In a world where screens rule our lives however, the attraction of tangible printed products hasn't decreased. Be it for educational use, creative projects, or just adding a personal touch to your home, printables for free have proven to be a valuable resource. In this article, we'll dive into the sphere of "Fuel Reimbursement Tax Exemption India," exploring the different types of printables, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Fuel Reimbursement Tax Exemption India Below

Fuel Reimbursement Tax Exemption India

Fuel Reimbursement Tax Exemption India - Fuel Reimbursement Tax Exemption India, Is Fuel Reimbursement Taxable In India, Is Fuel Reimbursement Taxable Income, Is Petrol Reimbursement Taxable, Are Fuel Reimbursements Taxable

Verkko 11 tammik 2023 nbsp 0183 32 Section 10 of the Income Tax Act maximum limit is of Rs 2 50 lakhs for people below 60 years of age and Rs 3 lakhs for individuals above 60 below 80 years and Rs 5 lakhs for people aged 80 years or more The higher limit of Rs 3 amp 5 lakhs is available only for those citizens who are Resident in India

Verkko 1 10 13A House Rent Allowance Sec 10 13A amp Rule 2A Least of the following is exempt a Actual HRA Received b 40 of Salary 50 if house situated in Mumbai Calcutta Delhi or Madras c Rent paid minus 10 of salary Salary Basic DA if part of retirement benefit Turnover based Commission Note

Fuel Reimbursement Tax Exemption India encompass a wide range of printable, free materials available online at no cost. They come in many kinds, including worksheets templates, coloring pages and many more. The great thing about Fuel Reimbursement Tax Exemption India is their flexibility and accessibility.

More of Fuel Reimbursement Tax Exemption India

KIA Lump Sum Fuel Reimbursement Program Seeks To Resolve MPG Circus

KIA Lump Sum Fuel Reimbursement Program Seeks To Resolve MPG Circus

Verkko What makes it a coveted employee benefit Here s just about everything you need to know about fuel benefits As per the first ever Employee Benefits study in India 72 employees prefer to opt for fuel allowances This not only indicates the popularity of this benefit among employees but also the relevance of offering it to them

Verkko 31 hein 228 k 2019 nbsp 0183 32 The contribution deducted from the employee s account is exempted from tax up to Rs 1 5 lakh This deduction is provided under section 80C of the Income tax Act 1961 The interest earned on EPF is also tax exempt subject to certain conditions Also Read EPF Contributions exceeding Rs 2 5 lakh You will have two

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

The ability to customize: You can tailor the design to meet your needs such as designing invitations to organize your schedule or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free can be used by students of all ages. This makes them an essential tool for parents and teachers.

-

An easy way to access HTML0: You have instant access an array of designs and templates, which saves time as well as effort.

Where to Find more Fuel Reimbursement Tax Exemption India

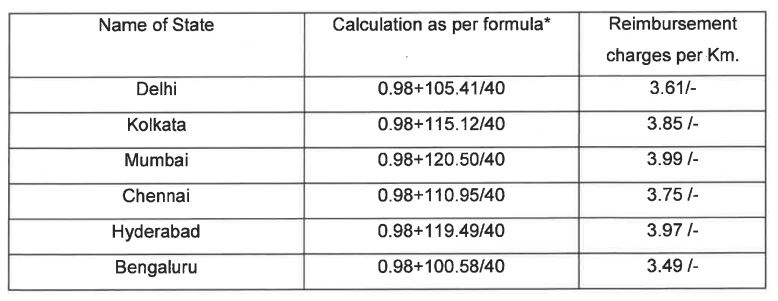

How To Calculate Tax Exemption On Fuel Vehicle Reimbursement

How To Calculate Tax Exemption On Fuel Vehicle Reimbursement

Verkko 15 huhtik 2016 nbsp 0183 32 What is the monthly perquisite value Ans Since the car s engine capacity is less than 1 6 litres and the car is used for both official and personal purposes the perquisite value per month is Rs 20 000 actual amount incurred towards car running expenses minus Rs 1 800 Rs 18 200 per month

Verkko 29 toukok 2019 nbsp 0183 32 The way fuel reimbursement is structured is employees get a full tax exemption to the extent of the receipts submitted Employees can save up to 30 in taxes on the billed amount And if they happen to miss their receipt submission employees will get taxed to the expense amount

Now that we've ignited your curiosity about Fuel Reimbursement Tax Exemption India Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Fuel Reimbursement Tax Exemption India designed for a variety goals.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning tools.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Fuel Reimbursement Tax Exemption India

Here are some inventive ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Fuel Reimbursement Tax Exemption India are a treasure trove of practical and innovative resources catering to different needs and needs and. Their availability and versatility make them an invaluable addition to both personal and professional life. Explore the world of Fuel Reimbursement Tax Exemption India now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Fuel Reimbursement Tax Exemption India really absolutely free?

