In this age of electronic devices, in which screens are the norm, the charm of tangible printed objects hasn't waned. For educational purposes in creative or artistic projects, or simply adding the personal touch to your space, Federal Tax Credit Vs Deduction have become an invaluable source. Here, we'll take a dive through the vast world of "Federal Tax Credit Vs Deduction," exploring what they are, how you can find them, and how they can enhance various aspects of your daily life.

Get Latest Federal Tax Credit Vs Deduction Below

Federal Tax Credit Vs Deduction

Federal Tax Credit Vs Deduction - Federal Tax Credit Vs Deduction, Irs Foreign Tax Credit Or Deduction, Standard Deduction Vs Tax Credit, What Are Federal Deductions On Taxes, Tax Credit Vs Tax Deduction Which Is Better

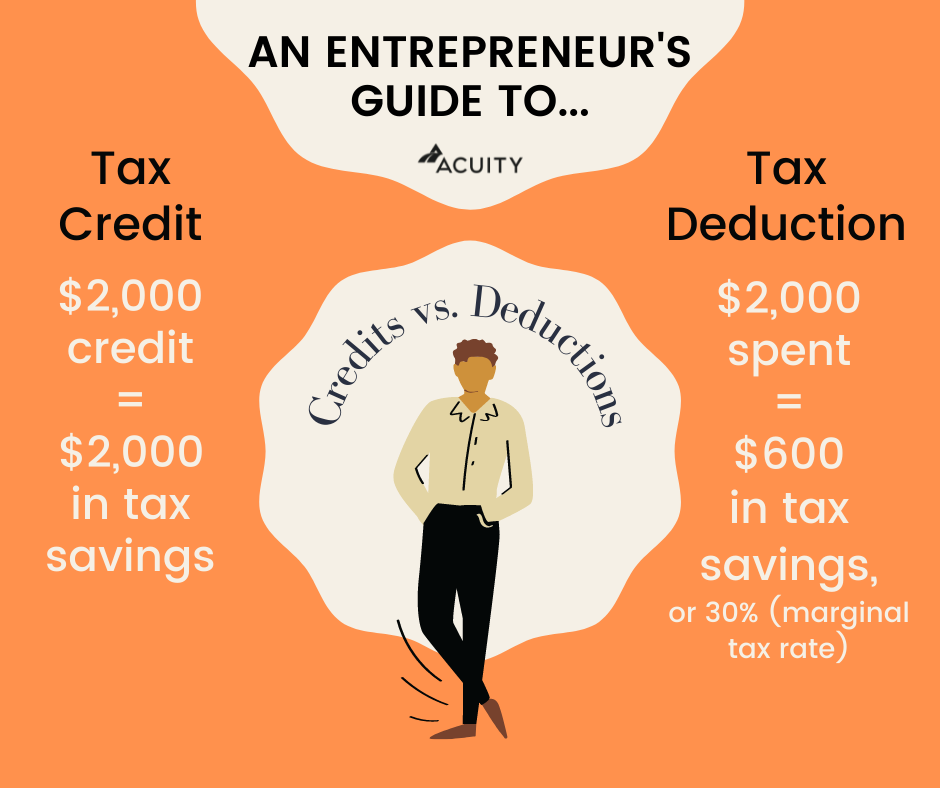

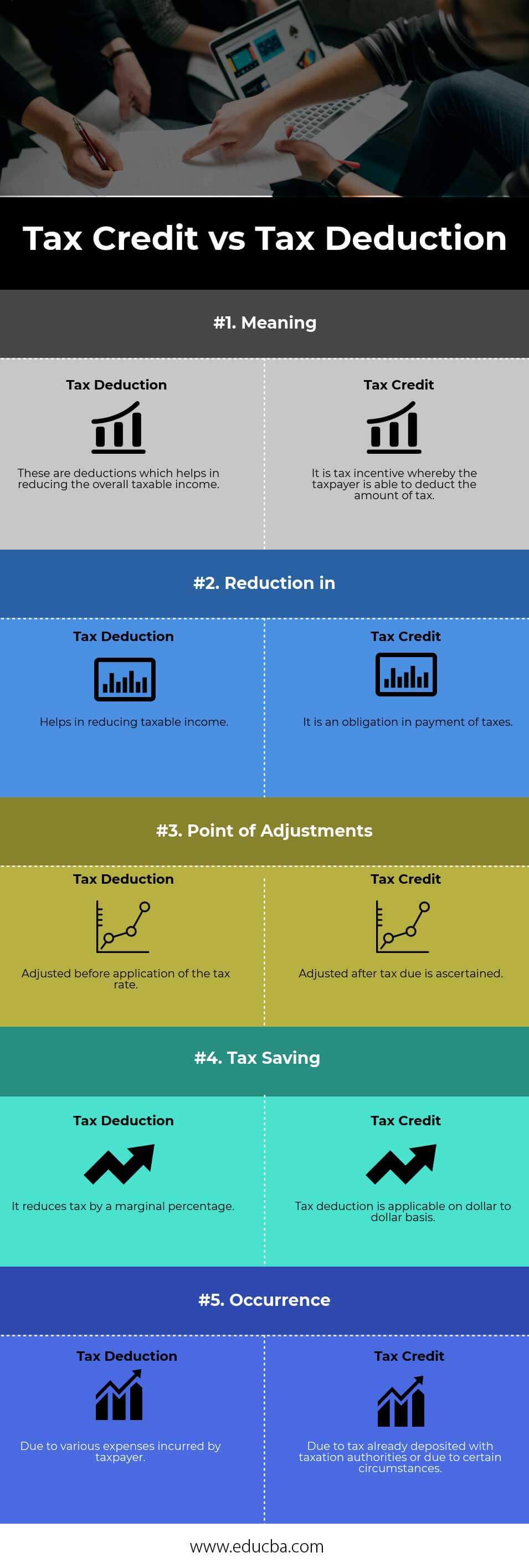

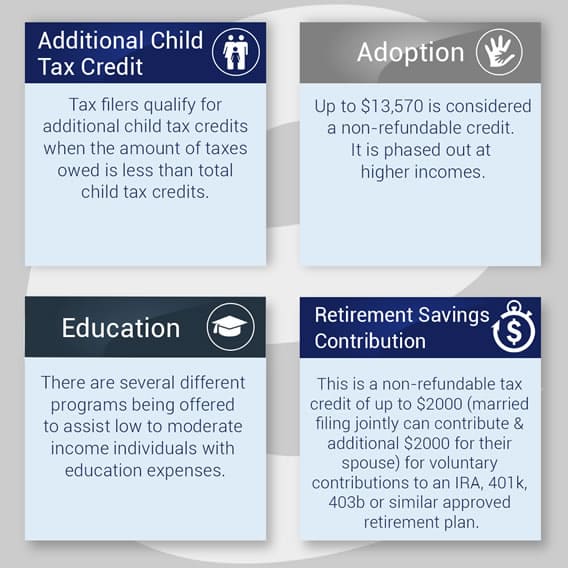

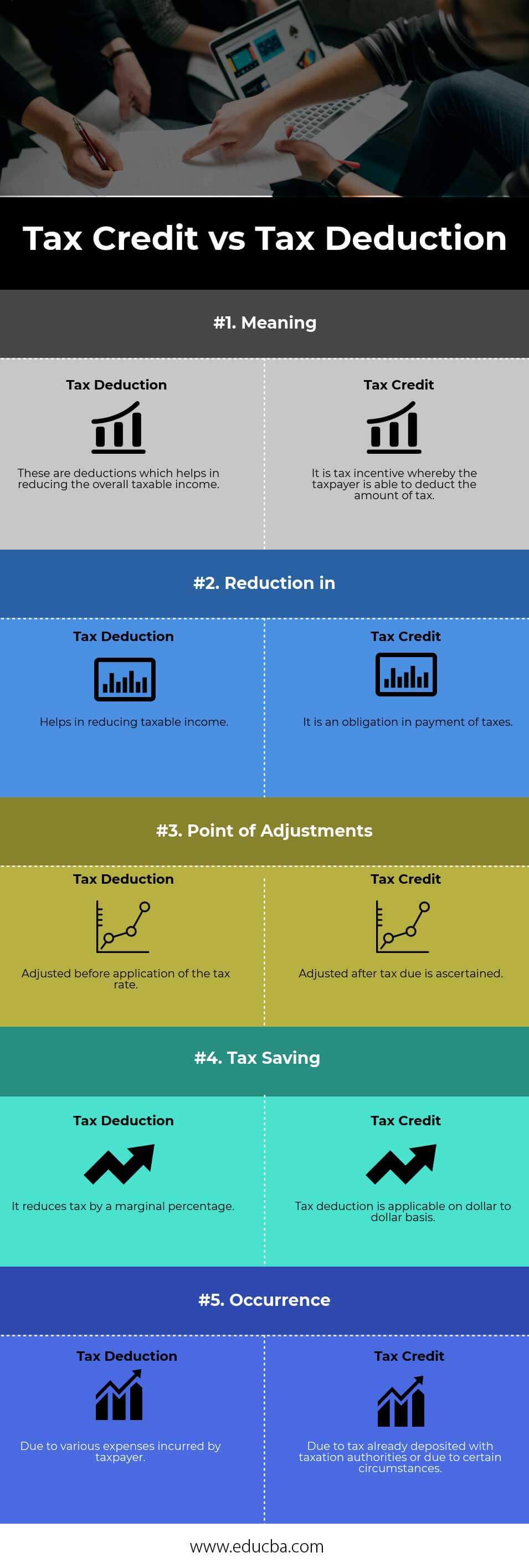

