In a world in which screens are the norm however, the attraction of tangible, printed materials hasn't diminished. If it's to aid in education and creative work, or simply adding an individual touch to the area, Energy Income Tax Credit are now a vital source. We'll dive into the world "Energy Income Tax Credit," exploring the different types of printables, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Energy Income Tax Credit Below

Energy Income Tax Credit

Energy Income Tax Credit -

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum owed to

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

Energy Income Tax Credit encompass a wide assortment of printable, downloadable materials available online at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and much more. The great thing about Energy Income Tax Credit lies in their versatility and accessibility.

More of Energy Income Tax Credit

SmartPower Financing Emmaty Exteriors

SmartPower Financing Emmaty Exteriors

The Inflation Reduction Act of 2022 P L 117 169 expanded and renamed the nonbusiness energy property credit as the energy efficient home improvement credit The

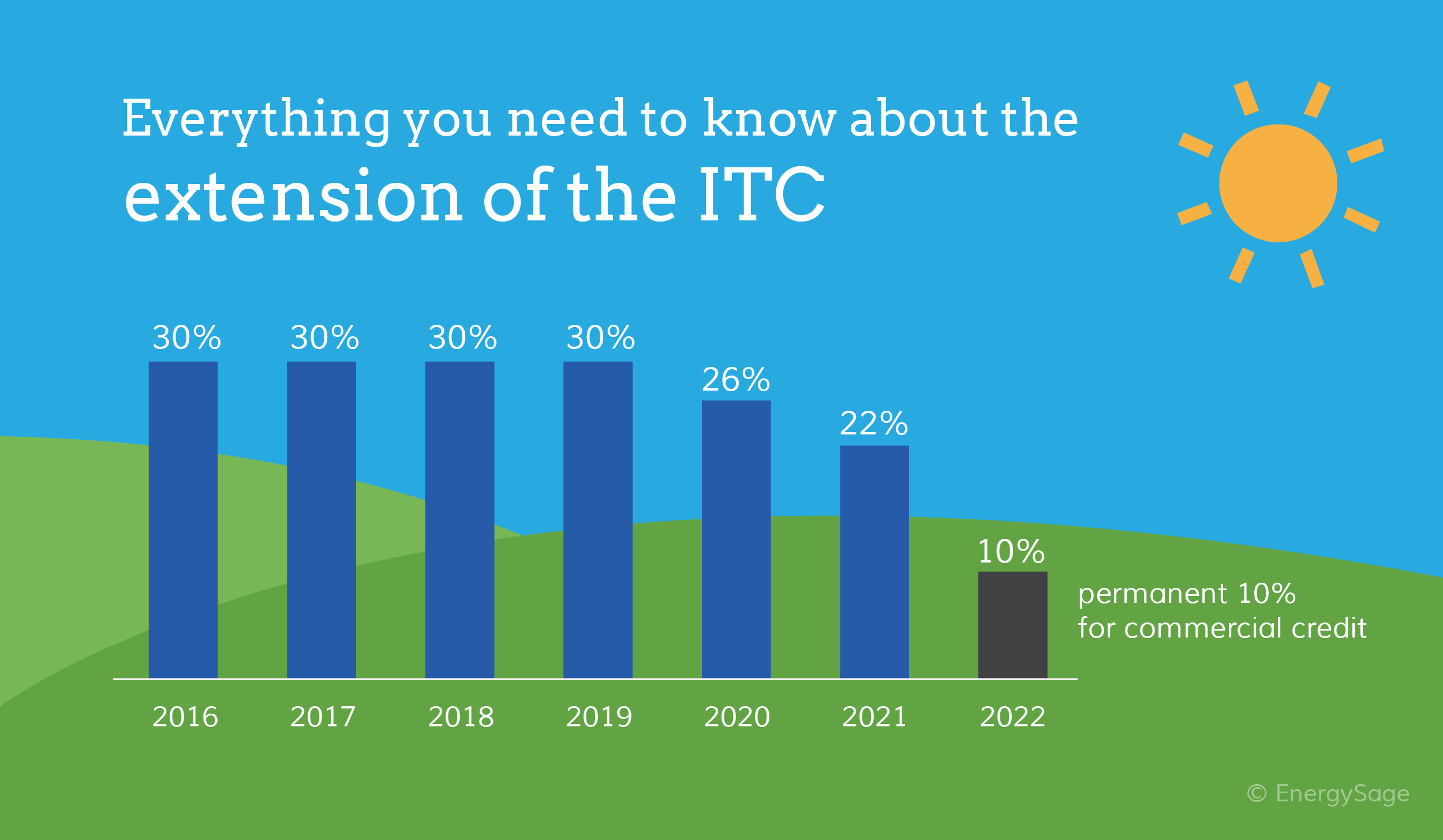

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage and

Energy Income Tax Credit have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: The Customization feature lets you tailor printables to fit your particular needs for invitations, whether that's creating them planning your schedule or even decorating your home.

-

Education Value Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them an essential resource for educators and parents.

-

The convenience of immediate access a variety of designs and templates, which saves time as well as effort.

Where to Find more Energy Income Tax Credit

Duke Energy Raising Rates Again Despite Record Profits And Tax Breaks

Duke Energy Raising Rates Again Despite Record Profits And Tax Breaks

You can be entitled to a tax credit if electricity expenses are high in your permanent home The credit is a temporary measure in response to increased prices Only the

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do

Since we've got your curiosity about Energy Income Tax Credit and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Energy Income Tax Credit designed for a variety needs.

- Explore categories like decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs covered cover a wide range of interests, including DIY projects to planning a party.

Maximizing Energy Income Tax Credit

Here are some inventive ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Energy Income Tax Credit are a treasure trove with useful and creative ideas designed to meet a range of needs and pursuits. Their accessibility and flexibility make them a valuable addition to both professional and personal lives. Explore the many options of Energy Income Tax Credit now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Energy Income Tax Credit really available for download?

- Yes they are! You can print and download the resources for free.

-

Can I make use of free printouts for commercial usage?

- It's based on the rules of usage. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues when you download Energy Income Tax Credit?

- Some printables may have restrictions regarding their use. Be sure to check the terms and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit the local print shops for better quality prints.

-

What program do I require to open printables free of charge?

- The majority of printables are in the format PDF. This is open with no cost software such as Adobe Reader.

