In this digital age, in which screens are the norm it's no wonder that the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses in creative or artistic projects, or just adding the personal touch to your home, printables for free are now a vital source. With this guide, you'll take a dive into the world "Higher Education Tax Deduction 2022," exploring their purpose, where to get them, as well as how they can improve various aspects of your life.

Get Latest Higher Education Tax Deduction 2022 Below

Higher Education Tax Deduction 2022

Higher Education Tax Deduction 2022 - Higher Education Tax Deduction 2022, Higher Education Tax Credit 2022, Is Higher Education Tax Deductible, Higher Education Tuition And Fees Deduction

There are two higher education tax credits for students in tax year 2022 the American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC Both credits can

The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid

The Higher Education Tax Deduction 2022 are a huge variety of printable, downloadable documents that can be downloaded online at no cost. These printables come in different styles, from worksheets to coloring pages, templates and more. The appealingness of Higher Education Tax Deduction 2022 lies in their versatility and accessibility.

More of Higher Education Tax Deduction 2022

Pin On Business Template

Pin On Business Template

Taxes tax planning Features 11 Education Tax Credits and Deductions 2023 Education tax credits and deductions are available for college savings current students and college graduates

The American opportunity tax credit lets you claim all of the first 2 000 you spent on tuition school fees and books or supplies needed for coursework but not living expenses or

Higher Education Tax Deduction 2022 have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor the design to meet your needs be it designing invitations planning your schedule or even decorating your house.

-

Educational Value: These Higher Education Tax Deduction 2022 offer a wide range of educational content for learners of all ages. This makes the perfect resource for educators and parents.

-

Affordability: The instant accessibility to a variety of designs and templates is time-saving and saves effort.

Where to Find more Higher Education Tax Deduction 2022

Special Education Tax Deductions Tax Strategies For Parents

Special Education Tax Deductions Tax Strategies For Parents

Such expenses must have been required for enrollment or attendance at an eligible educational institution The deduction was 100 of qualified higher education

Derek Silva Updated December 3 2021 6 min read Policygenius content follows strict guidelines for editorial accuracy and integrity Learn about our editorial

After we've peaked your curiosity about Higher Education Tax Deduction 2022 Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection with Higher Education Tax Deduction 2022 for all uses.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs are a vast range of interests, from DIY projects to party planning.

Maximizing Higher Education Tax Deduction 2022

Here are some innovative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home and in class.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Higher Education Tax Deduction 2022 are a treasure trove of useful and creative resources that satisfy a wide range of requirements and pursuits. Their availability and versatility make them a fantastic addition to both professional and personal life. Explore the many options of Higher Education Tax Deduction 2022 to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes they are! You can download and print these resources at no cost.

-

Can I make use of free printables to make commercial products?

- It is contingent on the specific rules of usage. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using Higher Education Tax Deduction 2022?

- Some printables may have restrictions on use. Make sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit an area print shop for premium prints.

-

What software do I need to open printables that are free?

- Many printables are offered in the PDF format, and can be opened using free software like Adobe Reader.

California Individual Tax Rate Table 2021 2022 Brokeasshome

Utilizing Higher Education Tax Benefits GYF

Check more sample of Higher Education Tax Deduction 2022 below

Write Offs For The Self Employed For All The Visual Learners Out

Tax Deduction Everything You Should Know About TDS And VDS

Student Aid And Income Tax Relief Important Facts About The Maryland

Education Tax Credits And Deductions Guide Nj

Meals Entertainment Deduction 2022 5 Must Know Tips FlyFin

Education Cess Including Secondary And Higher Secondary Education Cess

https://turbotax.intuit.com/tax-tips/college-and...

