In a world with screens dominating our lives but the value of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons as well as creative projects or simply adding personal touches to your area, Who Qualifies For Federal Ev Tax Credit are a great resource. In this article, we'll take a dive through the vast world of "Who Qualifies For Federal Ev Tax Credit," exploring what they are, how they are available, and what they can do to improve different aspects of your life.

Get Latest Who Qualifies For Federal Ev Tax Credit Below

Who Qualifies For Federal Ev Tax Credit

Who Qualifies For Federal Ev Tax Credit -

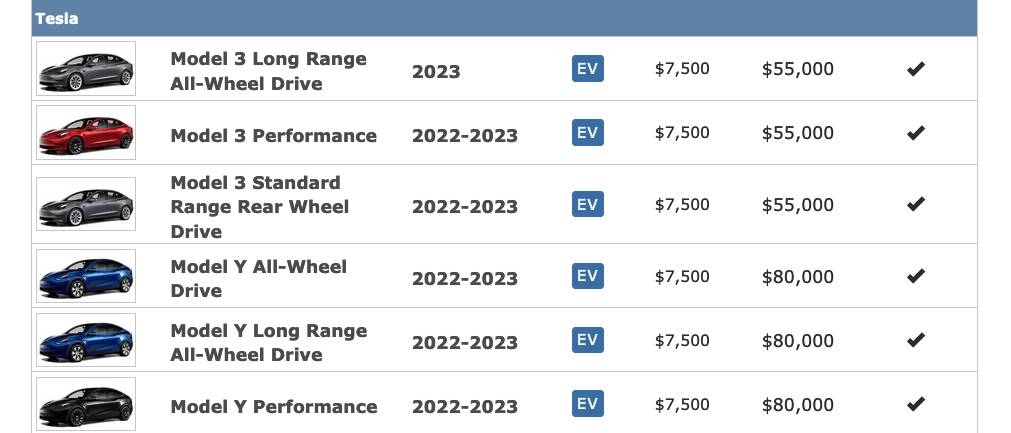

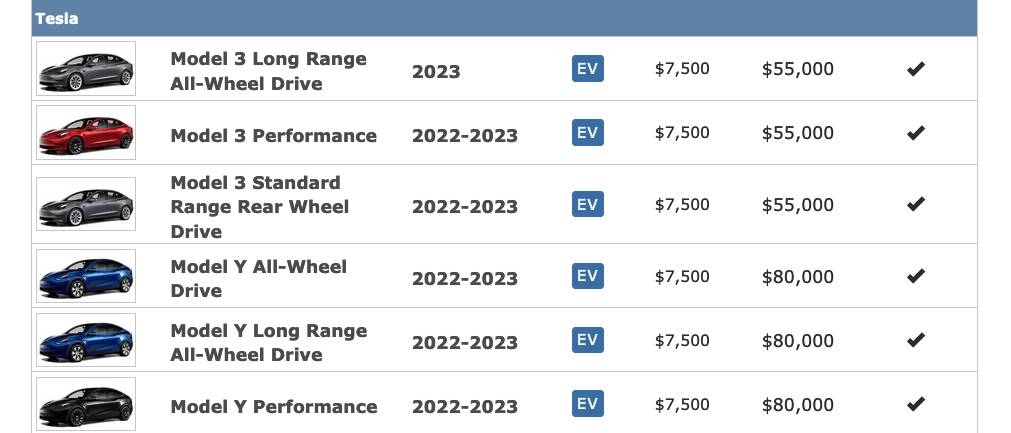

Plug in electric vehicles and fuel cell vehicles placed in service in 2023 or later may be eligible for a federal income tax credit of up to 7 500

Those who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to

Printables for free cover a broad assortment of printable, downloadable resources available online for download at no cost. These materials come in a variety of forms, like worksheets coloring pages, templates and more. The appealingness of Who Qualifies For Federal Ev Tax Credit is in their variety and accessibility.

More of Who Qualifies For Federal Ev Tax Credit

Is The Kia EV6 Eligible For The Federal EV Tax Credit

Is The Kia EV6 Eligible For The Federal EV Tax Credit

Here Is the EPA s List of EVs Eligible for the Federal Tax Credit We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax

The federal EV tax credit will be available to individuals reporting adjusted gross incomes of 150 000 or less 225 000 for heads of households or 300 000 for joint filers

Who Qualifies For Federal Ev Tax Credit have gained a lot of popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: This allows you to modify printing templates to your own specific requirements such as designing invitations to organize your schedule or even decorating your house.

-

Educational Value: Free educational printables are designed to appeal to students from all ages, making them a great source for educators and parents.

-

Simple: Quick access to a variety of designs and templates helps save time and effort.

Where to Find more Who Qualifies For Federal Ev Tax Credit

Tesla Claims Every New Model 3 Now Qualifies For 7 500 EV Tax Credit In US

Tesla Claims Every New Model 3 Now Qualifies For 7 500 EV Tax Credit In US

On January 1 2023 the Inflation Reduction Act of 2022 qualified certain electric vehicles EVs for a tax credit of up to 7 500 for eligible buyers Qualifications include Customers must buy it for their own use not for resale Use the vehicle primarily in the U S Adjusted Gross Income AGI limitations MSRP price caps

The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change which gives companies a few more

If we've already piqued your interest in printables for free we'll explore the places the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Who Qualifies For Federal Ev Tax Credit suitable for many uses.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a broad selection of subjects, starting from DIY projects to party planning.

Maximizing Who Qualifies For Federal Ev Tax Credit

Here are some ideas to make the most of Who Qualifies For Federal Ev Tax Credit:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Who Qualifies For Federal Ev Tax Credit are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and hobbies. Their accessibility and flexibility make them a wonderful addition to both professional and personal lives. Explore the many options of Who Qualifies For Federal Ev Tax Credit to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes you can! You can download and print these items for free.

-

Can I download free printables for commercial use?

- It is contingent on the specific usage guidelines. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download Who Qualifies For Federal Ev Tax Credit?

- Certain printables might have limitations on use. Make sure to read the terms and regulations provided by the creator.

-

How do I print Who Qualifies For Federal Ev Tax Credit?

- Print them at home using any printer or head to a print shop in your area for top quality prints.

-

What program is required to open printables for free?

- Most PDF-based printables are available in the format of PDF, which can be opened with free programs like Adobe Reader.

2024 Alfa Romeo Tonale Priced Under Fifty Grand Possibly Qualifies For

Has Federal EV Tax Credit Been Saved The Green Car Guy

Check more sample of Who Qualifies For Federal Ev Tax Credit below

Cheddar Explains Who Qualifies For EV Tax Credits

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Every EV That Qualifies For The Inflation Reduction Act Tax Credit In

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

Base Tesla Model 3 Now Also Qualifies For 7 500 Tax Credit

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

https://www.nerdwallet.com › article › taxes › ev-tax-credit-electric...

Those who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to

https://www.irs.gov › credits-deductions › credits-for-new-electric...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh

Those who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Base Tesla Model 3 Now Also Qualifies For 7 500 Tax Credit

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

These 11 Cars Now Qualify For The 7 500 Federal EV Tax Credit Flipboard

How To Know Whether Your New EV Qualifies For Joe Biden s 7 500 Tax

How To Know Whether Your New EV Qualifies For Joe Biden s 7 500 Tax

Who Qualifies For Education Tax Breaks For College