In this age of technology, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. In the case of educational materials and creative work, or simply adding the personal touch to your space, Current Tax Incentives For Solar Panels have proven to be a valuable resource. We'll dive through the vast world of "Current Tax Incentives For Solar Panels," exploring what they are, where they are available, and how they can be used to enhance different aspects of your life.

Get Latest Current Tax Incentives For Solar Panels Below

Current Tax Incentives For Solar Panels

Current Tax Incentives For Solar Panels - Current Tax Incentives For Solar Panels, What Are The Tax Incentives For Solar Panels, Current Solar Tax Incentives, Tax Incentives For Residential Solar Power

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2021

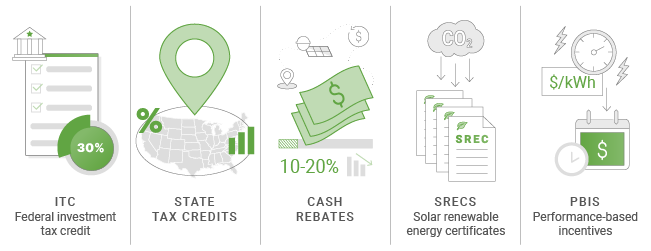

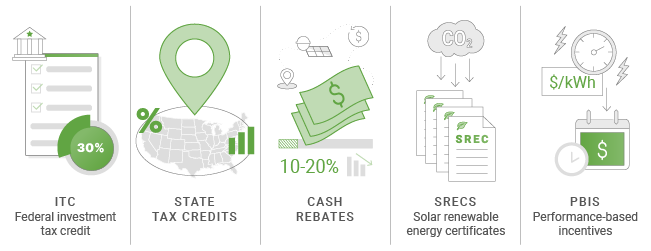

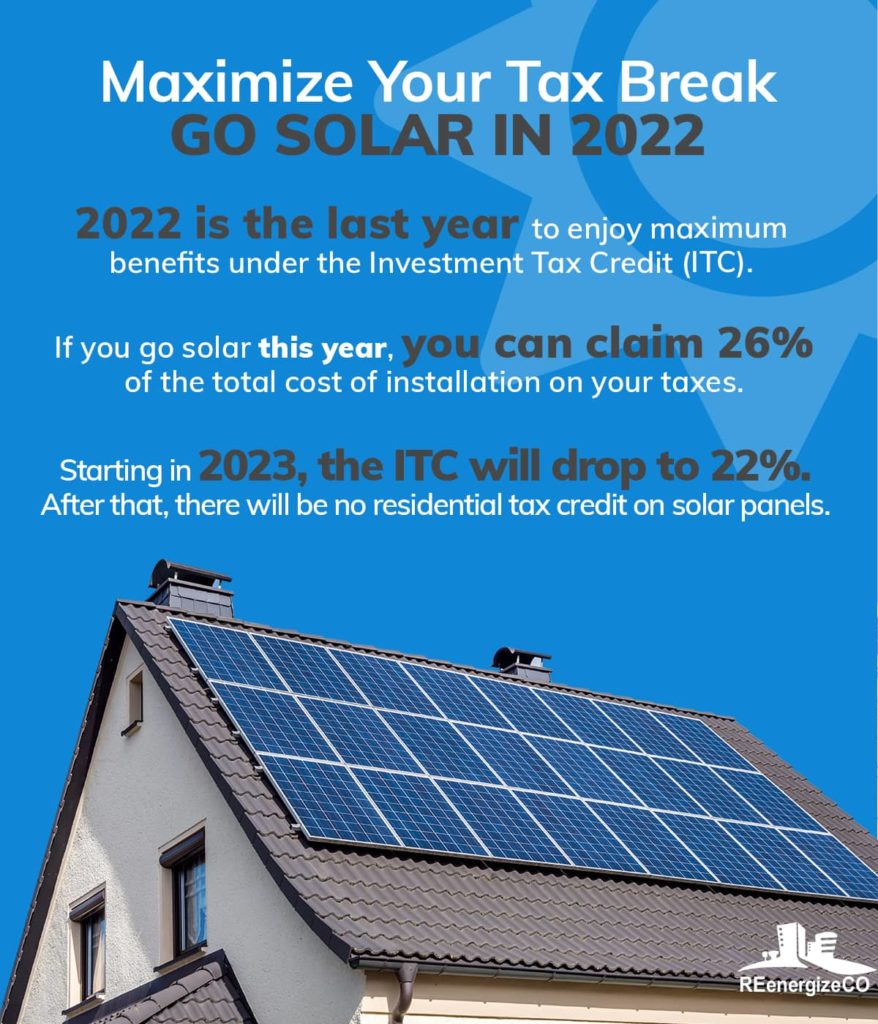

The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation Reduction Act the ITC is

The Current Tax Incentives For Solar Panels are a huge collection of printable resources available online for download at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages and more. The appeal of printables for free is their versatility and accessibility.

More of Current Tax Incentives For Solar Panels

All Solar Panel Incentives Tax Credits In 2023 By State

All Solar Panel Incentives Tax Credits In 2023 By State

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: We can customize the templates to meet your individual needs whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Worth: Free educational printables can be used by students of all ages, making them an invaluable aid for parents as well as educators.

-

Accessibility: instant access a plethora of designs and templates can save you time and energy.

Where to Find more Current Tax Incentives For Solar Panels

Pricing Incentives Guide To Solar Panels In Georgia Forbes Home

Pricing Incentives Guide To Solar Panels In Georgia Forbes Home

The first and most important solar incentive to know about is the federal solar tax credit which can earn solar owners 30 of the cost to install solar panels back on their income taxes in the year after installation

The Residential Clean Energy Credit often called the federal solar tax credit is an incentive you can earn when installing solar panels or other clean energy equipment on your property The tax credit equals 30 of installation costs and can reduce what you owe in federal income taxes by thousands of dollars

In the event that we've stirred your interest in Current Tax Incentives For Solar Panels we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Current Tax Incentives For Solar Panels for various objectives.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing, flashcards, and learning tools.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad variety of topics, all the way from DIY projects to planning a party.

