In this digital age, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an element of personalization to your area, Hba Interest Rebate In Income Tax 2021 22 can be an excellent source. With this guide, you'll dive in the world of "Hba Interest Rebate In Income Tax 2021 22," exploring the different types of printables, where you can find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Hba Interest Rebate In Income Tax 2021 22 Below

Hba Interest Rebate In Income Tax 2021 22

Hba Interest Rebate In Income Tax 2021 22 - Hba Interest Rebate In Income Tax 2021-22, Maximum Rebate Housing Loan Interest, How Much Interest Rebate On Home Loan, Maximum Rebate On Home Loan Interest

Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a home loan interest deduction of up to Rs

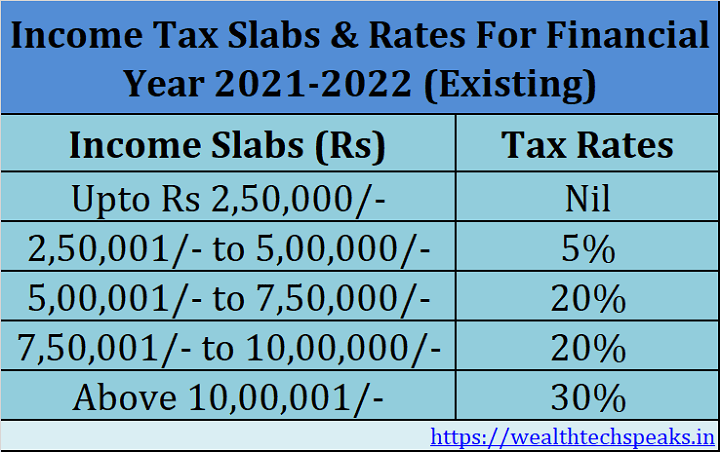

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000

Hba Interest Rebate In Income Tax 2021 22 cover a large assortment of printable material that is available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages and many more. The benefit of Hba Interest Rebate In Income Tax 2021 22 is their flexibility and accessibility.

