In a world when screens dominate our lives The appeal of tangible printed objects isn't diminished. For educational purposes and creative work, or simply adding the personal touch to your space, Claim Cis Tax Rebate can be an excellent source. With this guide, you'll take a dive in the world of "Claim Cis Tax Rebate," exploring the different types of printables, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Claim Cis Tax Rebate Below

Claim Cis Tax Rebate

Claim Cis Tax Rebate - Claim Cis Tax Refund, How Do I Claim My Cis Refund From Hmrc, Can You Claim A Tax Rebate, How Does A Limited Company Claim Back Cis Tax Deducted, How Do I Claim My Cis Refund Online

Web 9 f 233 vr 2023 nbsp 0183 32 CIS deductions what expenses can you claim TaxScouts gt Guides 4 min read Last updated 9 Feb 2023 If you re a self employed individual under the CIS

Web 4 avr 2014 nbsp 0183 32 Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year From HM

Printables for free cover a broad collection of printable material that is available online at no cost. These resources come in various forms, including worksheets, templates, coloring pages, and much more. The beauty of Claim Cis Tax Rebate lies in their versatility and accessibility.

More of Claim Cis Tax Rebate

Cis Tax Rebate Calculator CALCULATORSD

Cis Tax Rebate Calculator CALCULATORSD

Web Claiming CIS Construction Industry Scheme tax rebates can be a complicated process with errors leading to delays fines or even the loss of qualified returns To assist you in

Web CLAIM BACK YOUR CIS TAX RETURNS NOW If you work in any type of construction or labouring job you will almost certainly be entitled to claim a Construction Industry

Claim Cis Tax Rebate have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: This allows you to modify the templates to meet your individual needs whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Value: Free educational printables offer a wide range of educational content for learners of all ages, making these printables a powerful device for teachers and parents.

-

Convenience: Access to an array of designs and templates saves time and effort.

Where to Find more Claim Cis Tax Rebate

Cis Tax Rebate Calculator CALCULATORSD

Cis Tax Rebate Calculator CALCULATORSD

Web What is the CIS rebate The 20 deduction usually works out as more than you owe in tax so subcontractors can claim back a CIS tax rebate from HMRC in the April of the following tax year For most CIS construction

Web 9 mars 2023 nbsp 0183 32 The average tax rebate for CIS workers in the UK is 163 1453 so it s worth finding out what you re owed We will help you claim your CIS tax rebate as well as

Since we've got your interest in Claim Cis Tax Rebate, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Claim Cis Tax Rebate for all needs.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing including flashcards, learning tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs are a vast array of topics, ranging that range from DIY projects to party planning.

Maximizing Claim Cis Tax Rebate

Here are some ways create the maximum value use of Claim Cis Tax Rebate:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Claim Cis Tax Rebate are an abundance of useful and creative resources which cater to a wide range of needs and hobbies. Their availability and versatility make them an essential part of both professional and personal lives. Explore the vast collection of Claim Cis Tax Rebate right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can print and download these items for free.

-

Can I utilize free printables for commercial purposes?

- It is contingent on the specific conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables could have limitations on usage. Make sure to read the conditions and terms of use provided by the designer.

-

How can I print Claim Cis Tax Rebate?

- Print them at home using an printer, or go to a local print shop to purchase the highest quality prints.

-

What program do I require to open printables free of charge?

- The majority are printed in the format PDF. This is open with no cost software, such as Adobe Reader.

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

What Is The CIS Tax Rebate Calculator For Tax Rebate Services

Check more sample of Claim Cis Tax Rebate below

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

Are You Due A Tax Rebate As A Construction Worker CIS Tax Rebates

CIS Tax Rebates Get The Most From Your Tax Rebate Brian Alfred

How Do I Claim The Recovery Rebate Credit On My Ta

CIS Tax Refunds rebates For Sub contractors Claim Your Tax Refund Here

https://www.gov.uk/government/publications/construction-industry...

Web 4 avr 2014 nbsp 0183 32 Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year From HM

https://brianalfred.co.uk/guides/entitled-tax-rebate-cis-worker

Web Am I entitled to a tax rebate under the Construction Industry Scheme Under the CIS you will likely be entitled to a tax rebate as you will have had 20 tax deducted from your

Web 4 avr 2014 nbsp 0183 32 Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year From HM

Web Am I entitled to a tax rebate under the Construction Industry Scheme Under the CIS you will likely be entitled to a tax rebate as you will have had 20 tax deducted from your

CIS Tax Rebates Get The Most From Your Tax Rebate Brian Alfred

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

How Do I Claim The Recovery Rebate Credit On My Ta

CIS Tax Refunds rebates For Sub contractors Claim Your Tax Refund Here

CIS Tax Rebates Verulams

How Does A Limited Company Claim Back CIS Tax Deducted

How Does A Limited Company Claim Back CIS Tax Deducted

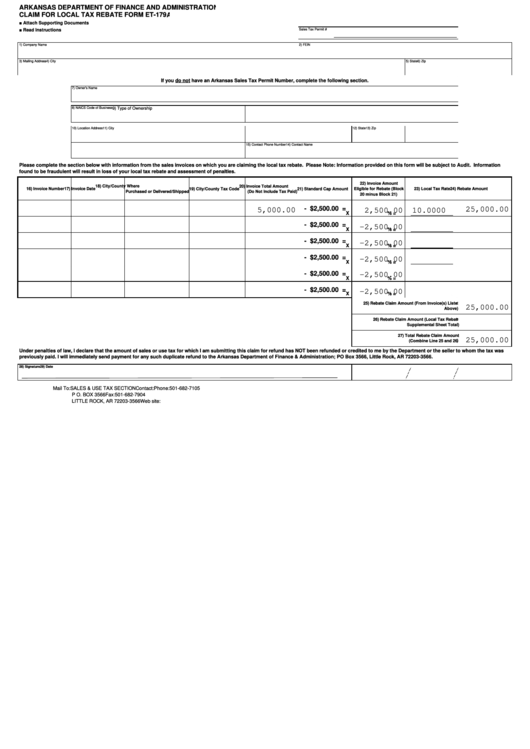

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download