In this age of technology, in which screens are the norm and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. For educational purposes, creative projects, or simply adding an extra personal touch to your area, Flat Amount Tax Deduction have proven to be a valuable source. With this guide, you'll take a dive into the sphere of "Flat Amount Tax Deduction," exploring their purpose, where to find them, and how they can improve various aspects of your daily life.

Get Latest Flat Amount Tax Deduction Below

Flat Amount Tax Deduction

Flat Amount Tax Deduction - Flat Amount Tax Deduction, What Is A Flat Rate Deduction, Flat Tax Amount, Is Flat Service Charge Tax Deductible, What Is A Flat Deductible

Flat rate expenses sometimes known as a flat rate deduction allow you to claim tax relief for an agreed fixed amount each tax year to cover what you spend on the clothing and tools you

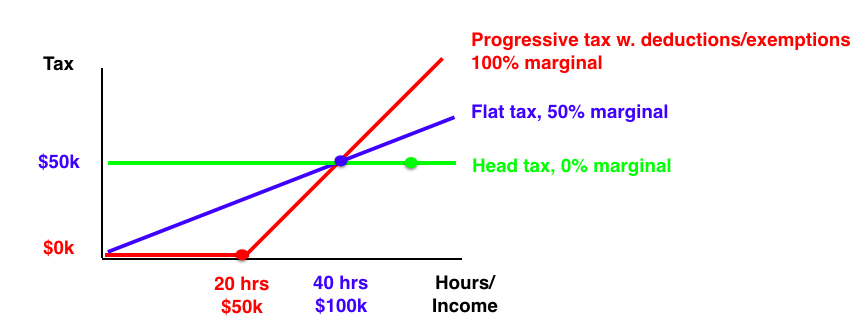

What is a Flat Tax A flat tax refers to a tax system where a single tax rate is applied to all levels of income This means that individuals with a low income are taxed at the same rate as individuals with a high income

Flat Amount Tax Deduction encompass a wide range of printable, free resources available online for download at no cost. These resources come in many kinds, including worksheets templates, coloring pages, and much more. The beauty of Flat Amount Tax Deduction lies in their versatility and accessibility.

More of Flat Amount Tax Deduction

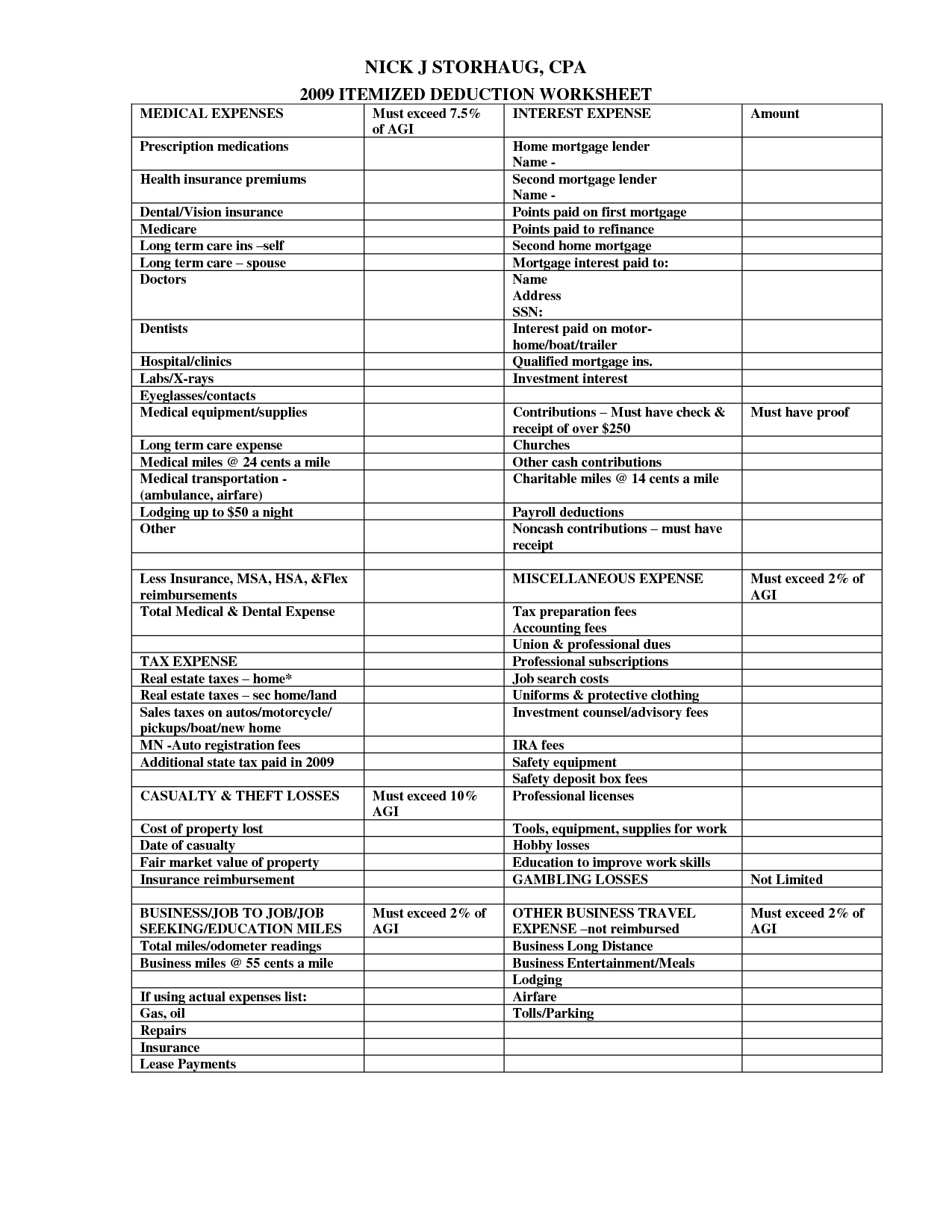

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

A flat tax system is a single rate tax applied uniformly to all income levels without considering deductions exemptions or varying tax brackets It simplifies the taxation system making it easier for taxpayers to understand and comply with tax laws

