In the age of digital, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes such as creative projects or simply adding personal touches to your space, Wisconsin Sales Tax Exemption For Nonprofit are now a useful source. For this piece, we'll take a dive into the world "Wisconsin Sales Tax Exemption For Nonprofit," exploring what they are, how to locate them, and how they can enhance various aspects of your daily life.

Get Latest Wisconsin Sales Tax Exemption For Nonprofit Below

Wisconsin Sales Tax Exemption For Nonprofit

Wisconsin Sales Tax Exemption For Nonprofit -

In our Publication 206 Sales Tax Exemption for Nonprofit Organizations Forms and Publications can be obtained through our website at revenue wi gov or through our forms ordering line at

Nonprofit organizations are often referred to as tax exempt because they are generally exempt from federal and state income tax However a nonprofit organization s

Wisconsin Sales Tax Exemption For Nonprofit encompass a wide variety of printable, downloadable material that is available online at no cost. They come in many forms, including worksheets, templates, coloring pages, and much more. The beauty of Wisconsin Sales Tax Exemption For Nonprofit lies in their versatility as well as accessibility.

More of Wisconsin Sales Tax Exemption For Nonprofit

How To Get A Wisconsin Sales Tax Exemption Certificate Resale

How To Get A Wisconsin Sales Tax Exemption Certificate Resale

This document provides information on the types of organizations that qualify for a certificate of exempt status and the application process

A nonprofit organization shall charge Wisconsin sales tax on sales of tangible personal property or items property or goods under s 77 52 1 b c or d Stats and

Wisconsin Sales Tax Exemption For Nonprofit have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor designs to suit your personal needs when it comes to designing invitations and schedules, or decorating your home.

-

Educational Worth: Education-related printables at no charge offer a wide range of educational content for learners of all ages, which makes them a great instrument for parents and teachers.

-

Simple: immediate access many designs and templates is time-saving and saves effort.

Where to Find more Wisconsin Sales Tax Exemption For Nonprofit

Wisconsin Sales Tax Exemption For Manufacturing Agile

Wisconsin Sales Tax Exemption For Manufacturing Agile

Considering the varying state processes for obtaining sales tax exemption along with specific charitable use requirements it can be challenging to determine where when and how a nonprofit organization qualifies for a

How do I obtain Wisconsin sales tax exemption for my nonprofit 501c3 federally exempt non profits are usually exempt from WI sales tax You will need a certificate of Exempt Status number

In the event that we've stirred your interest in printables for free, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Wisconsin Sales Tax Exemption For Nonprofit for various applications.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing Wisconsin Sales Tax Exemption For Nonprofit

Here are some inventive ways that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Wisconsin Sales Tax Exemption For Nonprofit are an abundance of creative and practical resources catering to different needs and pursuits. Their accessibility and flexibility make them an essential part of your professional and personal life. Explore the endless world that is Wisconsin Sales Tax Exemption For Nonprofit today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can download and print these free resources for no cost.

-

Are there any free printables for commercial uses?

- It's determined by the specific conditions of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations regarding their use. Check the terms and condition of use as provided by the designer.

-

How can I print Wisconsin Sales Tax Exemption For Nonprofit?

- Print them at home using either a printer at home or in the local print shops for higher quality prints.

-

What program is required to open printables at no cost?

- The majority of PDF documents are provided in PDF format. They is open with no cost software such as Adobe Reader.

