In the age of digital, where screens dominate our lives but the value of tangible printed materials isn't diminishing. No matter whether it's for educational uses or creative projects, or simply adding an element of personalization to your area, Hmrc Married Tax Allowance Rebate are now a vital resource. Here, we'll dive into the world "Hmrc Married Tax Allowance Rebate," exploring their purpose, where they are available, and the ways that they can benefit different aspects of your daily life.

Get Latest Hmrc Married Tax Allowance Rebate Below

Hmrc Married Tax Allowance Rebate

Hmrc Married Tax Allowance Rebate - Hmrc Married Tax Allowance Rebate, Hmrc Married Tax Allowance Refund, Hmrc Tax Code Marriage Allowance, Hmrc Wife's Tax Allowance, Hmrc Transfer Spouse Tax Allowance

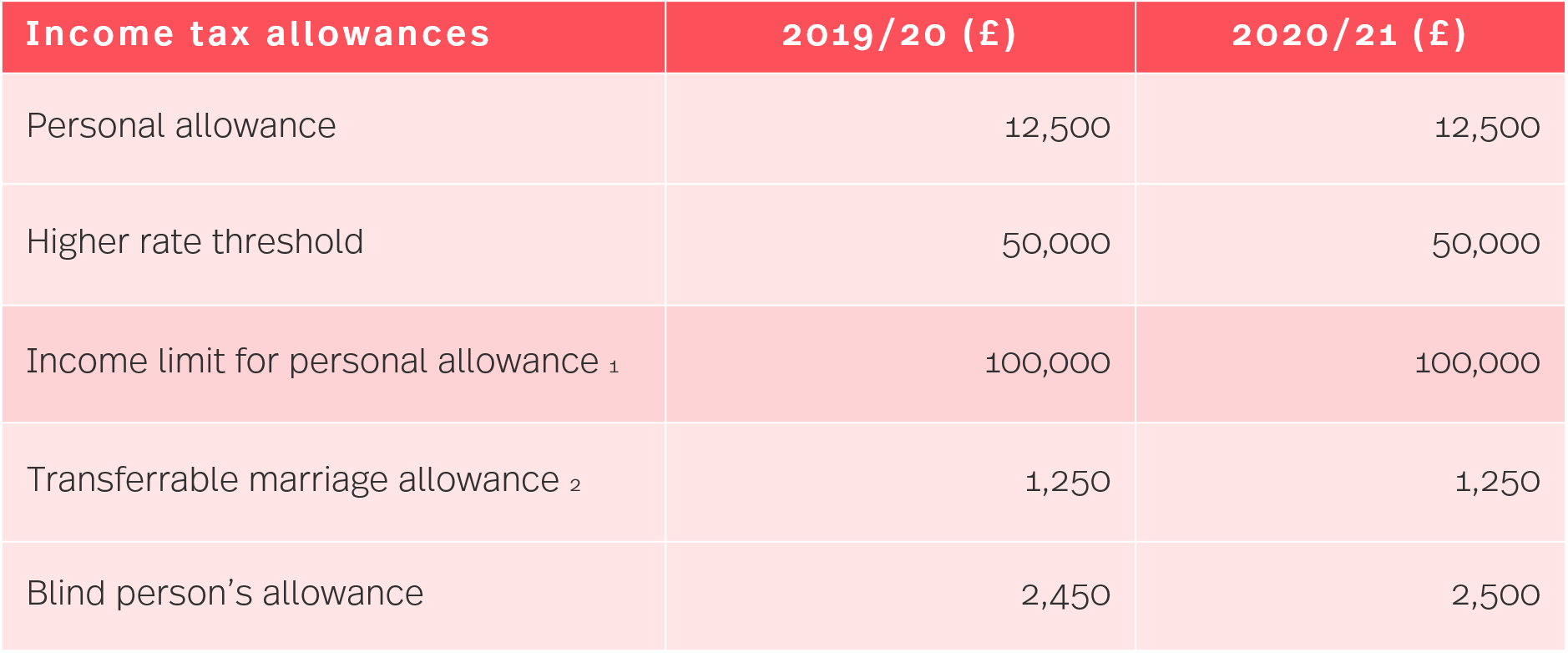

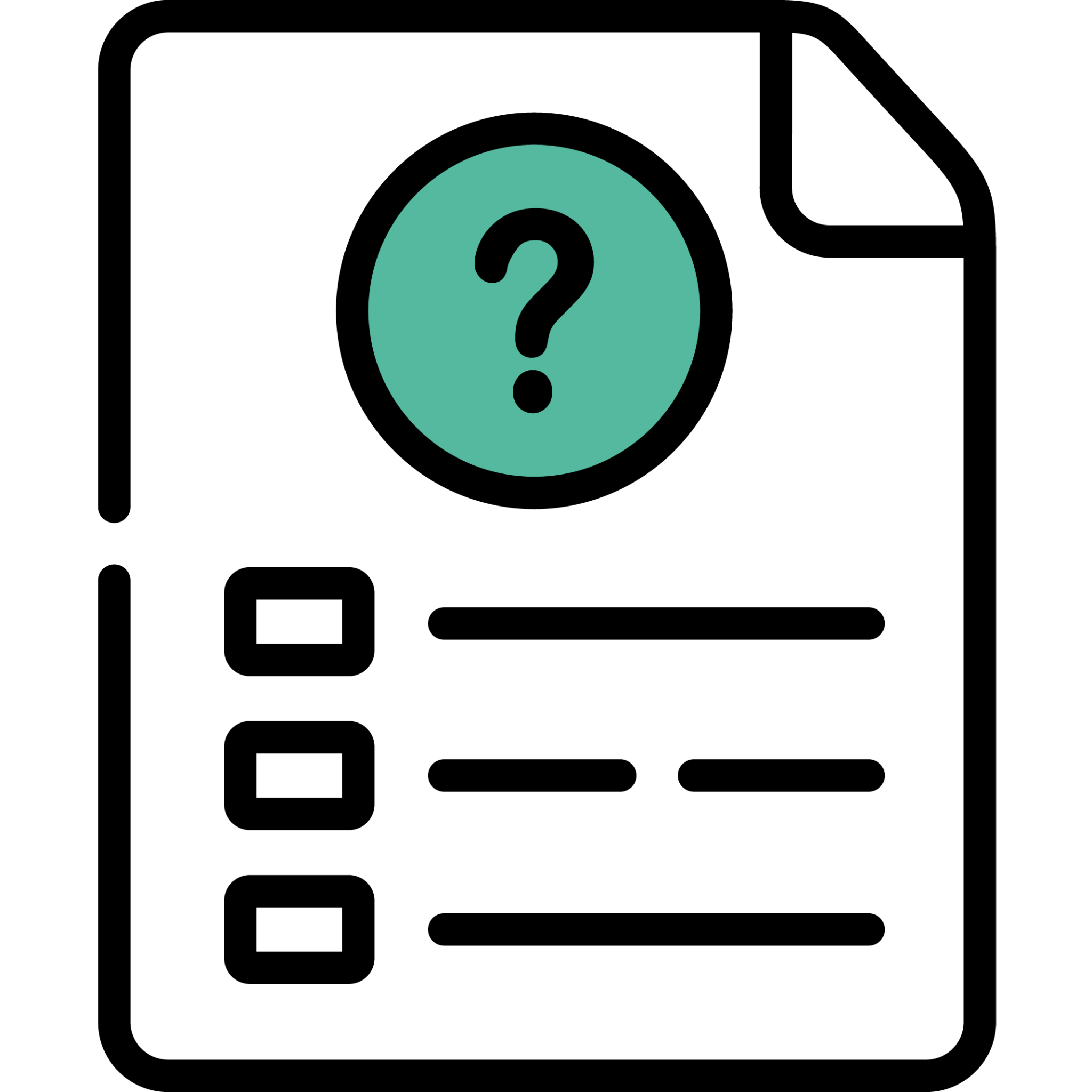

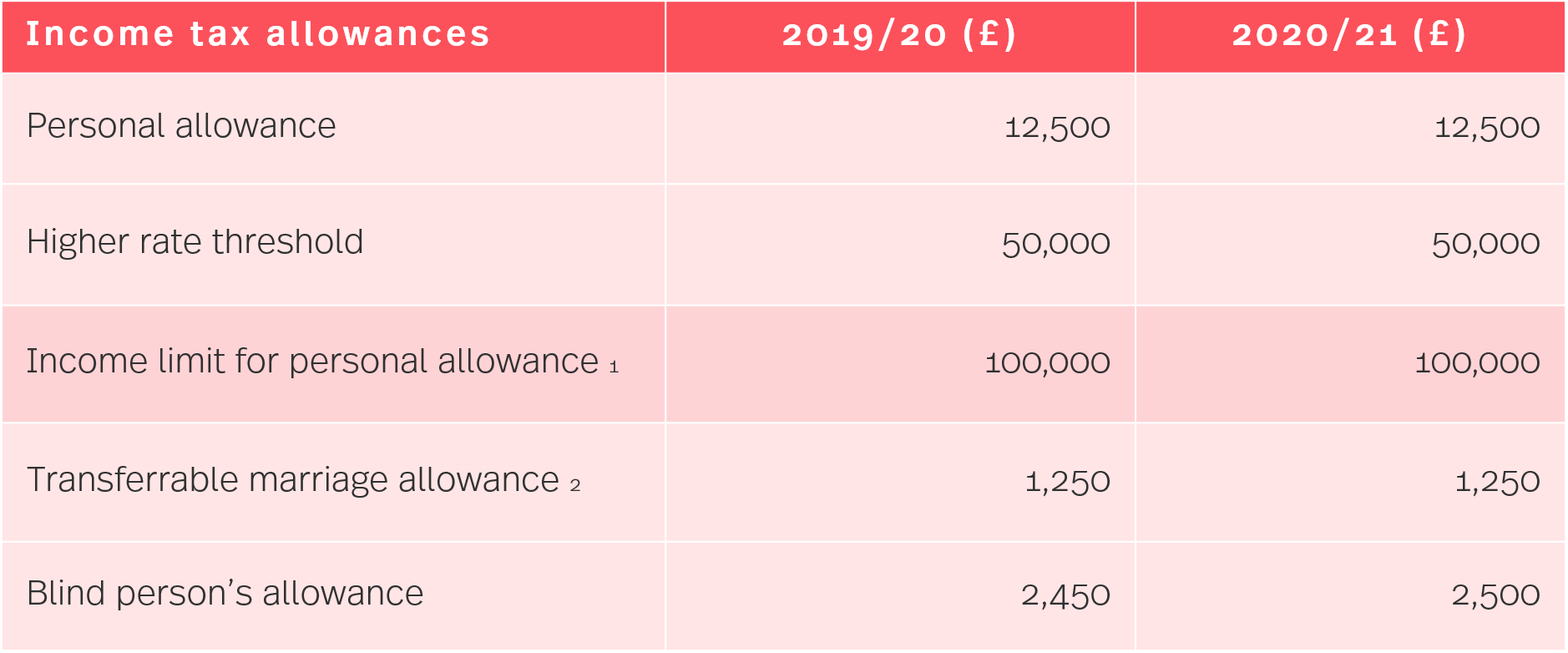

Web Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the 2023 to 2024 tax year it could cut your tax bill by between 163 401

