In this digital age, where screens rule our lives but the value of tangible printed material hasn't diminished. In the case of educational materials, creative projects, or simply adding personal touches to your area, Arizona Senior Property Tax Discount are now a vital source. Through this post, we'll take a dive through the vast world of "Arizona Senior Property Tax Discount," exploring the benefits of them, where you can find them, and what they can do to improve different aspects of your lives.

Get Latest Arizona Senior Property Tax Discount Below

Arizona Senior Property Tax Discount

Arizona Senior Property Tax Discount - Arizona Senior Property Tax Discount, Is There A Property Tax Break For Seniors In Arizona, Do Senior Citizens Have To Pay Property Taxes In Arizona, Do Seniors Pay Property Taxes In Arizona, Can Seniors Get A Discount On Property Taxes, Arizona Property Tax Benefits For Seniors

Senior citizens in Arizona can take advantage of various property tax benefits designed to provide financial relief and support These benefits include reduced property tax rates specifically for seniors and targeted tax credits aimed at

Senior Value protection offers citizens the opportunity to freeze their property value for a period of time primarily based on income age and residency primary residence Criteria is based on state statute

Printables for free cover a broad assortment of printable resources available online for download at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and many more. The value of Arizona Senior Property Tax Discount is in their variety and accessibility.

More of Arizona Senior Property Tax Discount

Update News Online Wilmington Senior Property Tax Assistance Program

Update News Online Wilmington Senior Property Tax Assistance Program

Form 140PTC provides a tax credit of up to 502 To claim a property tax credit you must file your claim or extension request by April 15 2020 You cannot claim this credit on an amended return if you file it after the due date

First there is an exemption for widows widowers and totally disabled persons For qualified people the exemption has the effect of reducing the assessed value of the real property by up to 3 000 with a corresponding reduction in property tax Second there is

Arizona Senior Property Tax Discount have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: This allows you to modify printed materials to meet your requirements such as designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: Free educational printables provide for students of all ages, which makes them an invaluable source for educators and parents.

-

The convenience of You have instant access various designs and templates can save you time and energy.

Where to Find more Arizona Senior Property Tax Discount

Florida Property Tax Discounts

Florida Property Tax Discounts

File your Senior Valuation Protection application online Certification of Disability for Property Tax Exemption 2024 Personal Exemptions DocuSign Version Exemption Deadline Waiver DocuSign Version

The Senior Property Valuation Protection Option Senior Freeze is available to residential homeowners 65 years of age or older who meet specific guidelines based on income ownership and residency Arizona Constitution Article 9 Section 18

We hope we've stimulated your curiosity about Arizona Senior Property Tax Discount Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Arizona Senior Property Tax Discount designed for a variety motives.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning materials.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide selection of subjects, that range from DIY projects to party planning.

Maximizing Arizona Senior Property Tax Discount

Here are some unique ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Arizona Senior Property Tax Discount are a treasure trove of practical and innovative resources which cater to a wide range of needs and needs and. Their access and versatility makes them an invaluable addition to your professional and personal life. Explore the vast world of Arizona Senior Property Tax Discount to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can print and download these items for free.

-

Are there any free templates for commercial use?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright issues with Arizona Senior Property Tax Discount?

- Some printables may come with restrictions in use. You should read the terms and condition of use as provided by the author.

-

How do I print printables for free?

- You can print them at home using the printer, or go to the local print shops for premium prints.

-

What software do I need to run printables free of charge?

- The majority of printables are as PDF files, which can be opened using free software such as Adobe Reader.

Brookland Terrace Civic Club NCC Senior Property Tax Reductions

California Senior Citizen Property Tax Relief Enjoy OC

Check more sample of Arizona Senior Property Tax Discount below

Property Tax Discount Package 2021 2022 YouTube

AMC Announces New Incentive Scheme For Property Tax Dues

PMC Discontinues 40 Property Tax Discount For Self occupied Homes

Understanding Senior Freeze Other Senior Property Tax Breaks

Property Tax Discount Plan means You Won t Pay Twice For Services

https://mcassessor.maricopa.gov/page/valuation_relief

Senior Value protection offers citizens the opportunity to freeze their property value for a period of time primarily based on income age and residency primary residence Criteria is based on state statute

https://www.azcentral.com/story/money/business/...

