In this digital age, where screens have become the dominant feature of our lives however, the attraction of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons such as creative projects or just adding some personal flair to your home, printables for free are now a vital resource. We'll dive through the vast world of "Education Loan Tax Exemption Calculator Sbi," exploring the benefits of them, where you can find them, and how they can add value to various aspects of your life.

Get Latest Education Loan Tax Exemption Calculator Sbi Below

Education Loan Tax Exemption Calculator Sbi

Education Loan Tax Exemption Calculator Sbi - Education Loan Tax Exemption Calculator Sbi, Education Loan Tax Exemption Limit, Can Education Loan Be Used For Tax Exemption, Can I Get Tax Benefit On Education Loan, Education Loan Tax Exemption Example

The interest component of the education loan can be deducted from your income just as deductions under Section 80C and Section 80D are deducted before arriving at your total income to calculate the tax However there is no limit for Section 80E exemption up to which you can claim the deduction

Income Tax department offers tax deductions on education loans to ease financial burden Section 80E of IT Act allows deductions on education loan interest Criteria includes loan from financial institutions study purpose and loan borrowers

The Education Loan Tax Exemption Calculator Sbi are a huge selection of printable and downloadable materials available online at no cost. These materials come in a variety of types, such as worksheets coloring pages, templates and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Education Loan Tax Exemption Calculator Sbi

