In a world with screens dominating our lives but the value of tangible printed materials isn't diminishing. If it's to aid in education for creative projects, just adding a personal touch to your space, Federal Tax Return Unemployment Income are a great resource. Through this post, we'll take a dive through the vast world of "Federal Tax Return Unemployment Income," exploring the benefits of them, where to find them and how they can enrich various aspects of your daily life.

Get Latest Federal Tax Return Unemployment Income Below

Federal Tax Return Unemployment Income

Federal Tax Return Unemployment Income - Federal Tax Return Unemployment Income

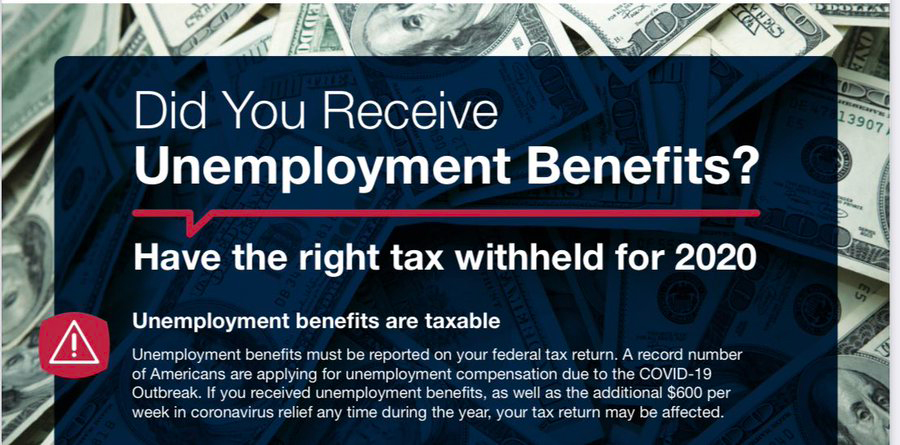

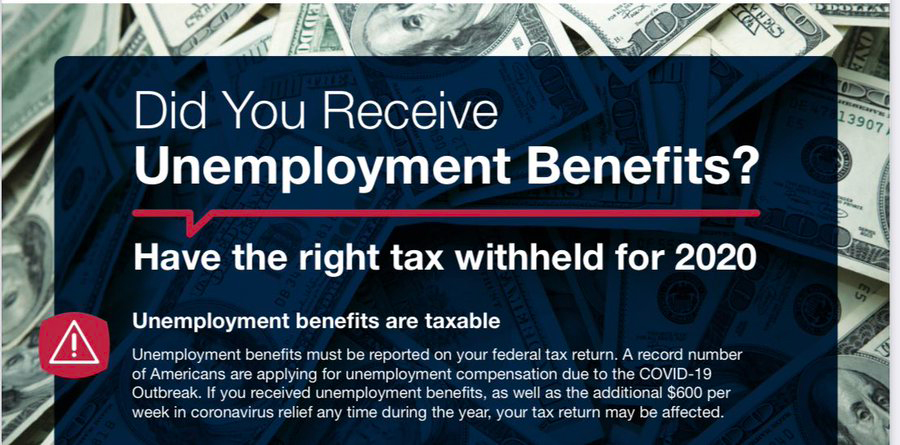

Unemployment benefits can be a financial lifeline when you lose a job but you should know that the IRS considers them taxable income As such you may need to have income taxes withheld