- Yes they are! You can download and print these items for free.

-

Can I make use of free printing templates for commercial purposes?

- It is contingent on the specific rules of usage. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright problems with Fuel Reimbursement Tax Exemption India?

- Certain printables might have limitations on use. Be sure to review the terms of service and conditions provided by the creator.

-

How do I print Fuel Reimbursement Tax Exemption India?

- Print them at home using a printer or visit an area print shop for high-quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printables are in the format of PDF, which can be opened with free software such as Adobe Reader.

Mileage Reimbursement Tax Benefits And State Laws

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Check more sample of Fuel Reimbursement Tax Exemption India below

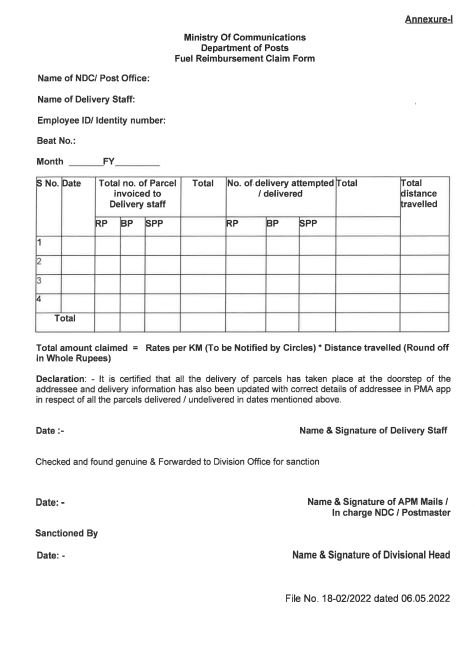

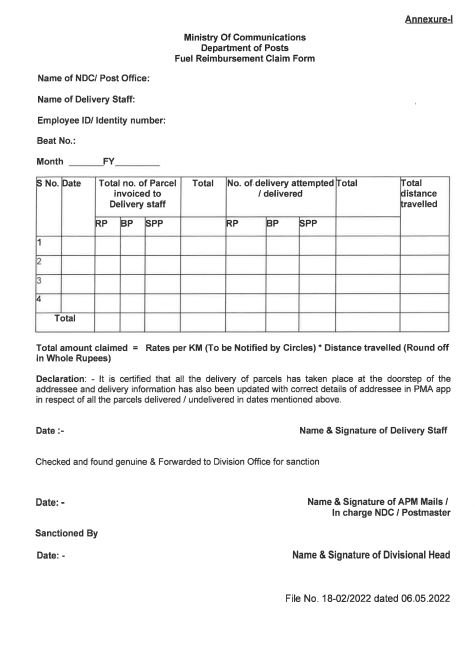

Fixing Payment Of Fuel Reimbursement Charges To Delivery Staff

Fuel Reimbursement Expenses For UAE Companies Increase By 38

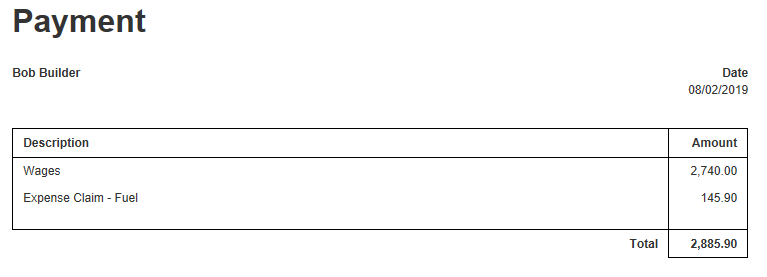

Fuel Reimbursement In Payslips Manager Forum

DOP Guidelines For Fixing Payment Of Fuel Reimbursement Charges

Fuel Reimbursement Charges Guidelines For Fixing Payment To

Corporate Tax Exemption For Companies And Startup India In Budget 2020

https://incometaxindia.gov.in/Charts Tables/List_of_benefits_available...