Maximizing Current Tax Incentives For Solar Panels

Here are some fresh ways to make the most of Current Tax Incentives For Solar Panels:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets for teaching at-home as well as in the class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Current Tax Incentives For Solar Panels are a treasure trove of practical and innovative resources catering to different needs and preferences. Their accessibility and versatility make them an essential part of each day life. Explore the endless world of Current Tax Incentives For Solar Panels to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Current Tax Incentives For Solar Panels really completely free?

- Yes they are! You can download and print the resources for free.

-

Can I download free printables in commercial projects?

- It's based on specific rules of usage. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright concerns when using Current Tax Incentives For Solar Panels?

- Some printables may come with restrictions on usage. Be sure to check these terms and conditions as set out by the author.

-

How can I print Current Tax Incentives For Solar Panels?

- Print them at home with an printer, or go to a local print shop to purchase premium prints.

-

What software do I need in order to open Current Tax Incentives For Solar Panels?

- The majority of printables are with PDF formats, which can be opened with free programs like Adobe Reader.

10 Available Incentives For Using Solar Energy SolarNRG

Bright Savings Understanding Solar Panel Tax Incentives For

Check more sample of Current Tax Incentives For Solar Panels below

Illinois Solar Incentives

Property Tax Incentives For Solar By State

Solar Panels Other DIY Electricity Solutions Rethink Green

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

2020 South Carolina Solar Incentives Rebates And Tax Credits Tax

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.forbes.com/.../solar-tax-credit-by-state

The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation Reduction Act the ITC is

https://www.energy.gov/eere/solar/articles/solar...

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation Reduction Act the ITC is

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Property Tax Incentives For Solar By State

2020 South Carolina Solar Incentives Rebates And Tax Credits Tax

Federal Solar Tax Credit What It Is How To Claim It For 2023

Every Year We Rank The Best States For Solar Power And The Worst

Solar Rebates And Incentives EnergySage

Solar Rebates And Incentives EnergySage

Colorado Government Solar Tax Credit Big History Blogger Photography