In a world where screens have become the dominant feature of our lives however, the attraction of tangible printed objects isn't diminished. In the case of educational materials for creative projects, simply to add a personal touch to your area, Who Qualifies For The Illinois Property Tax Credit can be an excellent source. In this article, we'll take a dive into the sphere of "Who Qualifies For The Illinois Property Tax Credit," exploring the benefits of them, where they are available, and how they can enhance various aspects of your lives.

Get Latest Who Qualifies For The Illinois Property Tax Credit Below

Who Qualifies For The Illinois Property Tax Credit

Who Qualifies For The Illinois Property Tax Credit -

You may figure a credit for the Illinois property taxes you paid in 2021 on your principal residence not a vacation home or rental property for the time you owned and lived at the property during 2020 if that residence was in Illinois Nonresidents of

The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own your residence in order to take this credit

Who Qualifies For The Illinois Property Tax Credit encompass a wide assortment of printable, downloadable resources available online for download at no cost. They come in many types, like worksheets, templates, coloring pages and much more. The benefit of Who Qualifies For The Illinois Property Tax Credit is their versatility and accessibility.

More of Who Qualifies For The Illinois Property Tax Credit

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

To receive both the property tax and income rebates or just the income tax rebate by itself you must file IL 1040 including Schedule ICR Illinois Credits as well as Schedule

The State of Illinois is also providing property tax rebates for eligible homeowners in an amount equal to the property tax credit they qualified for on their 2021 Illinois tax returns up to a maximum of 300

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization This allows you to modify print-ready templates to your specific requirements be it designing invitations or arranging your schedule or even decorating your home.

-

Educational Benefits: The free educational worksheets cater to learners of all ages, which makes them an invaluable device for teachers and parents.

-

The convenience of Instant access to many designs and templates will save you time and effort.

Where to Find more Who Qualifies For The Illinois Property Tax Credit

What Is My Illinois Property Id Number PROFRTY

What Is My Illinois Property Id Number PROFRTY

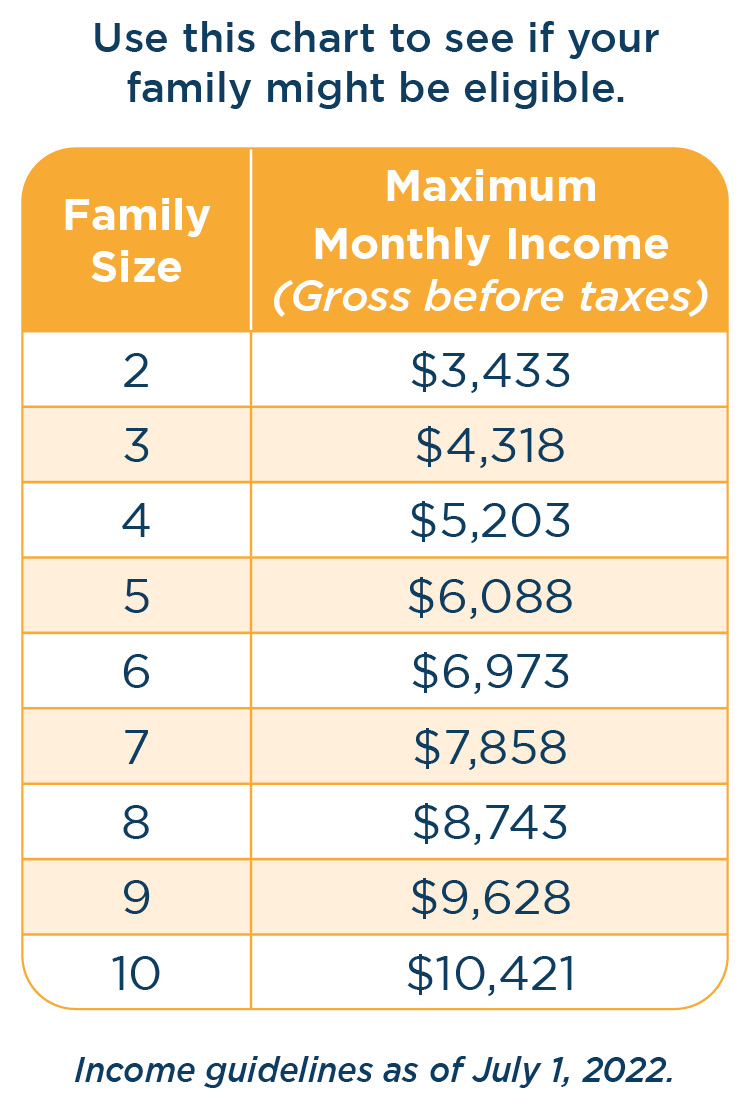

Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020 and 2021 and your adjusted gross income on the 2021 Form IL 1040 must be under 250 000 for single filers and 500 000 for joint filers

Taxpayers who filed their tax returns as a single person will be eligible to receive 50 Couples who filed joint returns are eligible to get 100 If you have dependents there s an additional 100 per dependent to a maximum of 300 Property tax

We hope we've stimulated your curiosity about Who Qualifies For The Illinois Property Tax Credit, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Who Qualifies For The Illinois Property Tax Credit designed for a variety goals.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs covered cover a wide spectrum of interests, ranging from DIY projects to party planning.

Maximizing Who Qualifies For The Illinois Property Tax Credit

Here are some inventive ways of making the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Who Qualifies For The Illinois Property Tax Credit are a treasure trove of creative and practical resources that meet a variety of needs and preferences. Their accessibility and flexibility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the endless world of Who Qualifies For The Illinois Property Tax Credit and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can download and print these documents for free.

-

Can I make use of free printables in commercial projects?

- It is contingent on the specific rules of usage. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may have restrictions regarding their use. Make sure you read the terms and regulations provided by the author.

-

How can I print Who Qualifies For The Illinois Property Tax Credit?

- You can print them at home with your printer or visit the local print shops for premium prints.

-

What software do I require to view printables that are free?

- The majority are printed with PDF formats, which can be opened using free software like Adobe Reader.

Who Qualifies For The Employee Retention Tax Credit

Who Qualifies For Assisted Living In Illinois

Check more sample of Who Qualifies For The Illinois Property Tax Credit below

Hecht Group How To Pay Your Lake County Illinois Property Taxes

Who Qualifies For MN Property Tax Credit Leia Aqui Who Qualifies For

What Arizona Real Estate Tax Qualifies For A Property Tax Credit

Get Your Full Illinois Property Tax Credit When Selling A Home

Hecht Group Property Taxes In Wheaton Illinois

Two Things Illinois Homeowners Should Know About The Property Tax

https://tax.illinois.gov/content/dam/soi/en/web/...

The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own your residence in order to take this credit

https://www.nbcchicago.com/news/local/illinois...

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid

The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own your residence in order to take this credit

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid

Get Your Full Illinois Property Tax Credit When Selling A Home

Who Qualifies For MN Property Tax Credit Leia Aqui Who Qualifies For

Hecht Group Property Taxes In Wheaton Illinois

Two Things Illinois Homeowners Should Know About The Property Tax

EBT Card Requirements Who Qualifies For The EBT Card In California

Enhanced STAR Property Tax Exemption Deadline Approaching Here s Who

Enhanced STAR Property Tax Exemption Deadline Approaching Here s Who

Who Qualifies For Child Care Assistance Tory Colwell