Solar Tax Credit Chart Energy Sage Sol Luna Solar

Earned Income Tax Credit EITC What It Is And Who Qualifies Quakerpedia

Check more sample of Energy Income Tax Credit below

Income Tax Langtons Chartered Accountants Business Advisers

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

Tax Credits Save You More Than Deductions Here Are The Best Ones

Massachusetts Solar Incentives And Rebates 2023 Solar Metric

New Mexico s Solar Energy Tax Credit Passes Legislature

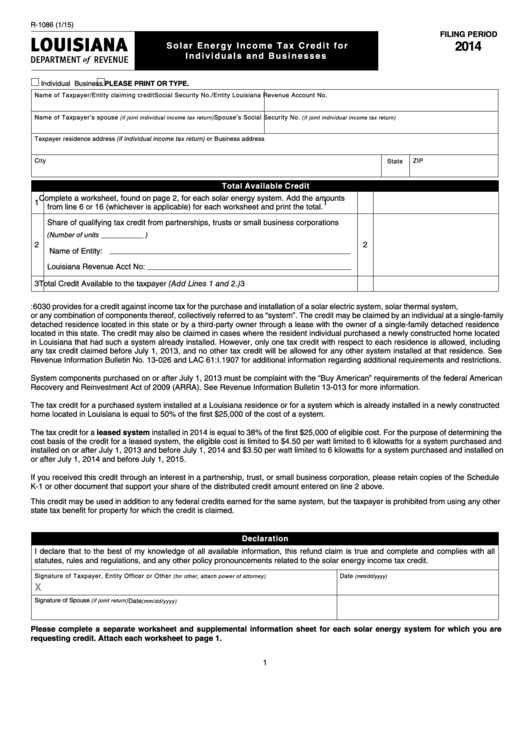

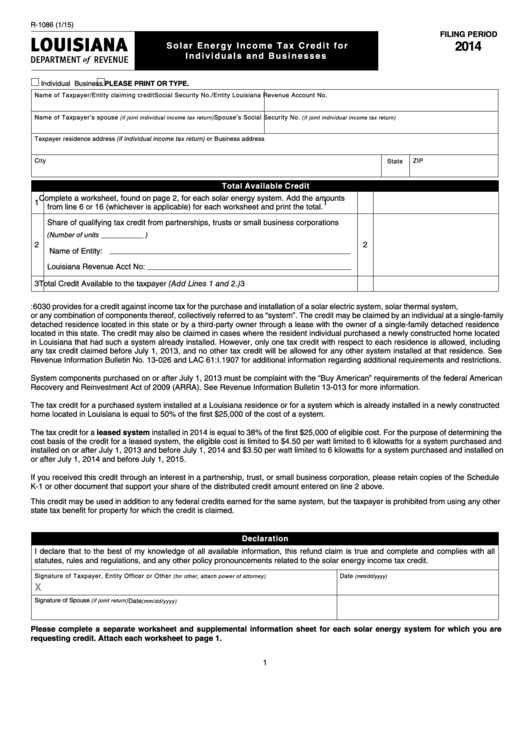

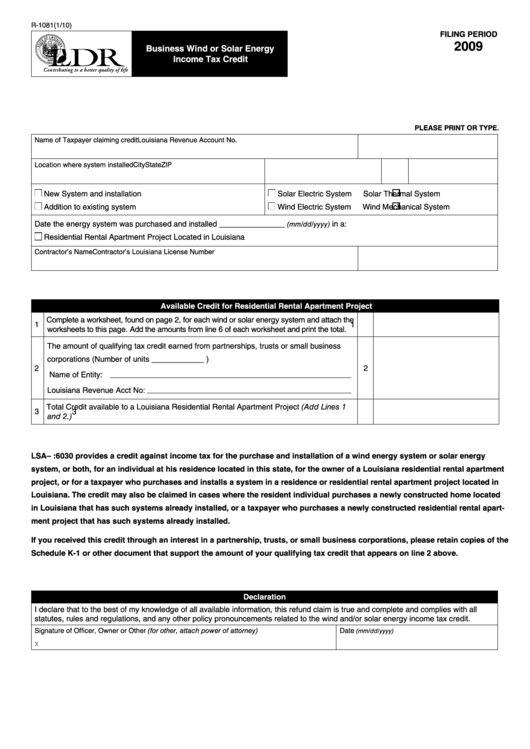

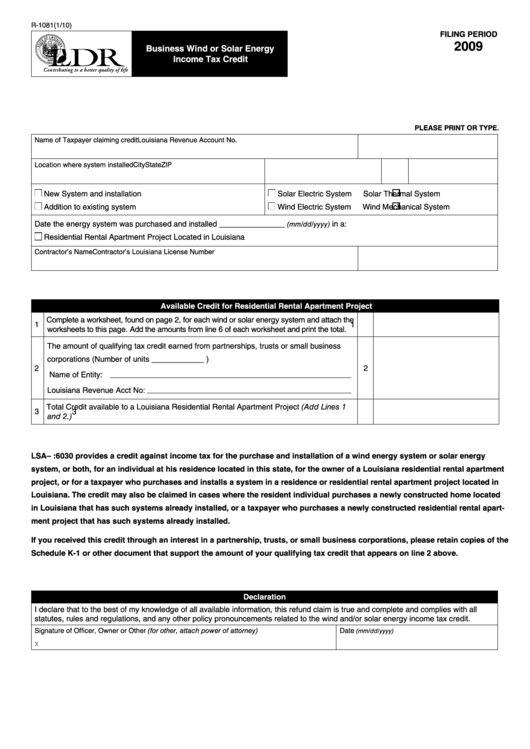

Fillable Form R 1086 Solar Energy Income Tax Credit For Individuals

https://www.irs.gov › credits-deductions › home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

https://www.irs.gov › credits-deductions › residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy

Massachusetts Solar Incentives And Rebates 2023 Solar Metric

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

New Mexico s Solar Energy Tax Credit Passes Legislature

Fillable Form R 1086 Solar Energy Income Tax Credit For Individuals

What Is The Earned Income Tax Credit Do I Qualify SFS Tax

Fillable Form R 1081 Business Wind Or Solar Energy Income Tax Credit

Fillable Form R 1081 Business Wind Or Solar Energy Income Tax Credit

Credit Card Balance Household Binder Income Tax Return Unexpected