In this age of electronic devices, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses as well as creative projects or just adding personal touches to your area, Education Loan Rebate In Income Tax Under Section 80e are now a vital resource. This article will dive deeper into "Education Loan Rebate In Income Tax Under Section 80e," exploring what they are, where to locate them, and how they can add value to various aspects of your life.

Get Latest Education Loan Rebate In Income Tax Under Section 80e Below

Education Loan Rebate In Income Tax Under Section 80e

Education Loan Rebate In Income Tax Under Section 80e - Education Loan Rebate In Income Tax Under Section 80e, Does Education Loan Comes Under 80c, Can I Get Tax Benefit On Education Loan, Is Education Loan Interest Tax Deductible, Is Education Loan Tax Deductible

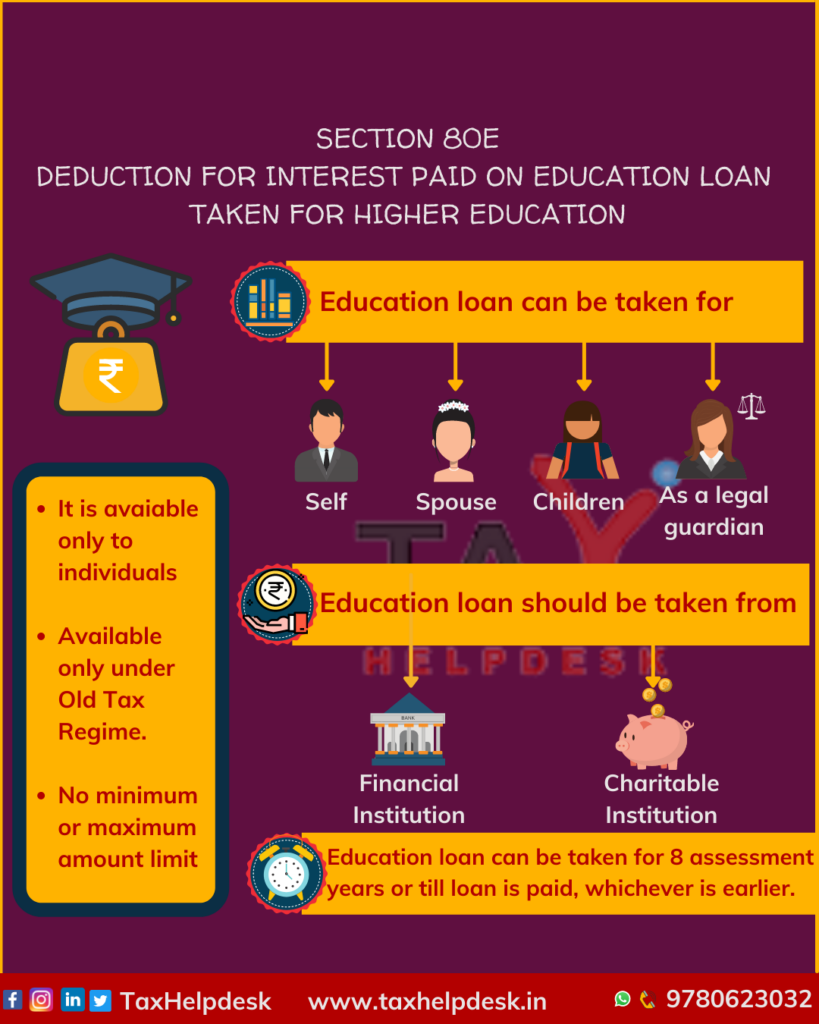

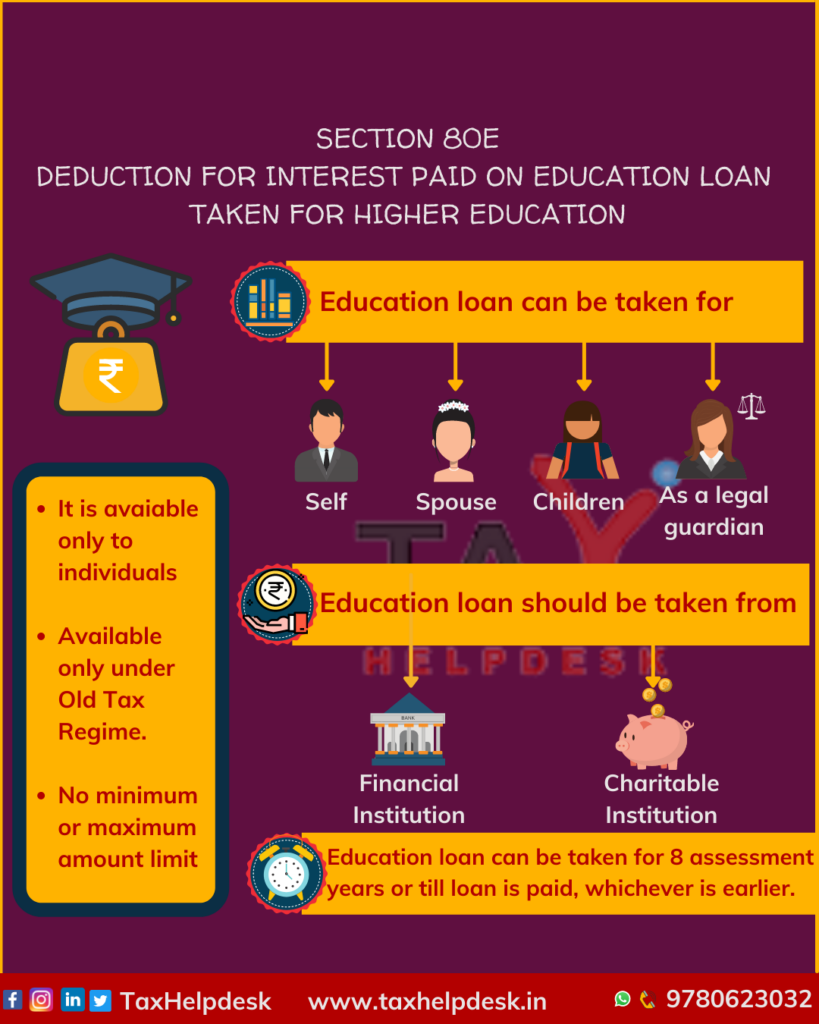

The provisions of Section 80E of the Income Tax Act 1961 specifically cater to educational loans This section offers deductions that apply to the interest component

If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a

Education Loan Rebate In Income Tax Under Section 80e offer a wide variety of printable, downloadable resources available online for download at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and more. The appeal of printables for free lies in their versatility and accessibility.

More of Education Loan Rebate In Income Tax Under Section 80e

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is

If you intend to take a loan for pursuing higher studies in India or abroad you can claim a deduction under section 80E of the Income Tax Act 1961 which caters specifically to

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor the design to meet your needs in designing invitations, organizing your schedule, or even decorating your house.

-

Educational Use: These Education Loan Rebate In Income Tax Under Section 80e are designed to appeal to students of all ages, making them an invaluable source for educators and parents.

-

It's easy: Instant access to various designs and templates reduces time and effort.

Where to Find more Education Loan Rebate In Income Tax Under Section 80e

How To Save Tax Under Section 80C 80E 80G 80DDB FY 2020 21

How To Save Tax Under Section 80C 80E 80G 80DDB FY 2020 21

Deduction under Section 80E is allowed under Income Tax for interest paid on student loan taken for higher education The deduction is allowed to encourage users to go for higher studies Deduction is

Section 80E of the Income Tax Act provides a valuable deduction on the interest paid on education loans paving the way for individuals to fulfill their dreams of

