In this age of technology, with screens dominating our lives yet the appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education or creative projects, or just adding a personal touch to your space, Federal Tax Credit For Electric Cars Income Limit can be an excellent source. We'll dive deep into the realm of "Federal Tax Credit For Electric Cars Income Limit," exploring what they are, how to find them and how they can improve various aspects of your lives.

Get Latest Federal Tax Credit For Electric Cars Income Limit Below

Federal Tax Credit For Electric Cars Income Limit

Federal Tax Credit For Electric Cars Income Limit - Federal Tax Credit For Electric Cars Income Limit, Federal Tax Credit For Electric Cars 2022 Income Limit, Federal Tax Credit For Electric Cars 2023 Income Limit, 7500 Federal Tax Credit Electric Car Income Limit, Federal Ev Tax Credit Income Limit, Federal Electric Vehicle Tax Credit Income Limit

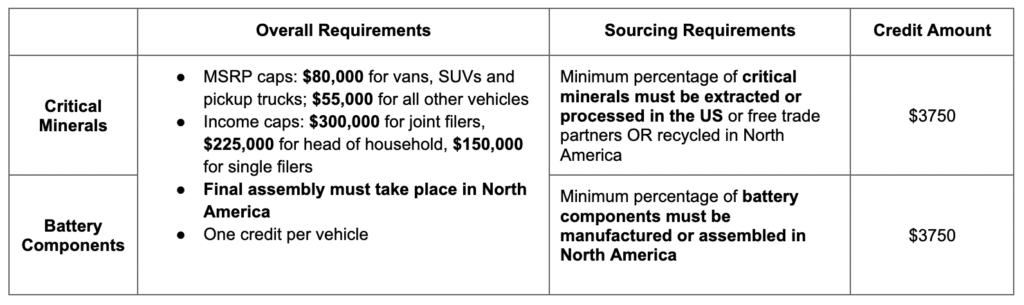

A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 for certain

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

The Federal Tax Credit For Electric Cars Income Limit are a huge selection of printable and downloadable material that is available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and more. The value of Federal Tax Credit For Electric Cars Income Limit is their flexibility and accessibility.

More of Federal Tax Credit For Electric Cars Income Limit

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household

If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year

Federal Tax Credit For Electric Cars Income Limit have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: They can make designs to suit your personal needs in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value The free educational worksheets are designed to appeal to students of all ages. This makes them a great device for teachers and parents.

-

Accessibility: Fast access a plethora of designs and templates reduces time and effort.

Where to Find more Federal Tax Credit For Electric Cars Income Limit

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500 for buyers of new all electric

The 7 500 tax credit for electric cars has some big changes in 2024 What to know Business Electric cars have a road trip problem even for the secretary of energy That s how

We've now piqued your curiosity about Federal Tax Credit For Electric Cars Income Limit we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Federal Tax Credit For Electric Cars Income Limit suitable for many objectives.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Federal Tax Credit For Electric Cars Income Limit

Here are some new ways for you to get the best use of Federal Tax Credit For Electric Cars Income Limit:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Federal Tax Credit For Electric Cars Income Limit are an abundance of useful and creative resources that can meet the needs of a variety of people and passions. Their accessibility and versatility make they a beneficial addition to your professional and personal life. Explore the many options of Federal Tax Credit For Electric Cars Income Limit today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes, they are! You can print and download these documents for free.

-

Does it allow me to use free printables for commercial use?

- It's determined by the specific rules of usage. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using Federal Tax Credit For Electric Cars Income Limit?

- Some printables may come with restrictions on their use. Be sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- You can print them at home using any printer or head to a local print shop for higher quality prints.

-

What program do I require to open printables free of charge?

- Most printables come as PDF files, which is open with no cost software such as Adobe Reader.

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

Electric Vehicle Chargers The Federal Tax Credit Is Back

Check more sample of Federal Tax Credit For Electric Cars Income Limit below

Federal Tax Credit For Electric Cars 2021 Form Wcarsj

![]()

Federal Tax Credit For Electric Cars In 2021 Atlantic Chevrolet

What Makes A Good Electric Bike Incentive Program PeopleForBikes

Tax Credit For Electric Vehicles Khou

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

https://www. irs.gov /credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www. irs.gov /credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

Tax Credit For Electric Vehicles Khou

Federal Tax Credit For Electric Cars In 2021 Atlantic Chevrolet

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Federal Tax Credit For Electric Cars OsVehicle

Ev Tax Credit 2022 Cap Clement Wesley

Ev Tax Credit 2022 Cap Clement Wesley

2022 EV Tax Credits From Inflation Reduction Act Plug In America