In the digital age, in which screens are the norm but the value of tangible printed items hasn't gone away. If it's to aid in education in creative or artistic projects, or just adding some personal flair to your area, Hk Salary Tax Mpf Deduction are now a useful resource. The following article is a dive in the world of "Hk Salary Tax Mpf Deduction," exploring the different types of printables, where you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Hk Salary Tax Mpf Deduction Below

Hk Salary Tax Mpf Deduction

Hk Salary Tax Mpf Deduction - Hk Salary Tax Mpf Deduction, Hong Kong Salary Tax Deductions, Is Mpf Taxable In Hong Kong, Hong Kong Salary Deductions, Hk Salaries Tax Rate

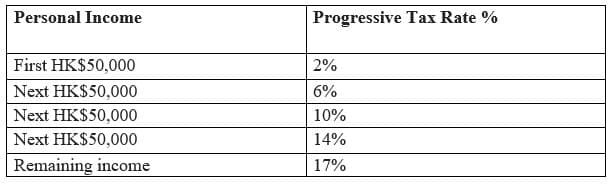

In summary there are 3 types of deductions that you may claim to deduct from your assessable income in your tax return outgoings and expenses including expenses of self education concessionary deductions and allowances except for taxpayers paying Salaries Tax at standard rate

Residents Taxes Duties Salaries Tax Personal Assessment Allowances Deductions Deductions Salaries Tax Personal Assessment Deductions Along with the various allowances available you may claim other deductions under

Hk Salary Tax Mpf Deduction offer a wide array of printable resources available online for download at no cost. These printables come in different designs, including worksheets coloring pages, templates and much more. The value of Hk Salary Tax Mpf Deduction is in their versatility and accessibility.

More of Hk Salary Tax Mpf Deduction

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

The amendment ordinance provides tax deductions for qualifying annuity premiums and tax deductible MPF voluntary contributions TVC under salaries tax and personal assessment The deductions are applicable to a year of assessment commencing on or after 1 April 2019 i e year of assessment 2019 20 onwards

The maximum total tax deduction allowed for i and ii above is HKD 60 000 for each tax year If an employee is entitled to tax deduction for both qualifying annuity premiums and MPF voluntary contributions for a year of assessment deductions will firstly be allowed for MPF voluntary contributions and then for qualifying annuity premiums

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization You can tailor printables to fit your particular needs when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Impact: The free educational worksheets are designed to appeal to students of all ages. This makes them an invaluable tool for teachers and parents.

-

Convenience: The instant accessibility to the vast array of design and templates cuts down on time and efforts.

Where to Find more Hk Salary Tax Mpf Deduction

2023 Salary Guide Hong Kong SAR Morgan McKinley

2023 Salary Guide Hong Kong SAR Morgan McKinley

Now that you have a basic understanding of MPF let s deep dive into your must do s also known as your legal obligations and things you get as an employer in Hong Kong your entitlements including opening an MPF account making MPF contributions and MPF tax deduction Types of MPF Schemes There are three types of MPF schemes

Under Section 26G and Schedule 3B of the Inland Revenue Ordinance mandatory contributions to MPFS are deductible in computing the assessable income profits of an employee or a self employed person but the deduction does not include contributions made by a self employed person in respect of his her employees

After we've peaked your interest in printables for free Let's look into where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Hk Salary Tax Mpf Deduction for all applications.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a broad spectrum of interests, starting from DIY projects to planning a party.

Maximizing Hk Salary Tax Mpf Deduction

Here are some unique ways for you to get the best of Hk Salary Tax Mpf Deduction:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Hk Salary Tax Mpf Deduction are a treasure trove of practical and innovative resources that cater to various needs and pursuits. Their access and versatility makes them a wonderful addition to your professional and personal life. Explore the wide world of Hk Salary Tax Mpf Deduction right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes, they are! You can download and print these tools for free.

-

Can I use the free printing templates for commercial purposes?

- It is contingent on the specific terms of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may contain restrictions concerning their use. Make sure to read the terms and conditions provided by the designer.

-

How do I print Hk Salary Tax Mpf Deduction?

- You can print them at home with printing equipment or visit a local print shop to purchase higher quality prints.

-

What program do I require to view Hk Salary Tax Mpf Deduction?

- The majority of printables are in PDF format. They is open with no cost software, such as Adobe Reader.

