In this digital age, when screens dominate our lives and the appeal of physical printed material hasn't diminished. For educational purposes and creative work, or simply to add the personal touch to your space, 2023 Solar Tax Credit Income Limits are now a vital source. Through this post, we'll dive deeper into "2023 Solar Tax Credit Income Limits," exploring the different types of printables, where to locate them, and how they can improve various aspects of your lives.

Get Latest 2023 Solar Tax Credit Income Limits Below

2023 Solar Tax Credit Income Limits

2023 Solar Tax Credit Income Limits - 2023 Solar Tax Credit Income Limits, Income Limit For Solar Tax Credit, Is There A Limit On Solar Tax Credit, Income Requirements For Solar Tax Credit

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Printables for free include a vast array of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages and much more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of 2023 Solar Tax Credit Income Limits

Income Limits Before Tax Deductions Start Phasing Out

Income Limits Before Tax Deductions Start Phasing Out

There are no income limits on the solar tax credit so all individual taxpayers are eligible to claim the credit on qualifying solar energy equipment investments made to their homes within the United States

In 2033 the tax credit you can claim will decline to 26 of the cost and in 2034 to 22 The tax credit will expire in 2035 unless Congress renews it While there is no maximum amount you can

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization This allows you to modify printed materials to meet your requirements in designing invitations planning your schedule or even decorating your home.

-

Educational Impact: Printables for education that are free provide for students of all ages. This makes them a great tool for teachers and parents.

-

Easy to use: The instant accessibility to numerous designs and templates helps save time and effort.

Where to Find more 2023 Solar Tax Credit Income Limits

Earned Income Tax Credit EITC Who Qualifies

Earned Income Tax Credit EITC Who Qualifies

Starting in 2023 the IRA added expenditures for battery storage technology as qualifying for this credit Several potentially qualifying expenditures are eligible for the credit including the following Solar electric property expenditures solar panels Solar water heating property expenditures solar water heaters Fuel cell

There is no income limit for the federal solar tax credit However you need a large enough taxable income to claim the full credit

After we've peaked your interest in 2023 Solar Tax Credit Income Limits Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of 2023 Solar Tax Credit Income Limits designed for a variety needs.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a wide spectrum of interests, from DIY projects to planning a party.

Maximizing 2023 Solar Tax Credit Income Limits

Here are some new ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

2023 Solar Tax Credit Income Limits are an abundance of useful and creative resources that meet a variety of needs and interests. Their accessibility and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the vast world of 2023 Solar Tax Credit Income Limits to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes you can! You can download and print these items for free.

-

Are there any free printouts for commercial usage?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using 2023 Solar Tax Credit Income Limits?

- Certain printables might have limitations in their usage. You should read the terms and regulations provided by the designer.

-

How do I print 2023 Solar Tax Credit Income Limits?

- Print them at home using any printer or head to an in-store print shop to get high-quality prints.

-

What program is required to open printables at no cost?

- The majority of printables are in the format PDF. This can be opened with free software, such as Adobe Reader.

