In this age of electronic devices, where screens have become the dominant feature of our lives, the charm of tangible printed objects hasn't waned. If it's to aid in education for creative projects, simply adding an individual touch to your home, printables for free have become a valuable source. In this article, we'll dive deep into the realm of "Geothermal Tax Credit 2022 Irs," exploring the benefits of them, where they can be found, and how they can add value to various aspects of your daily life.

Get Latest Geothermal Tax Credit 2022 Irs Below

Geothermal Tax Credit 2022 Irs

Geothermal Tax Credit 2022 Irs - Geothermal Tax Credit 2022 Irs, Is Geothermal Tax Credit Refundable, How Much Is The Geothermal Tax Credit

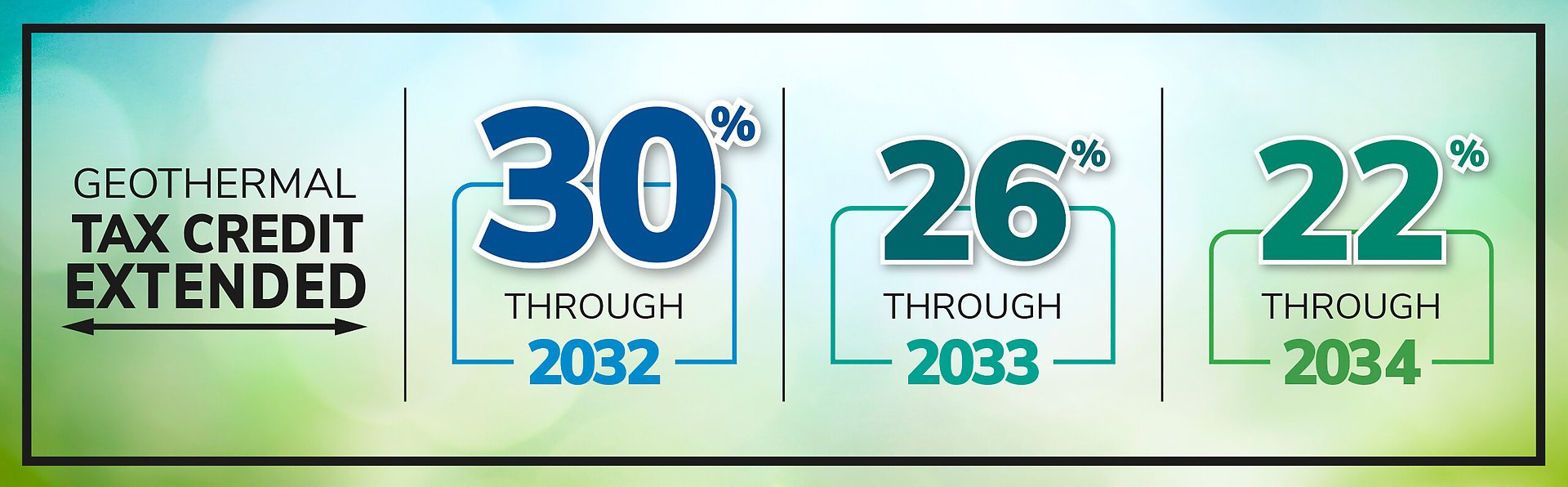

Verkko 30 jouluk 2022 nbsp 0183 32 The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 26 for property placed in service after December 31 2019 and before January 1 2022

Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Geothermal Tax Credit 2022 Irs encompass a wide array of printable material that is available online at no cost. They are available in a variety of types, like worksheets, coloring pages, templates and much more. The value of Geothermal Tax Credit 2022 Irs lies in their versatility as well as accessibility.

