In this digital age, with screens dominating our lives The appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses such as creative projects or just adding personal touches to your area, Child Care Tax Credit 2022 have become a valuable resource. In this article, we'll take a dive through the vast world of "Child Care Tax Credit 2022," exploring the benefits of them, where to find them and how they can improve various aspects of your life.

Get Latest Child Care Tax Credit 2022 Below

Child Care Tax Credit 2022

Child Care Tax Credit 2022 - Child Care Tax Credit 2022, Child Care Tax Credit 2022 Income Limit, Child Care Tax Credit 2022 Age Limit, Child Care Tax Credit 2022 Form, Child Care Tax Credit 2022 Calculator, Child Care Tax Credit 2022 Eligibility, Child Care Tax Credit 2022 Amount, Child Care Tax Credit 2022 Qualifications, Child Care Tax Credit 2022 Married Filing Separately, What Is The Maximum For Child Care Tax Credit

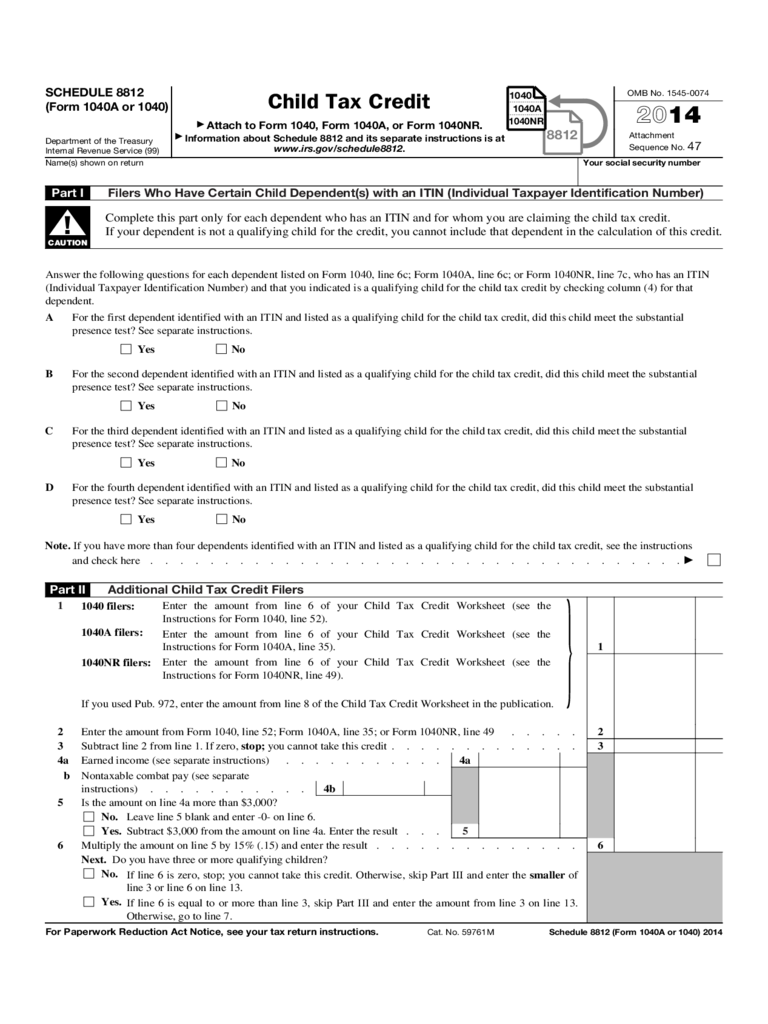

Verkko 13 tammik 2022 nbsp 0183 32 Key Points For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or more

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum

Child Care Tax Credit 2022 cover a large selection of printable and downloadable resources available online for download at no cost. These printables come in different styles, from worksheets to templates, coloring pages and much more. The benefit of Child Care Tax Credit 2022 lies in their versatility as well as accessibility.

More of Child Care Tax Credit 2022

Care Credit Printable Application Printable Word Searches

Care Credit Printable Application Printable Word Searches

Verkko 11 kes 228 k 2021 nbsp 0183 32 The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and Dependent Care Expenses For information regarding changes to the credit for 2021 only see Q6 through Q14

Verkko 18 lokak 2023 nbsp 0183 32 You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work Generally you may not take this credit if your filing status is married filing separately

The Child Care Tax Credit 2022 have gained huge popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Individualization We can customize printables to your specific needs whether it's making invitations, organizing your schedule, or even decorating your house.

-

Educational Value The free educational worksheets can be used by students of all ages, which makes them a valuable tool for teachers and parents.

-

The convenience of Fast access many designs and templates will save you time and effort.

Where to Find more Child Care Tax Credit 2022

2021 Child And Dependent Care Tax Credit

2021 Child And Dependent Care Tax Credit

Verkko For tax year 2022 the amount of eligible dependent care expenses has decreased from 8 000 to 3 000 for one eligible person and from 16 000 to 6 000 for two or more eligible persons The credit is also no longer refundable The maximum credit rate also decreases from 50 to 35 Employer Provided Dependent Care Benefits The

Verkko 2 elok 2021 nbsp 0183 32 The bill signed into law by President Joe Biden increased the Child Tax Credit from 2 000 to up to 3 600 and allowed families the option to receive 50 of their 2021 child tax credit in

After we've peaked your interest in printables for free we'll explore the places the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Child Care Tax Credit 2022 for a variety goals.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad spectrum of interests, that range from DIY projects to party planning.

Maximizing Child Care Tax Credit 2022

Here are some creative ways in order to maximize the use use of Child Care Tax Credit 2022:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home as well as in the class.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Child Care Tax Credit 2022 are an abundance of creative and practical resources which cater to a wide range of needs and hobbies. Their access and versatility makes them an essential part of each day life. Explore the world of Child Care Tax Credit 2022 to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can print and download these tools for free.

-

Can I make use of free templates for commercial use?

- It's based on specific usage guidelines. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables might have limitations in use. Be sure to read the conditions and terms of use provided by the creator.

-

How can I print Child Care Tax Credit 2022?

- Print them at home using any printer or head to a local print shop to purchase more high-quality prints.

-

What software do I need to open printables at no cost?

- The majority are printed with PDF formats, which can be opened with free software like Adobe Reader.

Use The Child Care Tax Credit To Save On Your 2022 Taxes Care HomePay

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return

Check more sample of Child Care Tax Credit 2022 below

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

Tax Year 2021 Dependent Tax Credits And Deductions PriorTax Blog

Great News Child Care Tax Credit Expanded For 2021 Isler Northwest LLC

2022 Child Tax Credit Dates Latest News Update

Did Child Tax Credit Get Extended 2022 Latest News Update

https://www.nerdwallet.com/.../taxes/child-and-dependent-care-tax-credit

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum

https://www.irs.gov/.../understanding-the-child-and-dependent-care-credit

Verkko IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum

Verkko IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

Great News Child Care Tax Credit Expanded For 2021 Isler Northwest LLC

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

2022 Child Tax Credit Dates Latest News Update

Did Child Tax Credit Get Extended 2022 Latest News Update

Child Care Tax Credit Dates Librus

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Government Announces New Child Care Tax Credit North Bay News