Child Tax Credit Income Limit 2023 Credits Zrivo

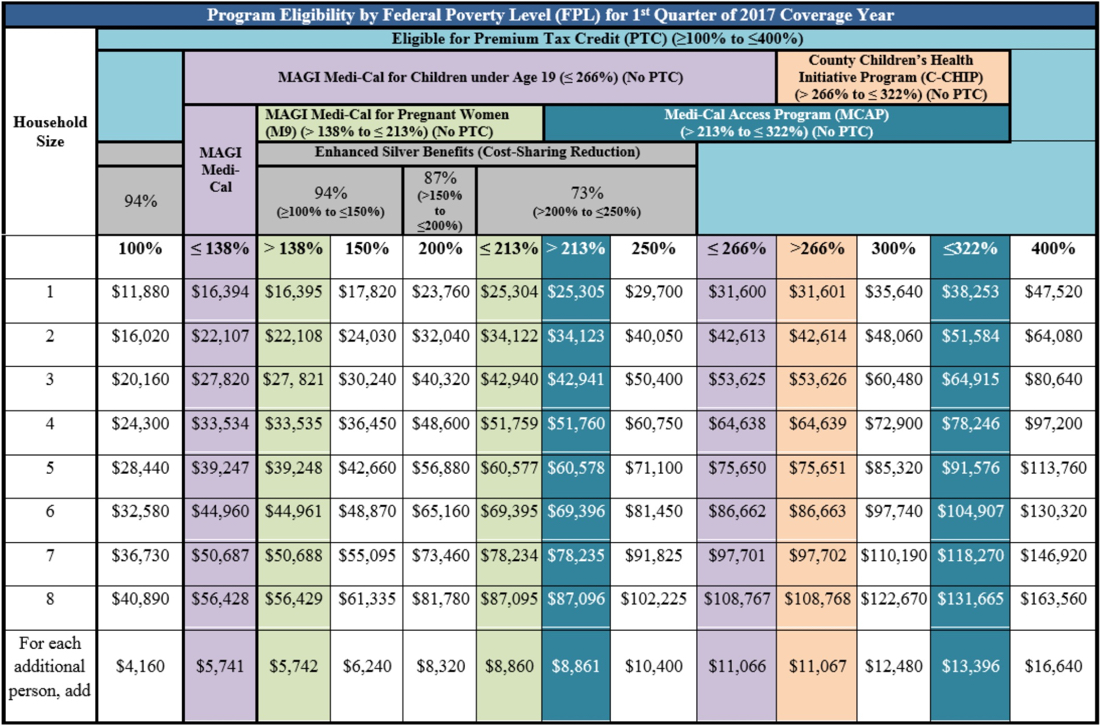

ACA Tax Credits To Help Pay Premiums White Insurance Agency

Check more sample of 2023 Solar Tax Credit Income Limits below

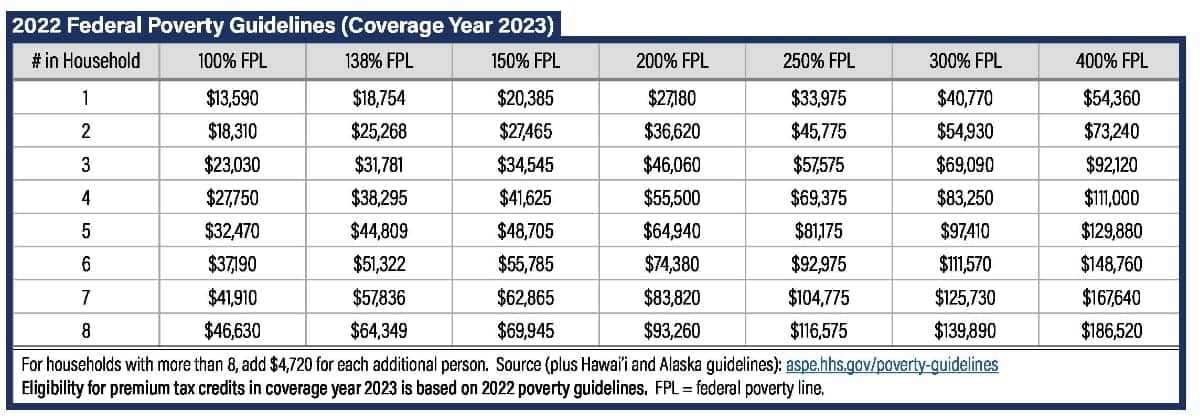

ACA Tax Credits To Help Pay Premiums White Insurance Agency

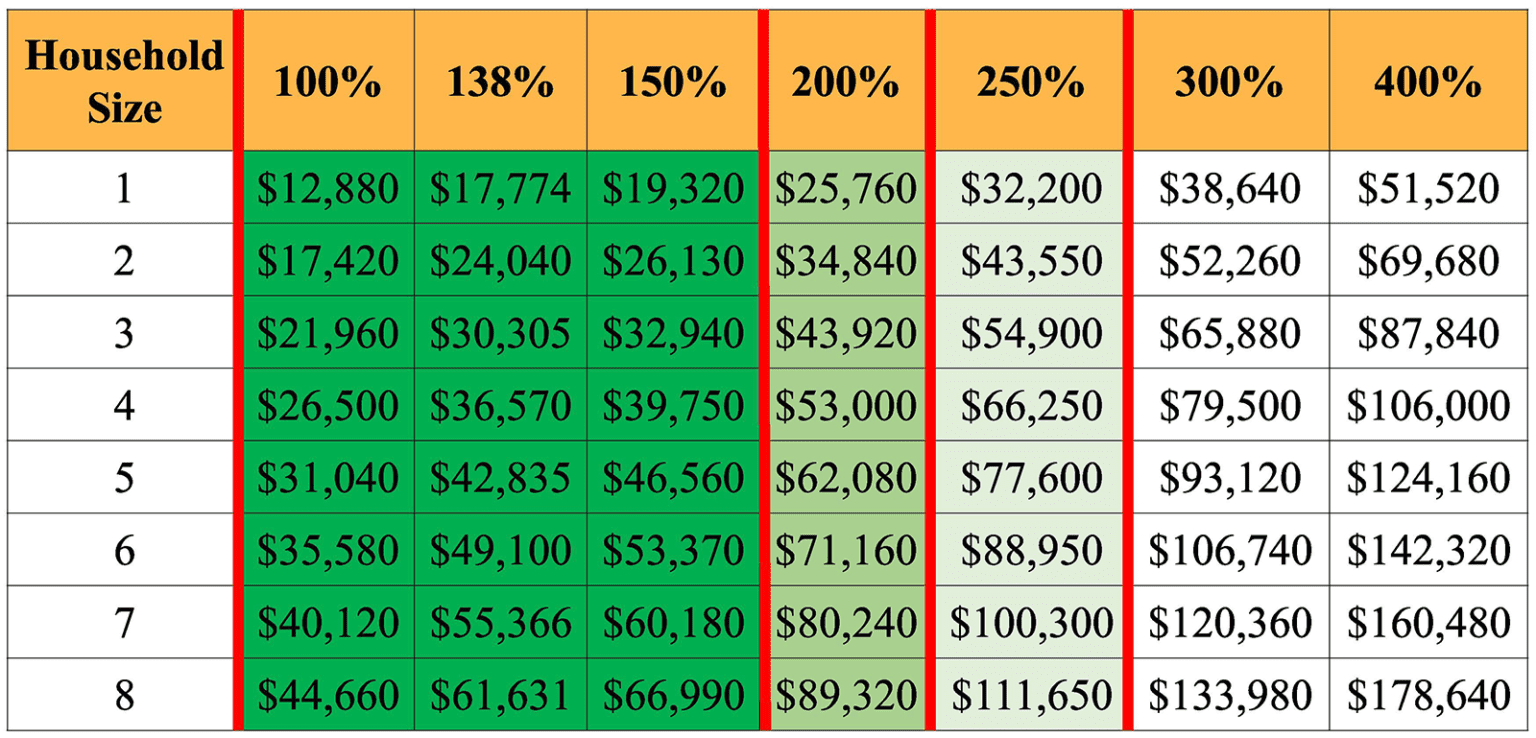

Child Tax Credit Income Limits 2023 Federal Tax Credits TaxUni