More of Geothermal Tax Credit 2022 Irs

Geothermal Tax Credits Are Back

Geothermal Tax Credits Are Back

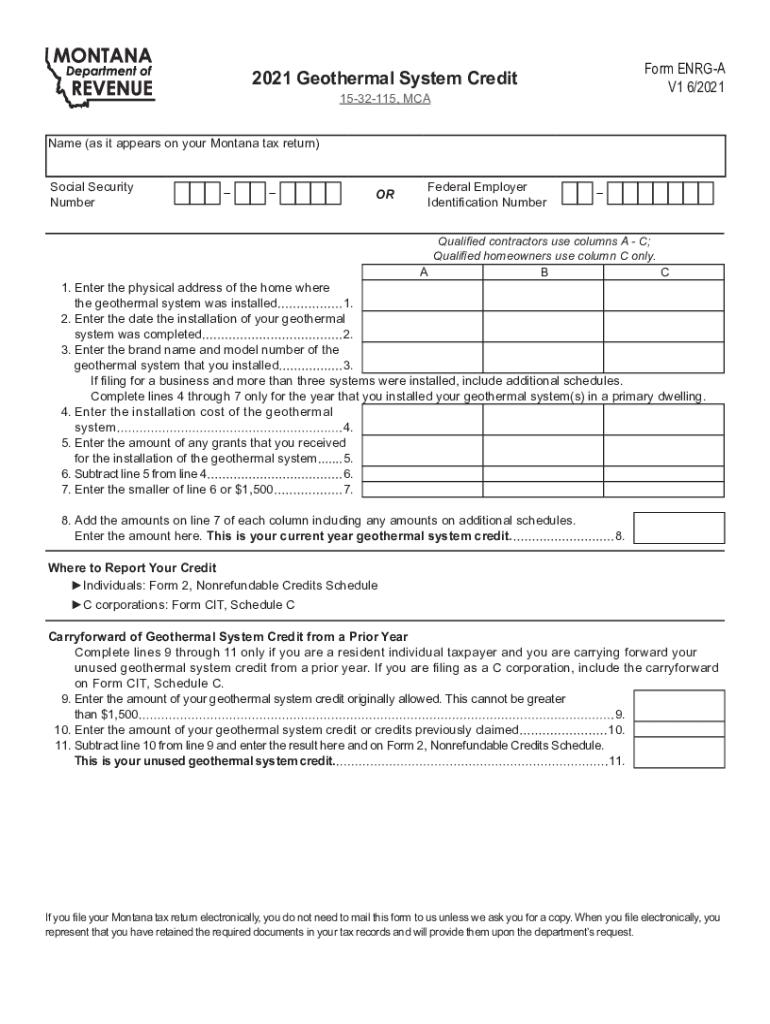

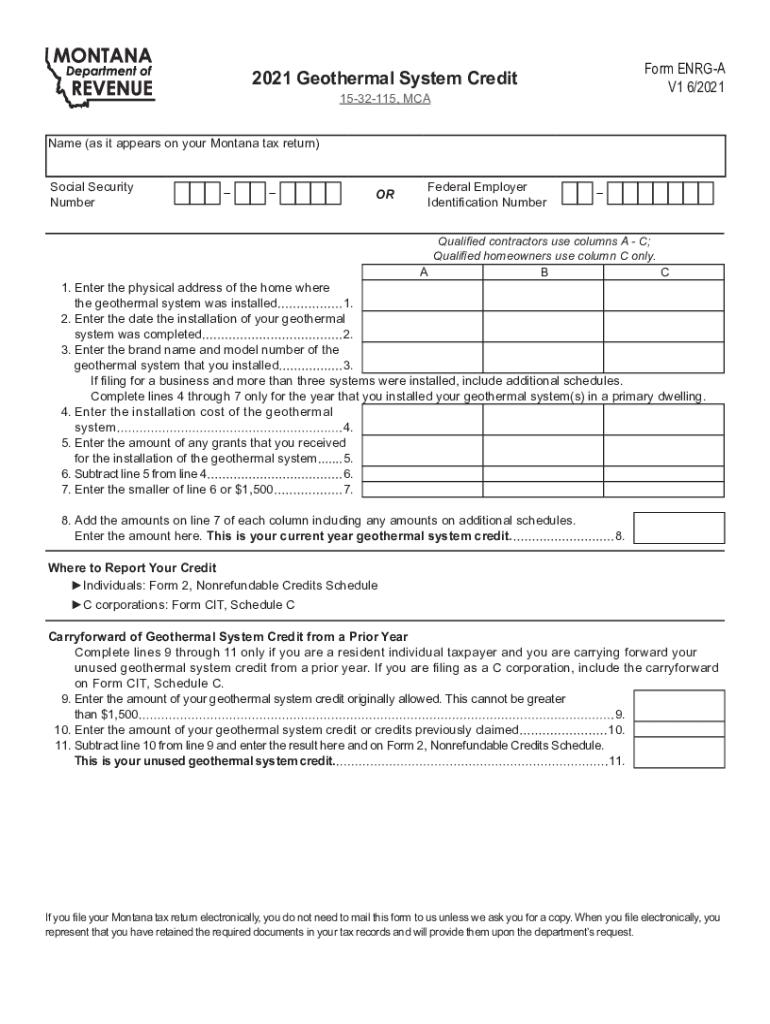

Verkko Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Geothermal Tax Credit 2022 Irs have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Flexible: You can tailor printed materials to meet your requirements when it comes to designing invitations and schedules, or even decorating your home.

-

Educational Value: These Geothermal Tax Credit 2022 Irs offer a wide range of educational content for learners of all ages, which makes them an essential tool for parents and educators.

-

It's easy: immediate access an array of designs and templates can save you time and energy.

Where to Find more Geothermal Tax Credit 2022 Irs

What You Need To Know About Energy Efficient Property Credits

What You Need To Know About Energy Efficient Property Credits

Verkko 30 jouluk 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat pumps heat pump water heaters insulation doors and windows as well as electrical panel upgrades

Verkko 27 huhtik 2021 nbsp 0183 32 Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property

We've now piqued your curiosity about Geothermal Tax Credit 2022 Irs Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Geothermal Tax Credit 2022 Irs for a variety reasons.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad range of interests, starting from DIY projects to planning a party.

Maximizing Geothermal Tax Credit 2022 Irs

Here are some innovative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Geothermal Tax Credit 2022 Irs are a treasure trove of fun and practical tools that can meet the needs of a variety of people and desires. Their accessibility and versatility make them a great addition to both professional and personal life. Explore the vast collection of Geothermal Tax Credit 2022 Irs now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes, they are! You can print and download these documents for free.