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to claim the deduction

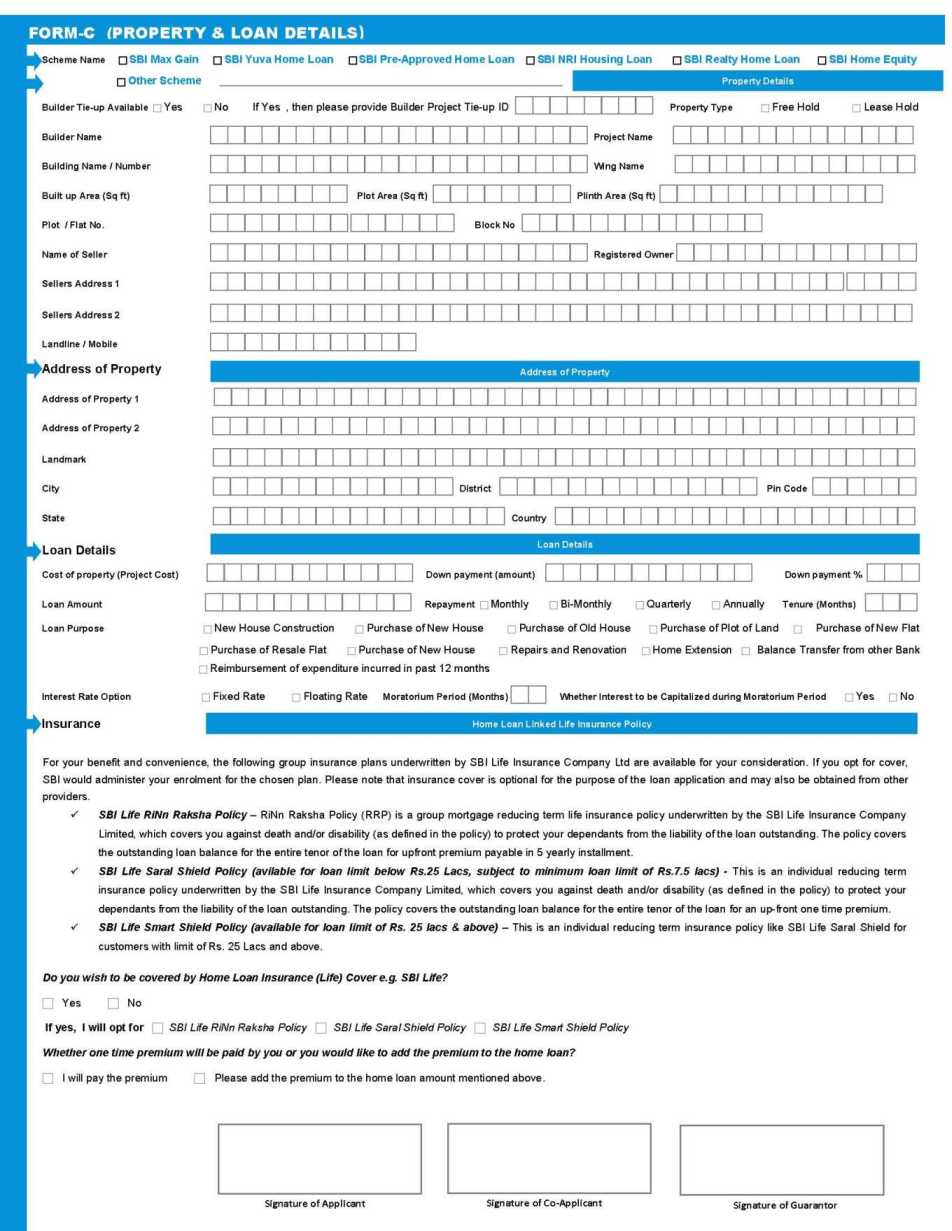

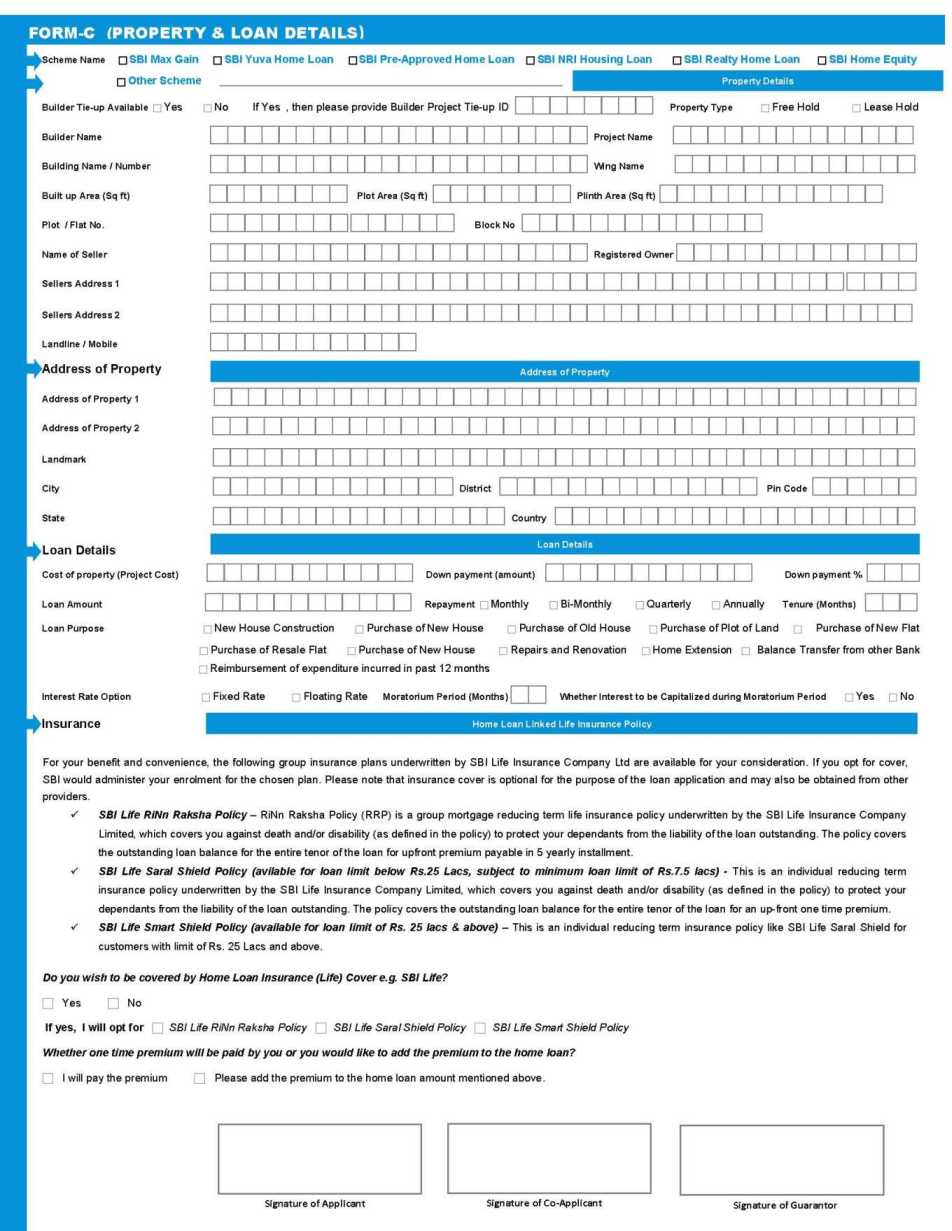

Student Loan Apply for Student loan online in India with SBI A loan granted to Pursue higher education in India or abroad where admission has been secured

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: The Customization feature lets you tailor printables to your specific needs in designing invitations planning your schedule or even decorating your home.