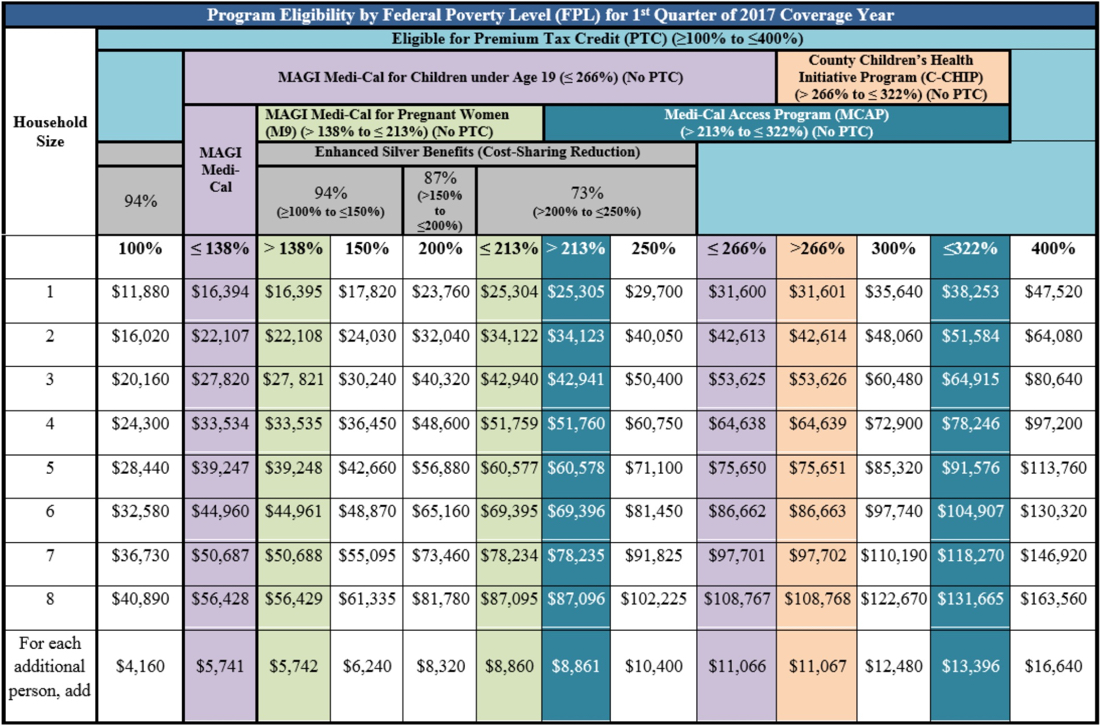

Tax Credit Income Limits 2021 Yabtio

Child Care Tax Credit Income Limit

Aca Percentage Of Income 2022 INCOMUNTA

Limits On Repayment Of Excess Premium Tax Credits

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

https://www.energy.gov/sites/default/files/2023-03/...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Child Care Tax Credit Income Limit

