In the digital age, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed items hasn't gone away. In the case of educational materials in creative or artistic projects, or just adding an individual touch to your area, House Loan Interest Income Tax Rebate have become an invaluable resource. In this article, we'll take a dive into the world of "House Loan Interest Income Tax Rebate," exploring the benefits of them, where to find them, and how they can be used to enhance different aspects of your lives.

Get Latest House Loan Interest Income Tax Rebate Below

House Loan Interest Income Tax Rebate

House Loan Interest Income Tax Rebate - Home Loan Interest Rebate In Income Tax, Home Loan Interest Income Tax Rebate, Housing Loan Interest Income Tax Exemption Limit, Housing Loan Interest Income Tax Exemption Section, Housing Loan Interest Income Tax Exemption 2019-20, Home Loan Interest Income Tax Deduction, Housing Loan Interest In Income Tax Return, Housing Loan Interest Tax Rebate, Home Loan Interest In Income Tax Return, Housing Loan Interest Rebate Under Income Tax

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

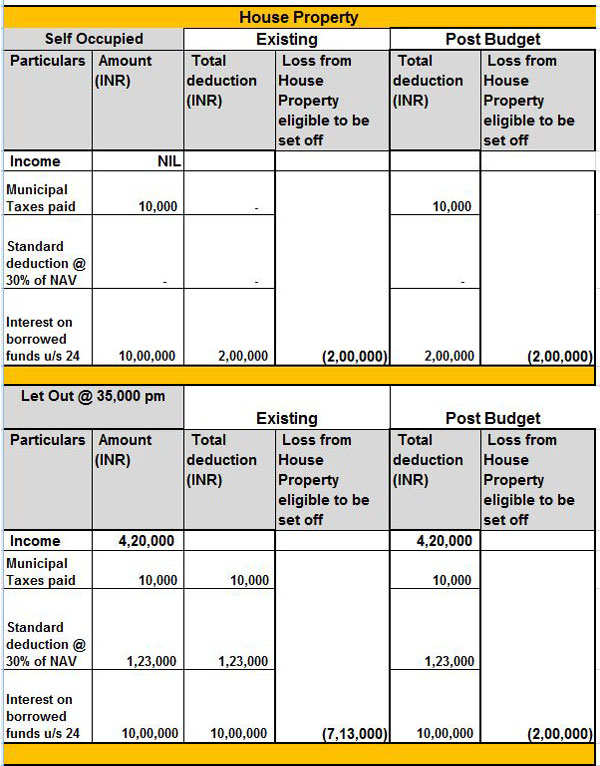

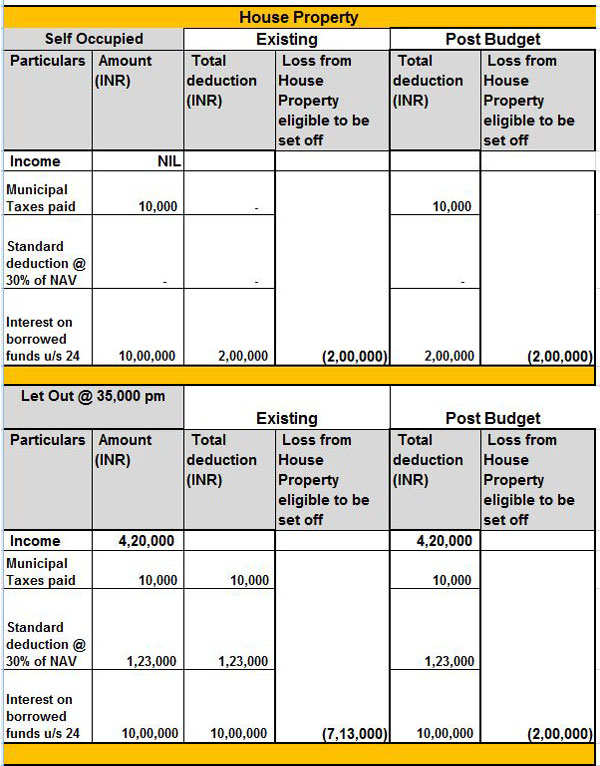

Web 28 mars 2017 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

House Loan Interest Income Tax Rebate offer a wide selection of printable and downloadable materials online, at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and more. The appeal of printables for free lies in their versatility and accessibility.

More of House Loan Interest Income Tax Rebate

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

Web income tax Sections that provide tax rebate when you take a home loan you make the home loan repayment to the lender in equated monthly installments EMIs the home

Web 1 f 233 vr 2021 nbsp 0183 32 Another rule is that if the construction of your under construction house is not completed within 5 years from the year in which the home loan was taken then the tax

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: This allows you to modify the templates to meet your individual needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Value: Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them a vital source for educators and parents.

-

Easy to use: The instant accessibility to the vast array of design and templates helps save time and effort.

Where to Find more House Loan Interest Income Tax Rebate

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on

We hope we've stimulated your interest in printables for free Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and House Loan Interest Income Tax Rebate for a variety reasons.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning tools.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a wide spectrum of interests, all the way from DIY projects to planning a party.

Maximizing House Loan Interest Income Tax Rebate

Here are some innovative ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

House Loan Interest Income Tax Rebate are a treasure trove with useful and creative ideas for a variety of needs and desires. Their availability and versatility make these printables a useful addition to each day life. Explore the vast array of House Loan Interest Income Tax Rebate today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are House Loan Interest Income Tax Rebate truly available for download?

- Yes they are! You can print and download these resources at no cost.

-

Can I utilize free printing templates for commercial purposes?

- It's contingent upon the specific terms of use. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions regarding usage. Be sure to read the terms of service and conditions provided by the creator.

-

How can I print House Loan Interest Income Tax Rebate?

- You can print them at home using the printer, or go to the local print shops for superior prints.

-

What software do I need to run printables that are free?

- Most printables come in PDF format. They can be opened with free programs like Adobe Reader.

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

Check more sample of House Loan Interest Income Tax Rebate below

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Form 12BB New Form To Claim Income Tax Benefits Rebate

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

Web 28 mars 2017 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

Form 12BB New Form To Claim Income Tax Benefits Rebate

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

DEDUCTION UNDER SECTION 80C TO 80U PDF

Home Loan Interest In Itr 4 Home Sweet Home Modern Livingroom

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Form 11 Mortgage Interest Deduction Understand The Background Of Form