More of Hba Interest Rebate In Income Tax 2021 22

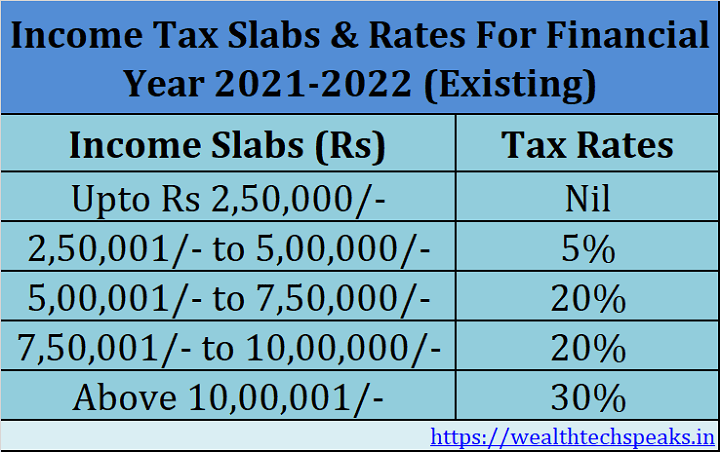

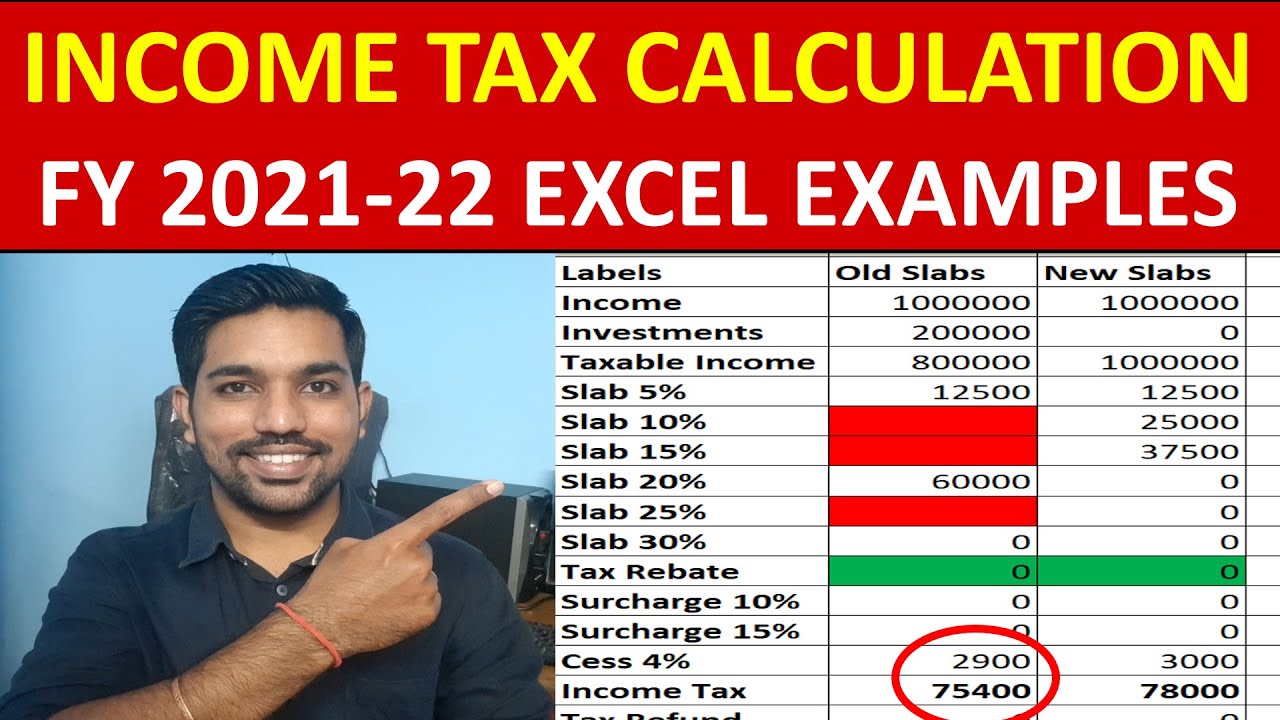

How To Calculate Income Tax FY 2021 22 New Tax Slabs Rebate

How To Calculate Income Tax FY 2021 22 New Tax Slabs Rebate

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for loans that were received till 31 March 2024

So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Income Tax Act

Hba Interest Rebate In Income Tax 2021 22 have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

customization The Customization feature lets you tailor printed materials to meet your requirements such as designing invitations planning your schedule or even decorating your house.

-

Educational Impact: These Hba Interest Rebate In Income Tax 2021 22 can be used by students of all ages. This makes them a useful source for educators and parents.

-

Convenience: Access to a variety of designs and templates will save you time and effort.

Where to Find more Hba Interest Rebate In Income Tax 2021 22

Income Tax 2021 22 Income From Salary Q 1 Hc Mehrotra Bcom

Income Tax 2021 22 Income From Salary Q 1 Hc Mehrotra Bcom

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing finance company You can claim a deduction of up to Rs 50 000 per

These instructions are guidelines for filling the particulars in Income tax Return Form 2 for the Assessment Year 2021 22 relating to the Financial Year 2020 21 In case of any doubt please refer to relevant provisions of the Income tax Act 1961 and the

We've now piqued your interest in Hba Interest Rebate In Income Tax 2021 22, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Hba Interest Rebate In Income Tax 2021 22 designed for a variety uses.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a broad selection of subjects, that includes DIY projects to planning a party.

Maximizing Hba Interest Rebate In Income Tax 2021 22

Here are some new ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Hba Interest Rebate In Income Tax 2021 22 are an abundance of practical and imaginative resources that satisfy a wide range of requirements and interests. Their accessibility and flexibility make these printables a useful addition to each day life. Explore the endless world of Hba Interest Rebate In Income Tax 2021 22 and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial purposes?

- It's determined by the specific usage guidelines. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright concerns when using Hba Interest Rebate In Income Tax 2021 22?

- Some printables may contain restrictions on usage. Make sure to read the terms and conditions offered by the author.

-

How can I print Hba Interest Rebate In Income Tax 2021 22?

- Print them at home using printing equipment or visit any local print store for superior prints.

-

What program do I require to view printables at no cost?

- The majority are printed in PDF format. They can be opened using free software like Adobe Reader.

Income Tax 2021 22 Income From House Property Q 7 Hc Mehrotra

Tolley s Income Tax 2021 22 Main Annual Temple Publications

Check more sample of Hba Interest Rebate In Income Tax 2021 22 below

How To Calculate Income Tax FY 2021 22 Excel Examples Income Tax

Agriculture Income Slab Rate Fy 2021 22 Pay Period Calendars 2023

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Income Tax 2021 22 Capital Gain Q 1 Hc Mehrotra Bcom Capital

