In the age of digital, with screens dominating our lives, the charm of tangible printed products hasn't decreased. If it's to aid in education project ideas, artistic or simply to add an element of personalization to your area, Dependent Spouse Income Tax Return can be an excellent resource. This article will take a dive into the world of "Dependent Spouse Income Tax Return," exploring what they are, where they can be found, and what they can do to improve different aspects of your lives.

Get Latest Dependent Spouse Income Tax Return Below

Dependent Spouse Income Tax Return

Dependent Spouse Income Tax Return -

Start filing Contents 3 Minute Read Eligible Dependant Amount Canada Caregiver Credit CCC Medical Expenses for Other Dependants The

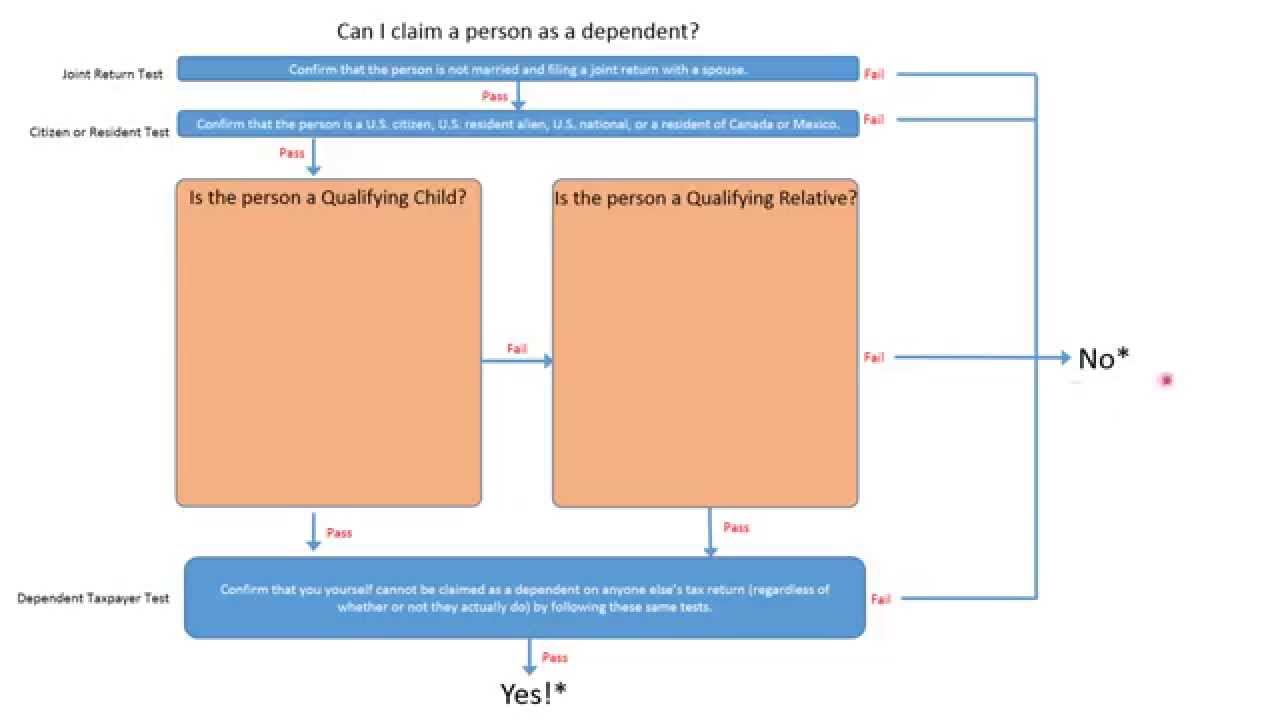

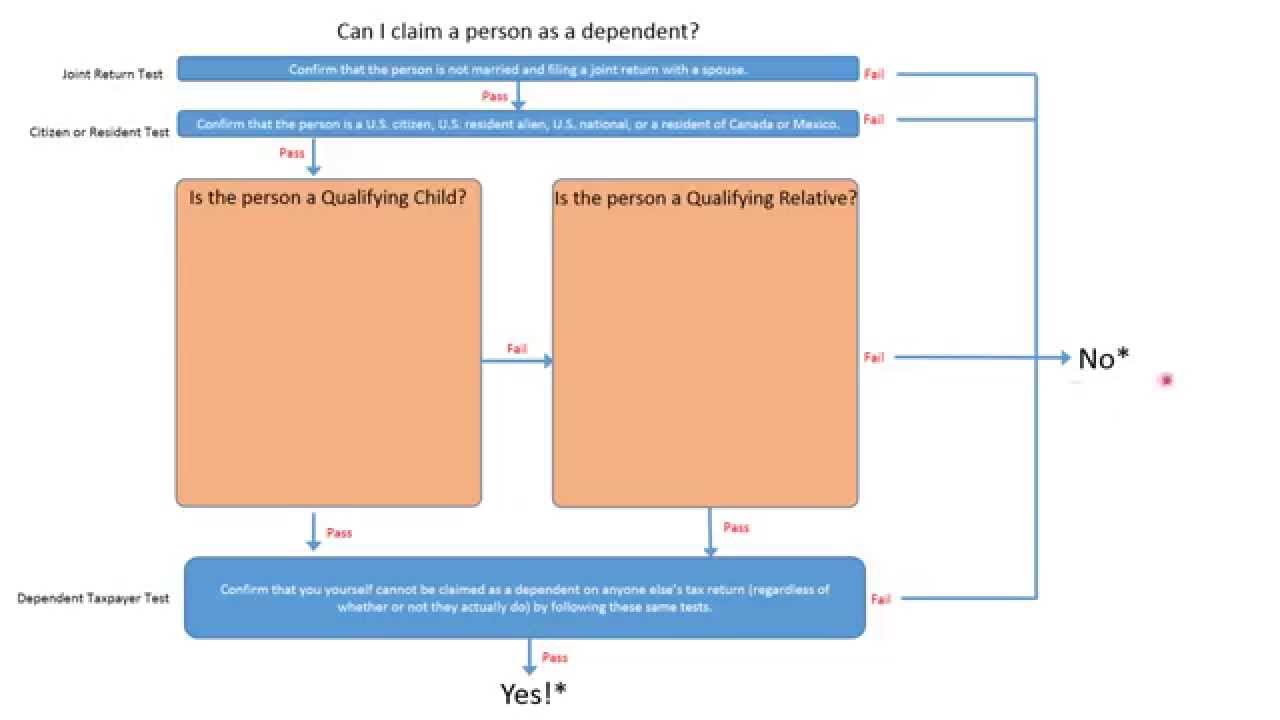

If you can be claimed as a dependent by another taxpayer you can claim someone else as a dependent if the person who can claim you or your spouse if filing a joint return as a dependent files a return only to claim a refund of income tax withheld or estimated tax paid

The Dependent Spouse Income Tax Return are a huge assortment of printable materials that are accessible online for free cost. These resources come in various forms, like worksheets templates, coloring pages and much more. One of the advantages of Dependent Spouse Income Tax Return lies in their versatility and accessibility.

More of Dependent Spouse Income Tax Return

Who Can I Claim As A Dependent On My Tax Return A Flow Chart YouTube

Who Can I Claim As A Dependent On My Tax Return A Flow Chart YouTube

Is a spouse a dependent We get the question Can I claim my spouse as a dependent from time to time and here s the short answer you can t claim spouses as dependents on your federal income tax return

You can t claim any dependents if you or your spouse if filing jointly could be claimed as a dependent by another taxpayer You can t claim a married person

The Dependent Spouse Income Tax Return have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize the templates to meet your individual needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Value: The free educational worksheets are designed to appeal to students of all ages, which makes them a vital source for educators and parents.

-

Accessibility: immediate access the vast array of design and templates reduces time and effort.

