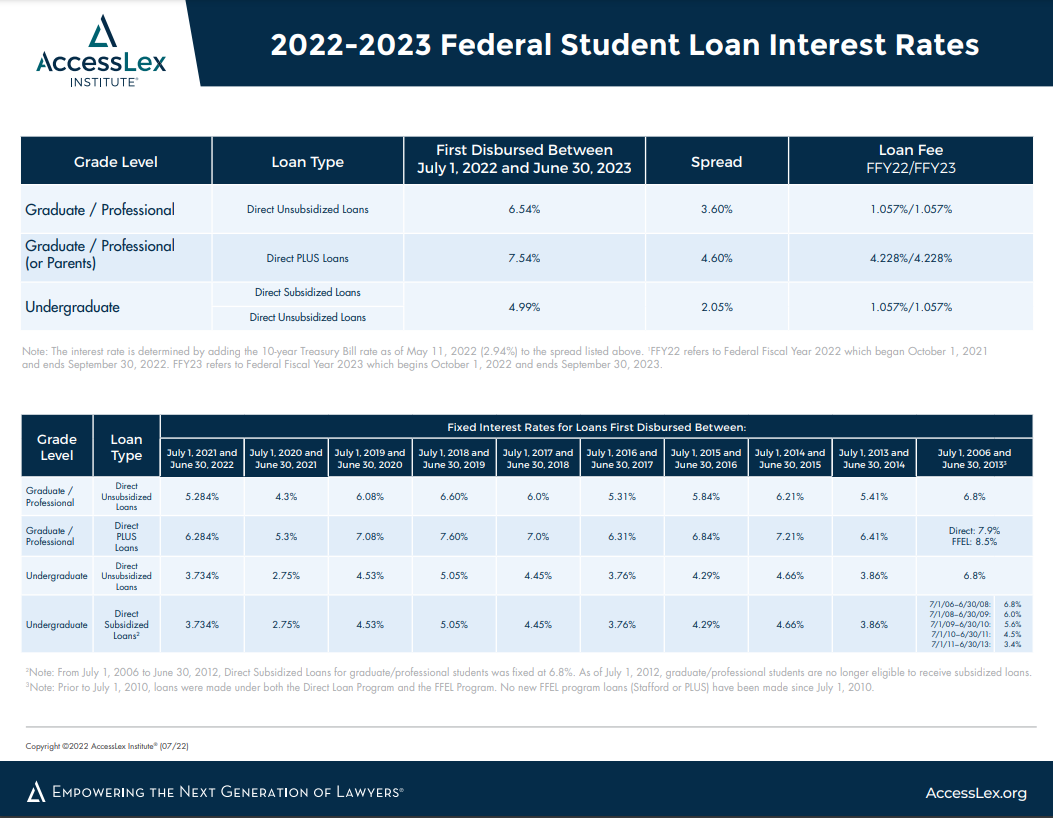

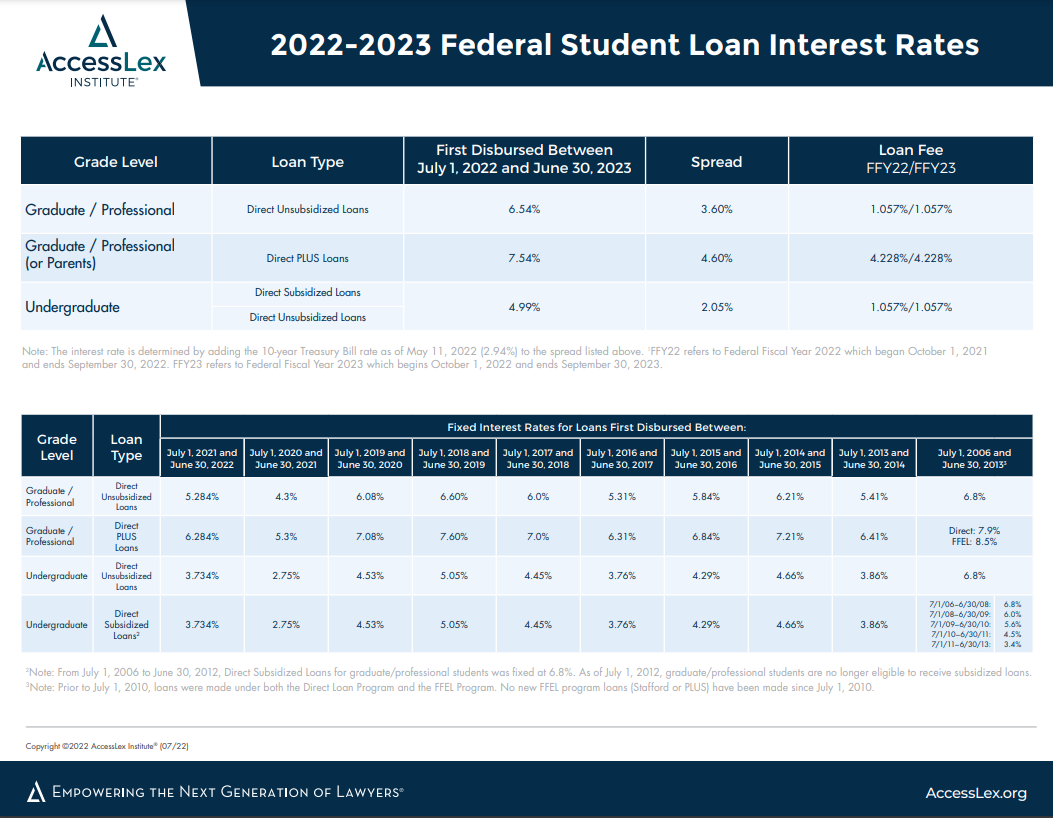

Student Loan Interest Rates For 2023

A New App Says It Can Save You 14 000 In Student Loan Interest Costs

Claiming The Student Loan Interest Deduction

https://www.1040.com/.../student-loan-interest

You paid interest during the tax year on a qualified student loan Your filing status is not married filing separately Your modified adjusted gross income MAGI must be less than 70 000 if

https://www.forbes.com/advisor/taxes/s…

Learn how to deduct student loan interest from your taxes who qualifies and how to calculate it Find out the income limits eligibility requirements and where to get Form 1098 E from your

You paid interest during the tax year on a qualified student loan Your filing status is not married filing separately Your modified adjusted gross income MAGI must be less than 70 000 if

Learn how to deduct student loan interest from your taxes who qualifies and how to calculate it Find out the income limits eligibility requirements and where to get Form 1098 E from your

Student Loan Interest Rates For 2023

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

A New App Says It Can Save You 14 000 In Student Loan Interest Costs

Claiming The Student Loan Interest Deduction

Federal Student Loan Interest Rate For 2019 20 PayForED

16 Best Private Student Loans Of March 2021 NerdWallet Student

16 Best Private Student Loans Of March 2021 NerdWallet Student

Lower Your Student Loan Interest Rate NOW