In this age of electronic devices, where screens dominate our lives The appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses as well as creative projects or simply to add a personal touch to your home, printables for free have become a valuable resource. With this guide, you'll take a dive deeper into "Donation Rebate Under Income Tax," exploring the benefits of them, where they are, and how they can improve various aspects of your lives.

Get Latest Donation Rebate Under Income Tax Below

Donation Rebate Under Income Tax

Donation Rebate Under Income Tax - Donation Rebate Under Income Tax, Donation Exemption Under Income Tax, Can I Claim Donations On Tax, How To Claim Tax On Charitable Donations

Web To encourage people to donate the government also allows for income tax deductions under Section 80G for the amount which has been donated The amount which has

Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities

Donation Rebate Under Income Tax offer a wide variety of printable, downloadable items that are available online at no cost. These resources come in various types, like worksheets, templates, coloring pages and more. The value of Donation Rebate Under Income Tax is in their versatility and accessibility.

More of Donation Rebate Under Income Tax

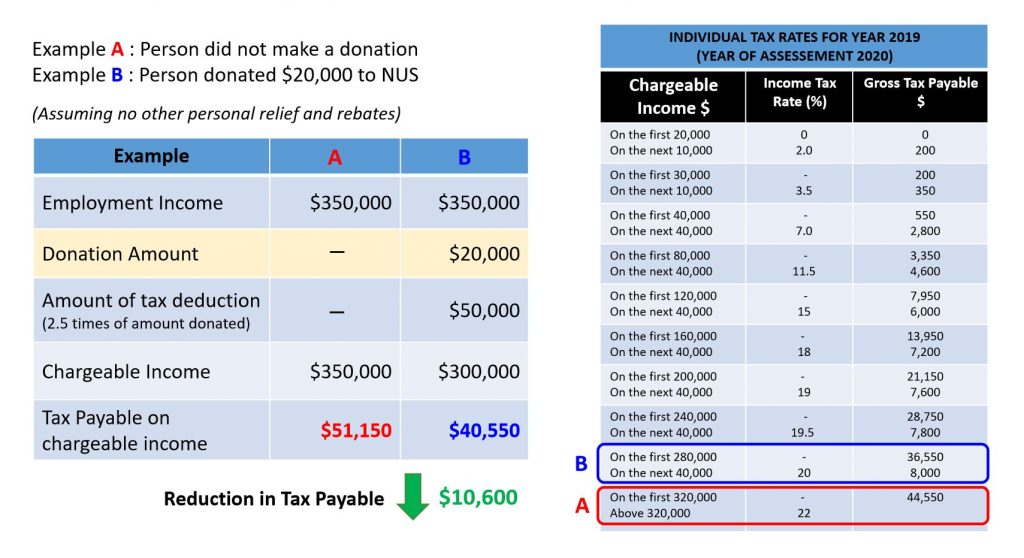

Tax Rebate For Individual Most Individual Tax Rates Go Down Under The

Tax Rebate For Individual Most Individual Tax Rates Go Down Under The

Web 23 sept 2021 nbsp 0183 32 Under 80G the amount donated to notified funds or institutions can be claimed as deduction at the time of filing income tax return Only donations made to

Web 5 juil 2021 nbsp 0183 32 A deduction of 50 or 100 of the amount contributed can be availed as a deduction Many people have lost their livelihoods during this pandemic and it is our

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: We can customize the design to meet your needs for invitations, whether that's creating them planning your schedule or decorating your home.

-

Educational Use: Printables for education that are free provide for students of all ages, which makes them an essential tool for parents and educators.

-

Accessibility: Instant access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Donation Rebate Under Income Tax

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

Web 21 juil 2020 nbsp 0183 32 Under the Income Tax Act you are allowed to make donations to charitable institutions and relief funds and this will be deducted from your gross income This means that only after this

Web 26 mai 2020 nbsp 0183 32 26 May 2020 349 882 Views 37 comments The amount donated towards charity attracts deduction under section 80G of the Income Tax Act Section 80G has been in the law book since financial

Since we've got your interest in printables for free Let's look into where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection in Donation Rebate Under Income Tax for different objectives.

- Explore categories like design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning materials.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a broad array of topics, ranging that includes DIY projects to planning a party.

Maximizing Donation Rebate Under Income Tax

Here are some ideas of making the most of Donation Rebate Under Income Tax:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to reinforce learning at home also in the classes.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Donation Rebate Under Income Tax are an abundance of innovative and useful resources that cater to various needs and passions. Their access and versatility makes them an essential part of each day life. Explore the vast collection of Donation Rebate Under Income Tax and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes you can! You can download and print these documents for free.

