In this age of electronic devices, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. In the case of educational materials for creative projects, just adding an individual touch to your space, Who Can Claim Deduction Under Section 80ccd 1b have become an invaluable source. With this guide, you'll take a dive deeper into "Who Can Claim Deduction Under Section 80ccd 1b," exploring the benefits of them, where they are available, and how they can add value to various aspects of your life.

What Are Who Can Claim Deduction Under Section 80ccd 1b?

Who Can Claim Deduction Under Section 80ccd 1b provide a diverse variety of printable, downloadable resources available online for download at no cost. These materials come in a variety of forms, like worksheets templates, coloring pages, and more. The great thing about Who Can Claim Deduction Under Section 80ccd 1b lies in their versatility as well as accessibility.

Who Can Claim Deduction Under Section 80ccd 1b

Who Can Claim Deduction Under Section 80ccd 1b

Who Can Claim Deduction Under Section 80ccd 1b -

[desc-5]

[desc-1]

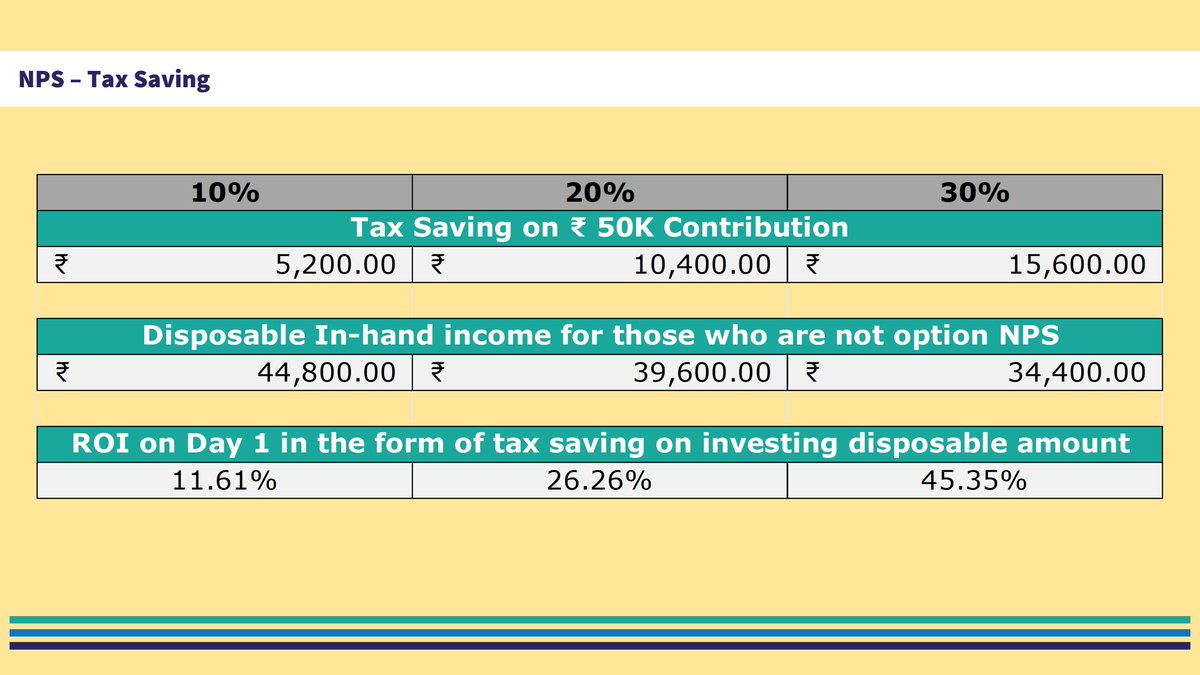

Do We Need To Invest Extra For Claiming Deduction Under Section 80CCD

Do We Need To Invest Extra For Claiming Deduction Under Section 80CCD

[desc-4]

[desc-6]

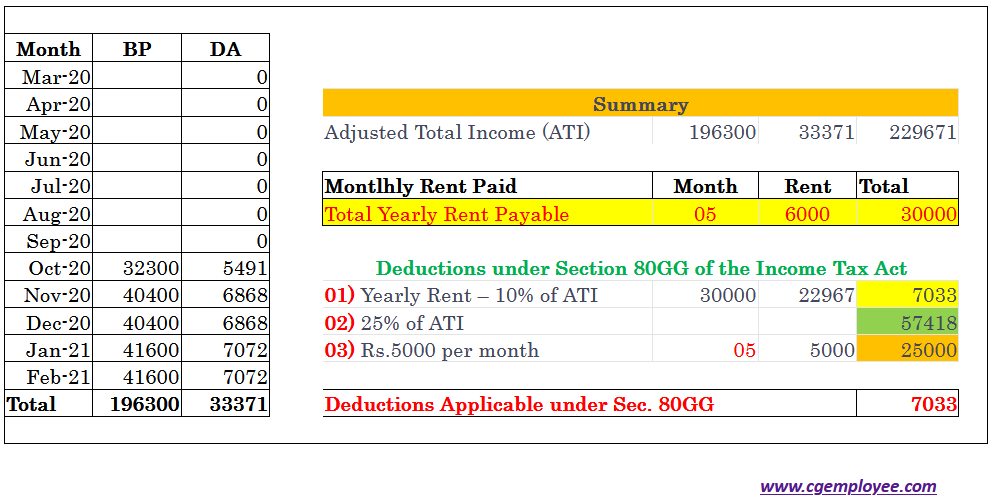

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

[desc-9]

[desc-7]

How To Save Tax On Additional 50 000 Income Under Section 80CCD 1B

Deduction Under Section 80CCD 2 For Employer s Contribution To

Deduction Under Income Tax 80CCC And 80CCD

8 Things You Must Know About National Pension Scheme NPS

80GG Deduction For Rent Paid

Rs10 Lakh Salary But ZERO Taxes How Thread You Could Be Paying 0

Rs10 Lakh Salary But ZERO Taxes How Thread You Could Be Paying 0

Section 80ccd Of Income Tax deduction In Income Tax Section 80ccd 1b