In this age of electronic devices, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Be it for educational use or creative projects, or simply to add an individual touch to your space, Deduction Of Tax At Source And Rebates And Reliefs can be an excellent source. The following article is a dive to the depths of "Deduction Of Tax At Source And Rebates And Reliefs," exploring their purpose, where they are, and how they can enhance various aspects of your lives.

Get Latest Deduction Of Tax At Source And Rebates And Reliefs Below

Deduction Of Tax At Source And Rebates And Reliefs

Deduction Of Tax At Source And Rebates And Reliefs - Deduction Of Tax At Source And Rebates And Reliefs, Discuss In Detail The Deduction Of Tax At Source And Rebates And Reliefs, What Deductions Help With Taxes, How Do Deductions Help With Taxes, Explain Rebate And Relief Of Tax

Web Tax deductions will be automatically granted for qualifying donations Deductions for self employed partnership trade business profession or vocation Claim deductions

Web 2 mars 2023 nbsp 0183 32 A tax deduction reduces your taxable income for the year thereby lowering your tax bill Taxpayers can take the standard deduction or itemize their deductions on Schedule A of Form 1040

Deduction Of Tax At Source And Rebates And Reliefs encompass a wide collection of printable content that can be downloaded from the internet at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and more. One of the advantages of Deduction Of Tax At Source And Rebates And Reliefs lies in their versatility and accessibility.

More of Deduction Of Tax At Source And Rebates And Reliefs

Tax Deduction At Source TDS Tax And Accounting Services For

Tax Deduction At Source TDS Tax And Accounting Services For

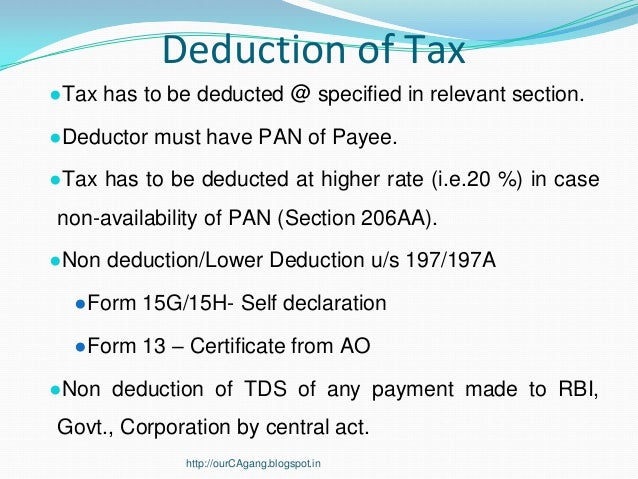

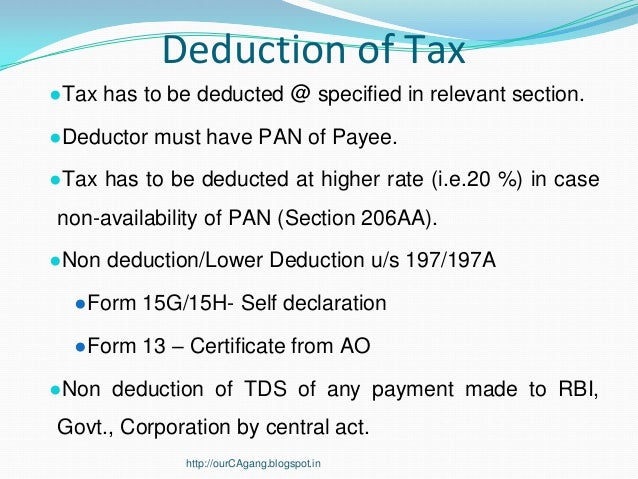

Web TDS stands for tax deducted at source As per the Income Tax act any company or person making a payment is required to deduct tax at source if the payment exceeds certain

Web 30 avr 2023 nbsp 0183 32 Tax Deduction A tax deduction is a reduction in tax obligation from a taxpayer s gross income Tax deductions can be the result of a variety of events that the taxpayer experiences over the

Deduction Of Tax At Source And Rebates And Reliefs have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Modifications: We can customize printed materials to meet your requirements for invitations, whether that's creating them making your schedule, or even decorating your house.

-

Educational Value: Downloads of educational content for free are designed to appeal to students from all ages, making them a vital tool for teachers and parents.

-

Simple: Access to numerous designs and templates will save you time and effort.

Where to Find more Deduction Of Tax At Source And Rebates And Reliefs

9 Deduction Of Tax At Source YouTube

9 Deduction Of Tax At Source YouTube

Web 1 mars 2023 nbsp 0183 32 Deduction A deduction is any item or expenditure subtracted from gross income to reduce the amount of income subject to income tax It is also referred to as

Web Open all Who pays tax at source How is tax deducted at source How much can you expect to pay To find out more A service of the Confederation cantons and communes

Since we've got your interest in printables for free We'll take a look around to see where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Deduction Of Tax At Source And Rebates And Reliefs to suit a variety of applications.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, everything from DIY projects to planning a party.

Maximizing Deduction Of Tax At Source And Rebates And Reliefs

Here are some new ways to make the most of Deduction Of Tax At Source And Rebates And Reliefs:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Deduction Of Tax At Source And Rebates And Reliefs are a treasure trove with useful and creative ideas for a variety of needs and desires. Their access and versatility makes they a beneficial addition to any professional or personal life. Explore the endless world of Deduction Of Tax At Source And Rebates And Reliefs now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes you can! You can print and download these documents for free.

-

Do I have the right to use free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Always check the creator's guidelines before using any printables on commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables may be subject to restrictions on use. Make sure you read the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- You can print them at home using an printer, or go to an in-store print shop to get higher quality prints.

