In this age of electronic devices, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. In the case of educational materials project ideas, artistic or simply to add an element of personalization to your home, printables for free are a great resource. For this piece, we'll dive to the depths of "Claim Mileage Tax Deduction," exploring their purpose, where to find them and how they can add value to various aspects of your lives.

Get Latest Claim Mileage Tax Deduction Below

Claim Mileage Tax Deduction

Claim Mileage Tax Deduction - Claim Mileage Tax Deduction, Claim Mileage Tax Relief, Mileage Claim Tax Rate, Claim Business Mileage Tax Relief Form, Can I Deduct Mileage And Expenses, Can I Deduct Mileage If I Get Reimbursed, Can You Claim Mileage On Taxes If You Are Reimbursed, What Can I Claim For Mileage On My Taxes

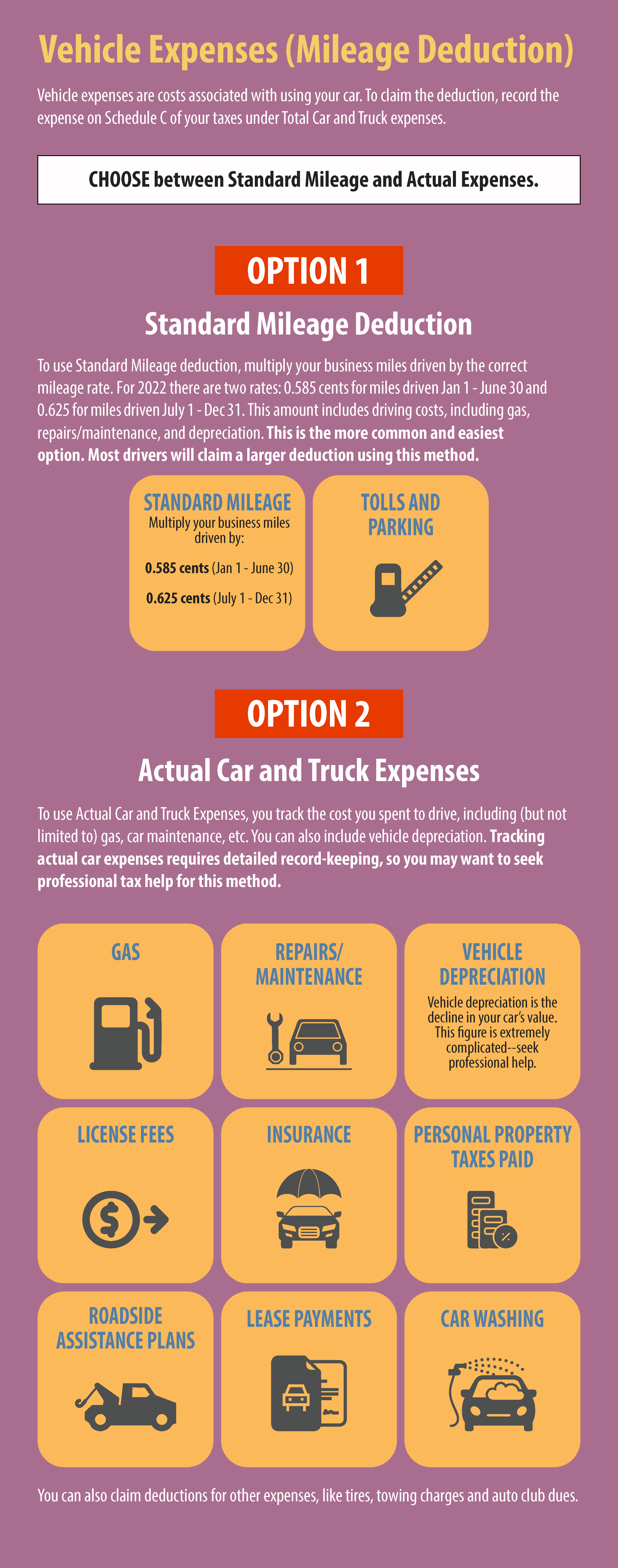

In a nutshell deductible mileage generally falls into three categories driving for business purposes charitable or medical trips and certain mileage for those in the armed forces But there s much more to unpack when talking about claiming mileage on your taxes

To work out how much you can claim multiply the total business kilometres you travelled by the rate You also need to apportion for private and business use understand the expenses you can claim and keep the right records Check how sole traders and some partnerships can use the cents per kilometre method for car related business expenses

Claim Mileage Tax Deduction include a broad range of printable, free materials available online at no cost. These resources come in various formats, such as worksheets, templates, coloring pages and many more. The value of Claim Mileage Tax Deduction is in their versatility and accessibility.