Child Tax Credit Income Limits 2023 Federal Tax Credits TaxUni

Aca Percentage Of Income 2022 INCOMUNTA

Limits On Repayment Of Excess Premium Tax Credits

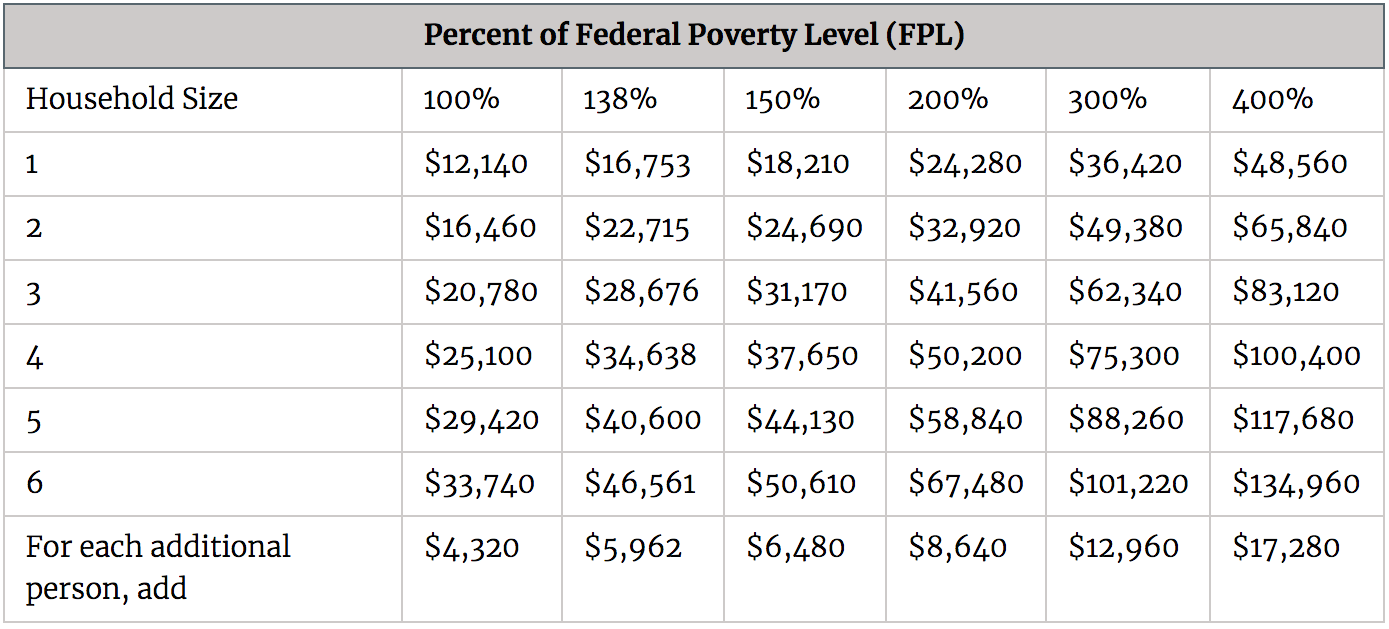

Premium Tax Credit Income Limits 2023

Covered Ca 2023 Income Limits 2023

Covered Ca 2023 Income Limits 2023

What Is Ohios Income Limit For Family To Get Caresource