Now that we've piqued your interest in Education Loan Rebate In Income Tax Under Section 80e Let's see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection and Education Loan Rebate In Income Tax Under Section 80e for a variety needs.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast variety of topics, all the way from DIY projects to party planning.

Maximizing Education Loan Rebate In Income Tax Under Section 80e

Here are some new ways in order to maximize the use use of Education Loan Rebate In Income Tax Under Section 80e:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Education Loan Rebate In Income Tax Under Section 80e are an abundance filled with creative and practical information that cater to various needs and passions. Their accessibility and versatility make they a beneficial addition to both professional and personal lives. Explore the plethora of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Education Loan Rebate In Income Tax Under Section 80e truly absolutely free?

- Yes they are! You can print and download the resources for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It depends on the specific conditions of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may contain restrictions on usage. Be sure to review the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home with a printer or visit the local print shop for more high-quality prints.

-

What program do I need in order to open printables for free?

- Most printables come with PDF formats, which can be opened using free programs like Adobe Reader.

Deduction Under Section 80E Interest Paid On Higher Education

Hits On Whatsapp Income tax Act Section 80E

Check more sample of Education Loan Rebate In Income Tax Under Section 80e below

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Section 80E Income Tax Deductions On Education Loan FY 2023

Deduction Under Section 80E Income Tax Act 1961 CommerceLesson in

Understanding Section 80E And Its Importance For Education Loan

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Deduction Under Section 80E Interest Paid On Higher Education

https://cleartax.in/s/section-80e-deducti…

If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a

https://tax2win.in/guide/sec-80e-deducti…

Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on

If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a

Maximize your tax savings by understanding Section 80E deduction and how it helps you claim tax benefits on the interest paid on

Understanding Section 80E And Its Importance For Education Loan

Section 80E Income Tax Deductions On Education Loan FY 2023

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Deduction Under Section 80E Interest Paid On Higher Education

Income Tax Rebate Under Section 87A All You Need To Know

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

80E Tax