In this age of electronic devices, where screens rule our lives but the value of tangible printed materials hasn't faded away. In the case of educational materials project ideas, artistic or simply to add the personal touch to your area, Wood Stove Tax Credit 2023 are a great source. Here, we'll take a dive through the vast world of "Wood Stove Tax Credit 2023," exploring what they are, how they are, and how they can improve various aspects of your lives.

Get Latest Wood Stove Tax Credit 2023 Below

Wood Stove Tax Credit 2023

Wood Stove Tax Credit 2023 -

With the signing of the 2022 Inflation Reduction Act high efficiency wood stoves now qualify for a 30 tax credit under Section 25 C of the Internal Revenue Code This tax credit is effective for installations between January 1 2023 and December 31 2032 and is capped at 2 000 annually

Beginning with the 2023 tax return you will file in 2024 you can claim a 30 tax rebate on your federal income tax return To claim your tax rebate you will need documents about the purchase and installation of the stove as well as the manufacturer s tax rebate certificate

The Wood Stove Tax Credit 2023 are a huge assortment of printable content that can be downloaded from the internet at no cost. These resources come in many designs, including worksheets templates, coloring pages, and many more. The value of Wood Stove Tax Credit 2023 lies in their versatility and accessibility.

More of Wood Stove Tax Credit 2023

2021 Wood Burning Stove Tax Credit EXPLAINED YouTube

2021 Wood Burning Stove Tax Credit EXPLAINED YouTube

Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped at 2 000 annually based on the full cost purchase and installation of the unit

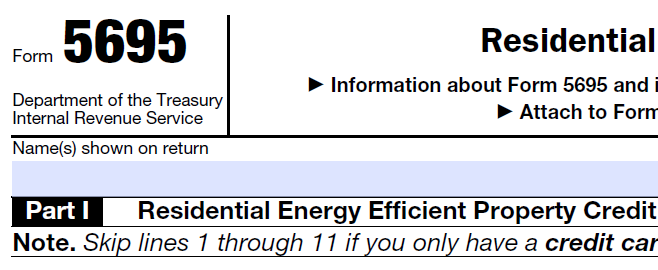

The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean energy credit carryforward from 2022 Form 5695 or to carry the unused portion of the residential clean energy credit to 2024

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Individualization It is possible to tailor printing templates to your own specific requirements whether it's making invitations, organizing your schedule, or even decorating your house.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners of all ages, making them an invaluable source for educators and parents.

-

An easy way to access HTML0: instant access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Wood Stove Tax Credit 2023

Save The Biomass Stove Tax Credit

Save The Biomass Stove Tax Credit

Beginning with the 2023 tax year the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the cost of certain biomass

During the period beginning January 1 2023 through December 31 2032 taxpayers who install qualifying wood and pellet stoves will receive a 30 tax credit up to 2 000 annually based on the full cost purchase and installation of the unit What Stoves are Eligible for a Federal Tax Credit

We hope we've stimulated your curiosity about Wood Stove Tax Credit 2023 Let's look into where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Wood Stove Tax Credit 2023 suitable for many purposes.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs are a vast range of topics, starting from DIY projects to planning a party.

Maximizing Wood Stove Tax Credit 2023

Here are some creative ways of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Wood Stove Tax Credit 2023 are an abundance with useful and creative ideas that cater to various needs and preferences. Their accessibility and flexibility make them an essential part of each day life. Explore the many options of Wood Stove Tax Credit 2023 today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes they are! You can download and print these free resources for no cost.

-

Can I use the free printables for commercial purposes?

- It depends on the specific conditions of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with Wood Stove Tax Credit 2023?

- Some printables could have limitations in their usage. Be sure to check the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home with an printer, or go to a local print shop to purchase more high-quality prints.

-

What software do I need in order to open printables that are free?

- The majority are printed in the PDF format, and can be opened using free software, such as Adobe Reader.

Heated Up February 2018

Get A 300 Tax Credit For Qualifying Wood Stoves Milford CT The Cozy

Check more sample of Wood Stove Tax Credit 2023 below

Learn More About The New Wood Pellet Stove Tax Credit Energy Center

Wood Burning Stove Tax Credit

![]()

Images For 362394 STOVE TAX Cast Iron Contemporary Auctionet

All The Details On The Pellet And Wood Stove Tax Credit Energy Center

2023 Woodstove Tax Credit 25C Energy Distribution Systems

Hearthstone s Heritage Soapstone Wood Stove Shown With Polished

https://stoneandheat.com/blogs/buying-guides/how-to-claim-your-22...

Beginning with the 2023 tax return you will file in 2024 you can claim a 30 tax rebate on your federal income tax return To claim your tax rebate you will need documents about the purchase and installation of the stove as well as the manufacturer s tax rebate certificate

https://www.energystar.gov/about/federal-tax-credits/biomass...

2 000 maximum amount credited What products are eligible Biomass stoves burn biomass fuel to heat a home or heat water Biomass fuel includes agricultural crops and trees wood and wood waste and residues including wood pellets plants including aquatic plants grasses residues and fibers

Beginning with the 2023 tax return you will file in 2024 you can claim a 30 tax rebate on your federal income tax return To claim your tax rebate you will need documents about the purchase and installation of the stove as well as the manufacturer s tax rebate certificate

2 000 maximum amount credited What products are eligible Biomass stoves burn biomass fuel to heat a home or heat water Biomass fuel includes agricultural crops and trees wood and wood waste and residues including wood pellets plants including aquatic plants grasses residues and fibers

All The Details On The Pellet And Wood Stove Tax Credit Energy Center

Wood Burning Stove Tax Credit

2023 Woodstove Tax Credit 25C Energy Distribution Systems

Hearthstone s Heritage Soapstone Wood Stove Shown With Polished

Castleton HearthStone Stoves

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

The 2022 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire