Today, where screens dominate our lives, the charm of tangible printed objects isn't diminished. If it's to aid in education such as creative projects or simply adding some personal flair to your home, printables for free are now an essential resource. In this article, we'll dive into the world "Can I Deduct State Taxes Paid For Previous Year," exploring the different types of printables, where they are, and how they can add value to various aspects of your lives.

Get Latest Can I Deduct State Taxes Paid For Previous Year Below

Can I Deduct State Taxes Paid For Previous Year

Can I Deduct State Taxes Paid For Previous Year - Can I Deduct State Taxes Paid For Previous Year, Can I Deduct State Taxes Paid For Previous Year Turbotax, Can I Deduct Taxes Paid For Previous Year, Can I Deduct Federal Taxes Paid For Previous Year

You might be able to get a federal deduction for state or local income taxes you paid in 2023 even if they were for an earlier tax year To get this deduction you ll need to itemize There s a cap on the SALT deduction state and local tax

You may deduct as an itemized deduction state and local income taxes withheld from your wages during the year as reported on your Form W 2 Wage and Tax Statement and estimated state and local income taxes and prior years state and local income taxes paid during the year

Printables for free cover a broad array of printable materials available online at no cost. They are available in a variety of forms, including worksheets, coloring pages, templates and much more. The beauty of Can I Deduct State Taxes Paid For Previous Year is in their versatility and accessibility.

More of Can I Deduct State Taxes Paid For Previous Year

Can I Deduct Dental Implants On My Taxes Dental News Network

Can I Deduct Dental Implants On My Taxes Dental News Network

If the taxes you paid this year related to a prior year was for Federal income taxes there is no deduction on the current year return and that amount is not entered anywhere on the current year return

You would be deducting taxes paid with your prior year federal return since that return would have been filed during the current calendar year You must deduct the amount of any federal refund received

Can I Deduct State Taxes Paid For Previous Year have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: The Customization feature lets you tailor designs to suit your personal needs in designing invitations planning your schedule or even decorating your house.

-

Educational Value The free educational worksheets provide for students of all ages, making them an essential source for educators and parents.

-

Affordability: You have instant access many designs and templates can save you time and energy.

Where to Find more Can I Deduct State Taxes Paid For Previous Year

Can I Deduct Health Insurance Premiums If I m Self Employed The

Can I Deduct Health Insurance Premiums If I m Self Employed The

You may be able to deduct state and local income OR sales taxes they paid during the year The catch you have to itemize deductions to claim the deduction

The state income tax deduction can help with year end tax planning because taxpayers can elect to increase their state tax payments at the eleventh hour to cover any expected state liability that will occur for the year

We've now piqued your interest in printables for free We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of motives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs are a vast array of topics, ranging including DIY projects to party planning.

Maximizing Can I Deduct State Taxes Paid For Previous Year

Here are some ideas how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Can I Deduct State Taxes Paid For Previous Year are an abundance of practical and innovative resources that can meet the needs of a variety of people and passions. Their accessibility and flexibility make these printables a useful addition to your professional and personal life. Explore the many options of Can I Deduct State Taxes Paid For Previous Year and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Can I Deduct State Taxes Paid For Previous Year truly available for download?

- Yes they are! You can download and print the resources for free.

-

Are there any free templates for commercial use?

- It is contingent on the specific usage guidelines. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with Can I Deduct State Taxes Paid For Previous Year?

- Some printables may contain restrictions regarding their use. Check these terms and conditions as set out by the author.

-

How can I print Can I Deduct State Taxes Paid For Previous Year?

- Print them at home using either a printer or go to an area print shop for high-quality prints.

-

What program do I need in order to open printables for free?

- Most printables come in the format PDF. This can be opened with free software like Adobe Reader.

Can Homeowners Deduct Seller Paid Points Roger Rossmeisl CPA

Missouri Marijuana Businesses Can Deduct Expenses On State Tax Returns

Check more sample of Can I Deduct State Taxes Paid For Previous Year below

Can I Deduct Expenses For Growing Food That I Donate Nj

How Your Pass Through Business Can Deduct State Taxes In Excess Of The

Article Tag Property Taxes TaxAudit Blog

State Tax Deductions For Business Spiegel Accountancy

State Pass Through Entity Taxes

2 Tax Prep Fees Tax Prep Fees Common Expense Deductions

https://www.irs.gov/taxtopics/tc503

You may deduct as an itemized deduction state and local income taxes withheld from your wages during the year as reported on your Form W 2 Wage and Tax Statement and estimated state and local income taxes and prior years state and local income taxes paid during the year

https://www.hrblock.com/.../deduct-state-taxes-paid

Unfortunately you cannot deduct the federal taxes you paid However you can deduct state taxes as an itemized deduction on Schedule A If you choose to itemize your deduction to claim state taxes you will not be able to take the standard deduction

