Today, when screens dominate our lives, the charm of tangible printed objects isn't diminished. For educational purposes or creative projects, or just adding a personal touch to your home, printables for free are now a vital source. In this article, we'll take a dive to the depths of "Cghs Contribution Income Tax Exemption," exploring the different types of printables, where they are, and what they can do to improve different aspects of your life.

Get Latest Cghs Contribution Income Tax Exemption Below

Cghs Contribution Income Tax Exemption

Cghs Contribution Income Tax Exemption - Cghs Contribution Income Tax Exemption, Is Cghs Contribution Taxable, Income Tax Deduction For Cghs Contribution, Cghs Contribution Rules

Under Section 80D of the Income Tax Act every individual or Hindu Undivided Family HUF can deduct from their total income up to a certain amount for

Section 80D of the Income Tax Act allows individuals or HUF to claim a deduction for medical insurance premiums paid in a financial year Section 80D provides

Cghs Contribution Income Tax Exemption encompass a wide assortment of printable, downloadable items that are available online at no cost. They are available in numerous types, like worksheets, templates, coloring pages and many more. The appealingness of Cghs Contribution Income Tax Exemption is in their versatility and accessibility.

More of Cghs Contribution Income Tax Exemption

300

300

Contribution to CGHS notified scheme Individuals can claim a tax deduction of up to 25 000 for contributions made to the Central Government Health Scheme

Section 80D allows taxpayers to avail tax deductions on the premiums paid towards health and medical insurance in a financial year Section 80D permits a

Cghs Contribution Income Tax Exemption have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize the templates to meet your individual needs such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Impact: Downloads of educational content for free cater to learners of all ages, making the perfect resource for educators and parents.

-

It's easy: Quick access to a plethora of designs and templates reduces time and effort.

Where to Find more Cghs Contribution Income Tax Exemption

Income Tax On Co Operative Group Housing Society Taxation On CGHS

Income Tax On Co Operative Group Housing Society Taxation On CGHS

Section 80D of the Income Tax Act provides individuals with a deduction in respect of medical insurance premiums paid This section is aimed at encouraging taxpayers to

Who can claim tax benefits under Section 80D of Income Tax Act 1961 A taxpayer may deduct expenses under Section 80D Deductions are allowed for health

In the event that we've stirred your interest in printables for free, let's explore where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Cghs Contribution Income Tax Exemption to suit a variety of reasons.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a broad range of topics, all the way from DIY projects to planning a party.

Maximizing Cghs Contribution Income Tax Exemption

Here are some creative ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home for the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Cghs Contribution Income Tax Exemption are a treasure trove of useful and creative resources that can meet the needs of a variety of people and hobbies. Their availability and versatility make them a wonderful addition to both personal and professional life. Explore the vast world of Cghs Contribution Income Tax Exemption right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes they are! You can print and download these resources at no cost.

-

Can I download free printables for commercial use?

- It is contingent on the specific rules of usage. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright violations with Cghs Contribution Income Tax Exemption?

- Some printables may come with restrictions on use. Be sure to check the terms and conditions provided by the creator.

-

How do I print Cghs Contribution Income Tax Exemption?

- Print them at home using any printer or head to a local print shop to purchase top quality prints.

-

What program do I require to view printables that are free?

- The majority of printed documents are with PDF formats, which is open with no cost software, such as Adobe Reader.

