Today, with screens dominating our lives, the charm of tangible printed objects hasn't waned. Be it for educational use, creative projects, or simply adding an individual touch to your space, Construction Industry Tax Rebate are now a vital source. This article will take a dive through the vast world of "Construction Industry Tax Rebate," exploring what they are, where to get them, as well as how they can enhance various aspects of your life.

Get Latest Construction Industry Tax Rebate Below

Construction Industry Tax Rebate

Construction Industry Tax Rebate - Construction Company Tax Rebate, Construction Industry Tax Deduction Scheme, Construction Industry Tax Return, Construction Industry Tax Deduction, Construction Industry Tax Refunds, Construction Company Tax Credits, Building Industry Tax Deduction, Construction Company Tax Return, What Is Rebate In Construction, What Is Hmrc Tax Rebate

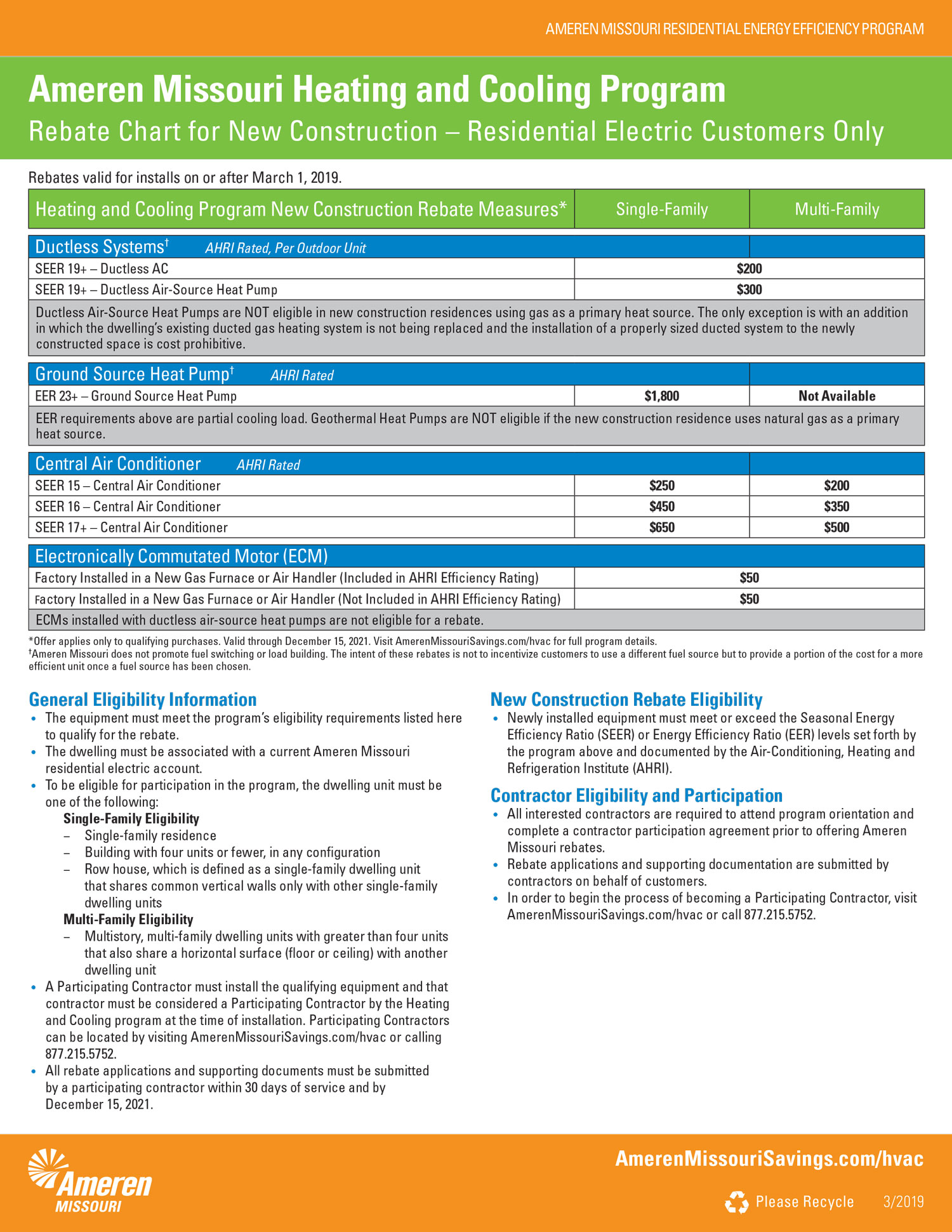

Web Those subcontracted in construction under CIS are often due annual Tax rebates This is mainly because too much Tax has been deducted from the sub contractors payments

Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company

Printables for free include a vast assortment of printable materials available online at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and much more. The beauty of Construction Industry Tax Rebate lies in their versatility as well as accessibility.

More of Construction Industry Tax Rebate

5 Essential Features Of Construction Rebate Management Software Enable

5 Essential Features Of Construction Rebate Management Software Enable

Web Construction industry tax returns A self assessment tax return has to be completed by all CIS sub contractors and some PAYE workers If you work under PAYE only and you

Web START YOUR CIS TAX REBATE NOW ONLY 163 60 VAT 163 119 VAT GET STARTED Join over 7 900 happy customers and file your tax return with tax2u Are you

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: You can tailor the templates to meet your individual needs whether you're designing invitations planning your schedule or even decorating your home.

-