-

Educational value: Printables for education that are free are designed to appeal to students of all ages. This makes them a great device for teachers and parents.

-

The convenience of Quick access to many designs and templates reduces time and effort.

Where to Find more Education Loan Tax Exemption Calculator Sbi

SBI Home Loan Interest Rate 2021 New State Bank Of India Home Loan

SBI Home Loan Interest Rate 2021 New State Bank Of India Home Loan

Tax Exemption The education loan interest can be deducted from the income of the taxpayer before arriving at the taxable amount But for Section 80E there is no limit up to which the deduction can be claimed It completely depends on whatever amount was paid as interest in a financial year

Tax Benefit Calculator Apply for Loan Toll Free 1 800 209 3636 Please fill the fields to calculate your tax savings As per Section 80 E of Income Tax Act 1961 Enter Education Loan Amount CALCULATE Frequently Asked Questions Is there any tax benefit on interest paid on education loan

If we've already piqued your interest in Education Loan Tax Exemption Calculator Sbi and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Education Loan Tax Exemption Calculator Sbi for all applications.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Education Loan Tax Exemption Calculator Sbi

Here are some creative ways ensure you get the very most use of Education Loan Tax Exemption Calculator Sbi:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Education Loan Tax Exemption Calculator Sbi are an abundance of creative and practical resources that satisfy a wide range of requirements and desires. Their access and versatility makes them an invaluable addition to both personal and professional life. Explore the vast collection of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can print and download the resources for free.

-

Can I use the free printouts for commercial usage?

- It's based on specific conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright issues in Education Loan Tax Exemption Calculator Sbi?

- Some printables may have restrictions on use. Be sure to check the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using the printer, or go to any local print store for premium prints.

-

What program do I need to open printables that are free?

- Many printables are offered in PDF format, which is open with no cost programs like Adobe Reader.

Joint Home Loan Declaration Form For Income Tax Savings And Non

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Check more sample of Education Loan Tax Exemption Calculator Sbi below

Planning To Take An SBI Loan Why Not Avail Of SBI s Flexible Online

Tax Benefits Of Education Loan 80E Education Loan Tax Exemption

Education Loan Tax Benefit Education Loan Tax Exemption ICICI

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

Joint Home Loan Declaration Form For Income Tax Savings And Non

ECS Form SBI Home Loan 2023 2024 EduVark

https://cleartax.in/s/tax-benefits-on-education-loan

Income Tax department offers tax deductions on education loans to ease financial burden Section 80E of IT Act allows deductions on education loan interest Criteria includes loan from financial institutions study purpose and loan borrowers

https://cleartax.in/s/section-80e-deduction-interest-education-loan

The interest component of the education loan can be deducted from your income just as deductions under Section 80C and Section 80D are deducted before arriving at your total income to calculate the tax However there is no limit for Section 80E exemption up to which you can claim the deduction

Income Tax department offers tax deductions on education loans to ease financial burden Section 80E of IT Act allows deductions on education loan interest Criteria includes loan from financial institutions study purpose and loan borrowers

The interest component of the education loan can be deducted from your income just as deductions under Section 80C and Section 80D are deducted before arriving at your total income to calculate the tax However there is no limit for Section 80E exemption up to which you can claim the deduction

Auto Loan Calculator Surprise You Can Claim Income Tax Exemption If

Tax Benefits Of Education Loan 80E Education Loan Tax Exemption

Joint Home Loan Declaration Form For Income Tax Savings And Non

ECS Form SBI Home Loan 2023 2024 EduVark

Awesome Loan Calculator Education References Educations And Learning

Personal Loan Tax Exemptions Eligibility Criteria Limitations Tax

Personal Loan Tax Exemptions Eligibility Criteria Limitations Tax

What Are The Income Tax Benefits On Mortgage Loan Loanfasttrack