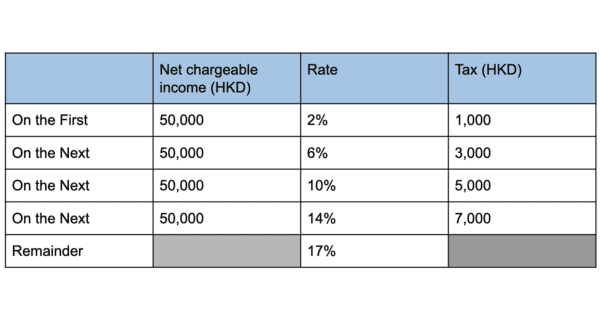

PwC Hong Kong 2022 23 Hong Kong Budget Revitalising Hong Kong s

MPF TVC And QDAP Should Each Enjoy Tax Deduction Of HK 60 000 HKIFA

Check more sample of Hk Salary Tax Mpf Deduction below

Corporate Tax Rate Benefits In Hong Kong Get Started HK

Accounting Tax Audit Salary MPF

Corporate Tax Rate Benefits In Hong Kong Get Started HK

Salary Slip Excel Templates

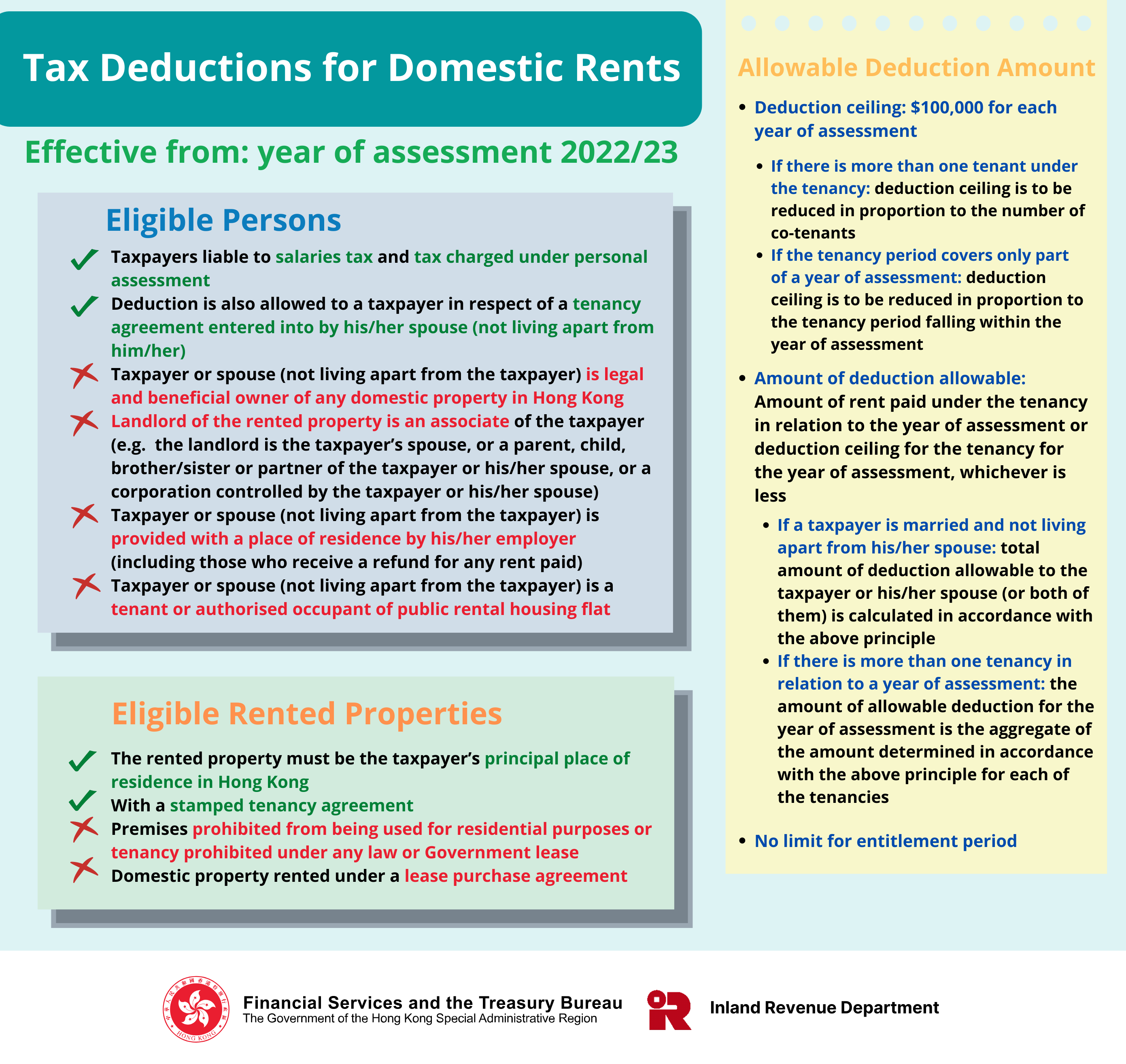

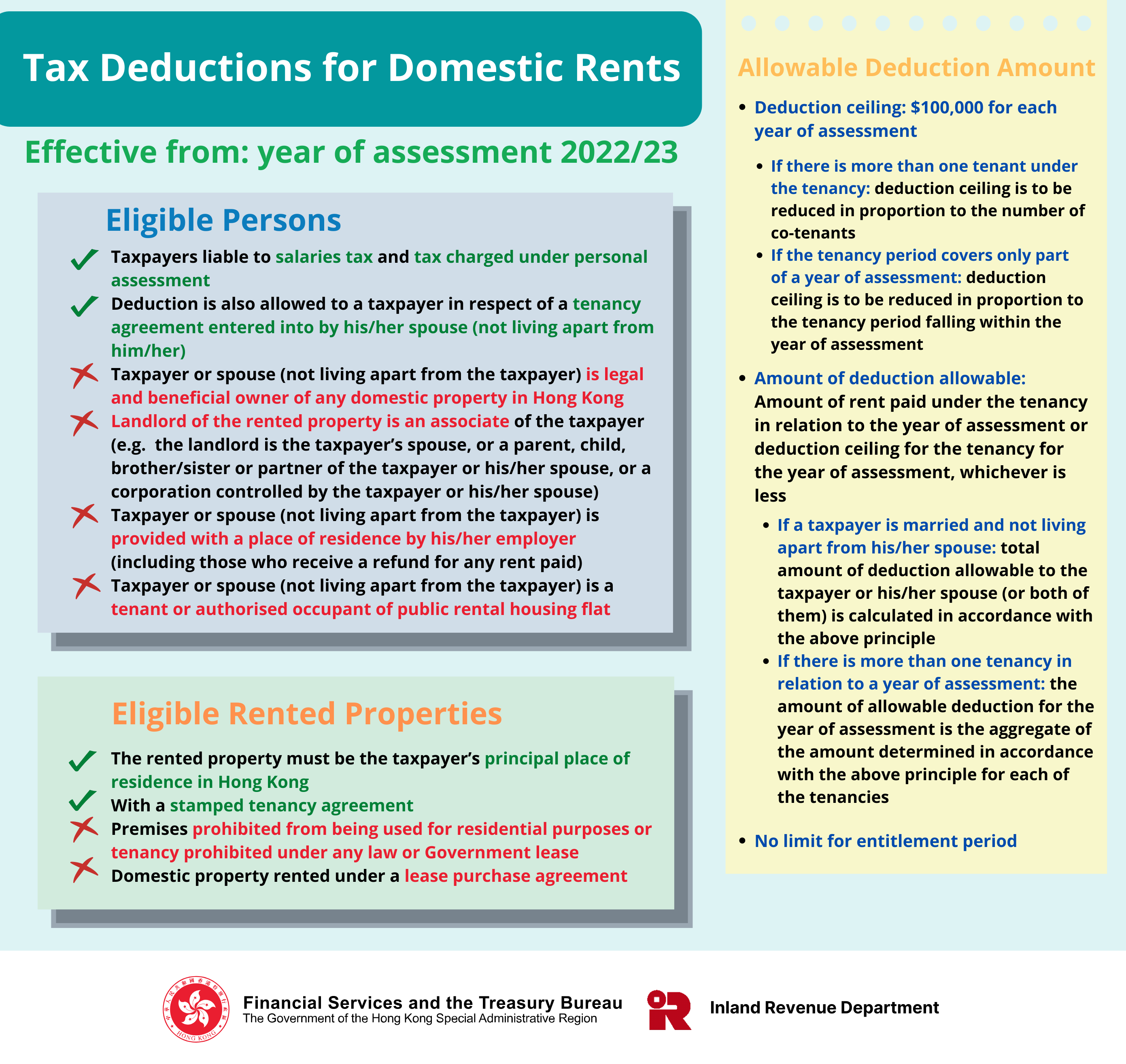

IRD Tax Deduction For Domestic Rent

Generate Driver Salary Receipt Company Salaries 2023

https://www.gov.hk:8443/en/residents/taxes/salaries...

Residents Taxes Duties Salaries Tax Personal Assessment Allowances Deductions Deductions Salaries Tax Personal Assessment Deductions Along with the various allowances available you may claim other deductions under

https://www.ird.gov.hk/eng/faq/mpf.htm

If my monthly salary is 10 000 and I have opted to contribute 10 of my salary i e 1 000 per month can I get the maximum tax deduction of 12 000 A At monthly salary of 10 000 if you make contributions to a MPF scheme your mandatory contribution would amount to 500 per month

Residents Taxes Duties Salaries Tax Personal Assessment Allowances Deductions Deductions Salaries Tax Personal Assessment Deductions Along with the various allowances available you may claim other deductions under

If my monthly salary is 10 000 and I have opted to contribute 10 of my salary i e 1 000 per month can I get the maximum tax deduction of 12 000 A At monthly salary of 10 000 if you make contributions to a MPF scheme your mandatory contribution would amount to 500 per month

Salary Slip Excel Templates

Accounting Tax Audit Salary MPF

IRD Tax Deduction For Domestic Rent

Generate Driver Salary Receipt Company Salaries 2023

Accounting Tax Audit Salary MPF

Hong Kong Salaries Tax Return Guide Tax FastLane

Hong Kong Salaries Tax Return Guide Tax FastLane

YOOV Payroll Management