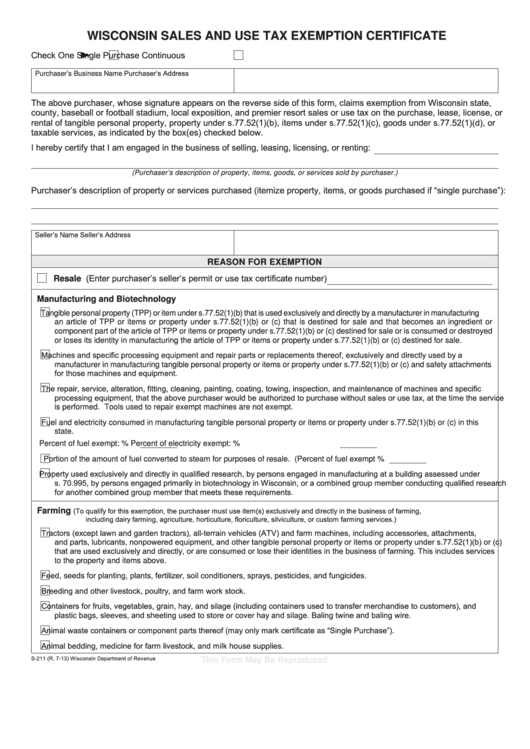

Sales Tax Exemption Certificate Wisconsin

S211 Sales Tax Exempt Form Wisconsin ExemptForm

Check more sample of Wisconsin Sales Tax Exemption For Nonprofit below

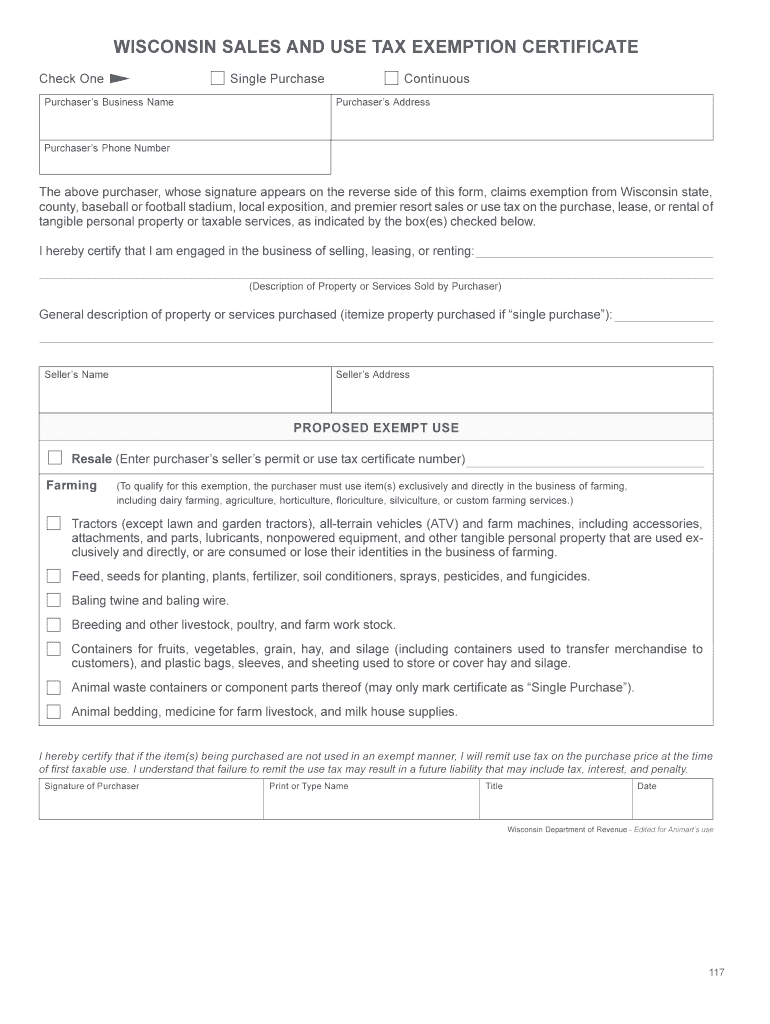

Wisconsin Tax Exempt Form Fillable Printable Forms Free Online

Colorado Resale Certificate Dresses Images 2022

Proposed Legislation Could Broaden Maine s Sales Tax Exemption For

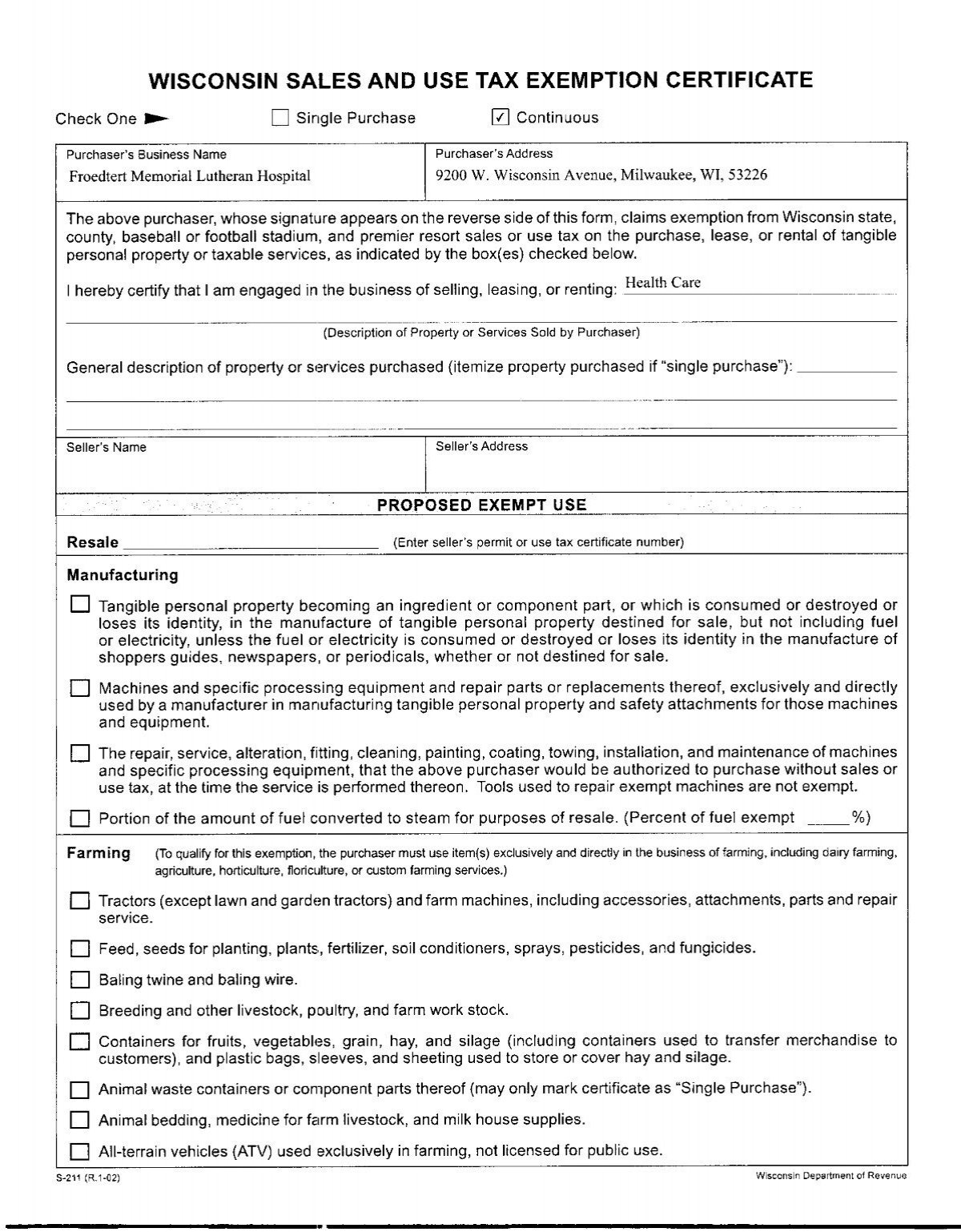

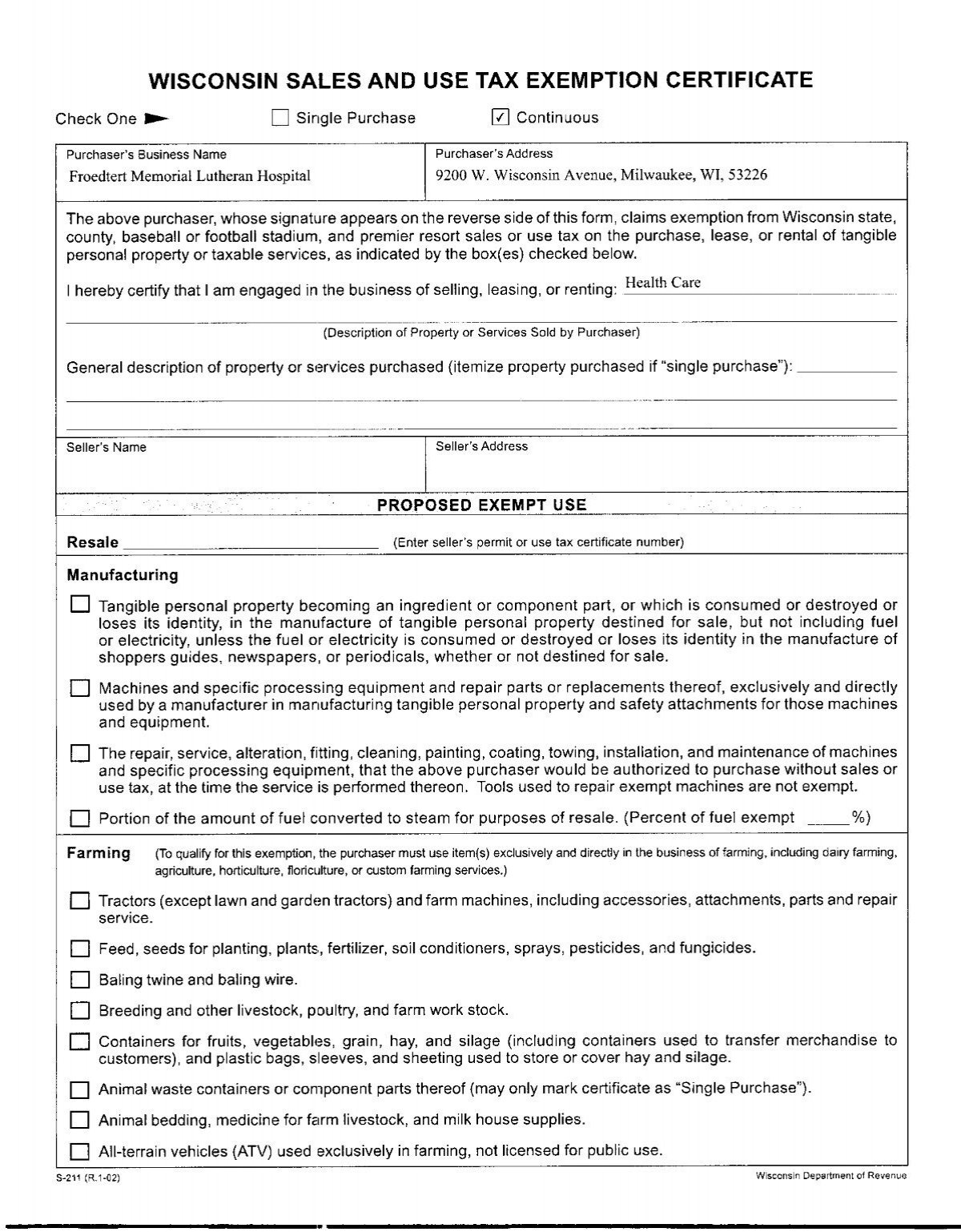

WISCONSIN SALES AND USE TAX EXEMPTION Froedtert Health

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

Wisconsin Tax Exemption Form

https://www.revenue.wi.gov › DOR Publications

Nonprofit organizations are often referred to as tax exempt because they are generally exempt from federal and state income tax However a nonprofit organization s

https://icma.org › sites › default › files

A nonprofit organization is required to charge Wiscon sin sales tax on sales of tangible personal property and taxable services unless such sales are exempt occa sional sales or

Nonprofit organizations are often referred to as tax exempt because they are generally exempt from federal and state income tax However a nonprofit organization s

A nonprofit organization is required to charge Wiscon sin sales tax on sales of tangible personal property and taxable services unless such sales are exempt occa sional sales or

WISCONSIN SALES AND USE TAX EXEMPTION Froedtert Health

Colorado Resale Certificate Dresses Images 2022

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

Wisconsin Tax Exemption Form

Wisconsin Sales Tax Exemption Form

The Estimated Value Of Tax Exemption For Nonprofit Hospitals Was About

The Estimated Value Of Tax Exemption For Nonprofit Hospitals Was About

Georgia Sales Tax Certificate Of Exemption Form St 5 Prosecution2012