In the age of digital, with screens dominating our lives, the charm of tangible printed items hasn't gone away. In the case of educational materials in creative or artistic projects, or simply to add an element of personalization to your home, printables for free are a great source. In this article, we'll dive to the depths of "Eligibility Recovery Rebate Credit," exploring their purpose, where to find them, and ways they can help you improve many aspects of your lives.

Get Latest Eligibility Recovery Rebate Credit Below

Eligibility Recovery Rebate Credit

Eligibility Recovery Rebate Credit - Eligibility Recovery Rebate Credit, Eligibility For Recovery Rebate Credit 2020, Recovery Rebate Credit Eligibility 2022, Recovery Rebate Credit Eligibility Calculator, Recovery Rebate Credit 2023 Eligibility

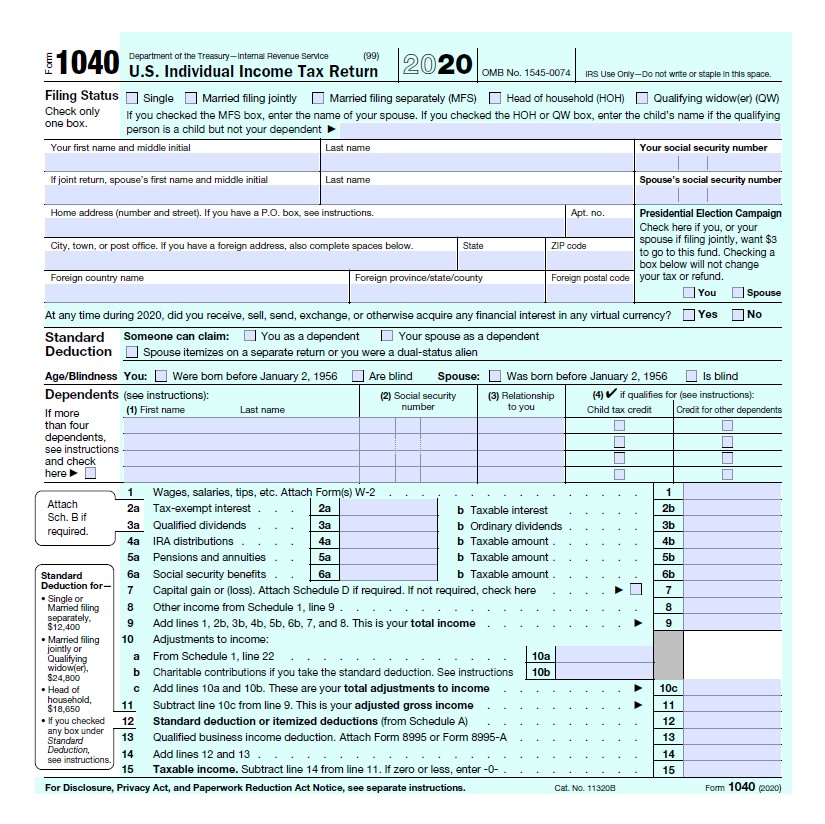

Web 1 d 233 c 2022 nbsp 0183 32 If the result is zero or a negative amount you don t qualify for any additional credit on your 2020 tax return If your result is a positive amount then you are eligible for a 2020 Recovery Rebate Credit

Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments

Eligibility Recovery Rebate Credit encompass a wide selection of printable and downloadable material that is available online at no cost. They are available in a variety of styles, from worksheets to coloring pages, templates and more. The value of Eligibility Recovery Rebate Credit lies in their versatility and accessibility.

More of Eligibility Recovery Rebate Credit

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted gross income up to a phase out threshold of 75 000 150 000 in the case of a joint

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the

Eligibility Recovery Rebate Credit have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Modifications: You can tailor printed materials to meet your requirements whether you're designing invitations or arranging your schedule or even decorating your home.

-

Education Value These Eligibility Recovery Rebate Credit are designed to appeal to students of all ages, making these printables a powerful aid for parents as well as educators.

-

The convenience of instant access a variety of designs and templates will save you time and effort.

Where to Find more Eligibility Recovery Rebate Credit

Recovery Rebate Eligibility Recovery Rebate

Recovery Rebate Eligibility Recovery Rebate

Web The eligibility criteria for the RRC is generally the same as for EIPs except that the RRC is based on tax year 2020 information instead of the tax year 2019 or tax year 2018 information used for EIP1 and tax year 2019 information used for EIP2

Web 16 nov 2022 nbsp 0183 32 Check eligibility for Recovery Rebate Credit IR 2021 49 March 2 2021 WASHINGTON The Internal Revenue Service reminds first time filers and those who usually don t have a federal filing requirement to consider filing a 2020 tax return They

We hope we've stimulated your interest in printables for free we'll explore the places the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and Eligibility Recovery Rebate Credit for a variety reasons.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Eligibility Recovery Rebate Credit

Here are some innovative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Eligibility Recovery Rebate Credit are an abundance of innovative and useful resources designed to meet a range of needs and hobbies. Their access and versatility makes they a beneficial addition to any professional or personal life. Explore the plethora of Eligibility Recovery Rebate Credit right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can print and download these tools for free.

-

Can I download free printables in commercial projects?

- It depends on the specific usage guidelines. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Are there any copyright issues with Eligibility Recovery Rebate Credit?

- Some printables could have limitations in use. Make sure to read the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home with either a printer or go to an area print shop for the highest quality prints.

-

What program do I need in order to open Eligibility Recovery Rebate Credit?

- Most PDF-based printables are available in the PDF format, and is open with no cost software, such as Adobe Reader.

Track Your Recovery Rebate With This Worksheet Style Worksheets

6 Tips What Is A Recovery Rebate Credit 2021 Alprojectalproject

Check more sample of Eligibility Recovery Rebate Credit below

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Federal Recovery Rebate Credit Recovery Rebate

Tax Time Guide Didn T Get Economic Impact Payments Check Eligibility

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Who Is Eligible For A Recovery Rebate Credit Printable Rebate Form

https://www.irs.gov/newsroom/check-your-recovery-rebate-credit-eligibi…

Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-b...

Web 10 d 233 c 2021 nbsp 0183 32 An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements

Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments

Web 10 d 233 c 2021 nbsp 0183 32 An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Federal Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Who Is Eligible For A Recovery Rebate Credit Printable Rebate Form

How To Figure The Recovery Rebate Credit Recovery Rebate

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style