Increase In CGHS Contribution BPS Request Reconsideration Of

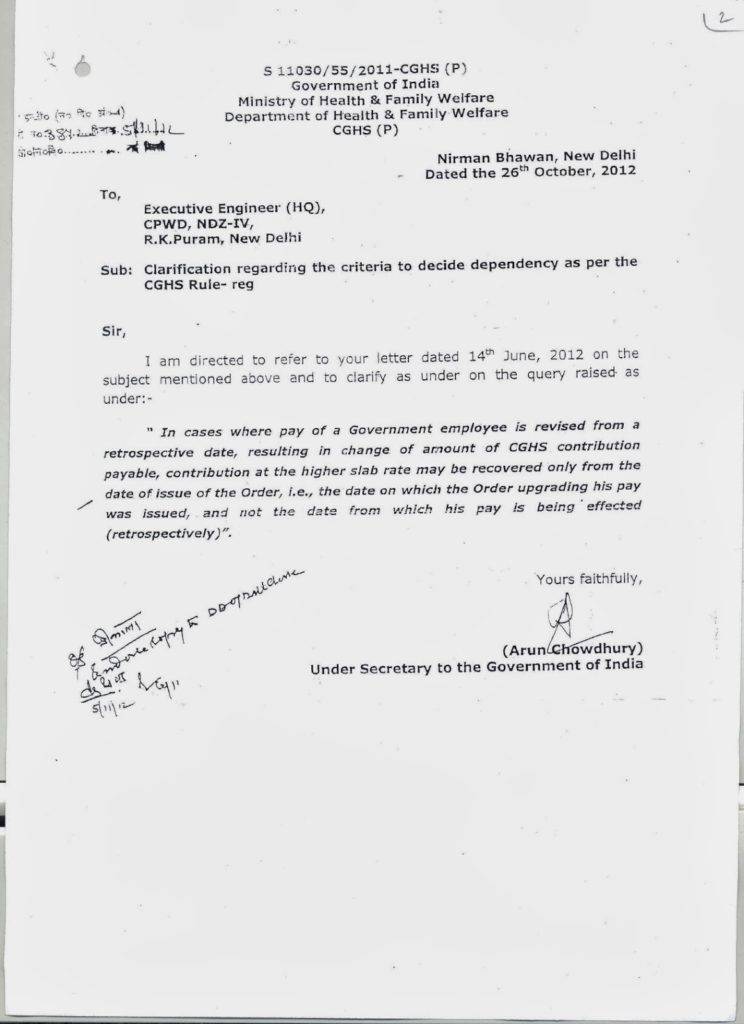

Deduction Of CGHS Contribution On Change Of Grade Pay By Virtue Of

Check more sample of Cghs Contribution Income Tax Exemption below

Nps Contribution By Employee Werohmedia

CGHS Yearly Contribution Deposited By Retired Employees Clarification

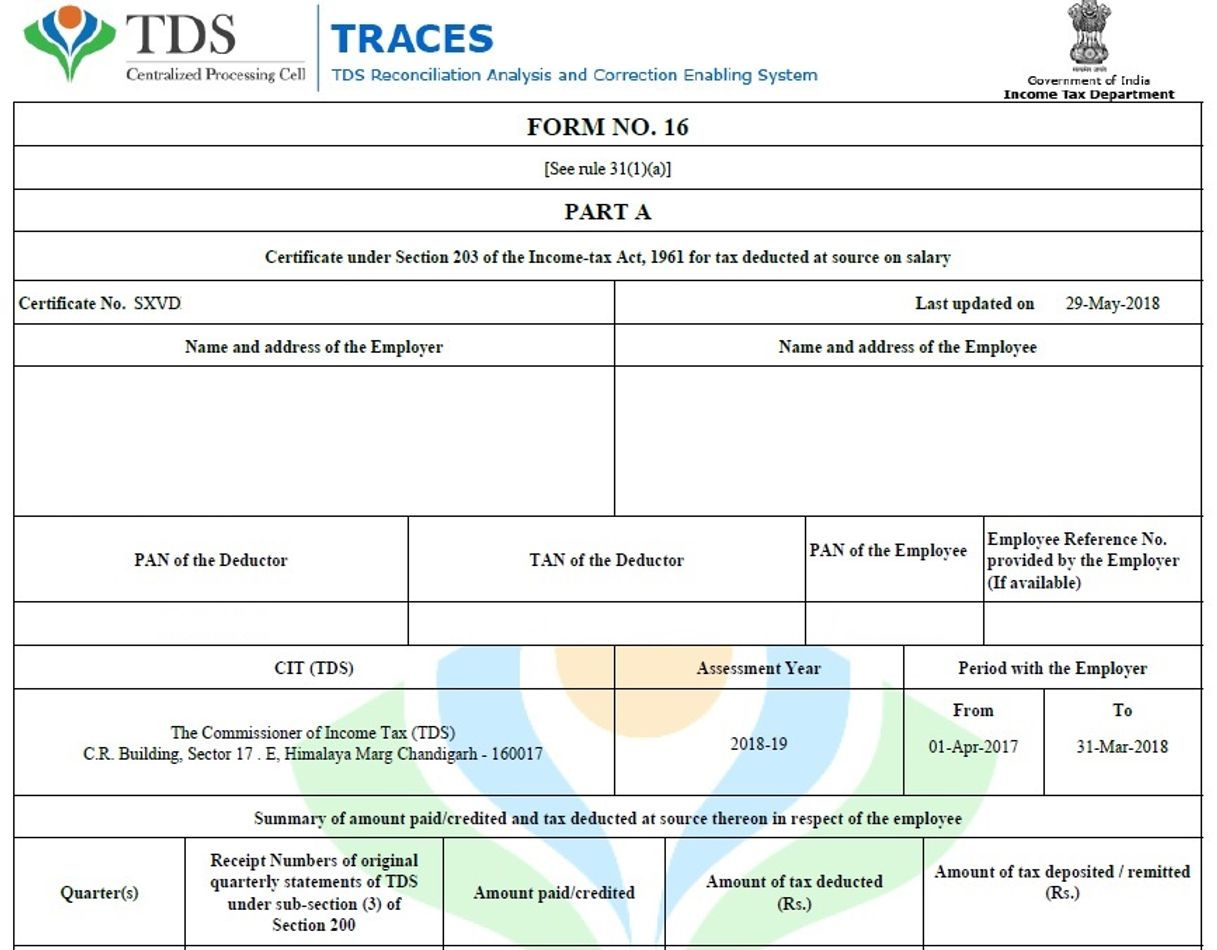

Providing Form 16 To All Pensioners And Family Pensioners CPAO

NPS Tax Exemption Important News Way To Get Tax Exemption On Employer

CGHS Application CGHS Contribution CGHS Card Loss CGHS Card

Instruction To Stop Facility Of Payment Of Subscriptions Contribution

https://tax2win.in/guide/section-80d-deduction...