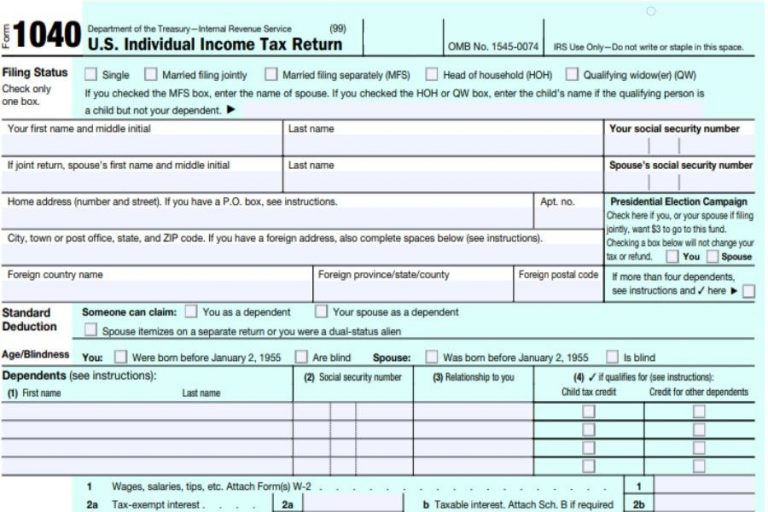

Any unemployment compensation in excess of 10 200 10 200 per spouse if married filing jointly is taxable income that must be included on your 2020 tax return Already filed a tax year 2020 tax return The IRS is no longer automatically determining the correct taxable amount of unemployment compensation and the correct tax impacted by

Federal Tax Return Unemployment Income offer a wide variety of printable, downloadable documents that can be downloaded online at no cost. They come in many forms, including worksheets, coloring pages, templates and much more. The beauty of Federal Tax Return Unemployment Income is their versatility and accessibility.

More of Federal Tax Return Unemployment Income

Unemployment Stimulus Taxable Income NEMPLOY

Unemployment Stimulus Taxable Income NEMPLOY

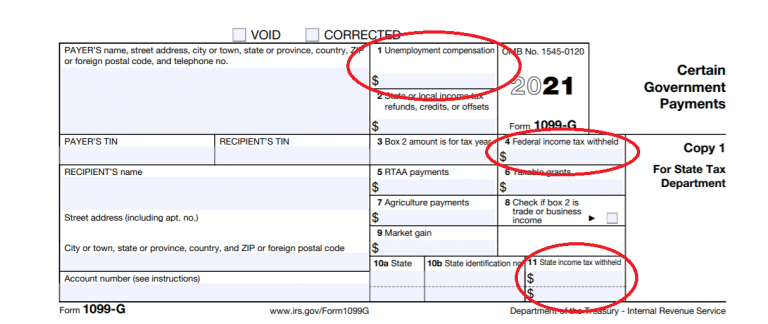

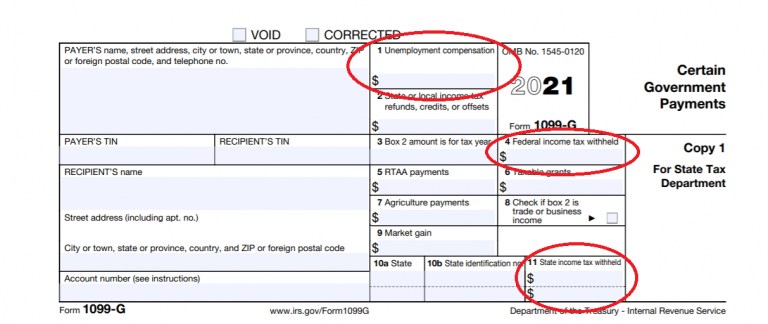

If you receive unemployment compensation your benefits are taxable You will need to report Form 1099 G Certain Government Payments on your federal tax return Most states mail this form to you but some do not Some states may send more than one Form 1099 G Use all to prepare your tax return Scroll down for how to find