If you re over age 65 in Arizona and are on a fixed income you may be eligible to significantly reduce your property tax bill There are two government programs that help low income seniors The

Senior Value protection offers citizens the opportunity to freeze their property value for a period of time primarily based on income age and residency primary residence Criteria is based on state statute

If you re over age 65 in Arizona and are on a fixed income you may be eligible to significantly reduce your property tax bill There are two government programs that help low income seniors The

AMC Announces New Incentive Scheme For Property Tax Dues

Understanding Senior Freeze Other Senior Property Tax Breaks

Property Tax Discount Plan means You Won t Pay Twice For Services

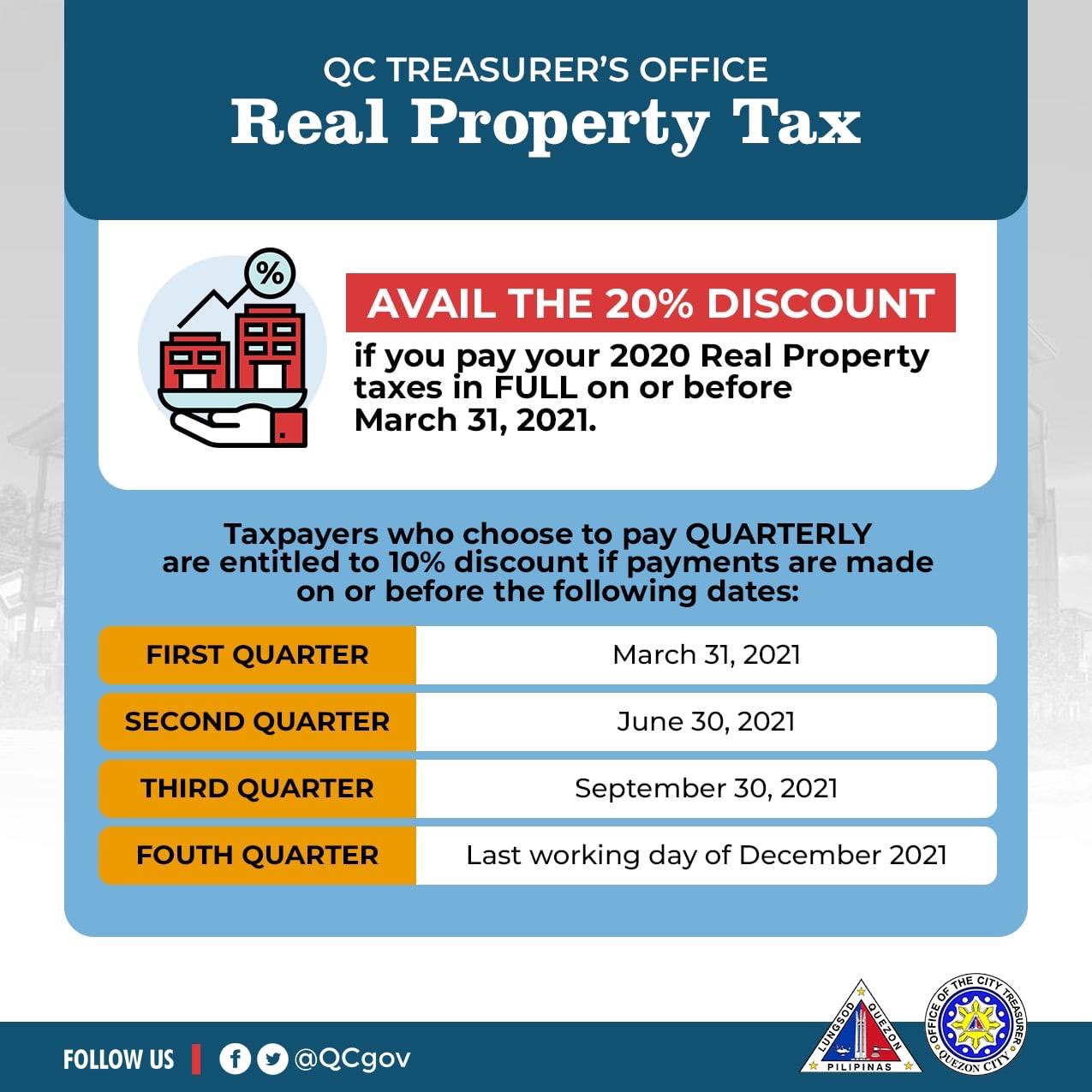

Quezon City Government On Twitter Pay Your Real Property Taxes Early

Hecht Group Who Should Pay Property Tax In Advance

Hecht Group Who Should Pay Property Tax In Advance

Committee To Pass The Oregon Senior Property Tax Freeze Act