In this age of technology, where screens dominate our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons project ideas, artistic or simply to add an individual touch to your space, Claiming Fuel Tax Credits Bas are a great resource. In this article, we'll take a dive in the world of "Claiming Fuel Tax Credits Bas," exploring what they are, how they are available, and how they can enhance various aspects of your daily life.

Get Latest Claiming Fuel Tax Credits Bas Below

Claiming Fuel Tax Credits Bas

Claiming Fuel Tax Credits Bas - Claiming Fuel Tax Credits Bas, Can I Claim The Fuel Tax Credit, Is Fuel Tax Credit Taxable Income

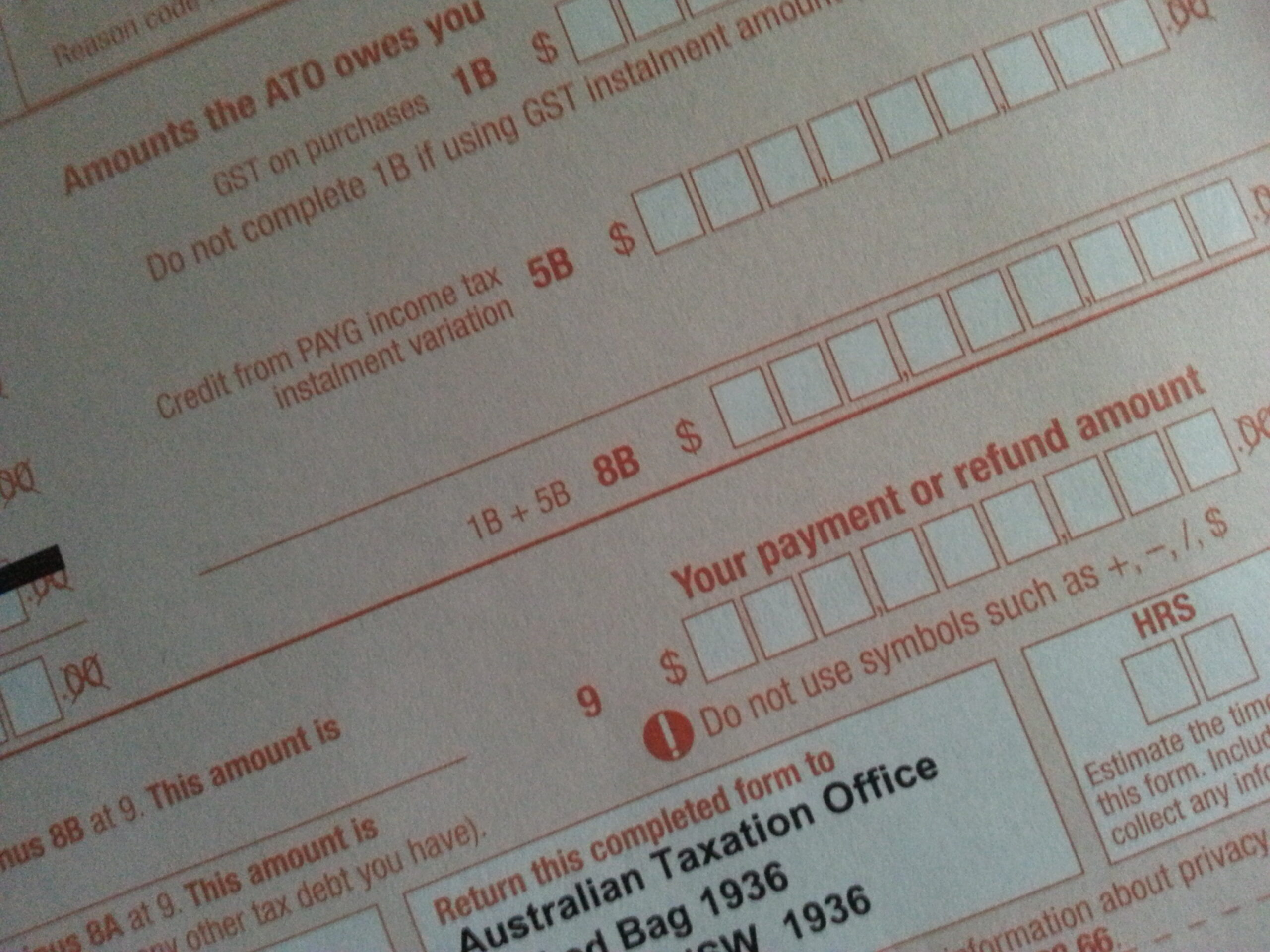

You claim fuel tax credits on your BAS in the same way as you claim GST credits You can register and claim fuel tax credits for eligible fuels petrol diesel are both eligible

You claim fuel tax credits on your BAS Before you can claim on your BAS you need to calculate your fuel tax credits To get your claim right use the fuel tax credit tools on

Claiming Fuel Tax Credits Bas include a broad variety of printable, downloadable materials online, at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and more. The benefit of Claiming Fuel Tax Credits Bas is their versatility and accessibility.

More of Claiming Fuel Tax Credits Bas

Claiming Reinstated Alternative Fuel Tax Credits Guidance Weaver

Claiming Reinstated Alternative Fuel Tax Credits Guidance Weaver

Lodge a Business Activity Statement BAS Fuel tax credits are claimed by reporting them on the BAS which is typically lodged on a quarterly basis Businesses

You ll claim the fuel tax credits on your business activity statement BAS Before you can claim fuel tax credits on your BAS you need to calculate the amount you can claim The amount of credit you

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Modifications: We can customize printed materials to meet your requirements such as designing invitations or arranging your schedule or decorating your home.

-

Education Value Downloads of educational content for free provide for students of all ages, making the perfect tool for parents and teachers.

-

Accessibility: Fast access various designs and templates reduces time and effort.

Where to Find more Claiming Fuel Tax Credits Bas

Calculating Claiming Fuel Tax Credits Platinum Accounting

Calculating Claiming Fuel Tax Credits Platinum Accounting

Under the right circumstances a small business can claim these duties called fuel credits against their BAS per quarter as necessary but you must be

To accurately claim Fuel Tax Credits on your Business Activity Statement BAS meticulous record keeping is essential Required documents can include

Now that we've piqued your interest in printables for free We'll take a look around to see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of purposes.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a wide variety of topics, all the way from DIY projects to planning a party.

Maximizing Claiming Fuel Tax Credits Bas

Here are some unique ways for you to get the best use of Claiming Fuel Tax Credits Bas:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home for the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Claiming Fuel Tax Credits Bas are an abundance of useful and creative resources that cater to various needs and hobbies. Their accessibility and flexibility make them a great addition to both personal and professional life. Explore the wide world of Claiming Fuel Tax Credits Bas to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Claiming Fuel Tax Credits Bas truly completely free?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial use?

- It's all dependent on the usage guidelines. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with Claiming Fuel Tax Credits Bas?

- Some printables may come with restrictions in use. Be sure to review these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in an in-store print shop to get high-quality prints.

-

What software do I need in order to open printables that are free?

- The majority of PDF documents are provided in PDF format. They can be opened with free software, such as Adobe Reader.

BAS Labels Explained Part 1 E BAS Accounts

How To Check Your Eligibility And Start Claiming Fuel Tax Credits

Check more sample of Claiming Fuel Tax Credits Bas below

Fuel Excise What s Changing With Your Business s Fuel Tax Credits

How To Prepare And Lodge BAS Online Xero AU

Maximize Your Business Returns Claim Fuel Tax Credits Today The

Federal Budget Fuel Excise Reduction Will All Businesses Benefit

HOW TO GET MORE FUEL TAX CREDITS Moore Lewis Partners

Rates Increase For Fuel Tax Credits Smart Steps Accounting

https://business.gov.au/finance/taxation/claim-fuel-tax-credits

You claim fuel tax credits on your BAS Before you can claim on your BAS you need to calculate your fuel tax credits To get your claim right use the fuel tax credit tools on

https://www.platinumaccounting.com.au/blog/...

Since the BAS period ending 31 March 2016 the ATO has simplified the way fuel tax credits are recorded and calculated for businesses that claim less than 10 000 in fuel

You claim fuel tax credits on your BAS Before you can claim on your BAS you need to calculate your fuel tax credits To get your claim right use the fuel tax credit tools on

Since the BAS period ending 31 March 2016 the ATO has simplified the way fuel tax credits are recorded and calculated for businesses that claim less than 10 000 in fuel

Federal Budget Fuel Excise Reduction Will All Businesses Benefit

How To Prepare And Lodge BAS Online Xero AU

HOW TO GET MORE FUEL TAX CREDITS Moore Lewis Partners

Rates Increase For Fuel Tax Credits Smart Steps Accounting

AV Chartered Accountants Common Errors With Fuel Tax Credits And How

BAS Labels Explained Part 3 E BAS Accounts

BAS Labels Explained Part 3 E BAS Accounts

Guide To Claiming Fuel Tax Credits TMS Financials