In this day and age where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses or creative projects, or simply adding some personal flair to your area, Wife Education Exemption In Income Tax have become a valuable resource. With this guide, you'll dive through the vast world of "Wife Education Exemption In Income Tax," exploring the benefits of them, where they are, and how they can enhance various aspects of your lives.

Get Latest Wife Education Exemption In Income Tax Below

Wife Education Exemption In Income Tax

Wife Education Exemption In Income Tax -

Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

Section 10 Income Tax Act The complete guide on what is section 10 of income tax act exemptions allowances eligibility benefits deductions how to claim

Wife Education Exemption In Income Tax encompass a wide range of printable, free materials online, at no cost. These printables come in different kinds, including worksheets coloring pages, templates and many more. The benefit of Wife Education Exemption In Income Tax is in their variety and accessibility.

More of Wife Education Exemption In Income Tax

Do This Work To Get Exemption In Income Tax Savings Upto 2 Lakh On

Do This Work To Get Exemption In Income Tax Savings Upto 2 Lakh On

Receiving further education in Malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses receiving further education outside

Section 80E provides for a deduction on the interest paid on the Education loan availed for higher studies whether in India or abroad also there is no maximum limit within which you need to claim the deduction Section

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor printed materials to meet your requirements in designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Free educational printables can be used by students of all ages, making them a useful device for teachers and parents.

-

An easy way to access HTML0: Fast access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Wife Education Exemption In Income Tax

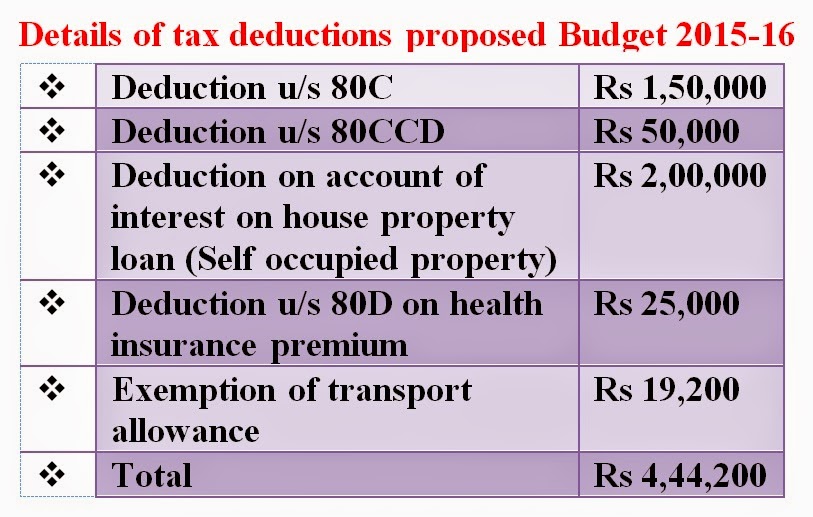

Income Tax Exemption Limit In The Budget 2015 16 StaffNews

Income Tax Exemption Limit In The Budget 2015 16 StaffNews

Currently HRA exemption under section 10 13A of the Income Tax Act is a relief for individuals paying substantial house rents This exemption is the least of the

The interest component of the education loan can be deducted from your income just as deductions under Section 80C and Section 80D are deducted before

After we've peaked your interest in printables for free Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Wife Education Exemption In Income Tax for various objectives.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a wide variety of topics, all the way from DIY projects to planning a party.

Maximizing Wife Education Exemption In Income Tax

Here are some ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Wife Education Exemption In Income Tax are a treasure trove with useful and creative ideas which cater to a wide range of needs and hobbies. Their availability and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the vast world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes, they are! You can download and print these items for free.

-

Can I make use of free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright violations with Wife Education Exemption In Income Tax?

- Some printables could have limitations in use. Check these terms and conditions as set out by the creator.

-

How do I print printables for free?

- Print them at home using the printer, or go to a local print shop to purchase higher quality prints.

-

What program do I require to view printables free of charge?

- A majority of printed materials are in the format of PDF, which can be opened with free software, such as Adobe Reader.