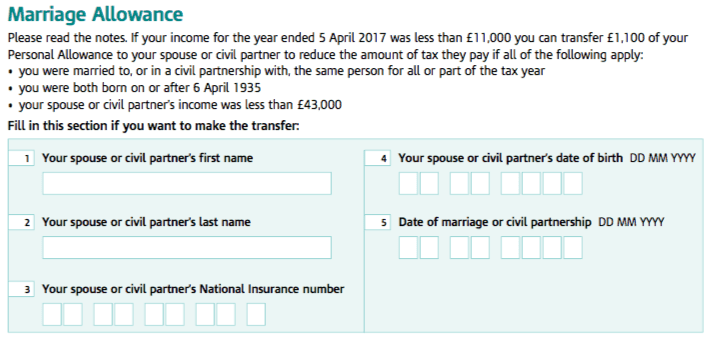

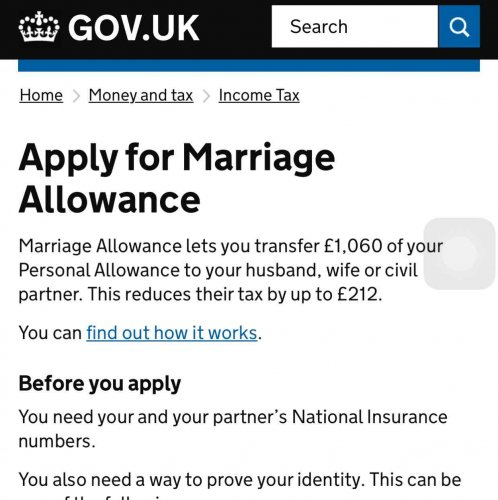

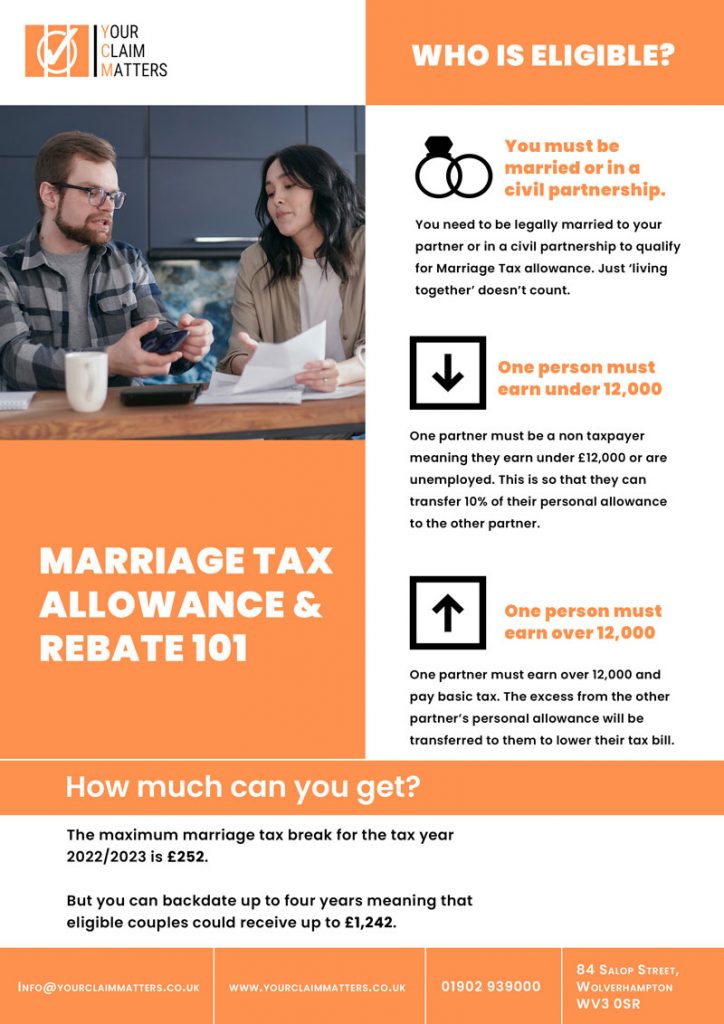

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Hmrc Married Tax Allowance Rebate encompass a wide assortment of printable, downloadable resources available online for download at no cost. These resources come in many kinds, including worksheets templates, coloring pages, and much more. The value of Hmrc Married Tax Allowance Rebate lies in their versatility and accessibility.

More of Hmrc Married Tax Allowance Rebate

Marriage Tax Allowance Explained Goselfemployed co

Marriage Tax Allowance Explained Goselfemployed co

Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is 10 of an individual s tax free Personal Allowance The maximum amount that can be transferred to their husband wife or civil partner is

Web Eligibility You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: It is possible to tailor designs to suit your personal needs be it designing invitations and schedules, or decorating your home.

-

Educational value: Printing educational materials for no cost are designed to appeal to students of all ages, which makes the perfect instrument for parents and teachers.

-

Easy to use: You have instant access numerous designs and templates reduces time and effort.

Where to Find more Hmrc Married Tax Allowance Rebate

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

Web If your income changes and you re not sure if you should still claim call HMRC Marriage Allowance enquiries How to cancel Either of you can cancel if your relationship has

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the tax break each year going forward so no need to keep reapplying

Now that we've ignited your interest in printables for free Let's find out where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Hmrc Married Tax Allowance Rebate designed for a variety applications.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs are a vast range of topics, from DIY projects to planning a party.