-

What program do I require to open printables at no cost?

- The majority of printables are as PDF files, which can be opened using free software such as Adobe Reader.

GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF REVENUE CENTRAL

Taxmann s Deduction Of Tax At Source TDS With Advance Tax And Refunds

Check more sample of Deduction Of Tax At Source And Rebates And Reliefs below

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

TDS Tax Deducted At Source

Overview Of Rates For Deduction Of Tax At Source TDS Under The Income

Taxmann s Deduction Of Tax At Source With Advance Tax And Refunds

Demystifying Tax Deduction At Source TDS Interest On Securities

PPT TAX DEDUCTION AT SOURCE TDS PowerPoint Presentation Free

https://www.investopedia.com/terms/t/tax-reli…

Web 2 mars 2023 nbsp 0183 32 A tax deduction reduces your taxable income for the year thereby lowering your tax bill Taxpayers can take the standard deduction or itemize their deductions on Schedule A of Form 1040

http://www.differencebetween.info/difference …

Web This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax It allows one to deduct an amount from the total income of the person A tax rebate also

Web 2 mars 2023 nbsp 0183 32 A tax deduction reduces your taxable income for the year thereby lowering your tax bill Taxpayers can take the standard deduction or itemize their deductions on Schedule A of Form 1040

Web This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax It allows one to deduct an amount from the total income of the person A tax rebate also

Taxmann s Deduction Of Tax At Source With Advance Tax And Refunds

TDS Tax Deducted At Source

Demystifying Tax Deduction At Source TDS Interest On Securities

PPT TAX DEDUCTION AT SOURCE TDS PowerPoint Presentation Free

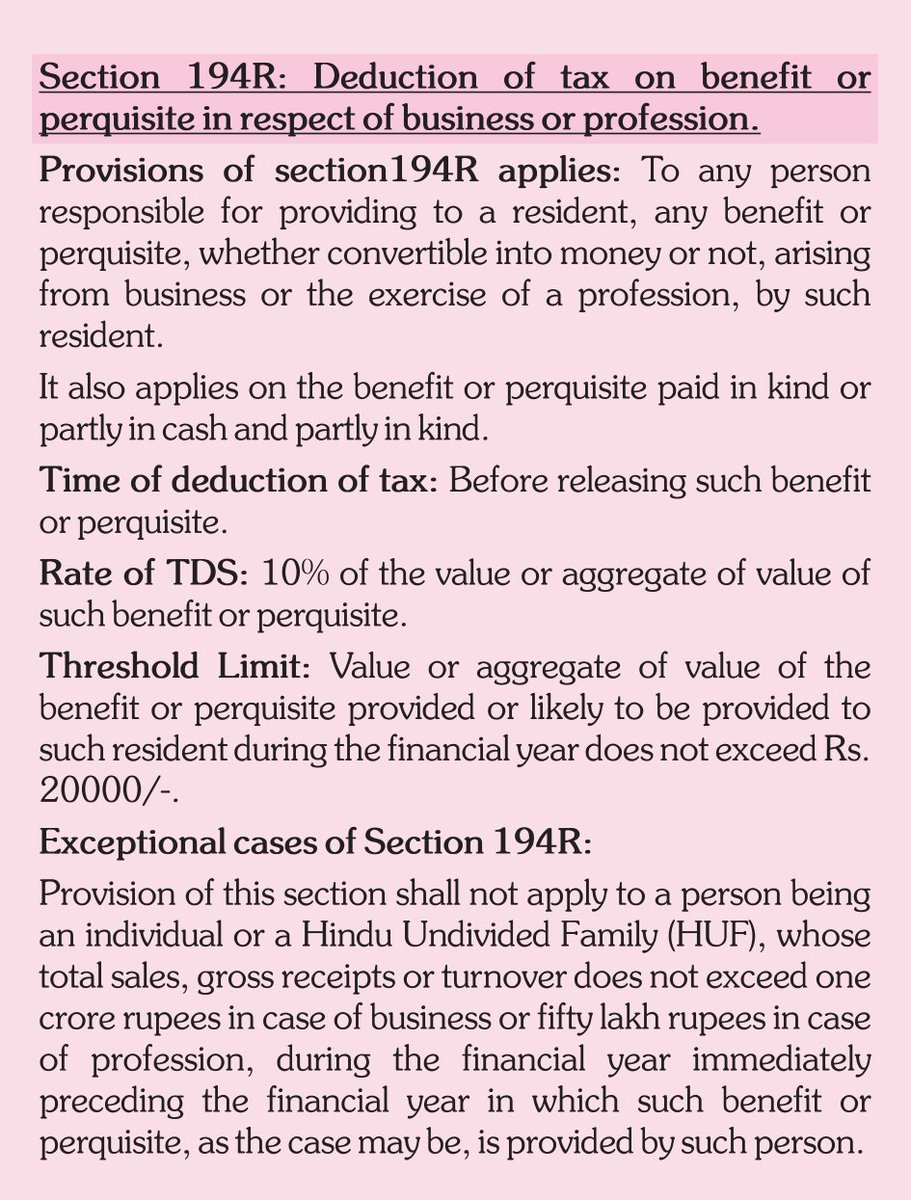

Taxation Updates Mayur J Sondagar On Twitter Section 194R N

TDS Deduction Of Tax At Source Under Section 194J Vakilsearch

TDS Deduction Of Tax At Source Under Section 194J Vakilsearch

Deduction Of Tax At Source With Advance Tax Refunds AY 2023 24 I