In the digital age, in which screens are the norm it's no wonder that the appeal of tangible printed material hasn't diminished. In the case of educational materials and creative work, or simply adding a personal touch to your area, Who Can Claim Interest On Education Loan have proven to be a valuable source. Through this post, we'll take a dive deep into the realm of "Who Can Claim Interest On Education Loan," exploring what they are, where to get them, as well as how they can improve various aspects of your daily life.

Get Latest Who Can Claim Interest On Education Loan Below

Who Can Claim Interest On Education Loan

Who Can Claim Interest On Education Loan -

Interest paid on education loans taken for higher studies of self spouse or children including for whom you are the legal guardian can be claimed as a deduction from the taxable income

Only people filing as single married filing jointly head of household or qualifying widow er can claim the student loan interest deduction

Who Can Claim Interest On Education Loan include a broad assortment of printable, downloadable items that are available online at no cost. They are available in numerous forms, like worksheets templates, coloring pages and much more. The benefit of Who Can Claim Interest On Education Loan is their versatility and accessibility.

More of Who Can Claim Interest On Education Loan

How To Claim Interest Expense As Tax Deduction YouTube

How To Claim Interest Expense As Tax Deduction YouTube

There is no maximum deduction amount that can be claimed against an education loan according to Section 80 E of income tax The interest you pay on an education loan is

You can claim a lifetime learning credit for qualified education expenses paid with the proceeds of a loan You use the expenses to figure the lifetime learning credit for the year in which the expenses are paid not the year in which the

The Who Can Claim Interest On Education Loan have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: They can make printables to your specific needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Downloads of educational content for free provide for students from all ages, making them an invaluable tool for teachers and parents.

-

It's easy: immediate access a myriad of designs as well as templates can save you time and energy.

Where to Find more Who Can Claim Interest On Education Loan

Payment Orders A Shortcut To Getting Your Money Back

Payment Orders A Shortcut To Getting Your Money Back

Interest on educational loan should have been paid on loan taken by him from any financial institution or any approved charitable institution for the purpose of pursuing his higher

Reporting the amount of student loan interest you paid in 2023 on your federal tax return may count as a deduction A deduction reduces the amount of your income that is subject to tax which may benefit you by reducing the amount of tax you

We hope we've stimulated your interest in printables for free, let's explore where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Who Can Claim Interest On Education Loan for different reasons.

- Explore categories such as interior decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing including flashcards, learning tools.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs covered cover a wide variety of topics, starting from DIY projects to planning a party.

Maximizing Who Can Claim Interest On Education Loan

Here are some creative ways of making the most of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets from the internet for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Who Can Claim Interest On Education Loan are a treasure trove of innovative and useful resources which cater to a wide range of needs and interests. Their accessibility and flexibility make them a wonderful addition to both professional and personal life. Explore the vast collection that is Who Can Claim Interest On Education Loan today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can download and print these tools for free.

-

Do I have the right to use free templates for commercial use?

- It's based on the conditions of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues in Who Can Claim Interest On Education Loan?

- Some printables could have limitations on use. Be sure to check the terms and condition of use as provided by the author.

-

How can I print Who Can Claim Interest On Education Loan?

- Print them at home using either a printer or go to a local print shop to purchase superior prints.

-

What software do I need in order to open printables free of charge?

- Many printables are offered with PDF formats, which can be opened with free programs like Adobe Reader.

How to claim interest on delay project under RERA

Interest In Advance

Check more sample of Who Can Claim Interest On Education Loan below

Essential Tax Deductions For Homeowners Filing Their 2022 Taxes

Taxoworld

Chatroom Interest Can Be Claimed On Delayed Payment Of Drawback

)

Section 80E Deduction For Interest On Education Loan How To Earn

Payment Of Legacies And Transfer Of Specific Assets JB Solicitors

Taxoworld

https://www.forbes.com › advisor › taxe…

Only people filing as single married filing jointly head of household or qualifying widow er can claim the student loan interest deduction

https://smartasset.com › taxes › studen…

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

Only people filing as single married filing jointly head of household or qualifying widow er can claim the student loan interest deduction

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

Section 80E Deduction For Interest On Education Loan How To Earn

Taxoworld

Payment Of Legacies And Transfer Of Specific Assets JB Solicitors

Taxoworld

Taxoworld

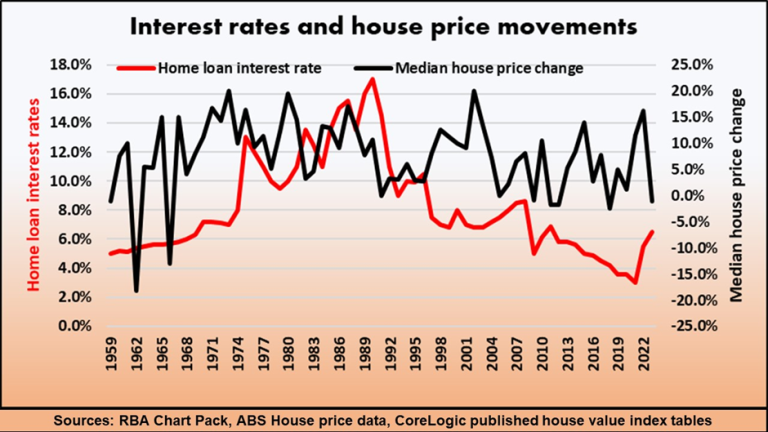

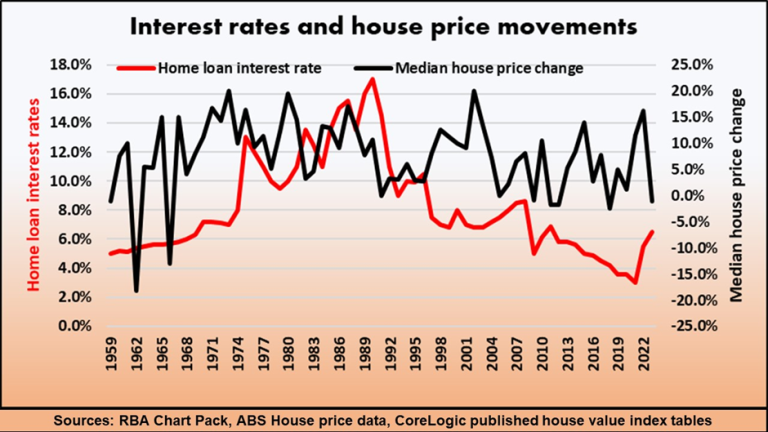

One Enduring Legacy Of The Pandemic Lindeman Reports

One Enduring Legacy Of The Pandemic Lindeman Reports

How To Recover Undisputed Debts Latest Legal News