Where to Find more Dependent Spouse Income Tax Return

Solved Determine The Amount Of The Child Tax Credit In Each Chegg

Solved Determine The Amount Of The Child Tax Credit In Each Chegg

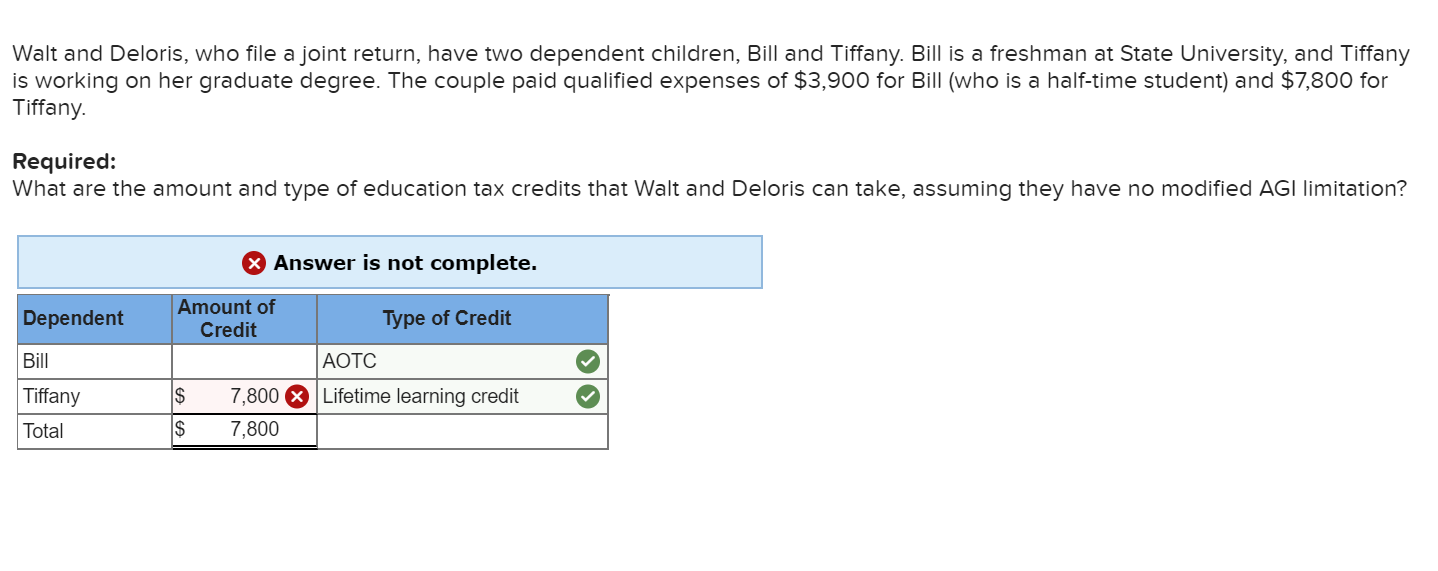

In the realm of tax laws a spouse cannot be claimed as a dependent However couples filing a joint return may access similar benefits through various

To qualify a dependent cannot file a joint tax return with a spouse except in certain cases Also the dependent cannot be claimed as a

After we've peaked your interest in Dependent Spouse Income Tax Return Let's look into where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Dependent Spouse Income Tax Return for various reasons.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad array of topics, ranging that includes DIY projects to planning a party.

Maximizing Dependent Spouse Income Tax Return

Here are some unique ways that you can make use of Dependent Spouse Income Tax Return:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Dependent Spouse Income Tax Return are an abundance of practical and innovative resources that satisfy a wide range of requirements and interest. Their access and versatility makes them an invaluable addition to each day life. Explore the world of Dependent Spouse Income Tax Return now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Dependent Spouse Income Tax Return really cost-free?

- Yes they are! You can print and download these resources at no cost.

-

Can I make use of free printables for commercial purposes?

- It depends on the specific usage guidelines. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may have restrictions in their usage. Make sure to read the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home using printing equipment or visit a print shop in your area for the highest quality prints.

-

What software do I need to run printables for free?

- Most PDF-based printables are available in PDF format. They can be opened with free software, such as Adobe Reader.