More of Claim Mileage Tax Deduction

How To Get A Business Mileage Tax Deduction Small Business Bookkeeping

How To Get A Business Mileage Tax Deduction Small Business Bookkeeping

If you re wondering whether you re eligible or how exactly to claim a mileage deduction on your tax return you re in the right place You ll learn how to track mileage which forms to fill and which records to keep

Learn the IRS rules for deducting your mileage on your tax return including how to choose a mileage method what records you need and how to claim the deduction at tax time

Claim Mileage Tax Deduction have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: There is the possibility of tailoring designs to suit your personal needs be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Impact: Education-related printables at no charge are designed to appeal to students of all ages, which makes them an invaluable tool for parents and teachers.

-

An easy way to access HTML0: immediate access an array of designs and templates is time-saving and saves effort.

Where to Find more Claim Mileage Tax Deduction

Business Use Of Vehicle Tax Deductions

Business Use Of Vehicle Tax Deductions

IRS Tax Topic on deductible car expenses such as mileage depreciation and recordkeeping requirements If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later

This calculator helps you to calculate the deduction you can claim for work related car expenses for eligible vehicles Use this calculator for the 2013 14 to 2023 24 income years Eligible vehicles include cars station wagons and sport utility vehicles

We've now piqued your interest in Claim Mileage Tax Deduction Let's find out where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety in Claim Mileage Tax Deduction for different motives.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing, flashcards, and learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad spectrum of interests, including DIY projects to planning a party.

Maximizing Claim Mileage Tax Deduction

Here are some creative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Claim Mileage Tax Deduction are an abundance with useful and creative ideas that cater to various needs and passions. Their availability and versatility make them an essential part of both professional and personal lives. Explore the many options of Claim Mileage Tax Deduction now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can download and print these files for free.

-

Are there any free templates for commercial use?

- It's based on specific terms of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright rights issues with Claim Mileage Tax Deduction?

- Certain printables might have limitations on their use. Be sure to check these terms and conditions as set out by the creator.

-

How do I print Claim Mileage Tax Deduction?

- You can print them at home using your printer or visit the local print shops for superior prints.

-

What program do I require to open printables for free?

- Most printables come in the PDF format, and is open with no cost programs like Adobe Reader.

Mileage Tax Deduction Claim Or Take The Standard Deduction

How To Get A Business Mileage Tax Deduction Small Business Sarah

Check more sample of Claim Mileage Tax Deduction below

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher

Mileage Tax Deduction Vs Reimbursement For Automobile Expenses

24 Vehicle Lease Mileage Tracker Sample Excel Templates

This Year s Mileage Tax Deduction

/shutterstock_315151916.driving.business.car_.cropped-5bfc4134c9e77c00519fd5d7.jpg)

2018 Mileage Tax Deductions Grant Management Nonprofit Fund Accounting

Easily Calculate Your Business Mileage Tax Deduction YouTube

https://www.ato.gov.au › businesses-and...

To work out how much you can claim multiply the total business kilometres you travelled by the rate You also need to apportion for private and business use understand the expenses you can claim and keep the right records Check how sole traders and some partnerships can use the cents per kilometre method for car related business expenses

https://money.usnews.com › money › personal-finance › ...

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their driving costs In the past taxpayers had

To work out how much you can claim multiply the total business kilometres you travelled by the rate You also need to apportion for private and business use understand the expenses you can claim and keep the right records Check how sole traders and some partnerships can use the cents per kilometre method for car related business expenses

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their driving costs In the past taxpayers had

/shutterstock_315151916.driving.business.car_.cropped-5bfc4134c9e77c00519fd5d7.jpg)

This Year s Mileage Tax Deduction

Mileage Tax Deduction Vs Reimbursement For Automobile Expenses

2018 Mileage Tax Deductions Grant Management Nonprofit Fund Accounting

Easily Calculate Your Business Mileage Tax Deduction YouTube

Mileage Claim Form Template

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

How To Claim The Standard Mileage Deduction Get It Back