In this day and age when screens dominate our lives and the appeal of physical printed objects hasn't waned. Be it for educational use and creative work, or simply to add a personal touch to your home, printables for free are now a useful resource. In this article, we'll dive into the sphere of "Dependent Care Tax Credit," exploring the benefits of them, where to get them, as well as how they can enhance various aspects of your daily life.

Get Latest Dependent Care Tax Credit Below

Dependent Care Tax Credit

Dependent Care Tax Credit - Dependent Care Tax Credit, Dependent Care Tax Credit 2023, Dependent Care Tax Credit 2022, Dependent Care Tax Credit 2022 Income Limit, Dependent Care Tax Credit Income Limit, Dependent Care Tax Credit Calculator, Dependent Care Tax Credit 2024, Dependent Care Tax Credit Vs Fsa, Dependent Care Tax Credit 2023 Phase Out, Dependent Care Tax Credit Calculator 2023

The child and dependent care credit is a tax credit offered to taxpayers who pay out of pocket expenses for childcare The credit provides relief to individuals and spouses who pay for

What is the child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified

Dependent Care Tax Credit provide a diverse variety of printable, downloadable material that is available online at no cost. These resources come in many kinds, including worksheets templates, coloring pages, and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Dependent Care Tax Credit

Can I Stop Claiming Child Tax Credits TAX

:strip_icc()/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png)

Can I Stop Claiming Child Tax Credits TAX

The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities There are two major benefits of the credit This is a tax credit rather than a tax deduction A tax deduction simply reduces the amount of income that you must pay tax on

Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child and dependent care credit works if you qualify and how to

The Dependent Care Tax Credit have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization You can tailor printed materials to meet your requirements for invitations, whether that's creating them as well as organizing your calendar, or decorating your home.

-

Educational Value: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a vital tool for teachers and parents.

-

Accessibility: The instant accessibility to a plethora of designs and templates reduces time and effort.

Where to Find more Dependent Care Tax Credit

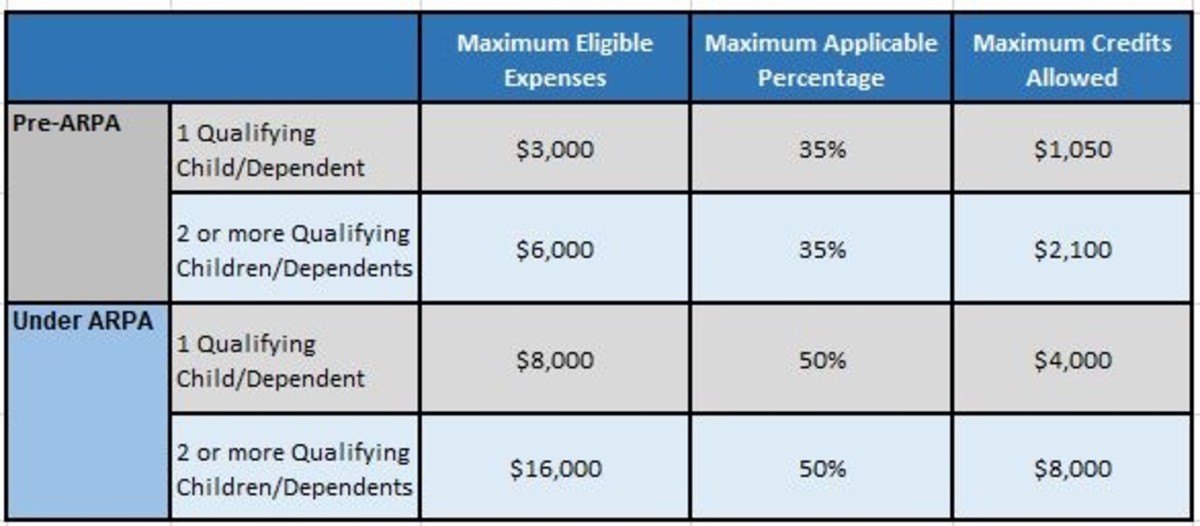

2021 Changes To Child And Dependent Care Tax Credit SaverLife

2021 Changes To Child And Dependent Care Tax Credit SaverLife

For tax year 2021 only the exclusion for employer provided dependent care assistance has increased from 5 000 to 10 500 Note If the qualifying child turned 13 during the tax year the qualifying expenses include amounts incurred for the child while under age 13 when the care was provided Dependent care benefits can include amounts paid

Here s how the credit works who qualifies and how much you could receive to help offset the cost of spending thousands of dollars each year on child care What is the child and dependent care

In the event that we've stirred your interest in Dependent Care Tax Credit, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Dependent Care Tax Credit for a variety uses.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing including flashcards, learning tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a broad variety of topics, all the way from DIY projects to planning a party.

Maximizing Dependent Care Tax Credit

Here are some fresh ways of making the most of Dependent Care Tax Credit:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free for teaching at-home (or in the learning environment).

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Dependent Care Tax Credit are an abundance of creative and practical resources for a variety of needs and interest. Their access and versatility makes them a valuable addition to both professional and personal lives. Explore the vast world of Dependent Care Tax Credit today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I use free printables for commercial purposes?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright violations with Dependent Care Tax Credit?

- Some printables may come with restrictions concerning their use. Make sure you read the terms and conditions offered by the creator.

-

How can I print Dependent Care Tax Credit?

- You can print them at home with your printer or visit a print shop in your area for better quality prints.

-

What software do I need in order to open printables at no cost?

- A majority of printed materials are in the format PDF. This can be opened with free programs like Adobe Reader.

Child And Dependent Care Credit 2022 2022 JWG

Promise The Children 2016 Child Care For All Promise The Children

Check more sample of Dependent Care Tax Credit below

2021 Child And Dependent Care Tax Credit

Learn About The Child And Dependent Care Tax Credit Credit Karma

How To Claim Child And Dependent Care Tax Credit In 2022 Karla Dennis

Child And Dependent Care Tax Credit How To Qualify And How Much It Is

What You Need To Know About The Child And Dependent Care Tax Credit

2021 Child And Dependent Care Tax Credit How To Get Up To An 8 000

https://www.nerdwallet.com/.../child-and-dependent-care-tax-credit

What is the child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified

:strip_icc()/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png?w=186)

https://www.irs.gov/.../child-and-dependent-care-credit-information

Child and Dependent Care Credit Information If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses Your federal income tax may be reduced by claiming the Credit for Child and Dependent

What is the child and dependent care tax credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified

Child and Dependent Care Credit Information If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses Your federal income tax may be reduced by claiming the Credit for Child and Dependent

Child And Dependent Care Tax Credit How To Qualify And How Much It Is

Learn About The Child And Dependent Care Tax Credit Credit Karma

What You Need To Know About The Child And Dependent Care Tax Credit

2021 Child And Dependent Care Tax Credit How To Get Up To An 8 000

Dependent Care Tax Credit VS Dependent Care Spending Account

Dependent Care Flexible Spending Account Vs Child And Dependent Care

Dependent Care Flexible Spending Account Vs Child And Dependent Care

American Rescue Plan Act Of 2021 And Divorce Planning Child