In this digital age, when screens dominate our lives but the value of tangible, printed materials hasn't diminished. Whatever the reason, whether for education such as creative projects or just adding the personal touch to your area, 80d Tax Exemption Limit 2022 23 are a great source. In this article, we'll dive deeper into "80d Tax Exemption Limit 2022 23," exploring their purpose, where you can find them, and how they can add value to various aspects of your life.

Get Latest 80d Tax Exemption Limit 2022 23 Below

80d Tax Exemption Limit 2022 23

80d Tax Exemption Limit 2022 23 - 80d Tax Exemption Limit 2022-23, 80d Exemption Limit, 80d Tax Exemption Limit, 80c Deduction Limit For Ay 2022-23

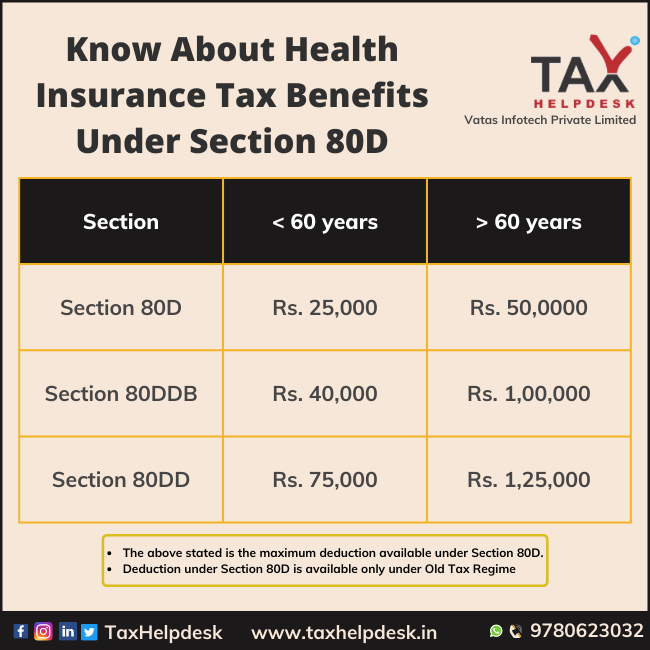

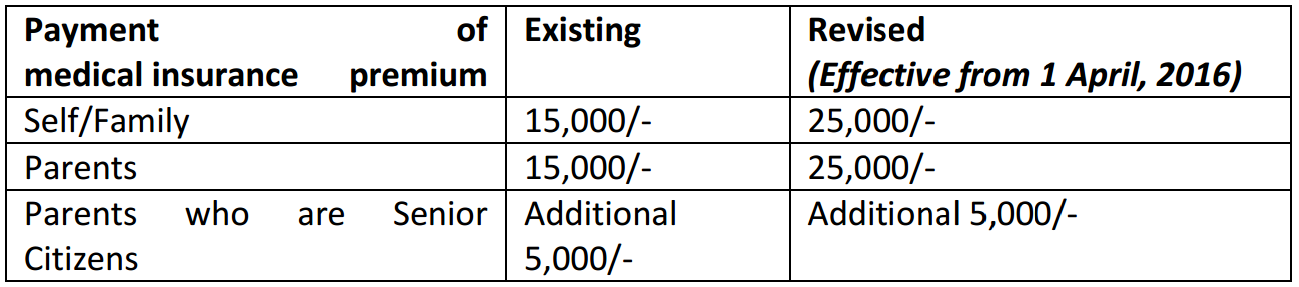

The deduction available under Section 80D is Rs 25 000 per financial year while senior citizens enjoy an increased deduction limit of Rs 50 000 Separate Deductions for

As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse dependent Children Assesee s parents Payment for

80d Tax Exemption Limit 2022 23 cover a large range of downloadable, printable resources available online for download at no cost. These materials come in a variety of forms, like worksheets templates, coloring pages, and many more. The attraction of printables that are free is their versatility and accessibility.

More of 80d Tax Exemption Limit 2022 23

Health Insurance Tax Benefits 80D Tax Benefits Section 80D

Health Insurance Tax Benefits 80D Tax Benefits Section 80D

Section 80D Deductions for FY 2022 23 AY 2023 24 Although the annual budget always brings up different provisions of tax savings for individuals from different sections of

Section 80D Health Insurance Applicability Discounts and Policies With Automatic Income Tax Calculator for Government and Non Government Employees Fiscal Year

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor print-ready templates to your specific requirements be it designing invitations making your schedule, or decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free are designed to appeal to students of all ages. This makes these printables a powerful resource for educators and parents.