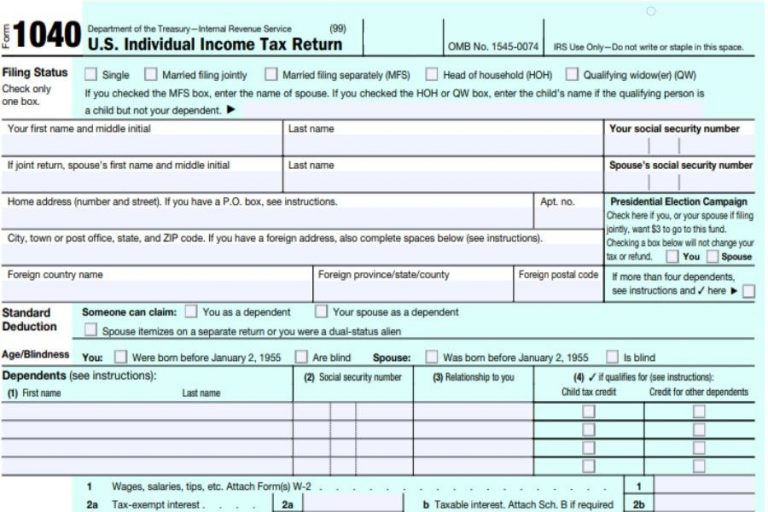

When you receive unemployment benefits you are required to report them on your federal income tax return The IRS treats unemployment as income just like wages or salary from a job which means they are subject to federal income tax Do I have to pay state taxes on unemployment compensation

Federal Tax Return Unemployment Income have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: There is the possibility of tailoring designs to suit your personal needs such as designing invitations, organizing your schedule, or decorating your home.

-

Education Value Education-related printables at no charge cater to learners from all ages, making them a useful resource for educators and parents.

-

An easy way to access HTML0: The instant accessibility to a variety of designs and templates is time-saving and saves effort.