Educational Impact: Downloads of educational content for free provide for students of all ages. This makes the perfect instrument for parents and teachers.

-

Easy to use: You have instant access the vast array of design and templates reduces time and effort.

Where to Find more Construction Industry Tax Rebate

Types Of Rebates To Help Construction Companies Buildertrend

Types Of Rebates To Help Construction Companies Buildertrend

Web PAYE construction tax refunds who can claim When you re working a Pay As You Earn PAYE job and travel to temporary worksites you re probably owed some money back

Web 29 sept 2020 nbsp 0183 32 Construction Industry Scheme CIS tax rebate is available to CIS subcontractors who have overpaid income tax on their Self Assessment tax return

In the event that we've stirred your interest in Construction Industry Tax Rebate, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and Construction Industry Tax Rebate for a variety purposes.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets as well as flashcards and other learning tools.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad spectrum of interests, starting from DIY projects to party planning.

Maximizing Construction Industry Tax Rebate

Here are some ideas to make the most use of Construction Industry Tax Rebate:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Construction Industry Tax Rebate are an abundance of practical and imaginative resources that cater to various needs and desires. Their accessibility and versatility make them a wonderful addition to your professional and personal life. Explore the vast array of Construction Industry Tax Rebate and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can print and download these materials for free.

-

Can I utilize free printables for commercial uses?

- It's dependent on the particular terms of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download Construction Industry Tax Rebate?

- Certain printables may be subject to restrictions on usage. Make sure to read the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase top quality prints.

-

What software do I need to open printables that are free?

- The majority are printed in PDF format, which is open with no cost software like Adobe Reader.