-

Simple: instant access many designs and templates can save you time and energy.

Where to Find more 80d Tax Exemption Limit 2022 23

Income Tax Slab For FY 2022 23 What You Need To Know

Income Tax Slab For FY 2022 23 What You Need To Know

Checking your browser before accessing incometaxindia gov in This process is automatic Your browser will redirect to requested content shortly

Section 80D of the Income tax Act 1961 provides income tax exemption for health insurance premium and select health expenses Health insurance premium can be

In the event that we've stirred your interest in printables for free Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of 80d Tax Exemption Limit 2022 23 to suit a variety of reasons.

- Explore categories such as decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad selection of subjects, starting from DIY projects to planning a party.

Maximizing 80d Tax Exemption Limit 2022 23

Here are some inventive ways create the maximum value use of 80d Tax Exemption Limit 2022 23:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

80d Tax Exemption Limit 2022 23 are an abundance of innovative and useful resources which cater to a wide range of needs and hobbies. Their accessibility and versatility make them a valuable addition to your professional and personal life. Explore the vast world that is 80d Tax Exemption Limit 2022 23 today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can print and download these items for free.

-

Can I use free printing templates for commercial purposes?

- It is contingent on the specific conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables may be subject to restrictions regarding their use. You should read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- You can print them at home with an printer, or go to the local print shop for high-quality prints.

-

What software is required to open printables for free?

- Most printables come in the format PDF. This can be opened using free programs like Adobe Reader.

Preventive Check Up 80d Wkcn

A K Bhattacharya Time To Revert To Rs 3 5 Lakh As Tax Exemption Limit

Check more sample of 80d Tax Exemption Limit 2022 23 below

School Toilet Bag Moos Negro Padded Black 23 X 12 8 Cm

Tax Exemption Limit For Mediclaim In Budget 2023

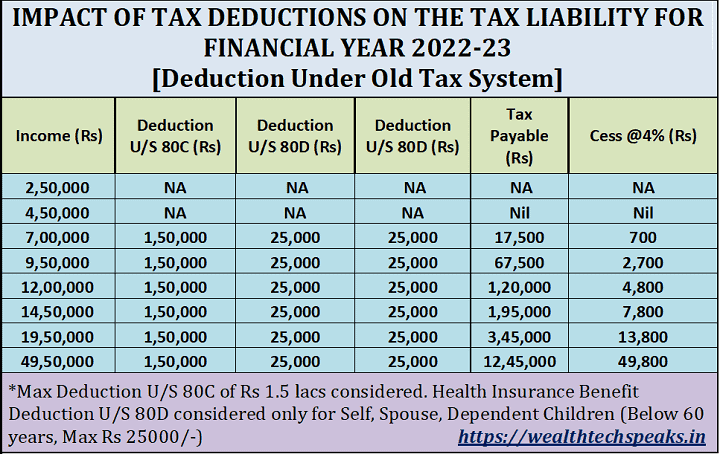

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Section 80D Deduction Limit For AY 2021 22 New Tax Route

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Anything To Everything Income Tax Guide For Individuals Including

https:// incometaxindia.gov.in /Pages/tools/...

As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse dependent Children Assesee s parents Payment for

https:// tax2win.in /guide/section-80d-deduction...

Notes The amount of deduction u s 80D will remain the same for the FY 2022 23 and FY 2023 24 old income tax slab Deduction for HUF A medical claim can be taken under Section 80D for any of the

As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse dependent Children Assesee s parents Payment for

Notes The amount of deduction u s 80D will remain the same for the FY 2022 23 and FY 2023 24 old income tax slab Deduction for HUF A medical claim can be taken under Section 80D for any of the

Section 80D Deduction Limit For AY 2021 22 New Tax Route

Tax Exemption Limit For Mediclaim In Budget 2023

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Anything To Everything Income Tax Guide For Individuals Including

Income Tax Deductions List FY 2020 21 Blog De Livros

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Extend Exemption Limit And New Amendment In Respect Of U s 80C 80CCC