As a reminder tax deductions are top line meaning they re deducted from your income before your taxes are calculated Tax credits on the other hand are bottom line after your taxes are calculated a tax credit is deducted dollar for dollar from the amount you owe Tax credits therefore give you a lot more bang for the buck

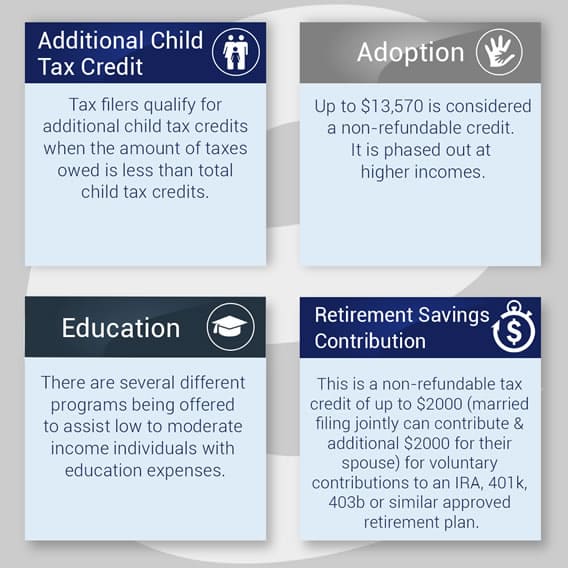

Both tax credits and tax deductions can reduce your tax bill but in different ways Tax credits directly reduce the amount of tax you owe the IRS Tax deductions reduce your taxable income so you re taxed on less You can claim both credits and deductions on your tax return if you meet the qualifications for each

The Federal Tax Credit Vs Deduction are a huge assortment of printable, downloadable resources available online for download at no cost. These resources come in many types, such as worksheets templates, coloring pages, and many more. The great thing about Federal Tax Credit Vs Deduction is their versatility and accessibility.

More of Federal Tax Credit Vs Deduction

Tax Credit Vs Tax Deduction What Are The Differences

Tax Credit Vs Tax Deduction What Are The Differences

While tax deductions reduce the amount of income you have to pay taxes on tax credits directly reduce what you owe Here s a breakdown of the differences between the two Insider s

How much you can deduct using the standard deduction mostly depends on your filing status and age For 2020 the standard deductions are 25 100 for people married filing jointly 18 800 for those filing as head of household and 12 500 for single and married filing separately

Federal Tax Credit Vs Deduction have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor the templates to meet your individual needs whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational value: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, which makes these printables a powerful tool for parents and educators.