CIS Tax Rebates Verulams

Rebates HOME By SMCI

Check more sample of Construction Industry Tax Rebate below

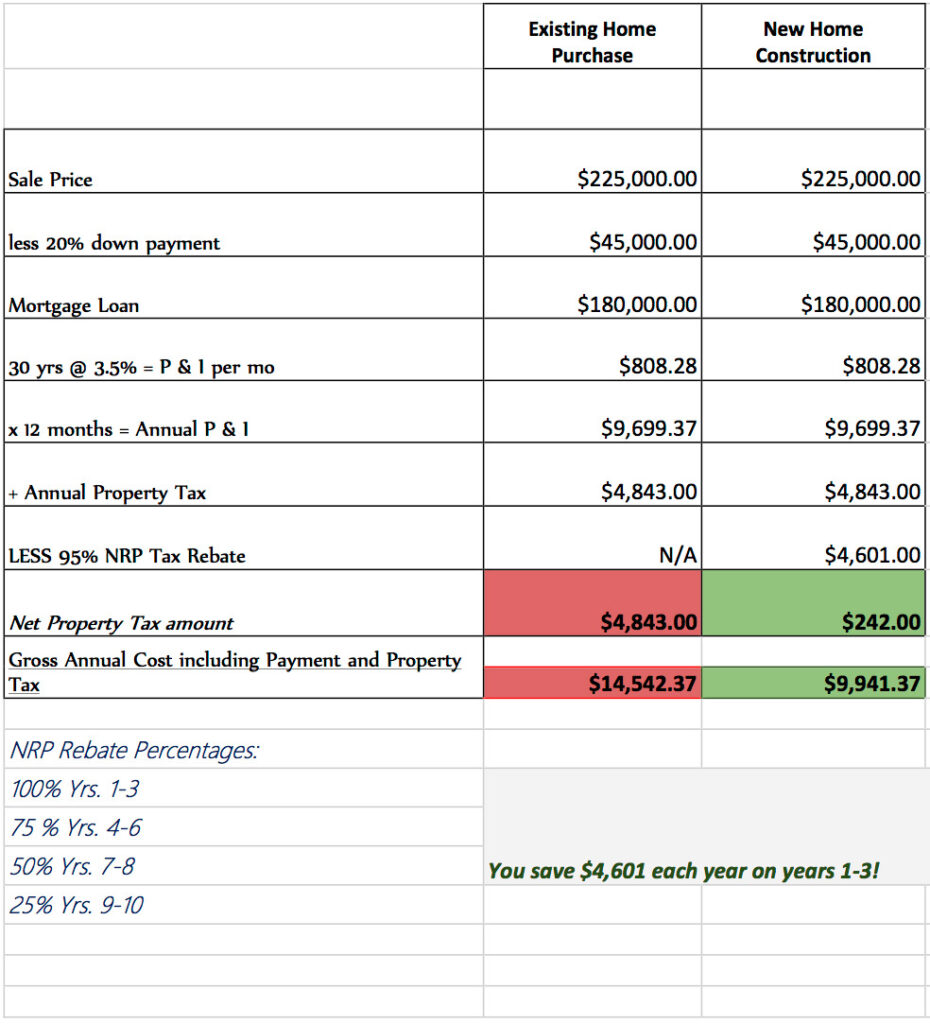

New Construction Advantage Realty

A Simple Guide To Construction Industry Scheme Tax Rebates VW

Types Of Rebates To Help Construction Companies Buildertrend

CIS Construction Industry Scheme Rebate My Tax Ltd

Construction Paye Tax Rebate Online

Top 5 Reasons The Construction Industry Needs Supplier Rebate

https://www.gov.uk/guidance/claim-a-refund-of-construction-industry...

Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company

https://www.litrg.org.uk/latest-news/news/220104-construction-industry...

Web 4 janv 2022 nbsp 0183 32 The personal allowance for 2020 21 was 163 12 500 and this alone is worth 163 2 500 in tax relief for a basic rate taxpayer This means CIS workers normally overpay

Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company

Web 4 janv 2022 nbsp 0183 32 The personal allowance for 2020 21 was 163 12 500 and this alone is worth 163 2 500 in tax relief for a basic rate taxpayer This means CIS workers normally overpay

CIS Construction Industry Scheme Rebate My Tax Ltd

A Simple Guide To Construction Industry Scheme Tax Rebates VW

Construction Paye Tax Rebate Online

Top 5 Reasons The Construction Industry Needs Supplier Rebate

How To Maximise A CIS Rebates EXPLAINED Construction Industry Scheme

Customer Rebates For Construction Industry Enable

Customer Rebates For Construction Industry Enable

Customer Rebates For Construction Industry Enable