HRA Exemption Calculator For Income Tax Benefits Calculation And

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Check more sample of Wife Education Exemption In Income Tax below

Income Tax Slabs

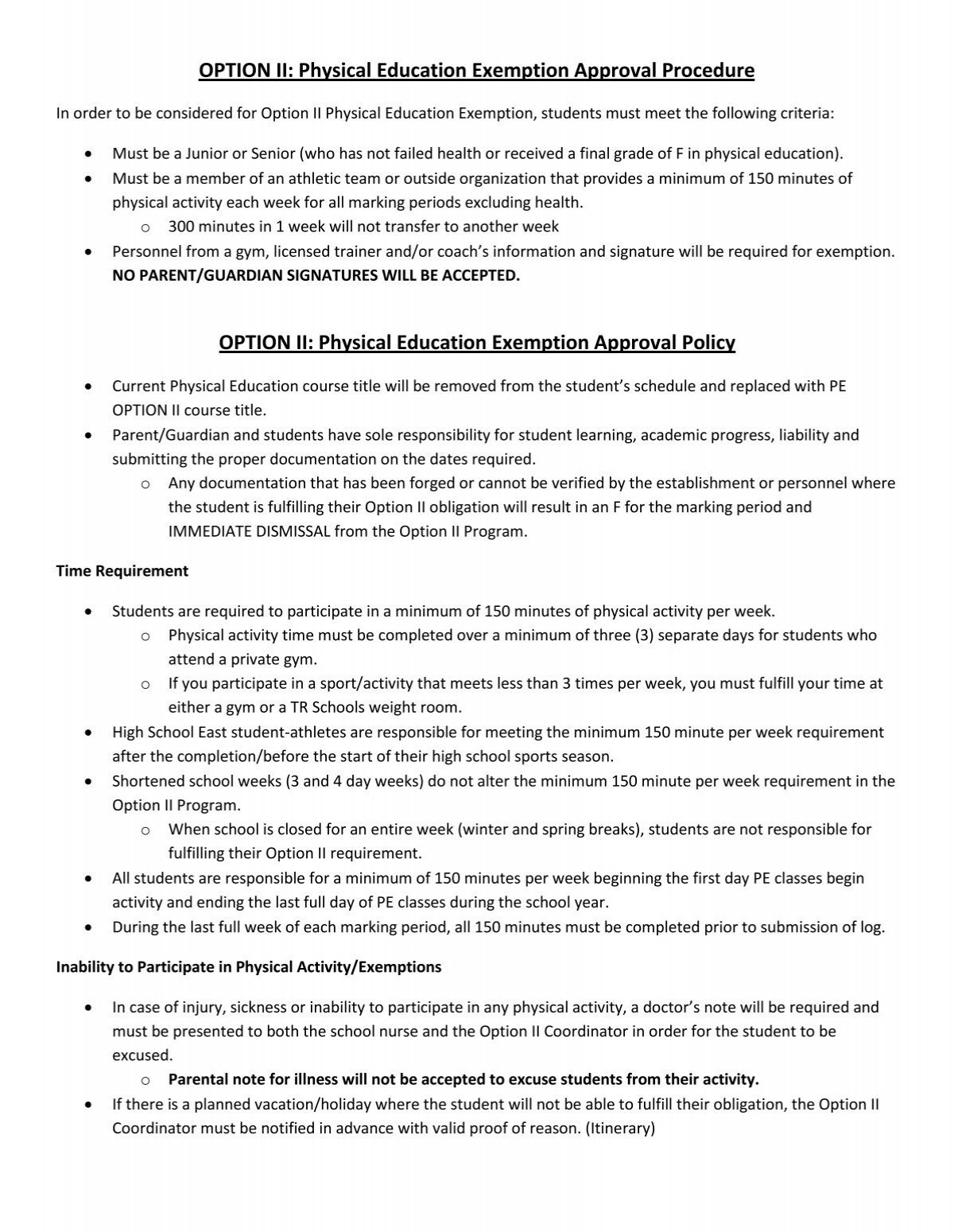

OPTION II Physical Education Exemption Approval Procedure

Quality Assurance Hot selling Products 1 NIP BAY DE NOC LURE CO THE

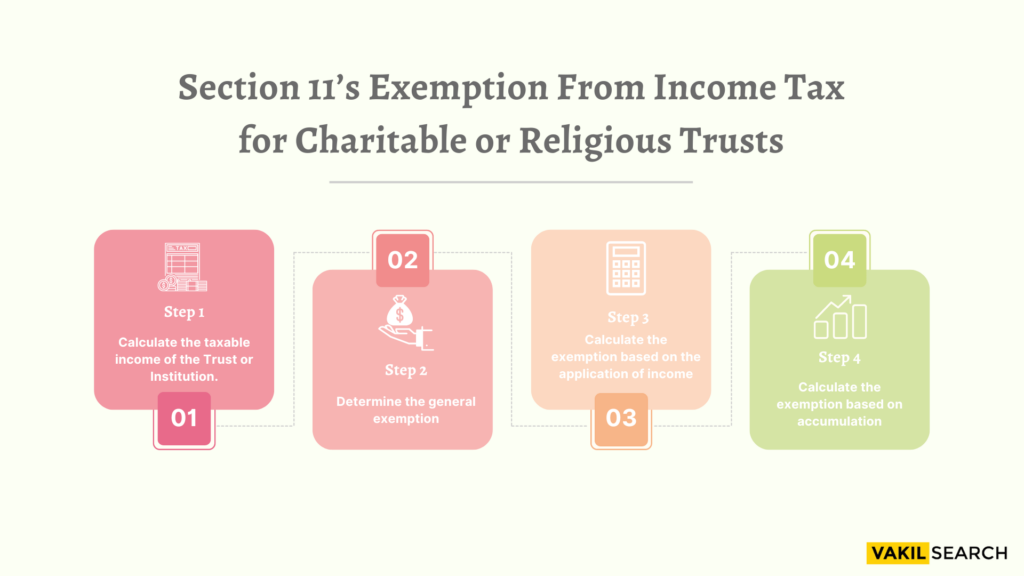

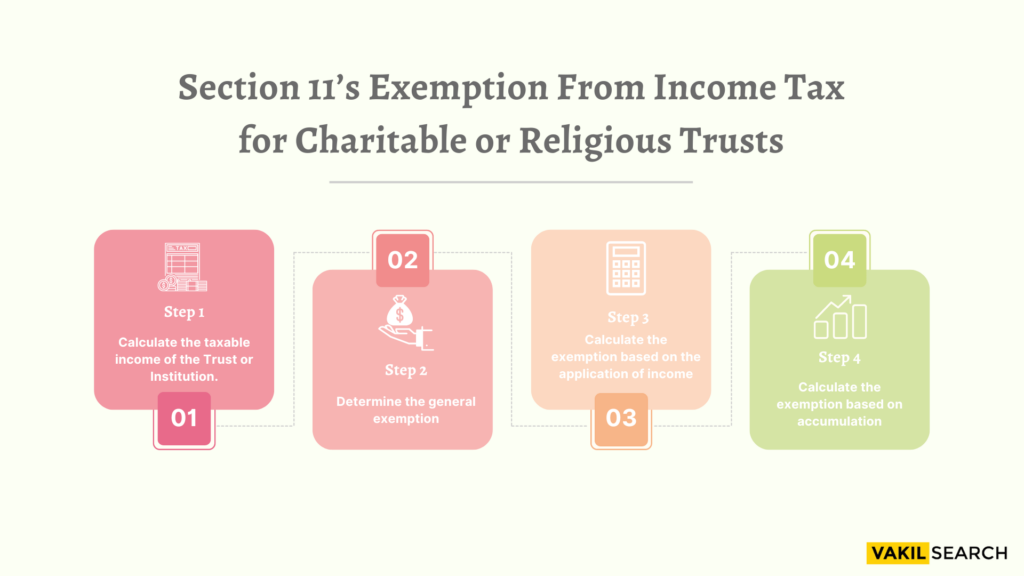

Section 11 Income Tax Act Exemptions For Charitable Trusts

Avoid Mistakes While Claiming HRA On The ITR Ebizfiling

Exemptions Still Available In New Tax Regime with English Subtitles

https:// cleartax.in /s/section-10-of-income-tax-act

Section 10 Income Tax Act The complete guide on what is section 10 of income tax act exemptions allowances eligibility benefits deductions how to claim

https://www. financialexpress.com /money/income-tax...

At present Indian income tax laws allow you to claim a deduction for education expenses incurred in any university college school or educational

Section 10 Income Tax Act The complete guide on what is section 10 of income tax act exemptions allowances eligibility benefits deductions how to claim

At present Indian income tax laws allow you to claim a deduction for education expenses incurred in any university college school or educational

Section 11 Income Tax Act Exemptions For Charitable Trusts

OPTION II Physical Education Exemption Approval Procedure

Avoid Mistakes While Claiming HRA On The ITR Ebizfiling

Exemptions Still Available In New Tax Regime with English Subtitles

Husband Can Claim Capital Gain Exemption For Investment Made In The

Budget 2023 Know In 10 Points What Are The Expectations From The

Budget 2023 Know In 10 Points What Are The Expectations From The

ITAT Allows Income Tax Exemption To Society Engaged In Imparting