-

Simple: You have instant access a myriad of designs as well as templates saves time and effort.

Where to Find more Federal Tax Credit Vs Deduction

Tax Credit Vs Deduction Differences Explained First Republic

Tax Credit Vs Deduction Differences Explained First Republic

Generally tax credits tend to be more valuable compared to deductions That s because of the dollar for dollar reduction mentioned earlier Here s a simplified example to make things easy Let s say a credit and a deduction that are both valued at 1 000 and that your tax liability is 3 000 With the 1 000 tax credit your tax bill is

The main difference is tax credits impact the total tax while deductions only affect the amount of your income that is subject to tax More of your 2023 tax season questions answered

Now that we've piqued your interest in Federal Tax Credit Vs Deduction Let's see where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Federal Tax Credit Vs Deduction for all goals.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Federal Tax Credit Vs Deduction

Here are some fresh ways in order to maximize the use use of Federal Tax Credit Vs Deduction:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Federal Tax Credit Vs Deduction are a treasure trove with useful and creative ideas which cater to a wide range of needs and needs and. Their accessibility and versatility make them a great addition to both personal and professional life. Explore the endless world of Federal Tax Credit Vs Deduction today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes you can! You can download and print these items for free.

-

Can I utilize free printables in commercial projects?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with Federal Tax Credit Vs Deduction?

- Certain printables could be restricted regarding their use. Make sure to read the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- You can print them at home with a printer or visit an area print shop for better quality prints.

-

What program must I use to open printables for free?

- The majority are printed in PDF format, which can be opened with free software such as Adobe Reader.

Tax Credit Vs Tax Deduction

Startup Tax Credits Deductions You Might Be Missing

Check more sample of Federal Tax Credit Vs Deduction below

Tax Credits Vs Deductions Key Differences And Similarities Synchrony

Tax Credit Vs Tax Deduction What s The Difference Expat US Tax

What Is The Difference Between A Tax Credit And Tax Deduction

Tax Credit Vs Tax Deduction E file

Tax Credit Vs Tax Deduction Top 5 Major Differences With Infographics

Tax Credit Vs Tax Deduction What Is The Difference YouTube

https://www.thebalancemoney.com/tax-credit-vs-deduction-5120556

Both tax credits and tax deductions can reduce your tax bill but in different ways Tax credits directly reduce the amount of tax you owe the IRS Tax deductions reduce your taxable income so you re taxed on less You can claim both credits and deductions on your tax return if you meet the qualifications for each

https://www.bankrate.com/taxes/tax-credit-vs-tax-deduction

Tax deductions and tax credits reduce how much you owe the IRS but in different ways Tax credit A tax credit gives you a dollar for dollar reduction in your tax bill For

Both tax credits and tax deductions can reduce your tax bill but in different ways Tax credits directly reduce the amount of tax you owe the IRS Tax deductions reduce your taxable income so you re taxed on less You can claim both credits and deductions on your tax return if you meet the qualifications for each

Tax deductions and tax credits reduce how much you owe the IRS but in different ways Tax credit A tax credit gives you a dollar for dollar reduction in your tax bill For

Tax Credit Vs Tax Deduction E file

Tax Credit Vs Tax Deduction What s The Difference Expat US Tax

Tax Credit Vs Tax Deduction Top 5 Major Differences With Infographics

Tax Credit Vs Tax Deduction What Is The Difference YouTube

Tax Credit Vs Tax Deduction Top 5 Best Differences With Infographics

Tax Credit Vs Tax Deduction Difference Between Tax Credit And Tax

Tax Credit Vs Tax Deduction Difference Between Tax Credit And Tax

Tax Credit Vs Deduction What All Homeowners Should Know Bob Vila