You may deduct as an itemized deduction state and local income taxes withheld from your wages during the year as reported on your Form W 2 Wage and Tax Statement and estimated state and local income taxes and prior years state and local income taxes paid during the year

Unfortunately you cannot deduct the federal taxes you paid However you can deduct state taxes as an itemized deduction on Schedule A If you choose to itemize your deduction to claim state taxes you will not be able to take the standard deduction

State Tax Deductions For Business Spiegel Accountancy

How Your Pass Through Business Can Deduct State Taxes In Excess Of The

State Pass Through Entity Taxes

2 Tax Prep Fees Tax Prep Fees Common Expense Deductions

What Can I Deduct In My Reselling Business YouTube

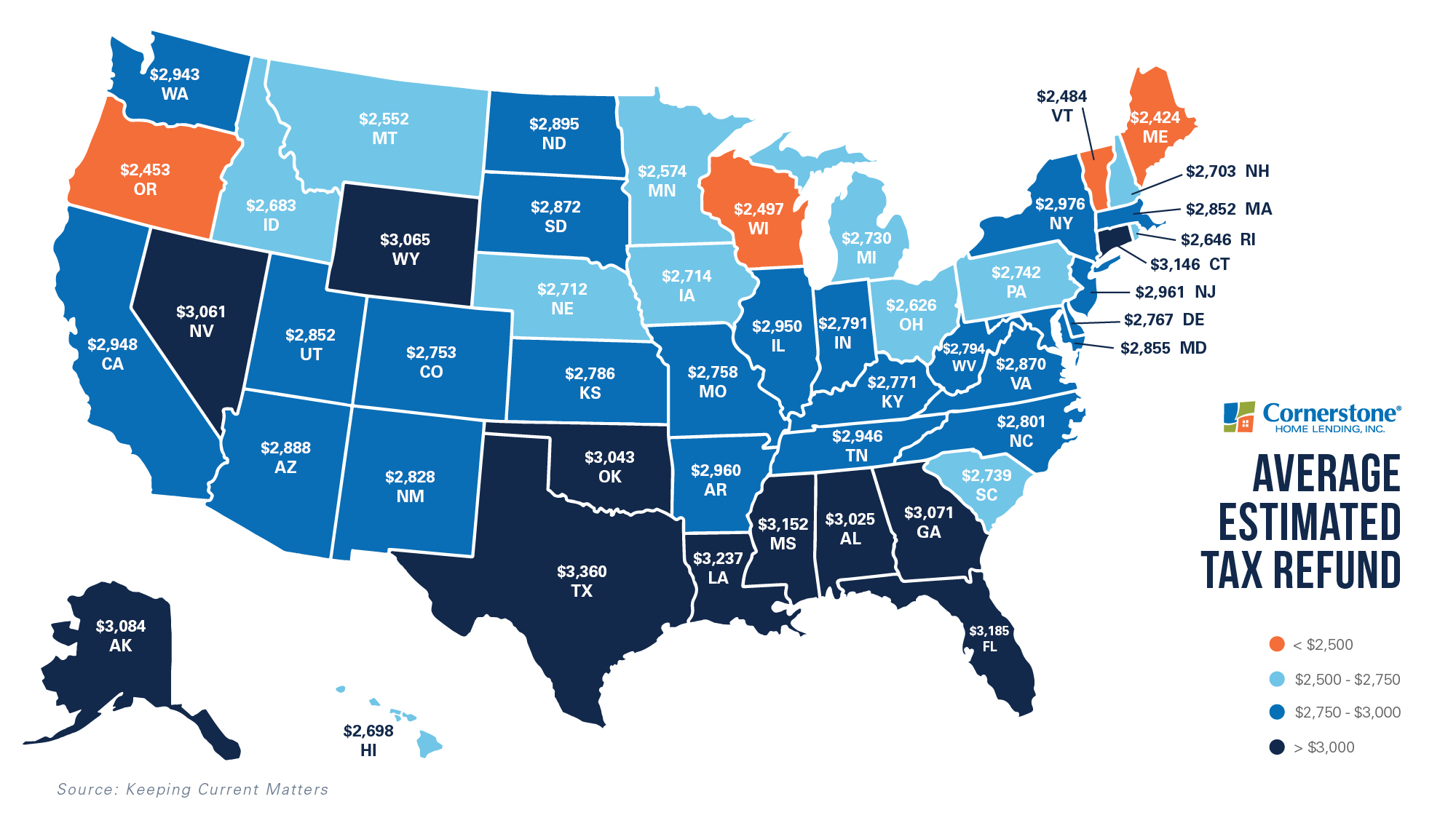

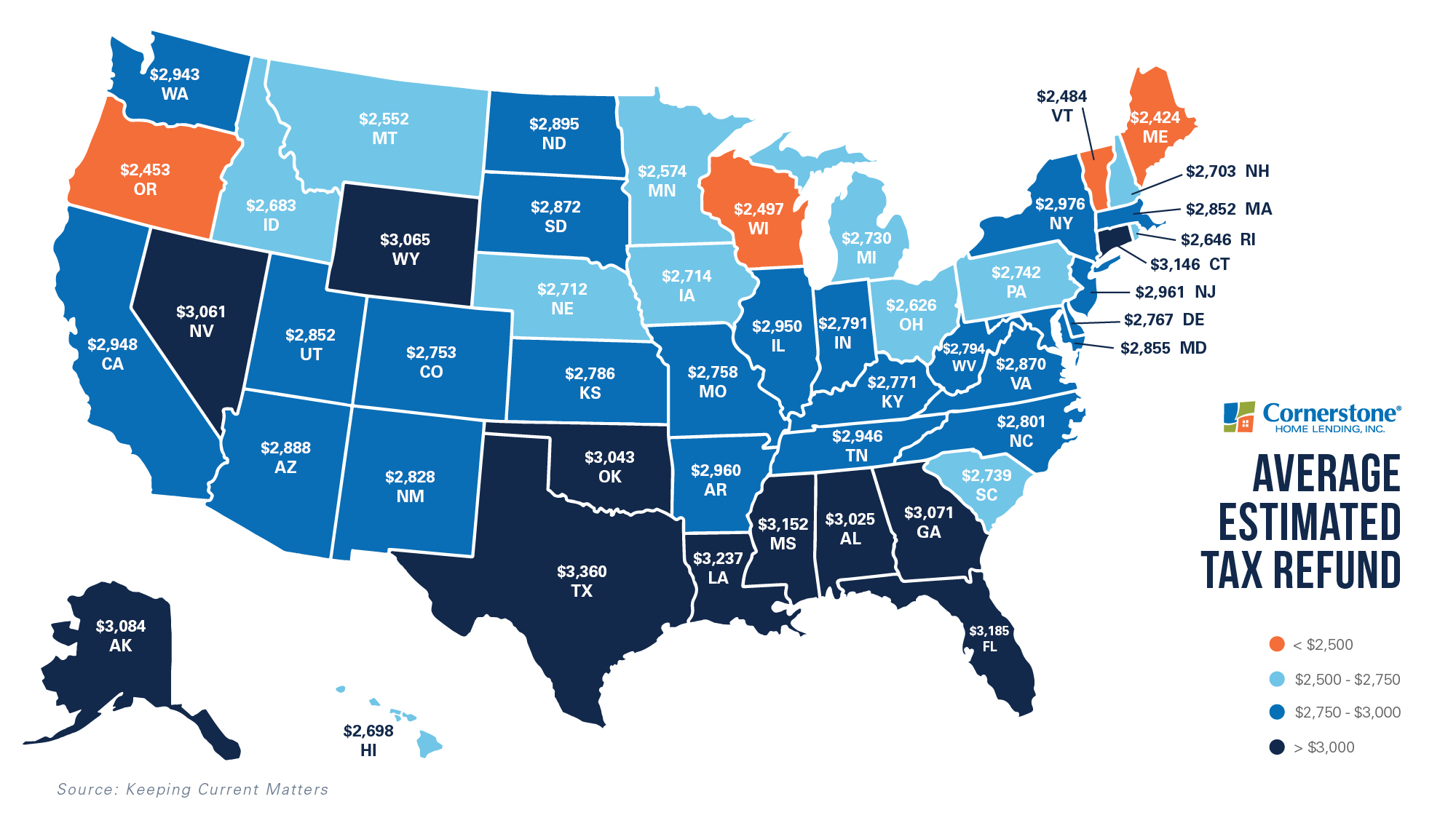

Tax Return 2021 Could Your Refund Make Homeownership A Reality

Tax Return 2021 Could Your Refund Make Homeownership A Reality

Can I Deduct Moving Expenses Simpleetax YouTube