Maximizing Hmrc Married Tax Allowance Rebate

Here are some unique ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Hmrc Married Tax Allowance Rebate are a treasure trove of creative and practical resources that cater to various needs and desires. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can download and print these files for free.

-

Do I have the right to use free printables to make commercial products?

- It's all dependent on the conditions of use. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with Hmrc Married Tax Allowance Rebate?

- Certain printables could be restricted in use. Be sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home using either a printer at home or in the local print shop for top quality prints.

-

What software do I require to view Hmrc Married Tax Allowance Rebate?

- A majority of printed materials are in PDF format. These is open with no cost programs like Adobe Reader.

HMRC Married Britons Could Get Tax Refund Worth Up To 252 Per Year

PSA HMRC Will Not E mail Or Call You About Tax Rebates CasualUK

Check more sample of Hmrc Married Tax Allowance Rebate below

Hmrc Tool Tax Rebate Form Printable Rebate Form

Draw Your Signature Marriage Tax Allowance Rebate

Hm4 Form Fill Out Sign Online DocHub

HMRC Are Reminding Married Couples And Civil Partnerships To Sign Up

The 101 Marriage Tax Allowance Rebate And Claim Guide

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

https://www.gov.uk/apply-marriage-allowance

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

https://www.gov.uk/married-couples-allowance/how-to-claim

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs

HMRC Are Reminding Married Couples And Civil Partnerships To Sign Up

Draw Your Signature Marriage Tax Allowance Rebate

The 101 Marriage Tax Allowance Rebate And Claim Guide

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

What Is Marriage Allowance HMRC s Message To Married Couples On

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Uses Form 17 To Confirm Where Civil Couples Or Married Own A Joint