Verkko 1 10 13A House Rent Allowance Sec 10 13A amp Rule 2A Least of the following is exempt a Actual HRA Received b 40 of Salary 50 if house situated in Mumbai Calcutta Delhi or Madras c Rent paid minus 10 of salary Salary Basic DA if part of retirement benefit Turnover based Commission Note

https://www.hinote.in/taxability-of-fuel-expense-reimbursement-to...

Verkko 13 huhtik 2016 nbsp 0183 32 Provide full tax exemption to the extent receipts are submitted Tax the amount for which receipts are not submitted We find employees getting paid significant sums of money under the head and receiving 100 tax exemption to the extent fuel receipts are submitted

Verkko 1 10 13A House Rent Allowance Sec 10 13A amp Rule 2A Least of the following is exempt a Actual HRA Received b 40 of Salary 50 if house situated in Mumbai Calcutta Delhi or Madras c Rent paid minus 10 of salary Salary Basic DA if part of retirement benefit Turnover based Commission Note

Verkko 13 huhtik 2016 nbsp 0183 32 Provide full tax exemption to the extent receipts are submitted Tax the amount for which receipts are not submitted We find employees getting paid significant sums of money under the head and receiving 100 tax exemption to the extent fuel receipts are submitted

DOP Guidelines For Fixing Payment Of Fuel Reimbursement Charges

Fuel Reimbursement Expenses For UAE Companies Increase By 38

Fuel Reimbursement Charges Guidelines For Fixing Payment To

Corporate Tax Exemption For Companies And Startup India In Budget 2020

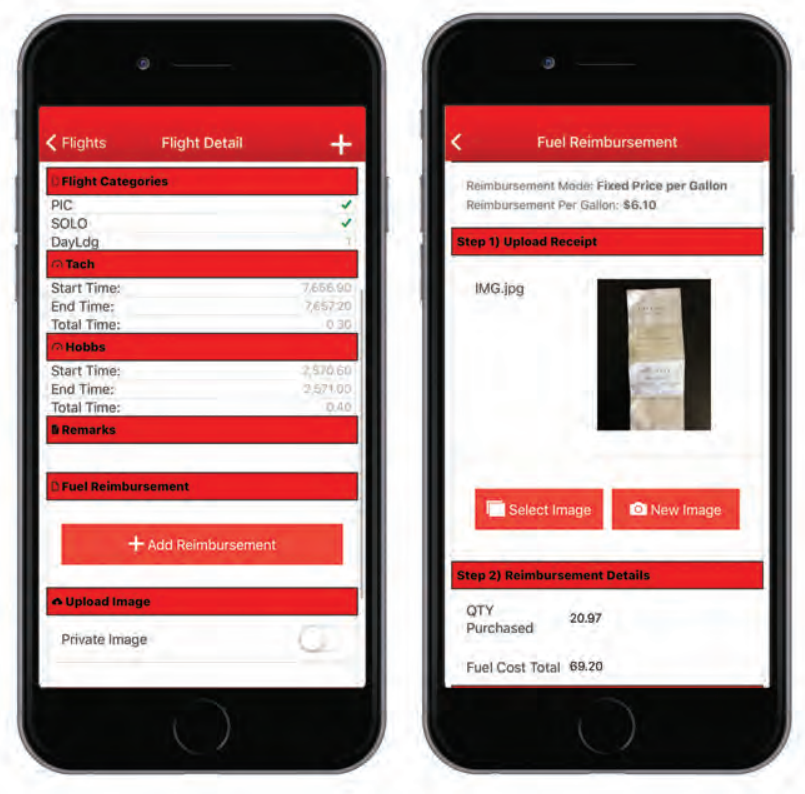

Fleet Member How To Submit Fuel Reimbursement Pilot Partner

Important Update Regarding Payment Of Fuel Reimbursement Charges For

Important Update Regarding Payment Of Fuel Reimbursement Charges For

Haryana Private Educational Institutions To Get One Year Property Tax