In the age of digital, where screens rule our lives The appeal of tangible printed materials isn't diminishing. In the case of educational materials or creative projects, or simply adding an element of personalization to your space, Who Are Eligible For Deduction Under Section 80c have become a valuable resource. Through this post, we'll dive to the depths of "Who Are Eligible For Deduction Under Section 80c," exploring their purpose, where they are available, and how they can improve various aspects of your lives.

What Are Who Are Eligible For Deduction Under Section 80c?

Who Are Eligible For Deduction Under Section 80c include a broad range of printable, free resources available online for download at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages, and many more. The great thing about Who Are Eligible For Deduction Under Section 80c is in their variety and accessibility.

Who Are Eligible For Deduction Under Section 80c

Who Are Eligible For Deduction Under Section 80c

Who Are Eligible For Deduction Under Section 80c -

[desc-5]

[desc-1]

98 Deductions Deduction Under Section 80G Donations Eligible For

98 Deductions Deduction Under Section 80G Donations Eligible For

[desc-4]

[desc-6]

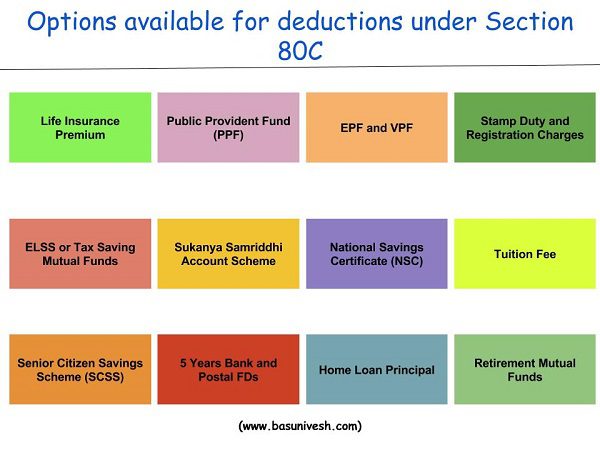

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deductions List To Save Income Tax FinCalC Blog

[desc-9]

[desc-7]

Section 80GGA Deduction Income Tax IndiaFilings

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Smart Things To Know Deduction Under Section 80C For Tuition Fee

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Step For Claiming Deduction Under Section 80JJAA

Step For Claiming Deduction Under Section 80JJAA

Section 80C Deduction For Tax Saving Investments Learn By Quicko