Section 80D of the Income Tax Act allows individuals or HUF to claim a deduction for medical insurance premiums paid in a financial year Section 80D provides

https://tilakmarg.com/opinion/central-government...

The amount of contribution you make to the CGHS qualifies for deduction u s 80 D from the taxable income subject to a maximum of Rs 25 000 per financial year

Section 80D of the Income Tax Act allows individuals or HUF to claim a deduction for medical insurance premiums paid in a financial year Section 80D provides

The amount of contribution you make to the CGHS qualifies for deduction u s 80 D from the taxable income subject to a maximum of Rs 25 000 per financial year

NPS Tax Exemption Important News Way To Get Tax Exemption On Employer

CGHS Yearly Contribution Deposited By Retired Employees Clarification

CGHS Application CGHS Contribution CGHS Card Loss CGHS Card

Instruction To Stop Facility Of Payment Of Subscriptions Contribution

Colorado Homeless Contribution Income Tax Credit Eligible Organizations

CGHS Annual Contribution Of KVS Pensioners

CGHS Annual Contribution Of KVS Pensioners

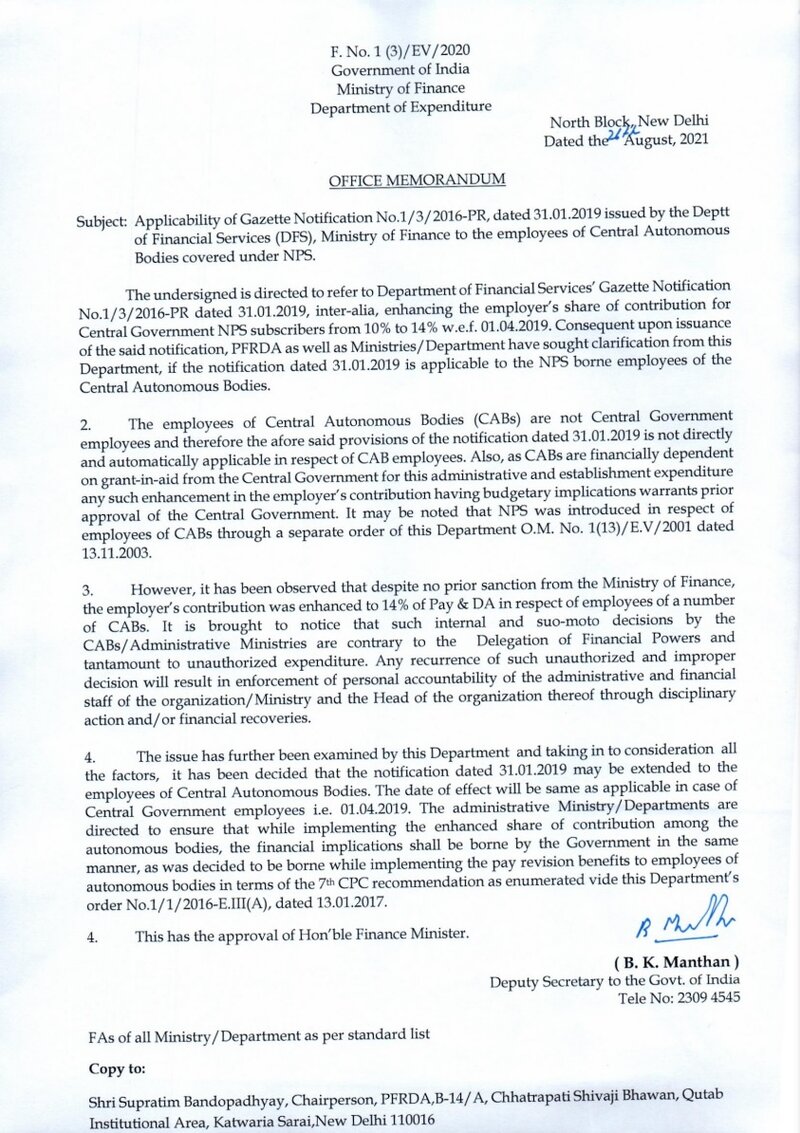

Enhancement Of Employer s Contribution From 10 To 14 In Central