Where to Find more Federal Tax Return Unemployment Income

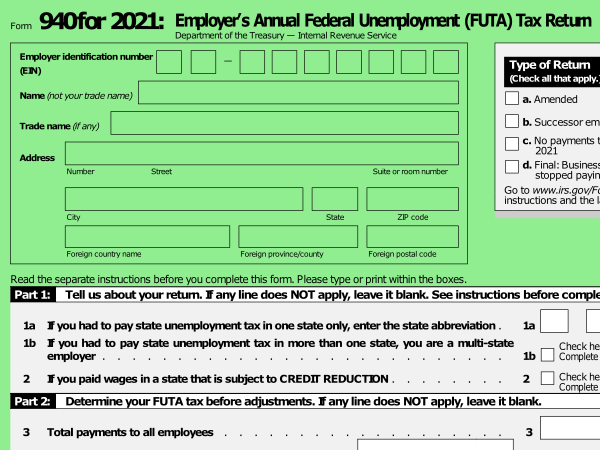

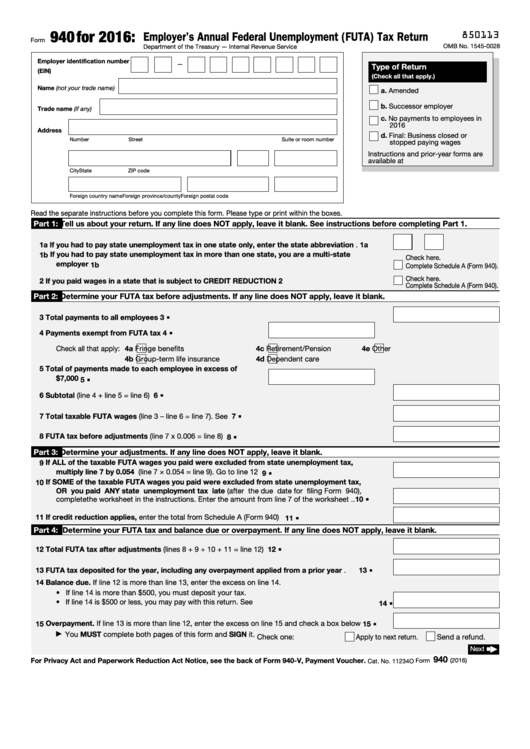

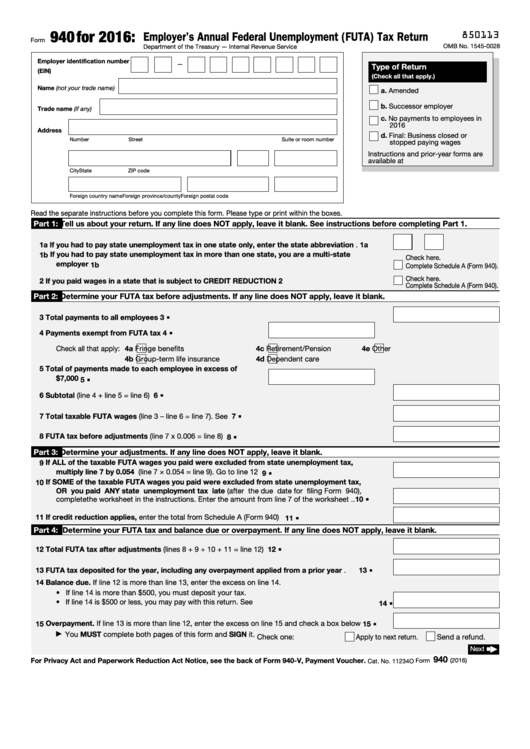

How To Complete Form 940 For 2021 Employer s Annual Federal

How To Complete Form 940 For 2021 Employer s Annual Federal

Generally yes The federal government will tax your unemployment benefits and most states will as well Unemployment benefits count toward your income and are taxed by the federal

Normally unemployment benefits are fully taxable by the IRS and must be reported on your federal tax return This tax break will be welcome news for the millions of Americans who lost

After we've peaked your interest in Federal Tax Return Unemployment Income We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Federal Tax Return Unemployment Income for various goals.

- Explore categories such as decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide range of interests, from DIY projects to planning a party.

Maximizing Federal Tax Return Unemployment Income

Here are some innovative ways how you could make the most of Federal Tax Return Unemployment Income:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free to build your knowledge at home also in the classes.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Federal Tax Return Unemployment Income are a treasure trove of fun and practical tools that can meet the needs of a variety of people and hobbies. Their accessibility and flexibility make them a valuable addition to both professional and personal life. Explore the vast collection of Federal Tax Return Unemployment Income now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can download and print these materials for free.

-

Can I use free printing templates for commercial purposes?

- It's contingent upon the specific rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted on usage. Make sure to read these terms and conditions as set out by the designer.

-

How can I print Federal Tax Return Unemployment Income?

- You can print them at home using any printer or head to any local print store for superior prints.

-

What software is required to open printables at no cost?

- Many printables are offered in the format PDF. This is open with no cost software like Adobe Reader.

How Unemployment Will Affect Your Tax Return YouTube

Refund For Unemployment Taxes Estela Funderburk

Check more sample of Federal Tax Return Unemployment Income below

Carlie Lilly

Thousands Told To Return Unemployment Overpayment

IRS Claim Your 1 200 Stimulus Check By November 21 Irs Student

Tax Printable Forms Printable Forms Free Online

Printable Irs Form 940 Printable Forms Free Online

Federal Income Taxes Your Unemployment Benefits

https://www.irs.gov/newsroom/tax-treatment-of-2020...

Any unemployment compensation in excess of 10 200 10 200 per spouse if married filing jointly is taxable income that must be included on your 2020 tax return Already filed a tax year 2020 tax return The IRS is no longer automatically determining the correct taxable amount of unemployment compensation and the correct tax impacted by

https://www.irs.gov/taxtopics/tc418

Unemployment compensation includes amounts received under the laws of the United States or of a state such as State unemployment insurance benefits Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund Railroad unemployment compensation benefits

Any unemployment compensation in excess of 10 200 10 200 per spouse if married filing jointly is taxable income that must be included on your 2020 tax return Already filed a tax year 2020 tax return The IRS is no longer automatically determining the correct taxable amount of unemployment compensation and the correct tax impacted by

Unemployment compensation includes amounts received under the laws of the United States or of a state such as State unemployment insurance benefits Benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund Railroad unemployment compensation benefits

Tax Printable Forms Printable Forms Free Online

Thousands Told To Return Unemployment Overpayment

Printable Irs Form 940 Printable Forms Free Online

Federal Income Taxes Your Unemployment Benefits

Filing Income Taxes Can Be Intimidating And Teaching Students How To

Tatuagem Descascando Saiba Os Motivos E Confira Dicas De Cuidado Tax

Tatuagem Descascando Saiba Os Motivos E Confira Dicas De Cuidado Tax

Unemployment Stimulus Taxable Income NEMPLOY