In this age of electronic devices, where screens rule our lives The appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons and creative work, or simply to add personal touches to your area, Georgia State Tax Credit For Electric Cars are a great source. The following article is a take a dive deep into the realm of "Georgia State Tax Credit For Electric Cars," exploring what they are, where to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest Georgia State Tax Credit For Electric Cars Below

Georgia State Tax Credit For Electric Cars

Georgia State Tax Credit For Electric Cars - Georgia State Tax Credit For Electric Cars, Ga Tax Credit For Electric Car, Does Georgia Have A Tax Credit For Electric Cars, State Tax Credits For Electric Vehicles, Electric Car Incentives In Georgia, State Taxes On Electric Vehicles

The Georgia EV tax credit is 10 of the station s cost with a maximum credit of 2 500 When purchasing leasing or installing an approved EV charging station in Georgia a

For pure electric vehicles the alternative fuel vehicle fees are dependent on vehicle type not the license plate type and will still have to be paid regardless of which license plate is placed

Georgia State Tax Credit For Electric Cars provide a diverse range of printable, free resources available online for download at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages and more. The appeal of printables for free lies in their versatility and accessibility.

More of Georgia State Tax Credit For Electric Cars

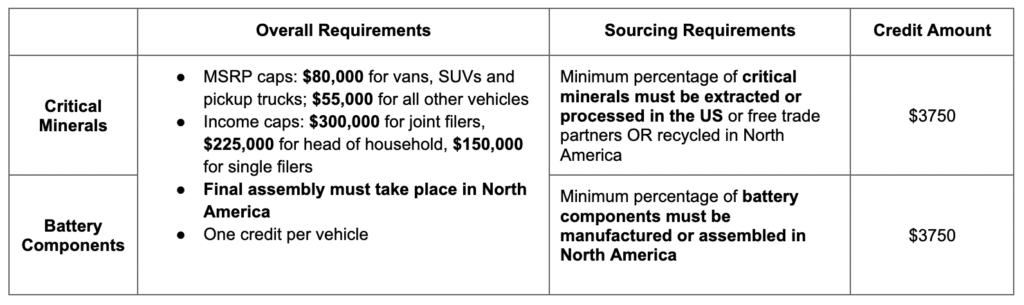

A 7 500 Tax Credit For Electric Cars Changed Again These Are The

A 7 500 Tax Credit For Electric Cars Changed Again These Are The

Georgia will give you tax credit to convert your vehicle electric Illinois offers a 4 000 electric vehicle rebate instead of a tax credit Maine electric vehicle rebates

Georgia does not currently offer state level purchase incentives for electric vehicle buyers but there are offers available from utilities Read on to see how much you could save or use the EV tax credit calculator

The Georgia State Tax Credit For Electric Cars have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

customization There is the possibility of tailoring designs to suit your personal needs when it comes to designing invitations and schedules, or even decorating your home.

-

Educational Value Free educational printables are designed to appeal to students of all ages. This makes them an essential resource for educators and parents.

-

Accessibility: Instant access to various designs and templates helps save time and effort.

Where to Find more Georgia State Tax Credit For Electric Cars

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

If you purchased or leased a vehicle on or before this date you can get a Georgia income tax credit of 10 of the vehicle cost up to 2 500 if you purchase or lease a low emission vehicle

Electric Vehicle EV Charging Station Tax Credit An eligible business enterprise may claim an income tax credit for the purchase or lease and installation of qualified EV charging station

Since we've got your curiosity about Georgia State Tax Credit For Electric Cars, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Georgia State Tax Credit For Electric Cars for a variety goals.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching materials.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a broad range of topics, everything from DIY projects to party planning.

Maximizing Georgia State Tax Credit For Electric Cars

Here are some fresh ways in order to maximize the use of Georgia State Tax Credit For Electric Cars:

1. Home Decor

- Print and frame beautiful art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home for the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Georgia State Tax Credit For Electric Cars are a treasure trove of practical and imaginative resources designed to meet a range of needs and needs and. Their availability and versatility make them a great addition to the professional and personal lives of both. Explore the world of Georgia State Tax Credit For Electric Cars and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can download and print these materials for free.

-

Are there any free printables for commercial use?

- It's based on specific terms of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may contain restrictions on use. Be sure to check the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- You can print them at home using your printer or visit a local print shop to purchase the highest quality prints.

-

What software do I need in order to open printables for free?

- The majority of printed documents are in PDF format. These is open with no cost programs like Adobe Reader.

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Tax Credit For Electric Vehicles Khou

Check more sample of Georgia State Tax Credit For Electric Cars below

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

What Makes A Good Electric Bike Incentive Program PeopleForBikes

Federal Tax Credit For Electric Cars In 2021 Atlantic Chevrolet

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

https://dor.georgia.gov › annual-alternative-fuel-vehicle-fees-faq

For pure electric vehicles the alternative fuel vehicle fees are dependent on vehicle type not the license plate type and will still have to be paid regardless of which license plate is placed

https://www.georgiapower.com › residential › save...

The federal government offers income tax credits of 7 500 for a battery electric vehicle and for a plug in hybrid electric vehicle An income tax credit is also available to any eligible business

For pure electric vehicles the alternative fuel vehicle fees are dependent on vehicle type not the license plate type and will still have to be paid regardless of which license plate is placed

The federal government offers income tax credits of 7 500 for a battery electric vehicle and for a plug in hybrid electric vehicle An income tax credit is also available to any eligible business

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

What Makes A Good Electric Bike Incentive Program PeopleForBikes

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

What Does The EV Tax Credit Overhaul Mean For Car Shoppers Cars

Federal Tax Credit For Electric Cars OsVehicle

Federal Tax Credit For Electric Cars OsVehicle

2022 EV Tax Credits From Inflation Reduction Act Plug In America