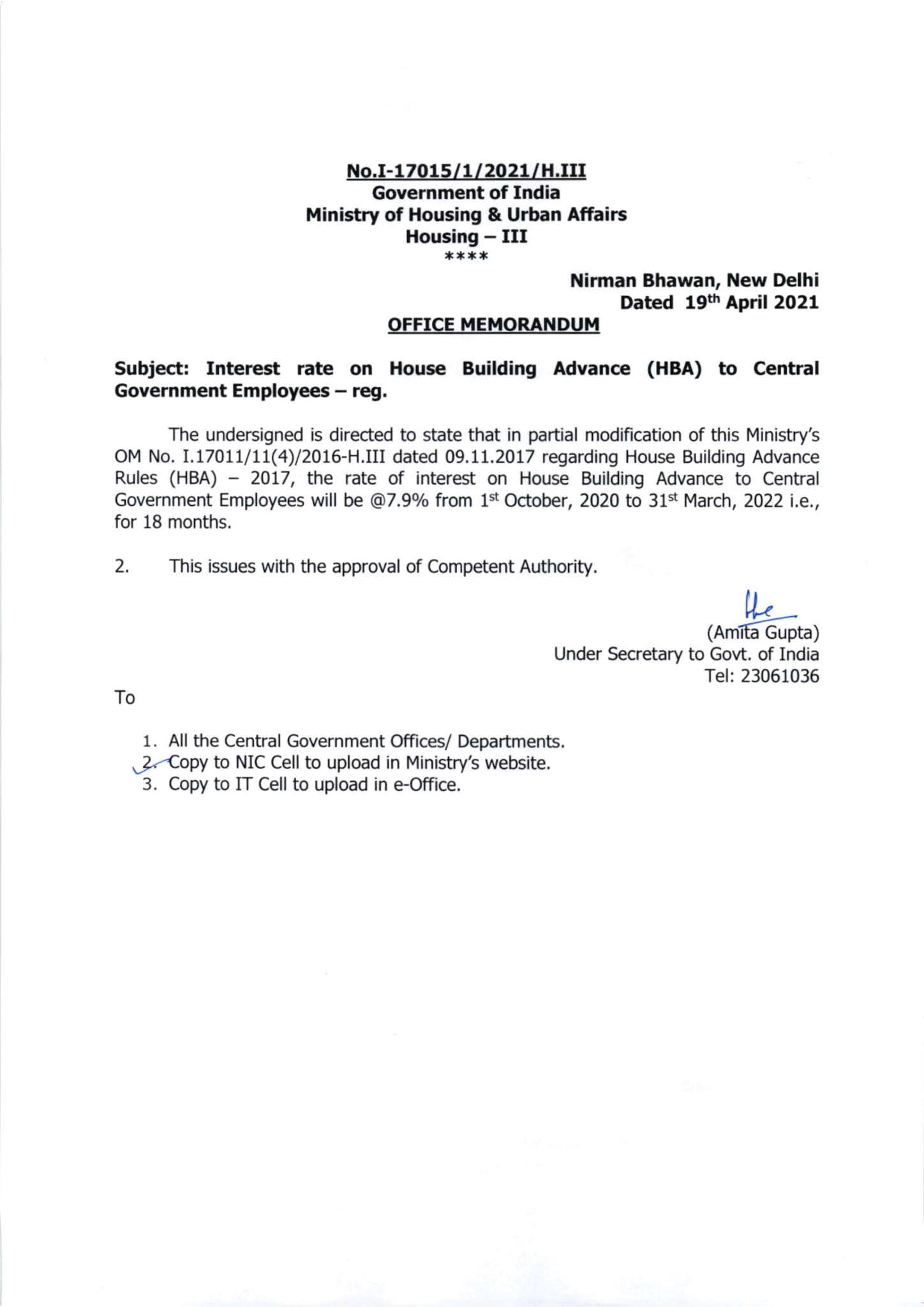

HBA Interest Rate To Central Government Employees Will Be 7 9 From

Bonus Dividend Loan Interest Rebate Windthorst Federal Credit Union

https://cleartax.in/s/section-80eea-deduction-affordable-housing

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

Section 80EE provides deduction for the interest paid on housing loan taken during the period of 01 April 2016 to 31 March 2017 under which you may claim upto Rs 50 000 if eligible Further Section 24 also provides deduction from interest paid on housing loan upto Rs 2 00 000

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

Income Tax 2021 22 Capital Gain Q 1 Hc Mehrotra Bcom Capital

Agriculture Income Slab Rate Fy 2021 22 Pay Period Calendars 2023

HBA Interest Rate To Central Government Employees Will Be 7 9 From

Bonus Dividend Loan Interest Rebate Windthorst Federal Credit Union

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

HBA INTEREST CALCULATOR YouTube

HBA INTEREST CALCULATOR YouTube

How To Deal With An Income Tax Notice Wealthzi