-

Can I utilize free printables for commercial use?

- It's based on the terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may have restrictions on use. Always read the terms and conditions set forth by the creator.

-

How do I print Geothermal Tax Credit 2022 Irs?

- You can print them at home using the printer, or go to an area print shop for the highest quality prints.

-

What program do I need to open printables that are free?

- Most printables come as PDF files, which can be opened with free software such as Adobe Reader.

Geothermal Wins With New IRA Tax Credits HVAC Distributors

New York Homeowners Could Qualify For Geothermal Tax Credit

Check more sample of Geothermal Tax Credit 2022 Irs below

The Geothermal Tax Credit Is Back

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Help Extend The Geothermal 30 Tax Credit Through 2024 ECS

Read This Regarding The Changes Just Announced Regarding The Geothermal

For 346PRODUCTION Www directingactors

Learning To Cope Without The Geothermal Tax Credit 2017 03 01

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

https://www.irs.gov/credits-and-deductions-under-the-inflation...

Verkko The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as it becomes available

Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Verkko The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as it becomes available

Read This Regarding The Changes Just Announced Regarding The Geothermal

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

For 346PRODUCTION Www directingactors

Learning To Cope Without The Geothermal Tax Credit 2017 03 01

Form 5695 Instructions 2023 Printable Forms Free Online

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

Breaking Down The Federal Geothermal Tax Credit For Commercial Business