Today, in which screens are the norm however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education project ideas, artistic or simply adding an element of personalization to your home, printables for free are now an essential resource. With this guide, you'll take a dive deeper into "Who Is Eligible For Deduction Under 80dd," exploring their purpose, where to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Who Is Eligible For Deduction Under 80dd Below

Who Is Eligible For Deduction Under 80dd

Who Is Eligible For Deduction Under 80dd -

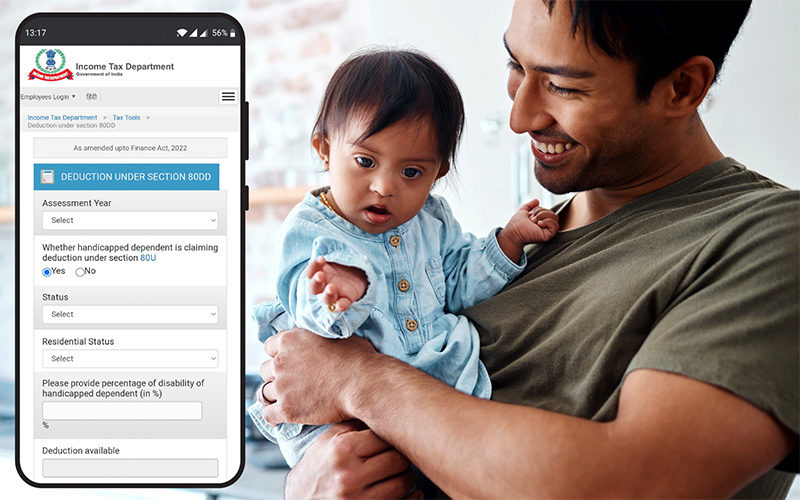

Verkko 18 marrask 2022 nbsp 0183 32 Section 80DD of the Income Tax Act allows residents whether individuals or HUFs to claim a deduction for a dependent who is differently abled and completely reliant on them for support and maintenance Families who provide care for disabled dependents are eligible for tax breaks under Section 80DD

Verkko 10 toukok 2023 nbsp 0183 32 Residents who are either individuals or HUFs are eligible for a deduction under section 80DD of the Income Tax Act for a dependent who is differently abled and fully dependent on them for support and maintenance Families of dependents with disabilities are eligible for tax advantages under Section 80DD to care for them

Who Is Eligible For Deduction Under 80dd encompass a wide range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in numerous types, such as worksheets coloring pages, templates and more. The beauty of Who Is Eligible For Deduction Under 80dd lies in their versatility and accessibility.

More of Who Is Eligible For Deduction Under 80dd

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

Verkko 3 helmik 2023 nbsp 0183 32 HUF Section 80DD Last updated on February 3rd 2023 Section 80DD of income tax act provides tax deductions to resident individuals or HUFs for any expenses incurred on the medical treatment of differently abled dependents This income tax deduction can be claimed at the time of filing ITR under Chapter VI A INDEX

Verkko 20 huhtik 2023 nbsp 0183 32 Section 80U can be used to claim tax deduction up to Rs 75 000 for disability and Rs 1 25 000 for severe disability for self i e when the taxpayer is the person suffering from such disability Deduction under this section can be claimed towards eligible expenses for any of the following dependents Spouse Children

The Who Is Eligible For Deduction Under 80dd have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

customization: It is possible to tailor printables to fit your particular needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Impact: These Who Is Eligible For Deduction Under 80dd are designed to appeal to students of all ages. This makes the perfect device for teachers and parents.

-

Easy to use: Quick access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Who Is Eligible For Deduction Under 80dd

80DD Deduction Income Tax I 80DD Deduction For Ay 2021 22 YouTube

80DD Deduction Income Tax I 80DD Deduction For Ay 2021 22 YouTube

Verkko 19 helmik 2022 nbsp 0183 32 Irrespective of the actual amount of medical treatment or maintenance cost the taxpayer can claim the deduction of Rs 75 000 in case of normal disability and Rs 1 25 000 in case of severe disability Note To claim the deduction a taxpayer should receive from medical practitioner a certificate showing the nature and

Verkko 22 marrask 2023 nbsp 0183 32 To be eligible for the claim deduction under the section 80DD one must Be an Individual or be a part of a Hindu undivided family who is a resident in India This deduction is not available to non resident Indian NRI since a lot of countries such as Canada largely help their residents when it comes to medical treatment

Now that we've piqued your curiosity about Who Is Eligible For Deduction Under 80dd Let's see where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Who Is Eligible For Deduction Under 80dd suitable for many reasons.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a broad spectrum of interests, from DIY projects to planning a party.

Maximizing Who Is Eligible For Deduction Under 80dd

Here are some ideas in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Who Is Eligible For Deduction Under 80dd are an abundance of innovative and useful resources that meet a variety of needs and passions. Their accessibility and flexibility make them a great addition to each day life. Explore the vast array of Who Is Eligible For Deduction Under 80dd now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Who Is Eligible For Deduction Under 80dd really completely free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I utilize free printing templates for commercial purposes?

- It is contingent on the specific terms of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with Who Is Eligible For Deduction Under 80dd?

- Some printables could have limitations regarding usage. Always read the terms of service and conditions provided by the author.

-

How can I print printables for free?

- Print them at home with a printer or visit a local print shop for high-quality prints.

-

What program must I use to open printables at no cost?

- Most PDF-based printables are available as PDF files, which can be opened using free programs like Adobe Reader.

Deduction Under Chapter 6A Of Income Tax Act Section 80D 80DD

Claim Deduction Under Section 80DD Learn By Quicko

Check more sample of Who Is Eligible For Deduction Under 80dd below

Section 80GGA Deduction Income Tax IndiaFilings

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Step For Claiming Deduction Under Section 80JJAA

80d 80dd 80ddb Deduction For AY 2022 23 I 80D I 80DD I 80DDB Maximum

Form 10 IA Online For Claiming Deduction Under Section 80DD 80U In

Deductions Under Section 80CCD Of Income Tax Act YouTube

https://vakilsearch.com/blog/claim-deduction-under-section-80dd

Verkko 10 toukok 2023 nbsp 0183 32 Residents who are either individuals or HUFs are eligible for a deduction under section 80DD of the Income Tax Act for a dependent who is differently abled and fully dependent on them for support and maintenance Families of dependents with disabilities are eligible for tax advantages under Section 80DD to care for them

https://tax2win.in/guide/section-80dd

Verkko 9 lokak 2023 nbsp 0183 32 Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The conditions to claim this deduction include The deduction is allowed only to the dependants of the taxpayer and not the taxpayer himself

Verkko 10 toukok 2023 nbsp 0183 32 Residents who are either individuals or HUFs are eligible for a deduction under section 80DD of the Income Tax Act for a dependent who is differently abled and fully dependent on them for support and maintenance Families of dependents with disabilities are eligible for tax advantages under Section 80DD to care for them

Verkko 9 lokak 2023 nbsp 0183 32 Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The conditions to claim this deduction include The deduction is allowed only to the dependants of the taxpayer and not the taxpayer himself

80d 80dd 80ddb Deduction For AY 2022 23 I 80D I 80DD I 80DDB Maximum

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Form 10 IA Online For Claiming Deduction Under Section 80DD 80U In

Deductions Under Section 80CCD Of Income Tax Act YouTube

Deduction Under Section 80DD 80DDB And 80U

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria