In this day and age where screens dominate our lives, the charm of tangible printed materials hasn't faded away. For educational purposes in creative or artistic projects, or simply to add some personal flair to your home, printables for free are a great source. For this piece, we'll dive into the sphere of "Claiming Tax Credits Self Employed," exploring what they are, where they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Claiming Tax Credits Self Employed Below

Claiming Tax Credits Self Employed

Claiming Tax Credits Self Employed - Claiming Tax Credits Self Employed, Applying For Tax Credits Self Employed, Claim Tax Rebate Self Employed, Can You Claim Tax Credits Self Employed, Claim My Tax Rebate Self Employed, Can Self Employed Claim Working Tax Credit, Can You Get Tax Credits Being Self Employed

16 Tax Deductions and Benefits for the Self Employed Deductions Credits Tax Deductions 16 Tax Deductions and Benefits for the Self Employed Know where you can save money and

You need to work out your income from being self employed for your award period this is usually from 6 April in the current tax year to the time you stop getting tax credits

Printables for free include a vast selection of printable and downloadable items that are available online at no cost. These printables come in different forms, including worksheets, coloring pages, templates and more. The appealingness of Claiming Tax Credits Self Employed is their flexibility and accessibility.

More of Claiming Tax Credits Self Employed

COVID 19 Sick And Family Leave Tax Credits For Self Employed

COVID 19 Sick And Family Leave Tax Credits For Self Employed

Tax credits are a type of tax incentive that can reduce the amount of tax a self employed individual owes This article will delve into the intricacies of tax credits focusing on their

As a self employed individual in 2020 and or 2021 you may be eligible for significant tax credits potentially up to 32 220 under the SETC This opportunity extends to sole

Claiming Tax Credits Self Employed have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: This allows you to modify print-ready templates to your specific requirements be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes them a vital resource for educators and parents.

-

Easy to use: Access to the vast array of design and templates can save you time and energy.

Where to Find more Claiming Tax Credits Self Employed

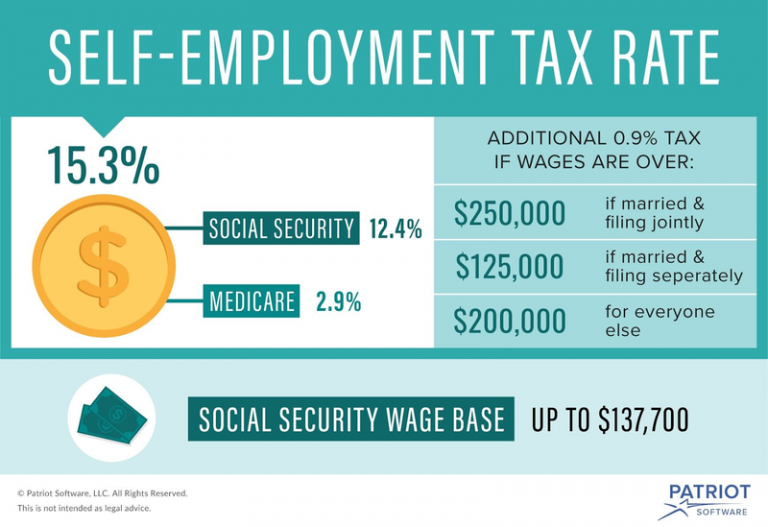

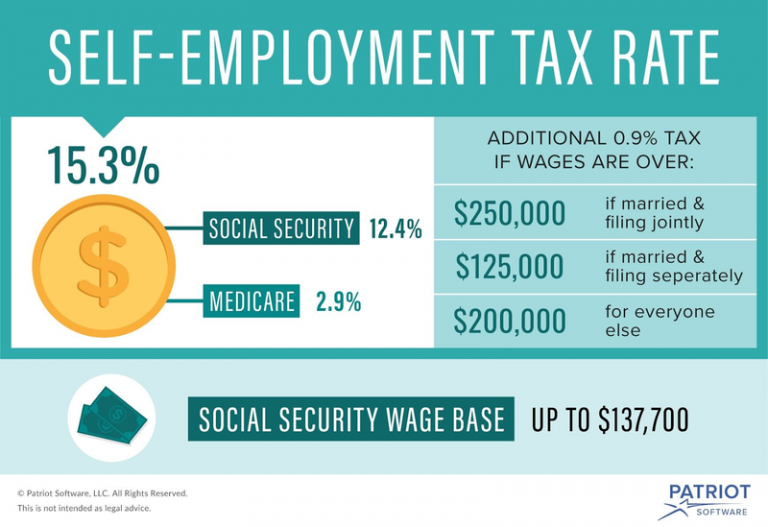

Are You Subject To Self Employment Tax Coastal Tax Advisors

Are You Subject To Self Employment Tax Coastal Tax Advisors

You have to file an income tax return if your net earnings from self employment were 400 or more If your net earnings from self employment were less than 400 you still have

1 The home office deduction 2 Health insurance maybe deduction 3 Continuing education deduction 4 Mileage deduction 5 Retirement savings deduction 6 Self employment taxes as

Now that we've piqued your curiosity about Claiming Tax Credits Self Employed and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of needs.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs covered cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing Claiming Tax Credits Self Employed

Here are some new ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Claiming Tax Credits Self Employed are a treasure trove of useful and creative resources that satisfy a wide range of requirements and passions. Their accessibility and flexibility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast world of Claiming Tax Credits Self Employed and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Claiming Tax Credits Self Employed really completely free?

- Yes, they are! You can print and download the resources for free.

-

Do I have the right to use free printouts for commercial usage?

- It's dependent on the particular terms of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may contain restrictions on their use. You should read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in a local print shop for better quality prints.

-

What software is required to open printables for free?

- The majority of printables are in PDF format. These is open with no cost programs like Adobe Reader.

Claiming Working Tax Credits When You re Self Employed

The Best Self Employed Tax Deductions And Credits In 2022

Check more sample of Claiming Tax Credits Self Employed below

Tax Credits For Self Employed During COVID Explained YouTube

You Can Claiming The Second Grant Under The SEISS From The 17th August

Tax Deductions For Self Employed Bruce L Anderson CPA CGA

Gig Workers Tax Credits self employed YouTube

Tax Credits Save You More Than Deductions Here Are The Best Ones

Quarterly Taxes Cu ndo Tienen Que Pagar Impuestos Los Trabajadores

https://www.gov.uk/end-tax-credits-claim/self-employed

You need to work out your income from being self employed for your award period this is usually from 6 April in the current tax year to the time you stop getting tax credits

https://www.gov.uk/working-tax-credit

Eligibility What you ll get How to claim Leave and gaps in your employment Eligibility You can only make a claim for Working Tax Credit if you already get Child Tax Credit

You need to work out your income from being self employed for your award period this is usually from 6 April in the current tax year to the time you stop getting tax credits

Eligibility What you ll get How to claim Leave and gaps in your employment Eligibility You can only make a claim for Working Tax Credit if you already get Child Tax Credit

Gig Workers Tax Credits self employed YouTube

You Can Claiming The Second Grant Under The SEISS From The 17th August

Tax Credits Save You More Than Deductions Here Are The Best Ones

Quarterly Taxes Cu ndo Tienen Que Pagar Impuestos Los Trabajadores

Self Employed Paternity Pay Goselfemployed co

How To Calculate Tax Liability For Your Business

How To Calculate Tax Liability For Your Business

Tax Credits That The Self employed Need To Know About VGenX CPA