How To Reduce Withholding Tax Outsiderough11

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

Tax Formula Finance Clever

Check more sample of Dependent Spouse Income Tax Return below

If You re A Surviving Spouse Or Estate Executor For Someone Who Died In

If A Student s Parents Do Not Claim Him As A Dependent On Their Income

All Six Rules For Claiming A Child Dependent On Your Tax Return

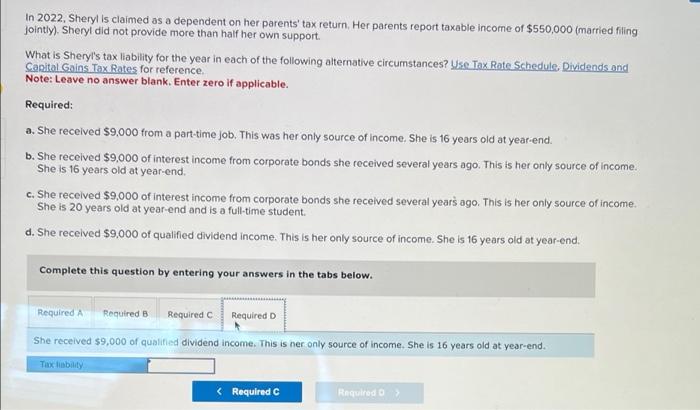

Solved I Need Help In 2022 Sheryl Is Claimed As A Depend

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

Step By Step Guide To File Itr 2 Online Ay 2022 23 Full Procedure

https://www.irs.gov/publications/p501

If you can be claimed as a dependent by another taxpayer you can claim someone else as a dependent if the person who can claim you or your spouse if filing a joint return as a dependent files a return only to claim a refund of income tax withheld or estimated tax paid

https://www.irs.gov/publications/p929

For 2021 the standard deduction amount has been increased for all filers The amounts are Single or Married filing separately 12 550 Married filing jointly or Qualifying widow er 25 100 and Head of household 18 800

If you can be claimed as a dependent by another taxpayer you can claim someone else as a dependent if the person who can claim you or your spouse if filing a joint return as a dependent files a return only to claim a refund of income tax withheld or estimated tax paid

For 2021 the standard deduction amount has been increased for all filers The amounts are Single or Married filing separately 12 550 Married filing jointly or Qualifying widow er 25 100 and Head of household 18 800

Solved I Need Help In 2022 Sheryl Is Claimed As A Depend

If A Student s Parents Do Not Claim Him As A Dependent On Their Income

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

Step By Step Guide To File Itr 2 Online Ay 2022 23 Full Procedure

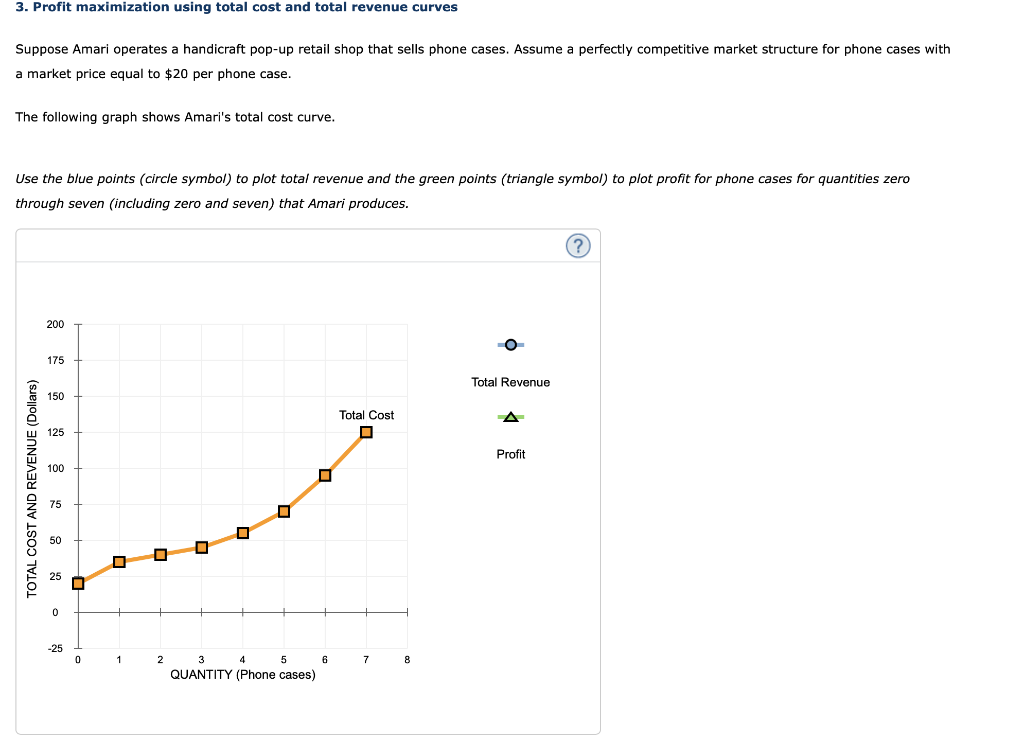

Solved 3 Profit Maximization Using Total Cost And Total Chegg

Tax Rules For Claiming A Dependent Who Works The Official Blog Of

Tax Rules For Claiming A Dependent Who Works The Official Blog Of

New Spouse Income YouTube