A flat income tax is a taxation model that applies the same rate to all taxpayers regardless of their income This concept starkly contrasts with the progressive tax system currently employed by many countries including the United States where tax rates increase as taxable income increases

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization We can customize print-ready templates to your specific requirements in designing invitations and schedules, or even decorating your home.

-

Educational value: The free educational worksheets offer a wide range of educational content for learners of all ages, making the perfect device for teachers and parents.

-

An easy way to access HTML0: Fast access many designs and templates reduces time and effort.

Where to Find more Flat Amount Tax Deduction

The Grumpy Economist Tax Graph

The Grumpy Economist Tax Graph

Use FIFTY50 for flat 50 Off When Can You Claim Deduction This deduction can only be claimed in the year the actual payment is made towards these expenses If you buy the property on 30th August 2023 and pay its stamp duty and registration charge you can claim these expenses under section 80C only in FY 2023 24

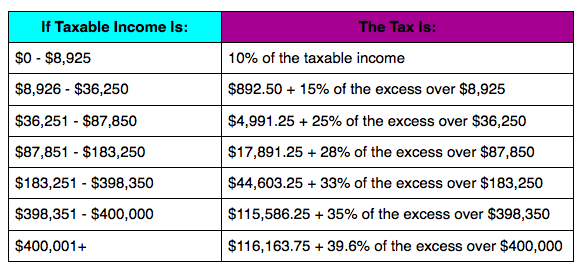

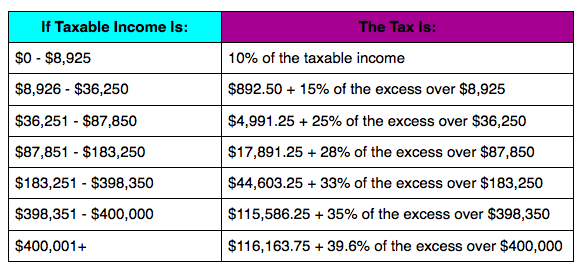

The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill The amount set by the IRS could vary by tax year and filing status generally single married filing jointly married

Now that we've ignited your interest in Flat Amount Tax Deduction we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Flat Amount Tax Deduction suitable for many uses.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning materials.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs covered cover a wide variety of topics, starting from DIY projects to planning a party.

Maximizing Flat Amount Tax Deduction

Here are some ideas ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home and in class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Flat Amount Tax Deduction are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and desires. Their availability and versatility make them a valuable addition to both personal and professional life. Explore the endless world of Flat Amount Tax Deduction and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes you can! You can print and download these files for free.

-

Can I download free printables for commercial use?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues with Flat Amount Tax Deduction?

- Some printables may come with restrictions in their usage. Make sure you read the terms of service and conditions provided by the designer.

-

How do I print Flat Amount Tax Deduction?

- Print them at home using either a printer at home or in the local print shops for the highest quality prints.

-

What program do I need in order to open printables that are free?

- The majority of PDF documents are provided as PDF files, which can be opened using free software such as Adobe Reader.

Flat Amount Synonyms 27 Words And Phrases For Flat Amount

Tax Deductions You Can Deduct What Napkin Finance

Check more sample of Flat Amount Tax Deduction below

2022 Tax Brackets Irs Calculator

What Is The Standard Federal Tax Deduction Ericvisser

Standard Deduction 2020 Self Employed Standard Deduction 2021

Payroll Withholding Calculator 2023 ZehnabNadra

The Standard Deduction Undermines Itemized Deductions Tax Foundation

Federal Income Tax Rates

https://corporatefinanceinstitute.com/resources/accounting/flat-tax

What is a Flat Tax A flat tax refers to a tax system where a single tax rate is applied to all levels of income This means that individuals with a low income are taxed at the same rate as individuals with a high income

https://en.wikipedia.org/wiki/Flat_tax

A flat tax short for flat rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base It is not necessarily a fully proportional tax Implementations are often progressive due to exemptions or regressive in case of a maximum taxable amount

What is a Flat Tax A flat tax refers to a tax system where a single tax rate is applied to all levels of income This means that individuals with a low income are taxed at the same rate as individuals with a high income

A flat tax short for flat rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base It is not necessarily a fully proportional tax Implementations are often progressive due to exemptions or regressive in case of a maximum taxable amount

Payroll Withholding Calculator 2023 ZehnabNadra

What Is The Standard Federal Tax Deduction Ericvisser

The Standard Deduction Undermines Itemized Deductions Tax Foundation

Federal Income Tax Rates

Text Showing Inspiration Tax Deduction Word For Amount Subtracted From

Municipal Tax Paid By Society On Behalf Of Flat Owners Is Eligible For

Municipal Tax Paid By Society On Behalf Of Flat Owners Is Eligible For

Fillable Itemized Fee Worksheet Free Download Goodimg co