The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid

https://www.vero.fi/en/detailed-guidance/guidance/86049

The taxation of higher education institutions is discussed in Tax guidance for higher education institutions 30 August 2020 is tax exempt in Finland but the

The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid

The taxation of higher education institutions is discussed in Tax guidance for higher education institutions 30 August 2020 is tax exempt in Finland but the

Education Tax Credits And Deductions Guide Nj

Tax Deduction Everything You Should Know About TDS And VDS

Meals Entertainment Deduction 2022 5 Must Know Tips FlyFin

Education Cess Including Secondary And Higher Secondary Education Cess

Amazon Microsoft Back Higher Education Tax In Washington Puget Sound

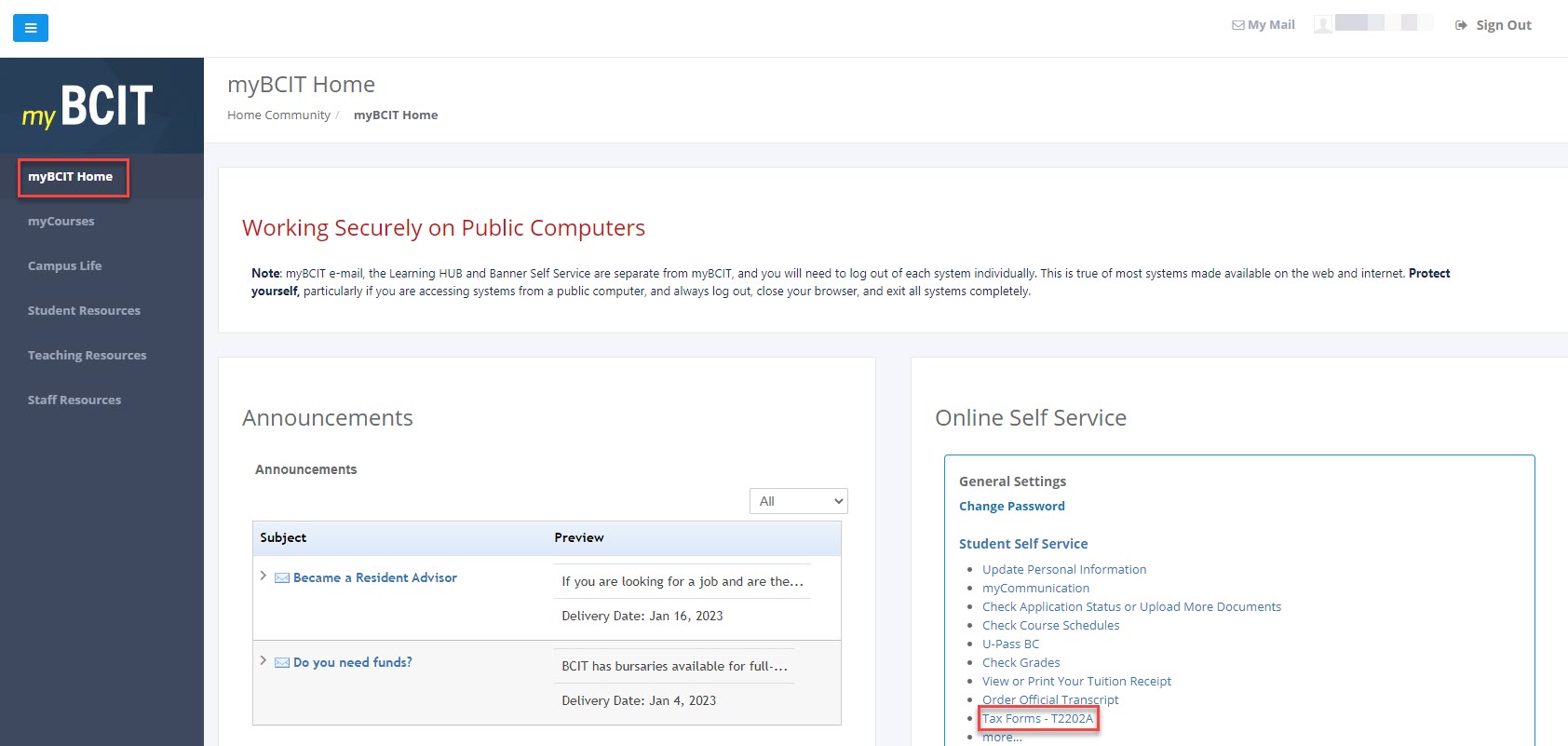

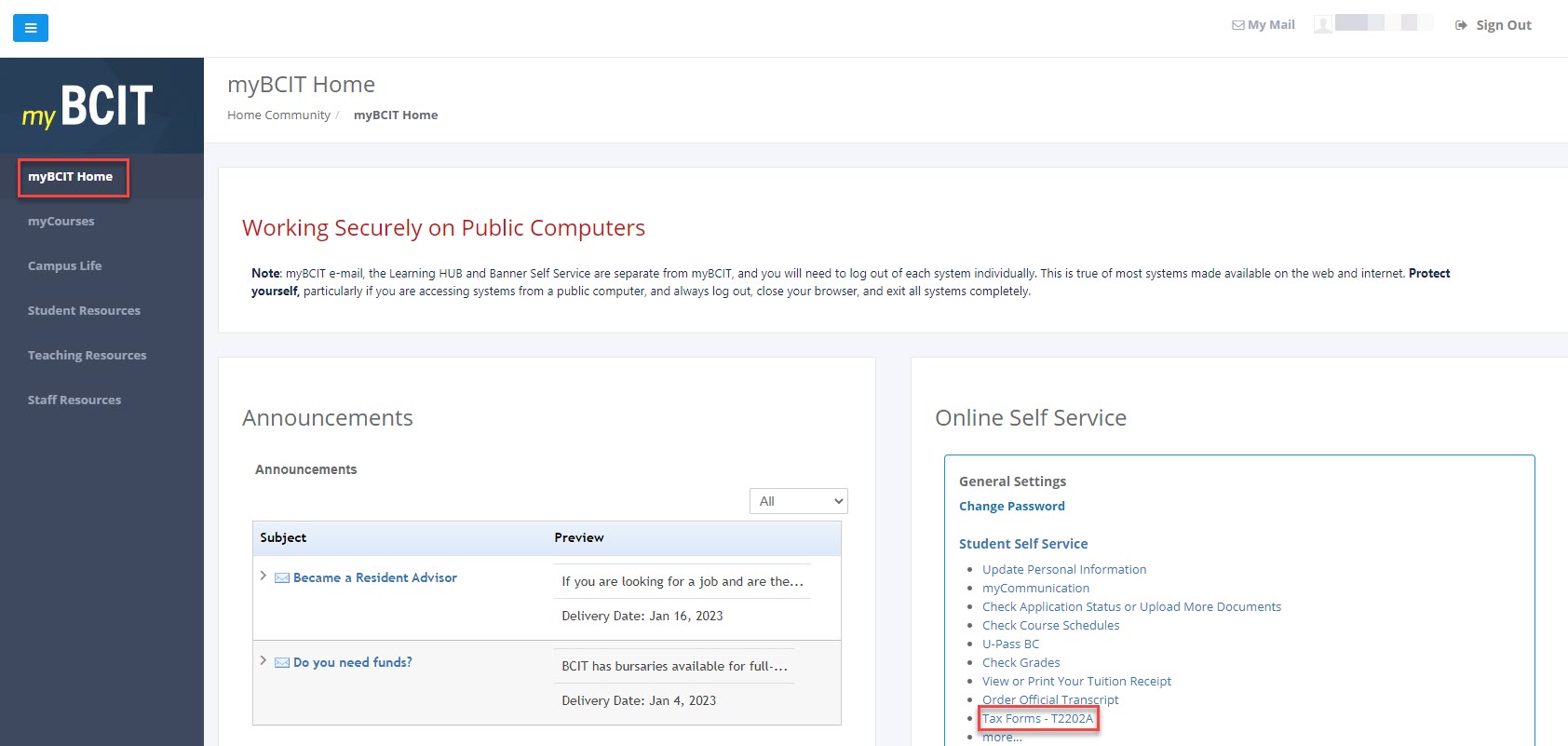

Printing Your Tuition Tax Receipt T2202 In MyBCIT Online Self Service

Printing Your Tuition Tax Receipt T2202 In MyBCIT Online Self Service

5 Commonly Overlooked Education Tax Credits And Deductions Chime