-

Does it allow me to use free printables for commercial uses?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download Donation Rebate Under Income Tax?

- Certain printables could be restricted regarding usage. Be sure to review the terms and conditions set forth by the author.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit a local print shop to purchase the highest quality prints.

-

What software do I require to open printables for free?

- Many printables are offered in the PDF format, and is open with no cost software like Adobe Reader.

Income Tax And Rebate For Apartment Owners Association

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Check more sample of Donation Rebate Under Income Tax below

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

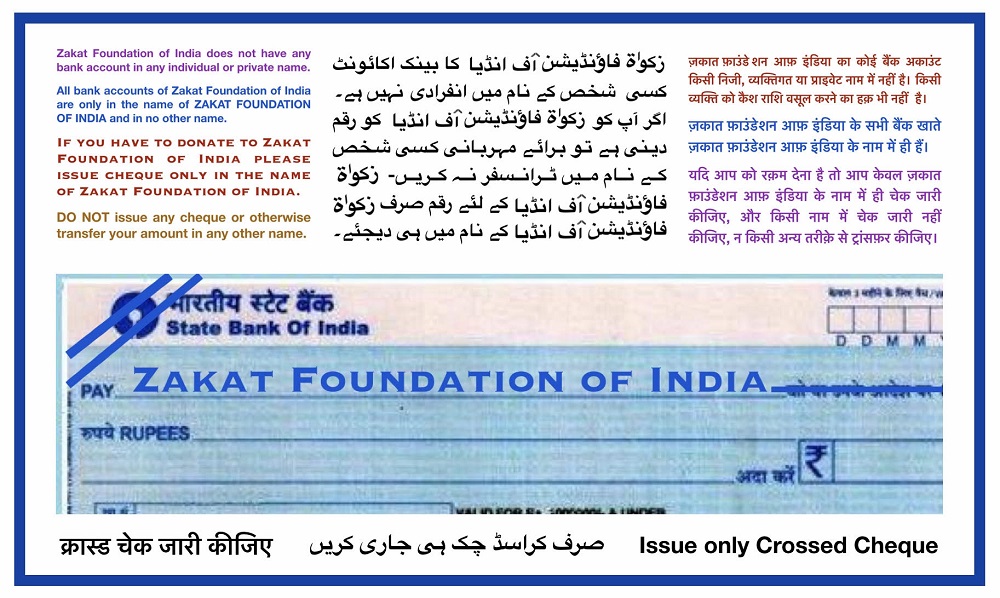

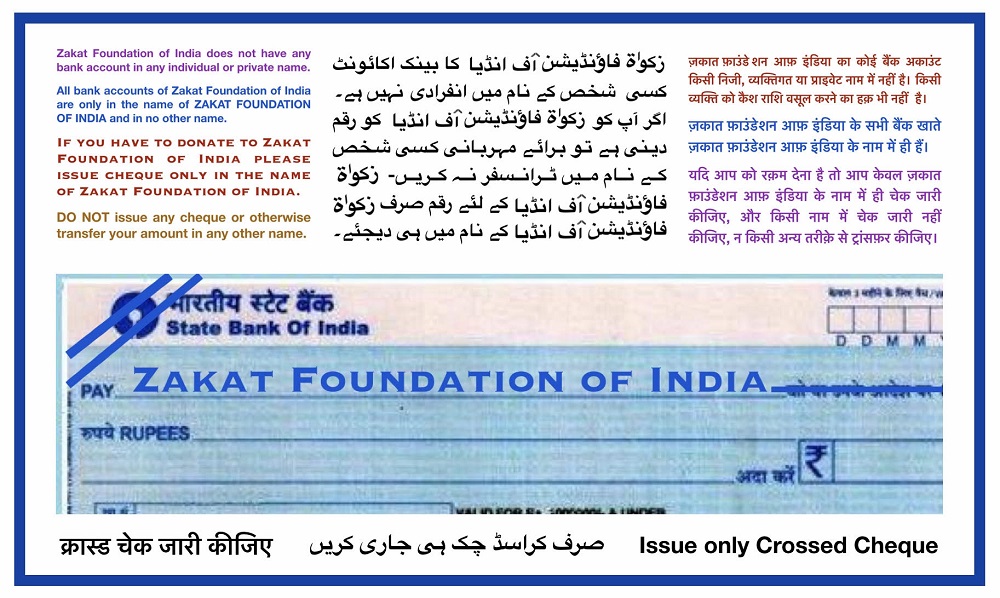

Zakat Foundation Of India

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://www.bankbazaar.com/tax/deduction-under-section-80g.html

Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Zakat Foundation Of India

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Individual Income Tax Rebate

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

501c3 Donation Receipt Template Addictionary 501c3 Donation Receipt